A soft landing is more likely after last week's jobs data

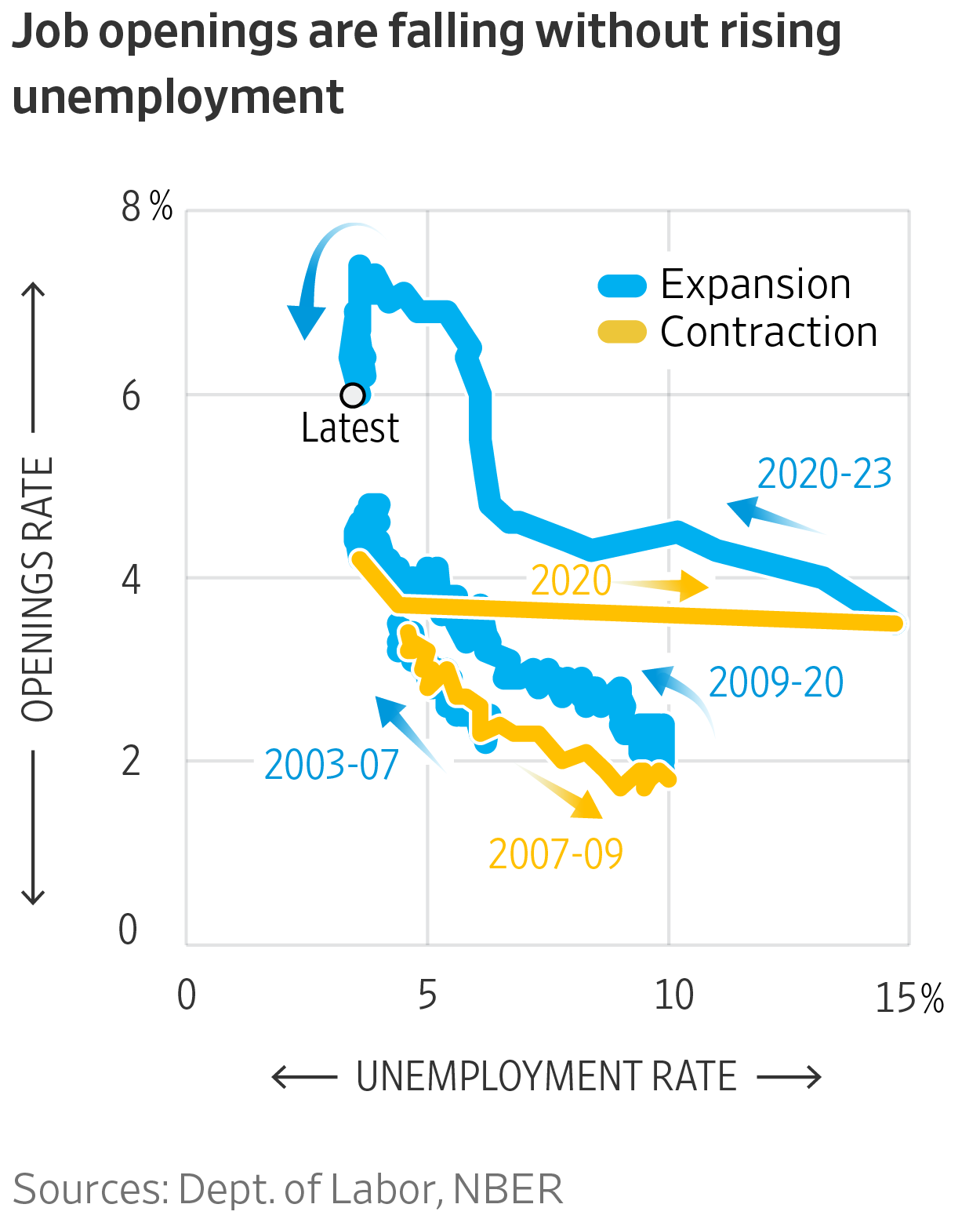

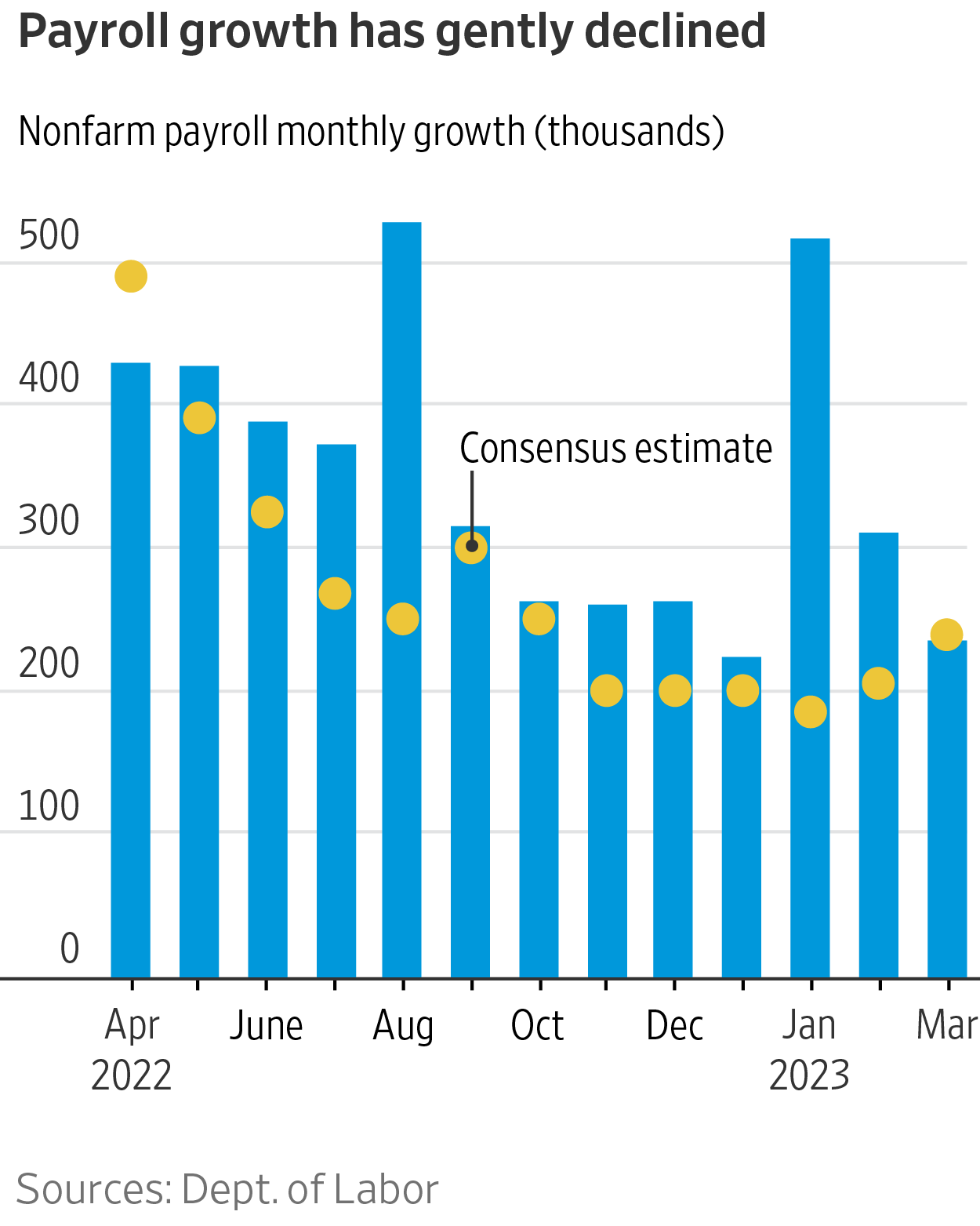

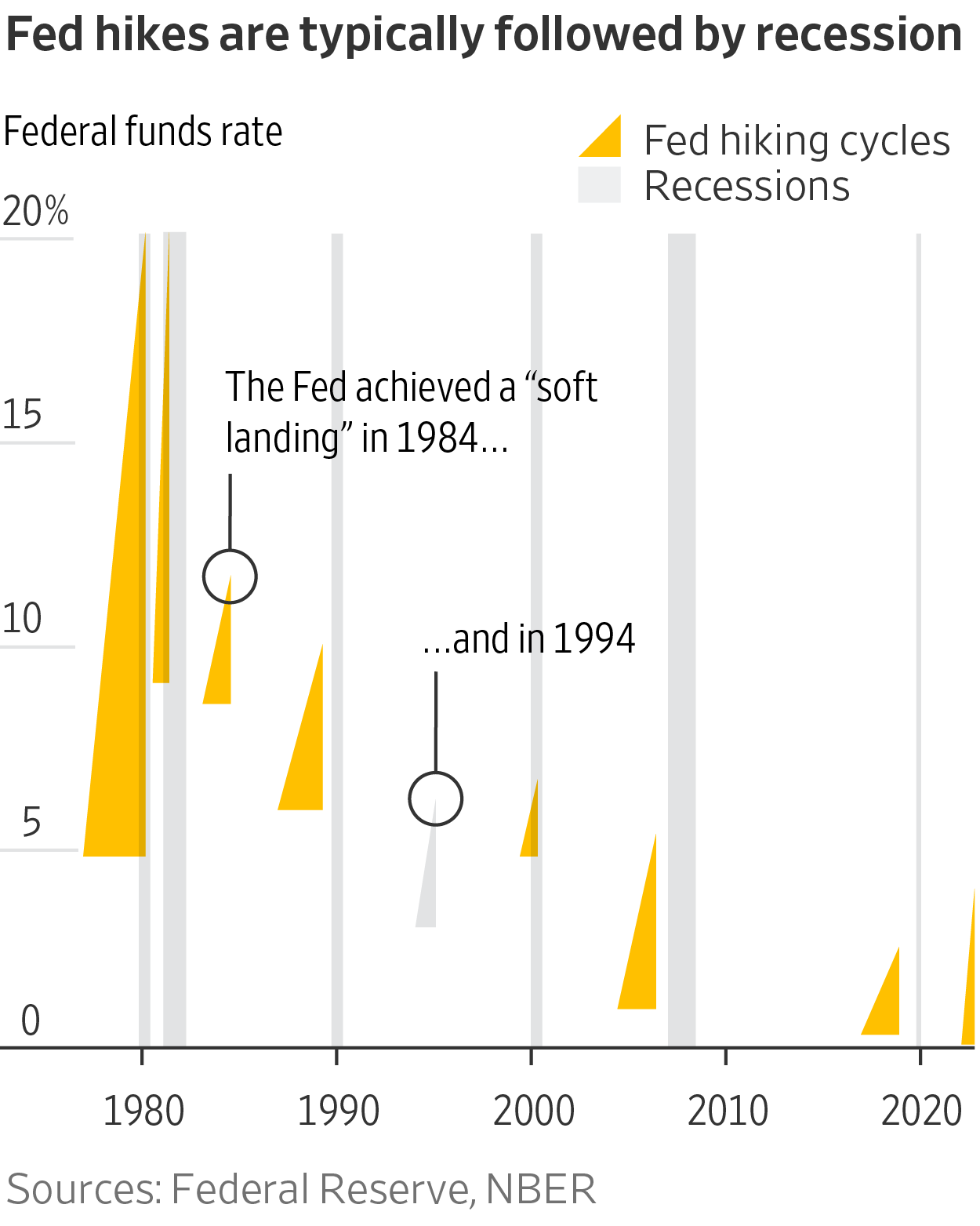

A soft landing is more likely after last week's jobs dataLower inflation usually costs jobs. This time could be different.Today’s inflation is the result of too much demand chasing too little supply. The labor market is the locus of this imbalance: companies can’t find enough workers. Job vacancies are unusually high. In order to fill these vacancies, companies are having to pay higher wages and recoup the cost from consumers in higher prices. One year ago, Fed chair Jerome Powell floated the possibility of this process ending in a “soft-landing”. In this scenario, the Fed raises interest rates high enough to slow the economy, reduce vacancies, restrain wage gains, and dampen inflation, but not so high that people lose their jobs. Economists responded with skepticism. Larry Summers, the former Treasury Secretary, and Olivier Blanchard, the former chief economist of the IMF, wrote last August, “we find it entirely unconvincing as support for the ‘soft landing’ idea...that vacancies can decline