Net Interest - The Price of Confidence

Welcome to another issue of Net Interest, my newsletter on financial sector themes. This week, I take a look through the history of deposit insurance; the system looks like it will be shaken up – we explore what that means. For paying subscribers, there’s also a segment on this week’s bank earnings. If you’re not already signed up, you can do so here: “There is an element in the readjustment of our financial system… and that is the confidence of the people.” — President Franklin D. Roosevelt Of all the innovations that underpin the modern financial system, one of the most central is deposit insurance. Like many ideas in finance, it heralds from the United States, which was the first major country to introduce a national deposit insurance scheme ninety years ago. Since then, similar programs have been rolled out across the world. There is even an International Association of Deposit Insurers which convenes from time to time to promote guidance and share best practice. When it works, deposit insurance goes by largely unnoticed. Customers brush past the FDIC mark stuck inside their bank branch window without giving it a second glance, confident that any money they leave behind will be available for withdrawal at a later date. But occasionally, as in the weekend of 11/12 March, deposit insurance launches itself into the public consciousness. When that happens, it’s usually not good news. Over the years, the parameters around deposit insurance have been revised to accommodate the latest events, and here we are again. This week, the Federal Deposit Insurance Corporation (FDIC) held an open board meeting to discuss what to do about the hole that has opened up in its accounts following the failure of two banks. Its staff estimate that losses from the collapse of Silicon Valley Bank and Signature Bank amount to $22.5 billion, of which $19.2 billion stems from the eleventh hour decision to protect uninsured depositors as well as insured. The deposit insurance fund was already tracking below its target. Funds available to backstop depositors sat at 1.27% of aggregate insured deposits as at end 2022, against a statutory minimum of 1.35%. The long term target is at least 2% which implies a $73 billion shortfall even before these latest losses are factored in. Now there is a debate about whether deposit coverage should be widened. Currently in the US, insurance is available on $250,000 per depositor per financial institution. That covers $10.0 trillion of deposits. But there is a further $7.7 trillion that remains uninsured. Capturing it will come at a cost; the question is, who pays? When Franklin Delano Roosevelt signed deposit insurance into law in 1933 he wasn’t exactly thrilled. On the campaign trail one year earlier he had pushed back on the idea of a blanket scheme, arguing that it would be “dangerous” because it would lead to “laxity in bank management” and be “an impossible drain on the federal treasury”. At his first press conference as president, he told journalists that guaranteeing deposits would “guarantee bad banks as well as good banks. The minute the Government starts to do that, the Government runs into a probable loss.” Within a few months, Roosevelt had been cornered into a compromise. Banks were collapsing at a rapid rate – between 1 January and 30 June, 1933, four thousand of them failed – and deposits were fleeing the system. Deposit insurance was seen as a clearcut way to stop the bleed. One of its proponents, former Senator Robert Owen, argued that by convincing people that their deposits were safe and the banking system sound, deposit insurance was “essential to the stability of the income of the Nation… a far greater matter than the very important end of protecting the individual depositor or the bank from loss.” His views were shared by Representative Henry B. Steagall who worked to bring a deposit insurance bill through Congress. Deposit insurance was nothing new. It had been practised over a hundred years earlier in the state of New York. The program there was devised by Joshua Forman, a local businessman, who had been inspired by the mechanics of international trade in China. Regulations in Guangzhou required merchants trading with foreigners to be liable for one another’s debts in return for a licence to operate. Writing in 1829, when bank-supplied circulating medium was largely in the form of bank notes rather than deposits, Forman noted:

