Net Interest - The Most Important Bank in the World

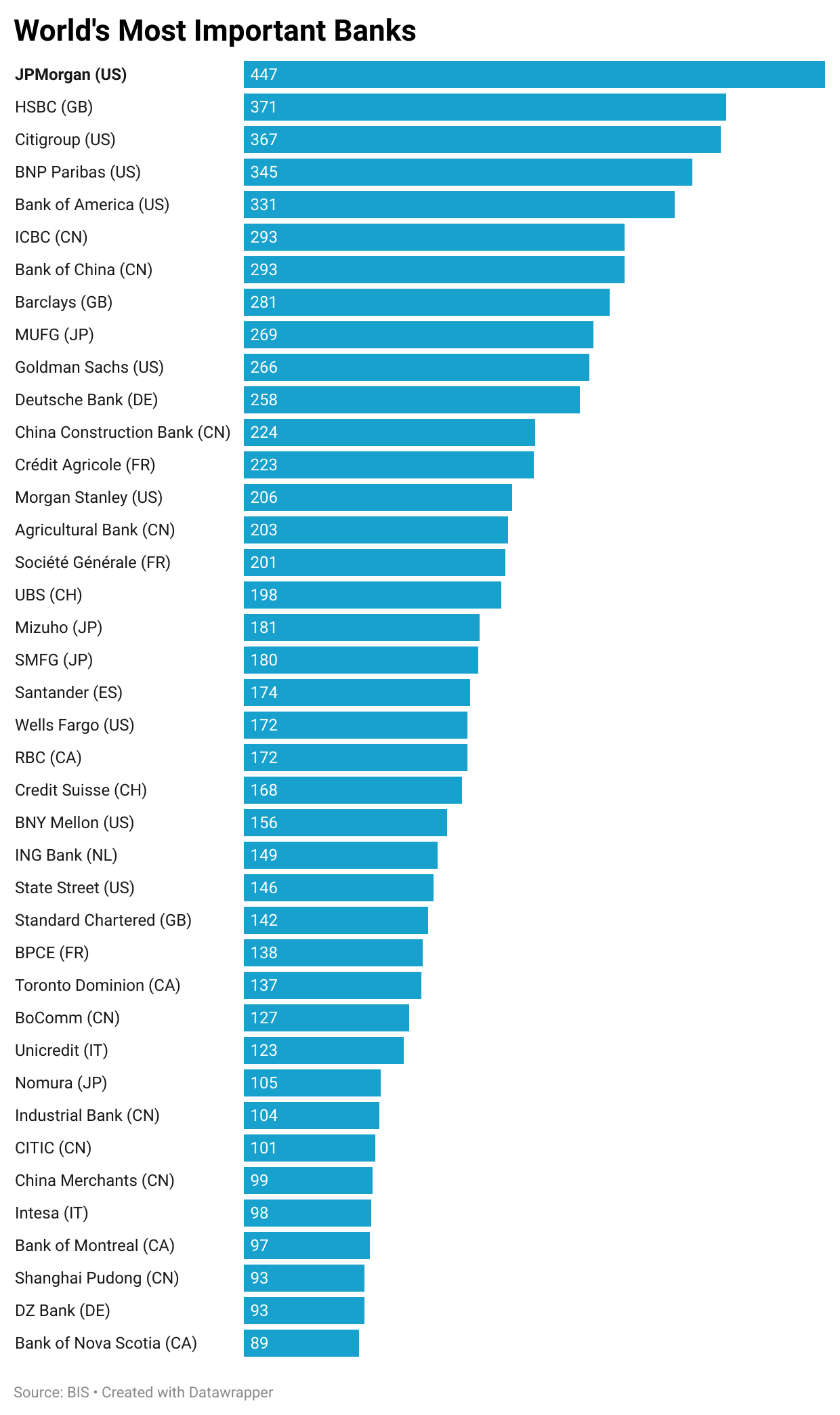

Each year, usually in the fall, a team of analysts gathers in Basel, Switzerland to determine which bank in the world is the most important. Armed with pages of financial data, they rank-order banks from all corners of the earth across five dimensions: size, interconnectedness, substitutability, complexity and cross-jurisdictional activity. How a bank scores across the five governs its importance. Size is easy – the bigger its balance sheet, the higher the bank scores. The largest banks in the world are Chinese; they take the top three slots on this component of the index. Interconnectedness, substitutability and complexity are harder to adjudicate, so the team has developed some proxies. For interconnectedness, they look at balance sheet positions within the financial industry, such as loans to other banks and deposits from them. For substitutability, they look at payments volumes and assets held on behalf of clients – it’s less easy being substituted if clients are locked into your payments network and custody their assets with you. For complexity, they look at trading securities, derivatives and exposure to assets that are hard to value. For as long as they’ve been doing it, one bank has ranked number one across these three dimensions: JPMorgan. As a result, while it is not the biggest bank in the world, nor the most cross-jurisdictional (where it ranks sixth behind HSBC, Citigroup and a trio of European banks), JPMorgan is consistently designated the most important. The team conducting the exercise sorts banks into groups of similar importance. Beneath it, HSBC, Citigroup and Bank of America sit together in a bucket, but at the very top, in a bucket all of its own: JPMorgan. Being crowned the most important bank in the world is somewhat bittersweet. On the one hand, it signals that you have the kind of “moat” that all companies covet – recognition that your business cannot be easily replicated. But it comes with various drawbacks which is why winners tend to downplay the honour. “We are the most important bank in the world,” says JPMorgan never. The most tangible is a capital cost. Banks in JPMorgan’s bucket are required to carry additional capital equivalent to 2.5% of their risk-weighted assets. American authorities gold-plate the rule, imposing an even higher capital charge of 4.5% of risk-weighted assets. The surcharge means that JPMorgan has to carry around an additional $75 billion of capital, a burden less important banks are free from. Management is not best pleased. “We feel strongly that we have more than enough capital,” said CFO Jeremy Barnum this week. “and that the G-SIB framework [that underpins capital treatment for important banks] is conceptually flawed.” Another downside is the political attention lavished on important banks. Scarred by the 2008 financial crisis, many policymakers are concerned about the risk of having to backstop the biggest banks with public funds again. They rail against banks that are too big to fail and regularly campaign for their wings to be clipped. JPMorgan puts up a robust defence. It argues the amount of liquidity and capital it holds renders the need for a backstop unlikely. This week, the bank published a chart showing that its total loss-absorbing capacity (comprising equity and debt that can be written down in the event of trouble) exceeds the entirety of loan losses incurred by all US banks during the 2008 financial crisis. It also positions itself as a protector rather than a rival to the smaller banks that anxious policymakers favour. “We are one of the largest bankers in America to regional and community banks,” writes Jamie Dimon in his latest shareholder letter. “We bank approximately 350 of America’s 4,000+ banks across the country.” A final cost is equity valuation. Larger, more