Weekly NFT & GameFi Update (Week 20, 13/05/2023 - 19/05/2023)

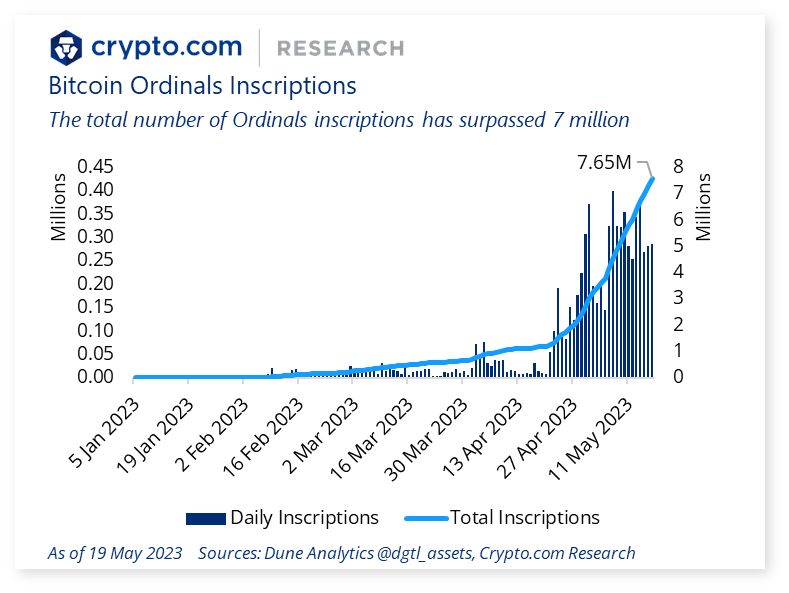

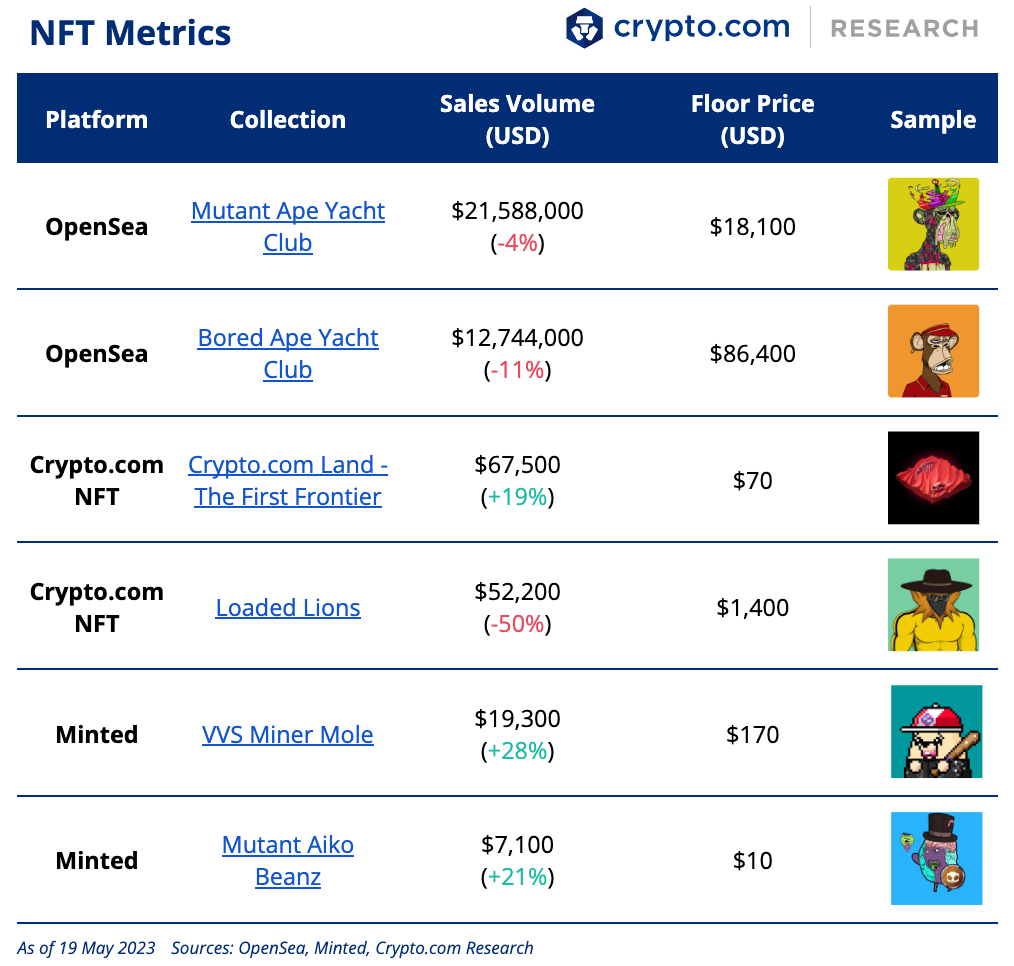

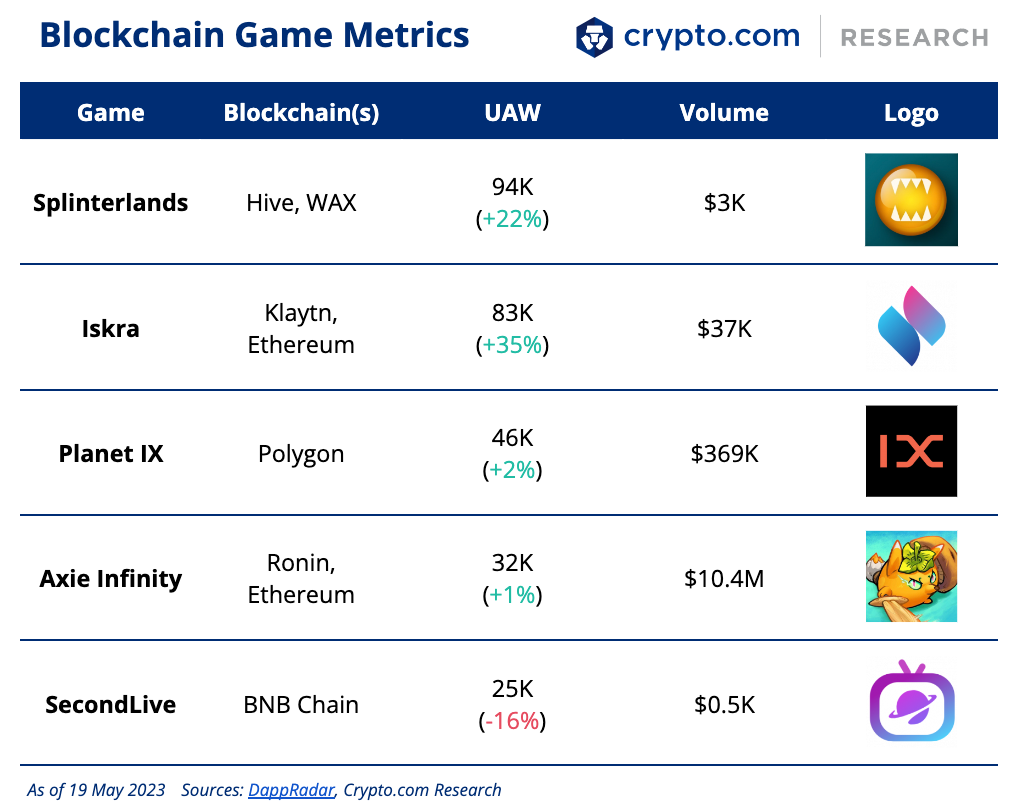

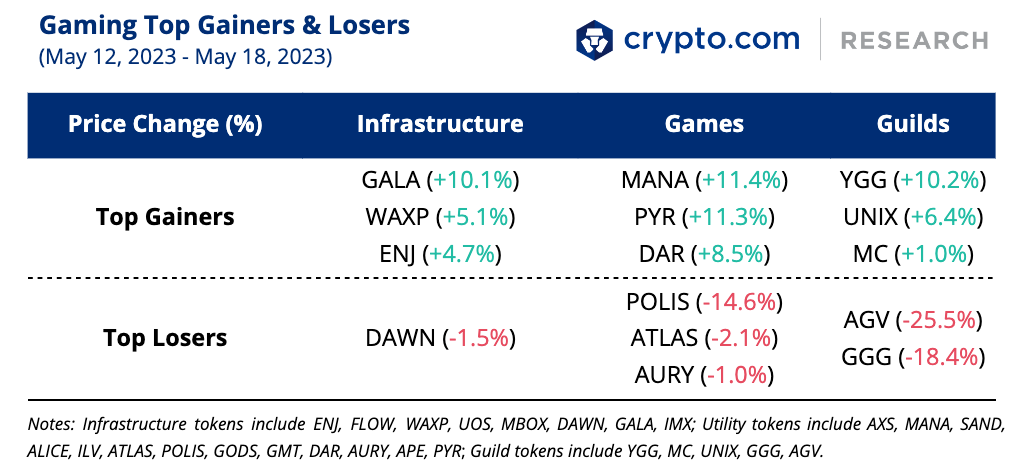

Weekly NFT & GameFi Update (Week 20, 13/05/2023 - 19/05/2023)Pepe-themed ‘Bitcoin Frogs’ NFTs gain popularity amid Ordinals hype. Epic Games and LEGO Group collaborate to build metaverse. Ubisoft is creating an NFT collection for Assassin’s Creed.Chart of the WeekBitcoin NFTs have gained considerable popularity and traction since the launch of the Ordinals protocol, which has made it possible to mint NFTs directly on the Bitcoin blockchain. At the time of writing, the number of Ordinals inscriptions reached 7.65 million. Readers may check out our new report, Bitcoin’s Expanding Ecosystem: Layer-2, DeFi, NFT. New Project SpotlightNFT Collectibles[COMING SOON] Crypto.com is launching ‘Crypto.com Expedition Gear’ backpack NFTs via an airdrop and sale. One random mystery package will be airdropped for every ‘Crypto.com Land – The First Frontier’ NFT owned. Meanwhile, ‘Loaded Lions’ and ‘Cyber Cubs’ NFT holders will be eligible for the Early Access sale. [COMING SOON] ‘aelfen’ is a collection by 3D artist Farruk Murad. This drop explores the harmony between the ælfen (forest dwellers) and nature. The collection goes live on Crypto.com NFT on 26 May. Blockchain Games[COMING SOON] D.G.Pals is releasing a free-to-play game, Merge Defence, where players can assemble a team of four friends to defend Panterra against waves of mythical rogues. The game will be available on 20 May. [LIVE] Croskull launched its Ordinals NFT collection, ‘bitCroSkull’, on 18 May. The bitCroSkulls will be available for minting in two whitelist stages, followed by a public mint. The following table shows select top collections (by weekly sales volume on each platform) and a sample of their art: The following table shows select top games by weekly Unique Active Wallets (UAW): Gaming Token PerformanceThe total market cap for gaming tokens now stands at US$11.25 billion, up +7% from last week. News Highlights

Recent Research Reports

Latest University Articles

DisclaimerThe information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.The brands and the logos appearing in this report are registered trademarks of their respective owners.Nothing in this report is intended to suggest that NFTs are investment products, nor securities, nor anything similar or “financial” of any description. NFTs are to be reserved for fun only and NOT with any expectation of “value”, “profit”, “yield” or “investment”. You are also aware that NFTs are not a store of value, are not a generally accepted medium of exchange, and are considered very illiquid and volatile.We’re all ears.Your feedback has always helped us provide insightful crypto market trends. Tell us how we can improve this newsletter further by taking a quick survey below (it will only take less than a minute). Thank you! Thank you for reading! We hope you find our Weekly NFT & GameFi Update enlightening! Hungry for more? Visit our Research Hub and University to access other insightful crypto research! Share with a friend if you like our email! |

