The $ARB Arbitrum Airdrop; Euler Finance Hack

The $ARB Arbitrum Airdrop; Euler Finance HackWhat's going on with the Arbitrum Airdrop Drama; Euler hacker returns stolen fundsDear Bankless Nation 🏴, In this edition of the DeFi Download, we’re going in a slightly different direction but still giving you the educational content you’re used to. Today, Austin Foss updates us on Arbitrum’s token launch, DAO, and governance drama. Afterwards, he gives us the down low on the Euler Finance hack and closes the chapter on the hacker-turned-researcher after they returned the stolen funds to Euler. Note that Twitter has disabled the ability to embed tweets in Substack that’s why things are a bit wonky. If you like the new direction of the DeFi Download, let us know in the comments! This is the DeFi Download ⚡️ Contributors: BanklessDAO Writers Guild (Jake and Stake, Austin Foss)

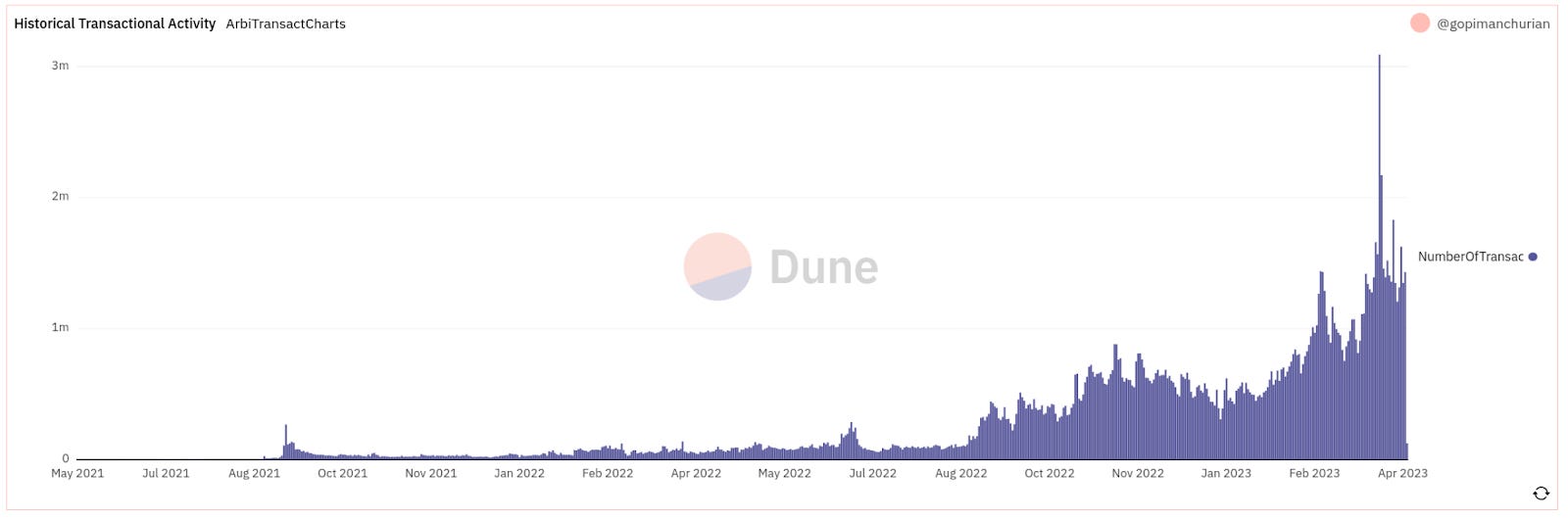

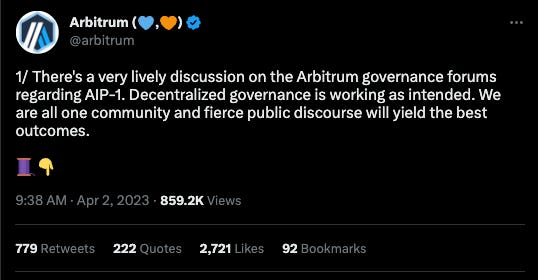

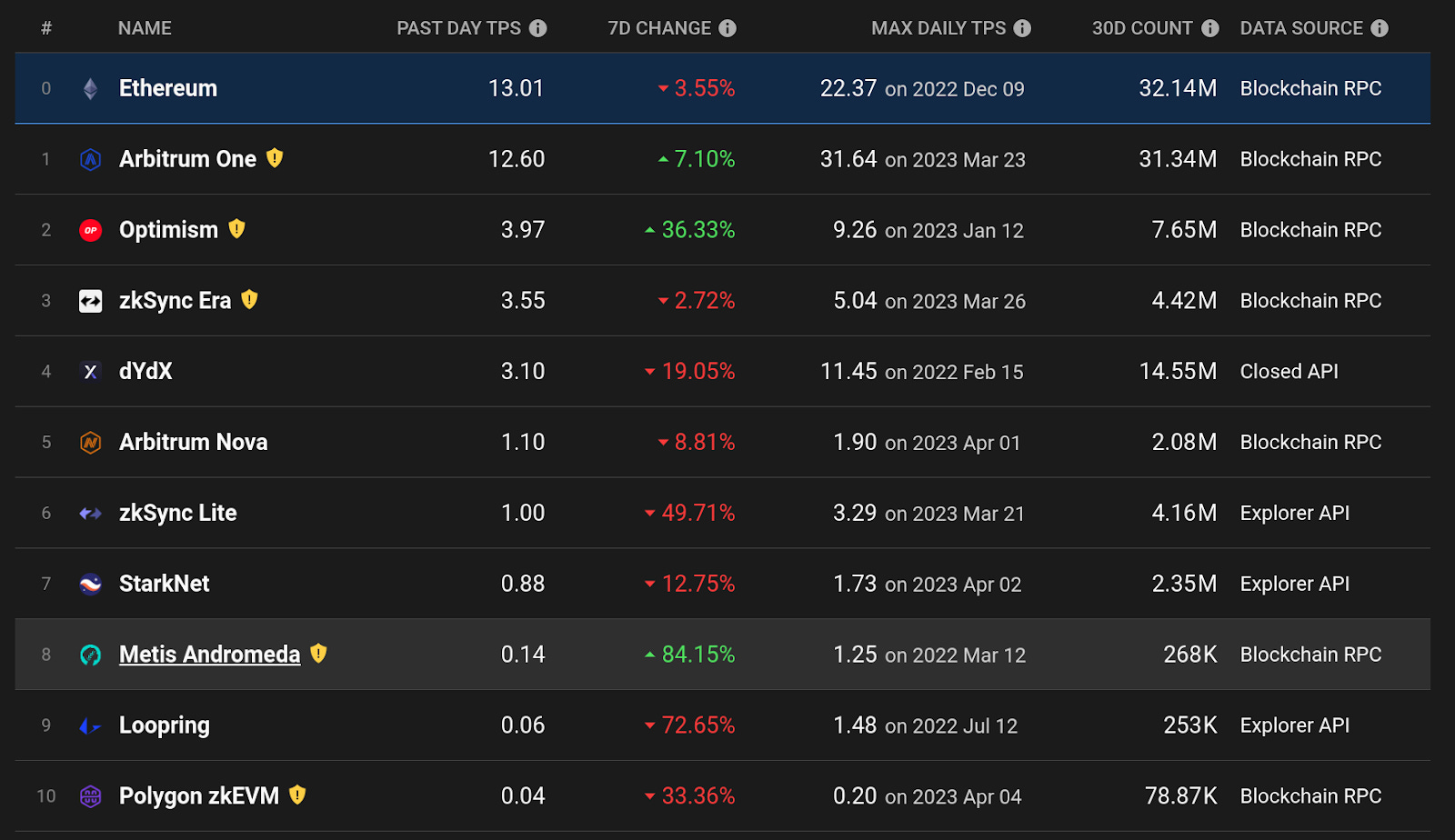

This is the official newsletter of BanklessDAO. To unsubscribe, edit your settings. The Arbitrum L2 Level UpAuthor: Austin Foss One of the earliest L2s to launch on Ethereum’s mainnet, Arbitrum has become a well recognized project in the Ethereum ecosystem. Recently, a lot of attention has been given to the various zk-rollups debuting on main-net, but the optimistic rollup has recaptured the spotlight in recent weeks following the announcement and launch of their ARB token and all the implications that came with that news. Arbitrum's Journey So FarBoth the Matic and xDAI chains, now known as Polygon and Gnosis Chain, beat Arbitrum to Ethereum's mainnet, but Optimism was even later at the very end of 2021. Launching in May 2021 Arbitrum stands out from the other three scaling solutions as the first Ethereum Virtual Machine (EVM) equivalent rollup. Development on Arbitrum is led by a team called Offchain Labs who formed the Arbitrum Foundation. After more than a year of successful growth, the team launched Arbitrum Nova, an entirely separate rollup designed for higher frequency applications—very similar to Gnosis Chain's use case. To differentiate between the two rollups the original one is called Arbitrum One. In February of this year, Offchain labs announced the next step "Beyond EVM Equivalence" called stylus. Using webassembly smart contracts, this tool would allow developers to program their dApps in languages like C++ and Rust. Over the course of this nearly two year time frame, Arbitrum has successfully operated almost the whole time, suffering two outages, and reaching more than one million transactions per day or ~11.57 transactions per second (TPS). Airdrop DistributionNot long after the Stylus announcement, Offchain Labs officially announced on March 16 that the Arbitrum token airdrop would happen a week later on March 23. In this single announcement were several major updates. First, because of the launch of the ARB token there would now be an Arbitrum DAO independent from Offchain Labs and the Arbitrum Foundation. Second, the DAO can grant licenses for new L2s built on the Arbitrum tech stack. Third was the reveal for support within Arbitrum One, or any Arbitrum powered L2, for L3 chains. Within Arbitrum One and Nova L3s "are automatically granted a free and perpetual license". To the distribution of the ARB tokens themselves, 56% of the 10 billion (B), 5.6B ARB, has been allocated for the community but just 12.75%, 1.275B ARB, was included in the airdrop. Of the remaining 43.25% to be given to the community "The Arbitrum Foundation and DAO will be tasked with distributing the additional community tokens over time." Leaving the remaining 44% which is not reported in the initial announcement unaccounted for. Something else absent from the announcement were any plans to decentralize the Arbitrum One sequencer by means of the ARB token and a staking mechanism. Not to say that this means it won't happen, but this could be an indication that the Foundation and Offchain labs will retain control of Arbitrum One, and a decentralized alternative might have to be licensed by the DAO. Governance Gets MessyAlmost immediately, just over a week after the airdrop, there was a "lively" discussion happening surrounding the first Arbitrum Improvement Proposal (AIP). AIP-1 was a proposal (asterisk on proposal) that did a number of things including the implementation of the DAO's constitution and further allocation of ARB tokens. It's how some of the tokens were to be allocated that caused said lively discussion. Even though this "proposal" was put up for a vote on Snapshot the contents of AIP-1 were apparently not up for discussion. In a follow up post made on April 2, intending to bring clarity to the purpose of the AIP, and what it was not. Much of the disagreement around the proposal focused on the 750M ARB to be used in "the Administrative Budget Wallet". Despite their attempt at providing clarity, and trying to communicate that these actions had already been decided would be, or had already been, taken, the vote on Snapshot failed to pass with 100M ARB, 76.67% of total ARB that voted against. Two days later the Arbitrum Foundation followed up with another thread on Twitter. Taking the community's feedback to heart, the foundation split the overly broad proposal into two separate