important banks frequently trade at a discount to less important peers. There are many factors that drive valuation, not least it may be harder to grow if you are already $3.7 trillion in size, but one factor is complexity. As defined by the Basel committee, important banks are more complex, and complexity is a feature investors typically shy from. To address this, JPMorgan hosts an annual investor day where executives take turns on stage to explain their businesses. The group held such an investor day this week in New York, its sixteenth in seventeen years (it skipped one in 2021). As well as creating discipline for management to rehearse their business plan and be held accountable, investor day provides a useful forum to educate the market on the contours of the business. So what did this year’s investor day teach us about what it means to be important?... Subscribe to Net Interest to read the rest.Become a paying subscriber of Net Interest to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

Capital One: Buffett’s Latest Banking Pick

Friday, May 19, 2023

Plus: Zombie Ratio, UBS/Credit Suisse, Podcasts

Vivat Charles Schwab

Friday, May 12, 2023

The history and current challenges of the king of discount brokers

Doom Loop

Friday, May 5, 2023

PacWest, Western Alliance and all the other banks

Return of the Zombies

Friday, April 28, 2023

“Slow and steady in their approach, weak, clumsy, often absurd, the zombie relentlessly closes in, unstoppable, intractable.” — Simon Pegg. In October 1968, Night of the Living Dead opened on screens

The Price of Confidence

Friday, April 21, 2023

Plus: Bank Earnings in the Aftermath of Crisis (Week 2)

You Might Also Like

Longreads + Open Thread

Saturday, March 8, 2025

Personal Essays, Lies, Popes, GPT-4.5, Banks, Buy-and-Hold, Advanced Portfolio Management, Trade, Karp Longreads + Open Thread By Byrne Hobart • 8 Mar 2025 View in browser View in browser Longreads

💸 A $24 billion grocery haul

Friday, March 7, 2025

Walgreens landed in a shopping basket, crypto investors felt pranked by the president, and a burger made of skin | Finimize Hi Reader, here's what you need to know for March 8th in 3:11 minutes.

The financial toll of a divorce can be devastating

Friday, March 7, 2025

Here are some options to get back on track ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Too Big To Fail?

Friday, March 7, 2025

Revisiting Millennium and Multi-Manager Hedge Funds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The tell-tale signs the crash of a lifetime is near

Friday, March 7, 2025

Message from Harry Dent ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👀 DeepSeek 2.0

Thursday, March 6, 2025

Alibaba's AI competitor, Europe's rate cut, and loads of instant noodles | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March 7th in 3:07 minutes. Investors rewarded

Crypto Politics: Strategy or Play? - Issue #515

Thursday, March 6, 2025

FTW Crypto: Trump's crypto plan fuels market surges—is it real policy or just strategy? Decentralization may be the only way forward. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What can 40 years of data on vacancy advertising costs tell us about labour market equilibrium?

Thursday, March 6, 2025

Michal Stelmach, James Kensett and Philip Schnattinger Economists frequently use the vacancies to unemployment (V/U) ratio to measure labour market tightness. Analysis of the labour market during the

🇺🇸 Make America rich again

Wednesday, March 5, 2025

The US president stood by tariffs, China revealed ambitious plans, and the startup fighting fast fashion's ugly side | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March

Are you prepared for Social Security’s uncertain future?

Wednesday, March 5, 2025

Investing in gold with AHG could help stabilize your retirement ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