Net Interest - The Money Business

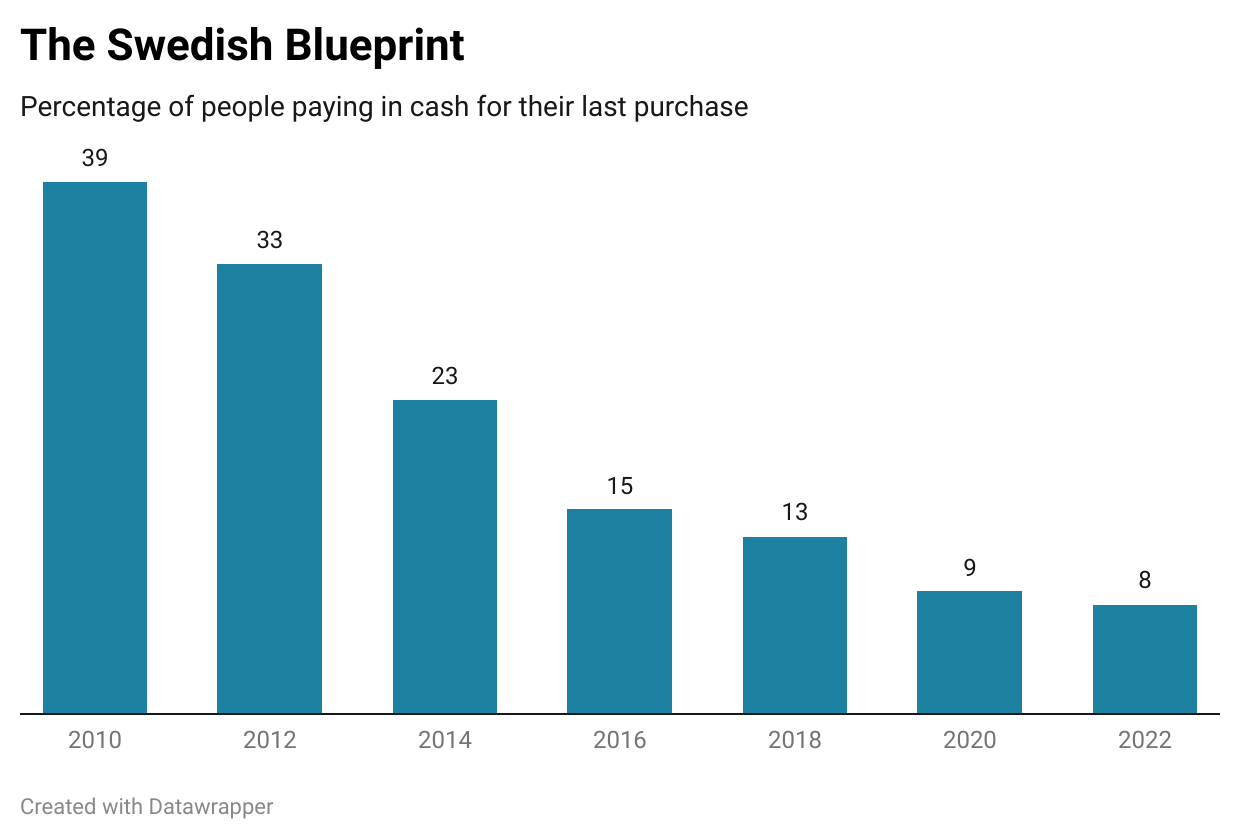

“The ATM has been the only useful innovation in banking for the past 20 years.” — Paul Volcker How much cash do you have in your wallet? If you’re anything like me, you might carry a few notes around. Sure, there’s nothing they can do that cards or Apple Pay or wire transfers can’t, but there’s something tangible about them and, well… you never know. If you travel a lot, you may have a stash of foreign banknotes stored somewhere as well, handy for paying the taxi when you arrive at your destination assuming they are still legal tender (I found some actual French Francs in an old wallet recently). But outside a narrowing range of use cases, most of us don’t use cash as much as we used to. In the UK, where I am based, cash transactions make up around 15% of payments, down from over half ten years ago. In the US, cash accounts for 18% of payments, down from close to a third in 2016. And in Sweden – much further along in its process of payments digitalisation – cash is almost extinct. In a recent survey conducted by the Sveriges Riksbank, only 8% of respondents said that they paid cash for their most recent store purchase, compared with almost 40% in 2010. Yet in spite of the lower use of cash in commercial activity, the stock of currency in circulation in most economies remains high. The value of US Dollar banknotes in circulation, for example, is currently $2.3 trillion, up significantly from $1.5 trillion at the end of 2016. It’s the same in the UK, where the value of banknotes in circulation has gone up by 28% over the same period. In a speech in 2009, Andrew Bailey, now Governor of the Bank of England, then its Chief Cashier, called this the paradox of banknotes. One explanation for the paradox is that demand for cash comes not just from people wanting to spend it but from people wanting to save it. The European Central Bank estimates that while around 20% of euro banknotes are used for transactional purposes, between 30% and 50% are held as a store of value within the euro area, with the rest stashed abroad. In Germany, individuals held an average of €1,364 in cash in 2018 – higher among older people – for reasons ranging from doubts about the security and reliability of technical systems to tax. In times of emergency, such demand for cash goes up. This happened during the pandemic, even as cash usage went down; and it happened after Russia’s invasion of Ukraine. In Sweden – curiously, one of the only countries not affected by the paradox of banknotes – the number of withdrawals from ATMs increased by 28% in the week following the attack. All this means that while cash may be dying out, managing it still sustains a large industry. Companies exist to manufacture cash, to transport it and to distribute it. This week, banking technology company NCR released financial information of its stand-alone ATM business ahead of a forthcoming spin-off; the company is the second largest vendor of ATMs in the world. In the same week, De La Rue PLC shone a light on the banknote manufacturing business when it reported earnings for its latest financial year. The challenge these companies and others in the cash industry face is that saving does not generate the same kind of velocity as spending, and so business has slowed. Higher interest rates also inject an opportunity cost to