pieces, AIP-1.1 and AIP-1.2. L2 Leader on EthereumRegardless of the rocky start at governance by the DAO and the Foundation it should not overshadow the momentum Arbitrum has. Currently neck and neck with Ethereum, the L1 it settles to, in daily TPS and is by far the most active L2 in terms of TPS, for now. ZkSync's Era launch a few weeks ago has already almost caught up with Optimism. Gone in a FlashAuthor: Austin Foss Eular Finance, a DeFi lending protocol on Ethereum's main-net, suffered a DeFi exploit on March 13, 2023, draining more than 200M USD at block number 16817996. Peckshield, "A blockchain security and data analytics company", broke the story just 9 minutes after the block was time stamped: The Defiant reported the next day that this was spread over "nearly $136M of Lido Finance’s stETH, $34M of USDC, $18.5M of WBTC and $8.8M in DAI." Euler FinanceLending protocols are a staple of modern DeFi with a wide variety of protocols in existence. Euler claims innovations such as "... permissionless lending markets, reactive interest rates, protected collateral, MEV-resistant liquidations, multi-collateral stability pools, and much more." In a crowded and competitive space doing something new can help your project stand out and attract new users, but doing so brings the greater risk that something can go wrong. Launching to main-net on December 1, 2021, the protocol was just over a year old when this exploit happened despite having numerous audits conducted over the course of that time. Two days after the attack Euler posted a 1M USD bounty for help in recovering the funds. Flash LoansWhat allowed the attacker to drain the lending protocol so quickly was an exploit called a flash loan attack. These were made possible when another lending protocol, Aave, first introduced flash loans; "new DeFi primitive enabling uncollateralized loans that can be used in the context of a single transaction." In essence, this allows any DeFi user, who can afford the gas, to execute a loan that borrows against the whole of a protocol's available collateral with the caveat that this loan must be paid back in the same block. This has several use cases such as arbitrage opportunities, but as Chainalysis points out in their report in the Euler Finance exploit they can also be used by hackers for such things as "to manipulate DeFi protocols’ pricing oracles." Chainalysis’ aforementioned evaluation of this particular flash loan attack states that "a liquidity issue in the DonateToReserve function" was causing an imbalance in eTokens (representing collateral) and dToken (representing debt). Broken down step by step the transaction summarizes to the following:

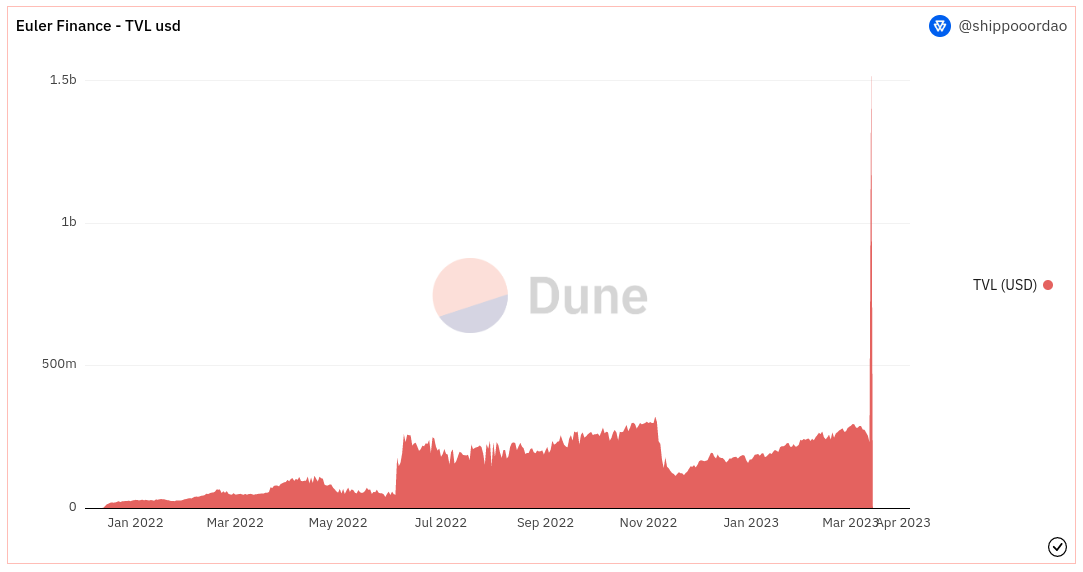

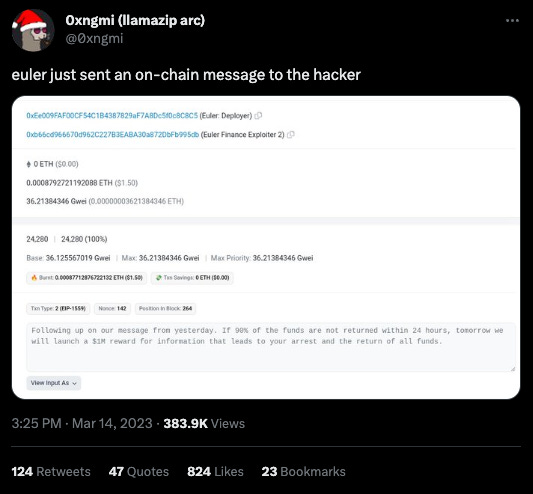

Chainalysis links to a thread by Igor Igamberdiev who provides far more detailed nuance to the details of what happened. He concludes that the "The root cause is the lack of checking liquidity in the donateToReserves() function". Looking at a Dune Analytics dashboard of Euler you can see the significant spike in TVL this huge, momentary, loan caused. For Euler, this was a case where leveraging the composability of different DeFi protocols led to unexpected risks and paths for abuse to open up. On Chain NegotiationsNegotiations began on March 14 when Euler sent an on-chain message to the attacker.

