Earnings+More - Activists pile pressure on 888

Activists pile pressure on 888Activist investor ups 888 stake, Betsson acquires betFIRST, Entain’s share drop, sector watch – sports streaming +MoreGood morning. On the agenda this weekend:

888’s high stakesHedge fund HG Vora is the latest activist investor to turn up on the 888 shareholder register. Buses: A second activist investor has unveiled a stake in 888 a week after it emerged that a group of senior gaming executives led by ex-GVC chair and CEO Lee Feldman and Kenny Alexander had amassed a 6%+ holding in the struggling operator.

Form guide: The New York-based HG Vora is run by former Goldman Sachs banker Parag Vora. It has previously appeared as an investor in the sector at Penn Entertainment (Penn National as was) and William Hill, where it revealed a 5% stake a matter of a fortnight before the company was bought by Caesars Entertainment.

King Kenny: E+M revealed on Monday this week that the new investors had plans to wrest control of 888 from the present board. 🚀 888 on a tear with activist vigor, up ~47% in past month ** SPONSOR’S MESSAGE ** Would you choose only one marketing channel for your brand messaging? Then why would you choose a single P2P or F2P provider for your acquisition efforts? Inside the Pocket has 20+ developers on our white-label platform (and more coming) opening up an entire marketplace of aggregated content with just one super-fast integration. Ready to unleash a new world of player acquisition and retention tools dynamically tailored for your audiences? Learn more at www.insidethepocket.io ICYMIM&A dominated the headlines this week as Earnings+More led with the news on Wednesday that Entain has offered £750m for Polish bookmakers STS. The bid came via the Entain CEE JV with EMMA Capital and saw Entain raise £600m via a rights issue.

Compliance+More this week debuted its new monthly edition The Token Word, which will be covering developments in the crypto space. Issue 1 dealt with the news of the SEC’s recent moves against both Binance and Coinbase.

LosIngresos+Mas this week reported, in both English and Spanish, that Entain expects 365Scores EBITDA to grow by up to 50% by 2025.

Betsson’s Belgian buyOperator is the latest to snap up a local hero with €120m acquisition of Belgium's betFIRST. Premier position: The Stockholm-listed Betsson has bought out the Belgium-based betFIRST, the operator of both online and retail betting in the country. The deal constitutes €117m in upfront cash and a €3m earnout, and represents a multiple of 10x betFIRST’s estimated 2023 EBITDA.

Touché: Concurrently, Betsson has announced a market access partnership for Belgium with France-based casino operator Partouche. The terms of the deal were not disclosed.

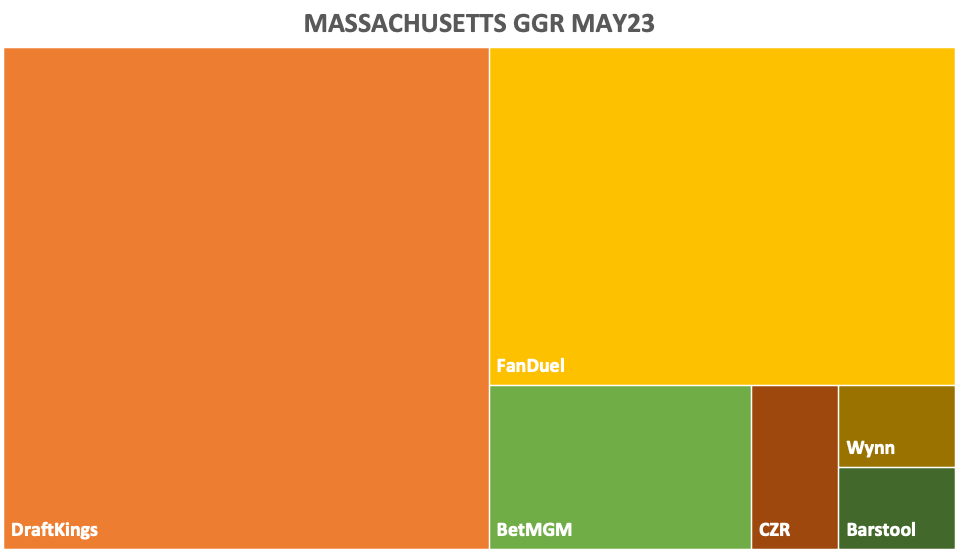

Partouche earnings in briefGGR was up 14% in the company's Q2 (Feb-Apr) to €169.1m YoY, continuing the rebound seen in Q1. In France, attendance rose 18%, helping to push a 14% rise in revenue to €152m. DK holds Mass. leadDraftKings extends its home state dominance. Home field advantage: DraftKings marginally extended its leadership in Massachusetts in May, grabbing 51% of GGR vs. the 48% share it controlled in April. Rival FanDuel lost ground in its chase of the market leader, down to 33% from 36% the month previous.

👑 DraftKings extends home advantage The shares weekThe discounted rights issue saw Entain’s share shed over 6% this week. Entain managed to get its £600m rights issue away in order to pay its share for the acquisition of STS but at the cost of investor faith in the company’s strategy. The new shares were issued via a combined retail and institutional offer at a discount of 6.9%, but the shares fell by 8.7% on the day of the announcement.