substantially taking pressure off inflation without driving unemployment way up.” But last week’s data suggests that's exactly what’s happening. The labor market is gently cooling and unfilled openings are falling. Unemployment remains at a 50-year low. A cooling labor market is evident in other data, too. People are working fewer hours. Wages are growing more slowly. The pay bump for job-switching has almost disappeared. But until last Friday, there had been a fly in the ointment: the Bureau of Labor Statistics’ nonfarm payroll reports showed companies hiring at a much faster rate than workers were entering the labor force. That’s a sign of an overheating economy with inflation in the pipeline. Moreover, the payrolls numbers didn’t really make sense in light of the other data. Was the economy cooling as the unemployment rate and other metrics suggest, or running too hot, as payrolls implied? Friday’s payrolls report showed that companies hired 236,000 workers last month. That’s a sharp slowdown from the red-hot pace of hiring earlier in the year. One swallow does not a summer make, but the data is now telling a more harmonious story. The labor market imbalance is being resolved from both sides. Fed hikes are slowing the economy and reducing companies’ demand for workers. People on the sidelines are rejoining the workforce. Rising supply is meeting falling demand. Lower inflation is the ultimate goal; a balanced labor market is just one way to get there. And it seems to be working. Most measures of inflation have declined. Investors’ inflation expectations for the next 5 years are now consistent with the Fed’s 2% target. To be fair, it’s far too soon to call it ‘mission accomplished’. Monetary policy acts with long and variable lags. The action the Fed has already taken, let alone any further hikes, may ultimately curb inflation but at the cost of a downturn. Company bosses are downbeat and some worry about a credit crunch after the recent turmoil in the financial sector. Bond markets show that investors expect the Fed to cut rates later this year, presumably in response to an economic slowdown. The Fed’s own forecasts call for recession-skirting 0.4% growth this year. These expectations are reasonable. Fed hikes are almost always followed by recessions. But the covid-ravaged economy of the past few years is unprecedented. Is this time different? |