This thread was noticed and tracked by 0xngmi on Twitter, of the DeFiLlama team. After 24 hours and no response to the offer for the hacker to return90% and keep 10% of the stolen funds Euler sent a third message on March 15:

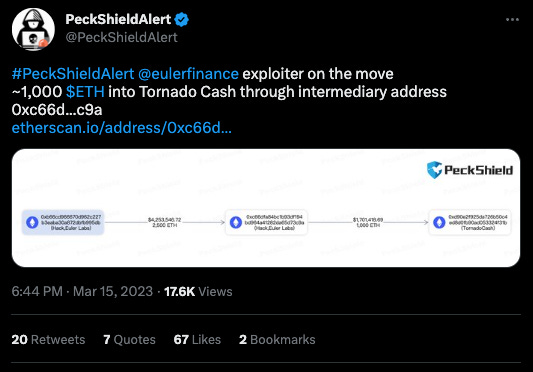

Unexpectedly, two days later on March 17, the exploiter sent 100 ETH to an address flagged as belonging to last year's record setting Ronin Bridge hacker, at the same time they sent 1000 ETH to another of their own wallets (Euler Finance Exploiter 4) which was then anonymized using Tornado Cash. Chainalysis later updated their report commenting on this behavior where they noted "it’s possible that this movement of funds was an attempt at misdirection by another hacking group." This makes some sense when considering why the Ronin hacker would need to set up secure communication channels with an actor they are already in contact with, and why that would days after the Euler exploiter sending 100 ETH to them. Three days later, March 20, the exploiter sent a transaction to the Euler Finance Deployer address with a message extending an olive branch.

Shortly after followed by a message the next day from the Ronin hacker's address that sent a 2 ETH transaction back to the attacker with a message reading:

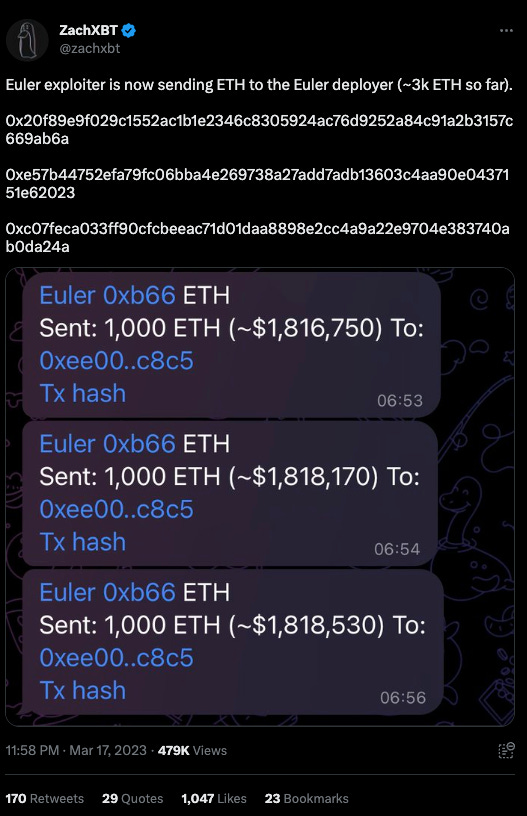

This was the last of on-chain messages until a week later. Recoverable Funds ReturnedWhile these communications were happening "On-chain sleuth" ZachXBT was reporting as early as March 18 that funds were starting to be returned to Euler Finance by the attacker. In an article published on April 4 Decrypt reported that "between March 25 and March 28, the Euler exploiter returned a total of 84,951 ETH worth $147.8 million, as well as $29.9 million in DAI." It was on March 28 that the attacker resumed public on-chain messages, these directed at the victims of their actions and begging for forgiveness.

Almost a week later, April 3, two more transactions were sent returning 8080 ETH and 2500 ETH to the Euler Finance multisig. In total this is approximately 98.5k ETH, at the current market price of 1900 USD that is 187.2M ETH. Combined with the 29.9M DAI also returned that results in a total current value of ~217M USD has successfully been returned to the protocol. ResolutionEuler Finance broke their silence at the end of the day, April 3, closing the 1M USD reward for information and teasing a larger update the next day when they released the following statement. A larger thread was also published to Twitter providing more context. They emphasized that all efforts now will go towards making the users of their protocol whole. One tweet of that thread stands out, giving a hint why the attacker chose* to return all the recoverable funds. Stating that this "is a reminder to all would-be black hats that it is very difficult to remain anonymous online if there’s a sufficiently skilled and motivated group of people looking for you." Considering that the attack began returning funds the very next day after using Tornado Cash is telling that the strength of that privacy tool's anonymity set may be weakening, or at the very least there are still practices users of privacy protocols must follow if they are to properly preserve their anonymity. We might never know exactly what misstep the attacker made, forcing themselves into a corner. This exploit serves as a reminder for us that even with a protocol that has been live on main-net for more than a year, and had numerous audits done to their code, DeFi is always risky. Project Releases 🎉