Older messages

Weekly Update - DeFi and Layer 1 & Layer 2 News (Week 20,11/05/2023 - 17/05/2023)

Wednesday, May 17, 2023

ETH's Beacon chain experienced two finality issues within 24 hours. Circle rebalanced its Treasury holdings, citing US debt default risk. Optimism's latest major upgrade, Bedrock, is set for 6

Market Pulse by the Crypto.com Research & Insights Team (Week 20, 09/05/2023 – 15/05/2023)

Monday, May 15, 2023

US inflation indicator CPI rose 4.9% YoY in April. Microsoft, Goldman Sachs, and more are developing a blockchain called Canton. New survey finds 26% of family offices are invested in crypto.

Weekly NFT & GameFi Update (Week 19, 05/05/2023 - 12/05/2023)

Friday, May 12, 2023

Elon Musk tweets meme from 'Milady' NFT collection. The market cap of BRC-20 Bitcoin tokens surpassed US$1 billion. The government of Turkey launches a virtual office in the metaverse.

Weekly Update - DeFi and Layer 1 & Layer 2 News (Week 19,04/05/2023 - 10/05/2023)

Friday, May 12, 2023

Bitcoin transaction fees surpass block subsidy for miners. MakerDAO launches Spark Protocol, a DeFi lending solution for $DAI users. SushiSwap rolls out v3 liquidity pools across 13 networks.

Market Pulse by the Crypto.com Research & Insights Team (Week 19, 03/05/2023 – 08/05/2023)

Monday, May 8, 2023

Crypto.com launches artificial intelligence chatbot, Amy. US Federal Reserve raises rates by 25 bps. Kingdom of Bhutan is running $BTC mining operations.

You Might Also Like

Texas doubles down on crypto with new $250 million Bitcoin reserve bill

Tuesday, March 11, 2025

Texas' second crypto bill seeks to enhance state and local government participation in digital asset investments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How-ey Can Get Out of Here

Tuesday, March 11, 2025

How On-Chain Data Can Clarify the Regulation of Cryptoassets ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

February CEX Data Report: Significant Decline in Trading Volume Across Major CEXs - Spot Down 21%, Derivatives Dow…

Tuesday, March 11, 2025

In February 2025, the spot trading volume of major CEXs decreased by 21% compared to January. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

El Salvador defies IMF, continues Bitcoin purchases amid market downtrend

Monday, March 10, 2025

El Salvador's Bitcoin holdings grow to $504 million, challenging IMF directives amid sharp price declines. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🖊️ Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO …

Monday, March 10, 2025

Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO for a Cronos Strategic Reserve; Texas's Senate passed bitcoin reserve bill SB-21 ͏ ͏ ͏

Vitalik TAKO AMA: ETH Positioning, Sequencer Centralization, L1 vs L2, Governance, and Success Metrics

Monday, March 10, 2025

On the evening of February 19th at 12 PM UTC and lasting until 12 PM UTC on February 20th, Vitalik Buterin, the founder of Ethereum, was invited to participate in a flash text interview on Tako (a

Donald Trump Creates U.S. Bitcoin Reserve

Monday, March 10, 2025

March 10th, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Donald Trump Creates US Bitcoin Reserve Diddy Shows 'Kindness' To Sam Bankman-Fried Robinhood Conducts $1M Crypto Trivia

Bitcoin’s realized volatility surges in as traders face extreme price swings

Sunday, March 9, 2025

Volatility clustering in Bitcoin reveals the impact of turbulent rallies and sharp pullbacks. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Mar 3 to Mar 9)

Sunday, March 9, 2025

Ms. Sun Xueling, Minister of State, Ministry of Home Affairs of Singapore, said that cryptocurrency fraud cases accounted for a quarter of the total loss amount involved in fraud last year. ͏ ͏ ͏ ͏ ͏ ͏

Trump declares end to ‘war on crypto,’ vows to propel America to Bitcoin supremacy

Saturday, March 8, 2025

Trump brands the Biden era as a crypto setback, .President Trump vows to make America the Bitcoin leader, ending Operation Chokepoint 2.0 and bolstering crypto strategies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