Older messages

We’ve been arguing about deposit insurance for 200 years

Thursday, April 6, 2023

Debating the tradeoff between moral hazard and financial stability is nothing new

Deposits should be safe. Insure them without limit.

Friday, March 24, 2023

Depositors have better things to do than monitor bank risk

How did SVB slip through regulators' fingers?

Monday, March 20, 2023

Bank stocks continue to fall, signaling problems with the financial system that may run deeper than deposit flight at SVB and other regional banks.

What happened to SVB, in pictures

Tuesday, March 14, 2023

Stability is expensive. SVB preferred taxpayers pay for it.

Are higher wages driving inflation, or only reacting to it?

Wednesday, March 8, 2023

Workers' wages are rising. Home Depot, Delta Airlines, and Walmart are some of the latest companies to announce substantial pay hikes. Yet, most economists have reservations about these gains.

You Might Also Like

6 Most Common Tax Myths, Debunked

Saturday, March 8, 2025

How to Finally Stick With a Fitness Habit. Avoid costly mistakes in the days and weeks leading up to April 15. Not displaying correctly? View this newsletter online. TODAY'S FEATURED STORY Six of

Weekend: My Partner Can’t Stand My Good Friend 😳

Saturday, March 8, 2025

— Check out what we Skimm'd for you today March 8, 2025 Subscribe Read in browser Header Image But first: this is your sign to throw away your old bras Update location or View forecast EDITOR'S

Your Body NEEDS to Cardio Row! Here Are Some Options.

Saturday, March 8, 2025

If you have trouble reading this message, view it in a browser. Men's Health The Check Out Welcome to The Check Out, our newsletter that gives you a deeper look at some of our editors' favorite

What Do You Really Need?

Saturday, March 8, 2025

Is opposing consumerism lacking gratitude? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

“Otway” by Phoebe Cary

Saturday, March 8, 2025

Poet, whose lays our memory still / Back from the past is bringing, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Cameron Diaz Returned To Fashion Week In A Fabulous Little Red Dress

Saturday, March 8, 2025

WOW. The Zoe Report Daily The Zoe Report 3.7.2025 Cameron Diaz's Asymmetrical Red Dress Lit Up The Stella McCartney Fall 2025 Show (Celebrity) Cameron Diaz Returned To Fashion Week In A Fabulous

5-Bullet Friday — Breaking the Sperm Bank, D-Cycloserine, Tools for Grumpy Elbows, and Wisdom from Seth Godin

Saturday, March 8, 2025

“If you're feeling creative, do the errands tomorrow. If you're fit and healthy, take a day to go surfing. When inspiration strikes, write it down." ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Inside Alex Pereira's Training for Saturday's UFC 313 Showdown

Friday, March 7, 2025

View in Browser Men's Health SHOP MVP EXCLUSIVES SUBSCRIBE Inside Alex Pereira's Training for Saturday's UFC 313 Showdown Inside Alex Pereira's Training for Saturday's UFC 313

Update Your Android Devices Now 🚨

Friday, March 7, 2025

This TikTok Cleaning Method Might Have Broken My Fan. The security update includes fixes for two zero-day exploits. Not displaying correctly? View this newsletter online. TODAY'S FEATURED STORY

EmRata's Itty-Bitty Bikini Just Brought Back This "Cheugy" 2010s Trend

Friday, March 7, 2025

Plus, everything you need to know about Venus retrograde, your daily horoscope, and more. Mar. 7, 2025 Bustle Daily New books from Emily Henry, Karen Russell, and Kate Folk are among Bustle's best