Immutable and Polygon join forces

(Jakes’ Take: Interesting partnership. While Polygon has had a lot of success doing business development, this partnership is evident that they haven’t been doing a good enough job attracting web3 game developers to their platform. On the other hand, Immutable is completely focused on the gaming market with an NFT platform, wallet, and SDK for game developers. Immutable began by creating the NFT game “Gods Unchained”, but Immutable also has a services business that helps other developers build NFT games using Immutable libraries. They have a great relationship with game developers and are often the first place devs go to integrate with blockchain tech. Remember Immutable partnered with Starkware in May 2020 to create Immutable X, a Layer 2 solution powered by StarkEx. Immutable is testing the waters and expanding to different solutions. Given Polygon’s user base and BD skills, it makes sense for them to expand and reach a broader audience. At the end of the day, the end user doesn’t care what scaling solution they’re using as long as they can do what they want to do cost-effectively: play the game they want to play and get liquidity for their NFTs. Putting companies with IP and relationships with developers in the driver’s seat.) Ledger releases browser extension

(Jake’s Take: Ledger is moving up the stack to own the entire user experience. Using the Ledger hardware wallet with many DeFi applications is difficult because there’s no native support for it in the Ledger Live Desktop app. Ledger has partnered with Metamask to integrate hardware-based transaction signing, but now ledger is moving to own a bigger piece of the stack. I’d consider this a soft-rollout because they’re only launching on Safari and MacOS so far. They plan to integrate with Chrome and Windows OS’s in the future.) ZK EVMS keep pushing

(Jake’s Take: Not much to comment on here. ZK-tech keeps on chuggin’.) Maker to increase diversity of collateral that backs DAI

https://twitter.com/MakerDAO/status/1641106700756213760 (Jake’s Take: Looks like Maker is reacting to the downsides of having DAI being significantly backed by RWAs like USDC via the Peg Stability Module or PSM. The PSM will tighten DAI’s range to its peg of $1 by acting as a release valve when the value of DAI swings too widely—usually as a result of volatility. After the SVB collapse, USDC holders started selling and the USDC-PSM saw a flurry of activity. The PSM acts as a tether that pulls the two assets together, and where one goes so does the other. DAI fell at the same rate as USDC before the DAO reconfigured the PSMs.) Chirping Birds

https://twitter.com/sassal0x/status/1637702828306358272 https://twitter.com/Fiskantes/status/1637497040933625858 https://twitter.com/friedberg/status/1641206963538399234 BANK utility (BanklessDAO token)With over 5,000 holders, BANK is one of the most widely held social tokens in crypto. So it bears asking, where are the best places to put our BANK to use? The five protocols below will allow you to deposit BANK in a liquidity pool and earn rewards. To get going, just click on the name, connect to the app, filter by BANK, and start earning passive income.  Resident tokenomist @ffstrauf turns inward, analyzing BanklessDAO's $BANK token and showing us how a movement becomes an incentivized community of buidlers (Cov @dippudo) ⚖️ BalancerBalancer has two 80/20 liquidity pools, meaning that you are required to deposit 80% BANK and 20% ETH in the pool. There is one pool on Ethereum and another on Polygon. Once you’ve provided liquidity, you’ll receive LP tokens. Keep an eye out for opportunities to stake these LP tokens. There is nearly 500,000 USD in the two Balancer liquidity pools. 🍣 SushiSwapSushiSwap has a 50/50 BANK/ETH pool. As with Balancer, you will receive LP tokens, and while you can’t stake them on SushiSwap’s Onsen Farm yet, you may be able to in the future. Liquidity providers earn a .25% fee on all trades proportional to their pool share. The SushiSwap pool has a little over 100,000 USD in liquidity. ⏛ Rari Fuse PoolDeprecated SoonThis will be deprecated soon. The Rari Fuse Pool allows you to borrow against your BANK or earn huge APY by providing assets like DAI to the pool. At present, all borrowing is paused for this pool. There is over 450,000 USD deposited in the Pool 🦄 UniswapThe Uniswap V3 liquidity pool is 50/50 BANK/ETH, and provides a price oracle for the Rari Fuse Pool. By depositing in the Uniswap pool, you can earn fees and help enable borrowing on Rari. This pool currently has over 500,000 USD in liquidity. 🪐 ArrakisYou can also provide liquidity to the Arrakis Uniswap V3 pool. The ratio is about 2/1 BANK/ETH. This pool is new, and only has a bit more than $6,000 in liquidity. In the future, you may be able to stake your BANK/ETH LP tokens within the protocol to earn additional rewards. |