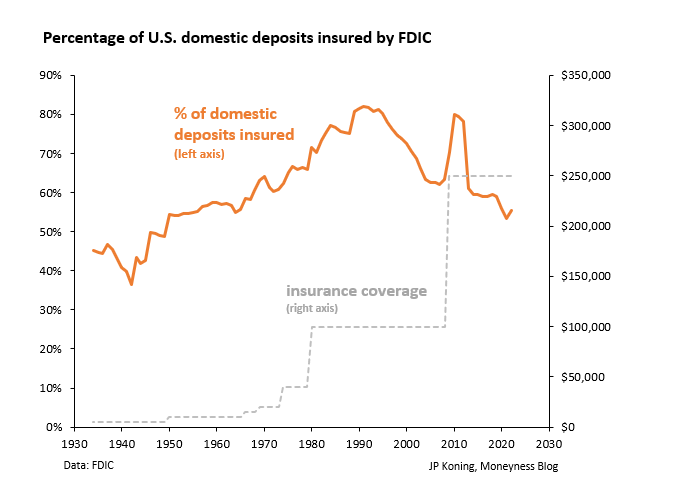

Forman’s scheme required member banks to pay an annual assessment of 0.5% of capital until their total payments equaled 3% of capital. The accumulated funds would be used to cover the notes and deposits of member banks that failed in the event their assets proved insufficient. By the end of 1837, almost all of New York’s banks were members. In the years that followed, five additional states adopted insurance programs. However, various flaws in their design hampered their success. In New York, losses depleted the resources of the fund so that by 1842 it ceased to be able to repay losses of failed banks. The limit on annual assessments prevented adequate insurance during panics, and a poor supervisory regime allowed large risk-takers to free ride on other banks. Nor was the system compulsory; once solvent banks realised the extent of the losses, they checked out. Where schemes were successful, they paired effective supervision with the principle of shared risk. The mutual guarantee incentivised members to maintain discipline over each other and the best schemes afforded them that control. Such systems incorporated supervisory bodies staffed by bankers to keep a watchful eye over excessive risk-taking and free riding. By the time the Banking Act was being thrashed out in 1933, design features had been tested in numerous states all over the country. As well as the six schemes established before the Civil War, eight were established in the aftermath of the Banking Crisis of 1907. The only questions remaining were which banks would be eligible, how the scheme would be funded, and which deposits would be protected. The latter question was critical. In earlier proposals, full insurance had been advocated. At the end of the nineteenth century, presidential nominee William Jennings Bryan pushed for all deposits to be guaranteed, regardless of size. He gave the example of a huge $150,000 deposit the Nebraska state treasurer had made in a bank that ended up failing. “He cannot tell how that bank is being managed. He simply puts his money there for security, and it is the business of the Government to make that bank as secure as possible,” Bryan told a Congressional hearing. It was a sentiment many corporate treasurers would reprise in March of this year, including digital media company Roku’s, who had $487 million on deposit at Silicon Valley Bank. But Roosevelt would only budge with something lower. He believed that a more limited liability would incentivize depositors to continue to exercise some discretion in their choice of bank and incentivize bankers to make good management decisions. In the end, a compromise was settled on: a $2,500 insurance threshold. The cap mirrored a guarantee available in Postal Savings System accounts, creating an incentive to bring those deposits back into the mainstream system. And it covered 97% of depositors, so most fell under its protection. The industry didn’t like it – banks were mandated to fund the scheme via an assessment equal to 0.5% of insured deposits. But the cost of insurance would largely be offset by limits the Banking Act put on the amount of interest banks could pay on deposits. It was signed into law and, although greeted with little fanfare in the press, the new deposit insurance program had an immediate impact on financial stability. After over 9,000 bank failures in the prior four years, only nine banks didn’t make it through 1934. On 3 July 1934, Mrs. Lydia Lobsiger, a customer of the Fondulac State Bank in East Peoria, Illinois, became the first depositor to receive a federal deposit insurance payout in an amount of $1,250. The rise of deposit insurance in the US owes something to the fragmented nature of its banking system. Many banks (so-called “unit banks”) operated a single branch, reducing their capacity to diversify and increasing their risk profile. Geographic expansion and consolidation represented alternative system stabilisers – and states that allowed branch banking saw lower failure rates – but unit banking retained political patronage. Deposit insurance was one way to protect the smaller banks. All of the six states that enacted deposit insurance before the Civil War were unit banking states, as were the eight that introduced it post 1907. Representative Henry B. Steagall, the architect of deposit insurance in the 1933 Banking Act, opposed branch expansion, warning that it could lead to a banking monopoly. “Something must be done to preserve our historic banking system, with its services and credit facilities for all sections and all communities in our country,” he said. For many years, deposit insurance did its job. Coverage was quickly lifted to $5,000 and then, to keep pace with rising prices, it was lifted again, to $10,000 in 1950; to $20,000 in 1969; and to $40,000 in 1974. But then the parameters began to shift. In 1980, despite reservations of the Federal Deposit Insurance Corporation, new legislation jacked the threshold up to $100,000. Financial institutions were subject to limits on what they could pay on deposits and many had begun to suffer outflows as depositors switched to money market funds offering higher rates. By 1980, 85% of savings-and-loan associations were losing money and warnings were being sounded that without deregulation, they could collapse. In 1980, Congress passed the Depository Institutions Deregulation and Monetary Control Act. It began the process of eliminating interest rate controls on deposits placed with banks and savings-and-loans. But, under heavy lobbying from the savings-and-loan industry, lawmakers also slipped in an increase to the deposit insurance threshold. “It was almost an afterthought,” a House staffer later told a reporter. The increase would later be cited as a contributory factor in the savings-and-loan crisis that followed. In the few years after 1980, the industry reversed its losses to experience strong growth. But it was bad growth. Through brokers, savings-and-loans were able to attract pools of deposits from all over the country in $100,000 increments. Back in 1963, regulators had limited the amount of brokered deposits a savings-and-loan could hold to 5% of its total deposits but alongside the deregulation of 1980, the limit was repealed. Now, savings-and-loans had ready access to a stream of cheap funding. Their use of brokered deposits increased from $3 billion at the end of 1981, to an estimated $29 billion at the end of 1983. It wasn’t until 1989 that limits were re-imposed on brokered deposits, by which time many savings-and-loans had collapsed under the weight of fraud, bad loans and balance sheet mismatches. But the $100,000 deposit insurance threshold remained intact. At the height of the global financial crisis in October 2008, the limit was raised again, to $250,000, in a measure that was meant to be temporary but became permanent in 2010. (One reason it was made permanent was to address the issue of lapsed coverage on time deposits due to mature after the cap reverted. What’s easy to add is often less easy to subtract.) At the time, the new limit covered most depositors as well as 71% of deposits. Since then, however, uninsured deposits have risen to 57% of the total. It’s slightly odd, because there are ways to retain coverage by splitting up a larger deposit into smaller chunks. With 4,706 FDIC insured institutions in the US, there is certainly enough capacity – depositing $250,000 with each of them provides $1.2 billion of cover – and the technology exists to do it.