🙃 Not impressed: share price reaction suggests investor disappointment Sector watch – sports streamingSwedish-based streaming service Viaplay issues a midnite profit warning. Alarm call: The self-styled competitor to Netflix gave the market a rude awakening in early June when it issued a press release in the dead of night – 2am local time in Stockholm – saying it would miss its revenue targets and that CEO Anders Jensen had been ousted as a result.

Meanwhile, the FT also reported this week that Italy’s Serie A is in talks with private equity firms over a potential sale of a stake in its own future media rights. The league is working with advisers at the investment bank Lazard, which would see PE take a 10-20% stake.

Earnings in briefAllwyn’s CEO Robert Chvátal said a mix of organic and M&A-led growth had enabled the group to enjoy an 80% YoY rise in preliminary Q1 revenues to €1.6bn, while adj. EBITDA was up 28% to €347m.

Danske Spil: Q1 revenue rose 8% to €163m while operating profit was up 10% to €119m in Q1. The company confirmed prior guidance for FY revenues of €671m-€698m and net profit of €228m-€241m. Paf: The monopoly operator – which this week completed the acquisition of 888’s Latvian business – saw FY revenues rise 23% to €166m, while profit was up 29% to €44m. Golden Matrix: The online platform provider said Q2 revenues rose 21% to $10m, while net losses for the quarter were pinched slightly to minus $550k.

** SPONSOR’S MESSAGE ** The Huddle Journal: Huddle is revolutionizing baseball analytics by adapting their models to MLB’s ever-evolving game and the data proves it:

Check out our Knowledge Hub: https://huddle.tech/blog/ What we’re readingBy the buy: The EKG Line looks at the potential buyers of any up-for-sale IGT assets. NewslinesA’s get the nod: The Nevada Senate and Assembly have both given their approval to a bill that authorizes $380m of public funding to go towards building a stadium for Major League Baseball’s A’s franchise. Gov. Joe Lombardo signed the bill yesterday.

Churchill Downs has announced it has entered into an agreement with the city of Richmond, Virginia, for a $562m resort casino. The agreement is subject to a local referendum and certification by the state lottery department. Gambling.com shareholders including chair Mark Blandford have downsized their holdings via the placement of 4m shares this week. The three sellers, which include Edison Partners and Gerard Hall, remain as substantial shareholders. The shares fell over 12% on the day. EveryMatrix’s CasinoEngine platform exceeded €4bn in monthly handle while GGR surpassed €150m. LeoVegas has initiated an early redemption of an outstanding $65m in floating rate bonds. BetVictor has become BVGroup as part of a corporate rebrand. Lottery.com is once again trading on Nasdaq. The company was delisted earlier this year over reporting failures.

An +More Media publication. For sponsorship inquiries email scott@andmore.media. |

Older messages

DraftKings ignites PointsBet bidding battle

Tuesday, June 20, 2023

Fanatics bid faces competition, New York data, Entain shareholder revolt, Gambling Files ep 100, startup focus is ClearStake +More

Regtech roll-up gets a push

Tuesday, June 13, 2023

The potential for M&A in the gambling regtech space, recent transactions, M&A chatter +More

Exclusive: FS seeking to install Alexander as 888 CEO

Monday, June 12, 2023

Investor group's plans to grab control, BetMGM future discussed, IGT's sales options, startup focus – First Pitch Canada +More

Exclusive: FS seeking to install Alexander as 888 CEO

Monday, June 12, 2023

Investor group's plans to grab control, BetMGM future discussed, IGT's sales options, startup focus – First Pitch Canada +More

Breaking: Alexander and Feldman’s 888 stake

Monday, June 12, 2023

Former GVC execs are among investor group taking a 6.6% stake in 888

You Might Also Like

What’s Ola Hiding?

Wednesday, March 19, 2025

+ Even big companies such as Hindustan Aeronautics Limited (HAL) are falling for cyber fraud. Meanwhile, Mumbai airport plans tariff hikes that could make flying out of the city more expensive.

Join Jason Lemkin and Sam Blond for Workshop Wednesday!

Tuesday, March 18, 2025

LIVE Wednesday, March 18th at 10AM To view this email as a web page, click here workshop wednesday Live TODAY Hey SaaStr Fans, SaaStr Workshop Wednesdays is back again tomorrow and we've got an

😬Weeping and gnashing of teeth

Tuesday, March 18, 2025

Our paid ads team tests a Reddit strategy View in browser Masters In Marketing In a seismic time for SEO marketing, an unlikely winner emerged last year: Reddit. And while nobody seems happy about that

🤯 Get your business up and running faster with AI

Tuesday, March 18, 2025

Discover the AI tools you should start using. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Only 3 spots!

Tuesday, March 18, 2025

Agency owners have been asking for this for a long time ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

$164,449 In 15 Days (His side-income SECRET)

Tuesday, March 18, 2025

5-step action-plan to build a brand-new "side-income" View in browser ClickBank Hi there, This Friday (21st March) a top ClickBank client is running an online Strategy Lab where he'll

Canadian Ecom Seller? A New Course Just for You

Tuesday, March 18, 2025

How independent agencies are staying ahead of the curve

Tuesday, March 18, 2025

Elevating growth amid surging demand for digital media

It's time to bet on emerging platforms

Tuesday, March 18, 2025

Tips to keep your brand adaptable and embrace change ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Elon vs. Sora

Tuesday, March 18, 2025

Google's Veo 2 is in the race too!