Older messages

Oh My Goodness | Bankless Publishing Recap

Wednesday, April 5, 2023

Top-shelf Educational Web3 Content Shipped Directly to Your Inbox

Settled, Magic Eden, and NFTs' Role in Public Art | Decentralized Arts

Tuesday, April 4, 2023

Dear Bankless Nation, The use cases for NFT technology continues to expand, as users develop clever ways to utilize the tech. One such clever use has arisen in Atlanta, GA, where the City commissioned

Quadratic Funding Hits the Mark | BanklessDAO Weekly Rollup

Saturday, April 1, 2023

Catch Up With What Happened This Week in BanklessDAO

Building Mutable Organizations on an Immutable Blockchain | State of the DAOs

Wednesday, March 29, 2023

You're reading State of the DAOs, the high-signal low-noise newsletter for understanding DAOs.

Greedy Paws & NFT Project Migrations | Decentralized Arts

Tuesday, March 28, 2023

Dear Bankless Nation, As NFT projects grow, community leads must consider the viability of the spaces in which they operate. Do the platforms they use support the utility they aim to create, the people

You Might Also Like

Interview with MicroStrategy Founder Michael Saylor: The Company Holding the Most Bitcoin in the World

Thursday, February 27, 2025

In this interview, Colin from WuBlockchain had an in-depth discussion with MicroStrategy founder Michael Saylor about the company's ongoing Bitcoin acquisition strategy, the growing adoption of

Abu Dhabi Invests $436.9M In Bitcoin ETF

Thursday, February 27, 2025

February 17th, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Abu Dhabi Invests $436.9M In Bitcoin ETF Changpeng Zhao Sparks Meme Coin Rumours Coinbase Finally Lists POPCAT & PENGU

📈 BTC’s realised price (average acquisition price) reached an all-time high of $43,000; State of Wisconsin Invest…

Thursday, February 27, 2025

BTC's realised price reached an all-time high of $43000; Abu Dhabi's Mubadala Investment disclosed its BTC ETF holdings; South Korea to allow universities and charities to sell crypto donations

HashKey Exchange's Interpretation of the Hong Kong SFC Virtual Asset Roadmap

Thursday, February 27, 2025

We are pleased to see the Hong Kong government release the forward-looking and pragmatic “ASPI-Re” roadmap for advancing the virtual asset industry. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Argentina’s stock market plummets amid President Javier Milei’s LIBRA memecoin scandal

Thursday, February 27, 2025

Argentina's economic landscape shaken as Milei's LIBRA endorsement turns into multi-billion dollar fiasco. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Heated AMA Debate: 0G Team Responds to Allegations of CFX Soft Rug, Overvaluation, and Token Commitment Concerns

Thursday, February 27, 2025

This AMA primarily focused on the relationship between Conflux and 0G Labs, discussing 0G Labs' high valuation, fundraising structure, technical direction, and community concerns over transparency.

Pectra: Ethereum’s Next Major Upgrade

Thursday, February 27, 2025

Breaking down key changes included in Ethereum's Pectra hard-fork ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Solana falls to lowest price since November 2024 losing 43% since January

Thursday, February 27, 2025

Volatility reigns as Solana's price retreat tests its resilience against past support levels. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Five Projects with Real-World Revenue Scenarios Utiling Token Empowerment

Thursday, February 27, 2025

Memecoin once captured significant attention and investment with its unique culture, humorous image, and community-driven characteristics. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📉 Transactions on the Bitcoin network dropped to a 1-year low. The Ethereum Foundation alloc…

Thursday, February 27, 2025

Transactions on the Bitcoin network dropped to a 1-year low. The Ethereum Foundation allocated 45000 ETH to DeFi protocols. Standard Chartered established a JV to issue a HKD-backed stablecoin ͏ ͏ ͏ ͏