Indeed, the bill that eased regulation around banks in 2018, relaxing the scrutiny of Silicon Valley Bank, also facilitated growth in a new kind of deposit. Since the savings-and-loan crisis, brokered deposits have been stigmatised. But the bill reclassified so-called “reciprocal deposits” from brokered to non-brokered if they total less than $5 billion or 20% of total liabilities. Reciprocal deposits allow banks to dice up larger deposits and place them with other banks, via technology networks such as IntraFi (which works with 3,000 financial institutions). Around $1 trillion in deposits flow through these networks, of which about a fifth are reciprocal. Perhaps unsurprisingly, Silicon Valley Bank didn’t participate. It had just $469,000 of reciprocal deposits at the end of 2022 out of a total deposit base of $175 billion. It could be that depositors were simply inured to the risk. After all, we were coming off the second longest stretch without a bank failure in recent memory. Now, platforms like IntraFi are booming, although that may be short-lived if authorities raise the threshold again. The problem with insurance is that it isn’t free; banks need to top-up the fund and bolster it further if coverage is to be expanded. Already, the top-up plus any surcharge to cover losses on Silicon Valley Bank and Signature Bank mean the six largest banks have to cough up an additional $15 billion, equivalent to around 15% of their earnings. No doubt that will be passed on to consumers. Deposit insurance was never meant to preserve wealth, which is why insurance companies, pension companies and the like are not eligible. It was meant to preserve the functioning of the banking system. What the correct number is to accomplish that is a guess, but it’s going up. Sarah Jane Gates’ 2017 PhD dissertation, More Lives than a Cat: A State and Federal History of Bank Deposit Insurance in the United States was a valuable resource. As was Charles Calomiris’ Deposit Insurance: Lessons from the Record (1989) and Is Deposit Insurance Necessary? A Historical Perspective (1990). Paying subscribers read on for analysis of this week’s bank earnings…... Subscribe to Net Interest to read the rest.Become a paying subscriber of Net Interest to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

So You Want to Launch a Hedge Fund?

Wednesday, April 19, 2023

Plus: Bank Earnings in the Aftermath of Crisis

The Secret Diary of a Bank Analyst

Friday, March 31, 2023

Plus: Silicon Valley Bank, Money-Go-Round, Liquidity Coverage Ratios

The Demise of Credit Suisse

Friday, March 24, 2023

Plus! UBS: The Deal of the Decade?

Contagion

Friday, March 17, 2023

Plus: Credit Suisse, Charles Schwab, First Republic Bank

The Demise of Silicon Valley Bank

Friday, March 10, 2023

The Rapid Collapse of the 16th Largest Bank in America

You Might Also Like

Longreads + Open Thread

Saturday, March 8, 2025

Personal Essays, Lies, Popes, GPT-4.5, Banks, Buy-and-Hold, Advanced Portfolio Management, Trade, Karp Longreads + Open Thread By Byrne Hobart • 8 Mar 2025 View in browser View in browser Longreads

💸 A $24 billion grocery haul

Friday, March 7, 2025

Walgreens landed in a shopping basket, crypto investors felt pranked by the president, and a burger made of skin | Finimize Hi Reader, here's what you need to know for March 8th in 3:11 minutes.

The financial toll of a divorce can be devastating

Friday, March 7, 2025

Here are some options to get back on track ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Too Big To Fail?

Friday, March 7, 2025

Revisiting Millennium and Multi-Manager Hedge Funds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The tell-tale signs the crash of a lifetime is near

Friday, March 7, 2025

Message from Harry Dent ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👀 DeepSeek 2.0

Thursday, March 6, 2025

Alibaba's AI competitor, Europe's rate cut, and loads of instant noodles | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March 7th in 3:07 minutes. Investors rewarded

Crypto Politics: Strategy or Play? - Issue #515

Thursday, March 6, 2025

FTW Crypto: Trump's crypto plan fuels market surges—is it real policy or just strategy? Decentralization may be the only way forward. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What can 40 years of data on vacancy advertising costs tell us about labour market equilibrium?

Thursday, March 6, 2025

Michal Stelmach, James Kensett and Philip Schnattinger Economists frequently use the vacancies to unemployment (V/U) ratio to measure labour market tightness. Analysis of the labour market during the

🇺🇸 Make America rich again

Wednesday, March 5, 2025

The US president stood by tariffs, China revealed ambitious plans, and the startup fighting fast fashion's ugly side | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March

Are you prepared for Social Security’s uncertain future?

Wednesday, March 5, 2025

Investing in gold with AHG could help stabilize your retirement ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