hoarding cash that may yet collapse the paradox of banknotes. Plus, the direction of travel is clear. UK industry group UK Finance estimates that the share of payments made in cash will fall from 15% to 6% by 2031; in the US, The Nilson Report projects that cash usage will decline from 18% to 8-9% by 2025. But it’s always interesting seeing how companies manage decline, so let’s take a look at the supply chain that has developed beneath the cash industry. Printing MoneyCash begins its life cycle on the printing presses. We discussed the process in a short piece on De La Rue in November. At the time, De La Rue was struggling. Founded in 1821, the company began producing banknotes in 1860 and by the 2010s was manufacturing them for 150 central banks across the world. Most countries retained primary responsibility for printing their own banknotes but would outsource to De La Rue in the event they needed additional capacity (such as in times of emergency). In the mid 2010s, De La Rue estimated that around 162 billion fresh banknotes were being issued around the world each year, of which 87% were made at home, 11% were made by commercial printers such as De La Rue and 2% were outsourced to manage demand fluctuations (known as “overspill” in the industry). Underlying growth was projected to be 3-4% per year. But demand was never smooth and De La Rue struggled to adjust its print capacity to match it. When demand surged in 2020, the company failed to capitalise on pricing nor did it win additional contracts afterwards. Cost inflation placed additional pressure on the business. A string of profit warnings followed, during which auditors raised a “material uncertainty” about the company’s status as a going concern. The latest profit warning, in April, came with an acknowledgement that demand for banknotes was at its lowest level in over 20 years as central banks worked through stocks built up during the pandemic. This week’s earnings pull De La Rue back from the abyss. Lending facilities have been amended, putting a pause on auditors’ concerns about the company being a going concern. And with a win rate in excess of 70% on new contracts, De La Rue’s order book is filling up. “The significant majority of our planned FY ‘24 banknote print volume is already under confirmed orders,” said the CEO. But it doesn’t exactly print money, the money-printing business. Last year, De La Rue earned an operating profit of just £14 million on £255 million of revenue. That’s down from £42 million on £399 million of revenue in 2019. One reason is the amount of excess capacity that exists in the private sector. It’s a specialised business – not anyone can set up shop as a banknote manufacturer – but it’s still quite fragmented. Another is that De La Rue may be cannibalising its own market via the introduction of polymer banknotes. These new banknotes – in issuance in the UK since 2016 – are more durable than paper, lasting at least 2.5 times longer. Banknotes may be on their way out, but the last generation to survive will be circulating for a long time. Moving MoneyOnce the cash has been printed, it has to be delivered. Moving cash is a bigger business than making it: Market leader Brink’s estimates the global cash management industry is worth $20 billion. You may have seen Brink’s trucks on the highway and some may remember its Heathrow warehouse as the scene of one of the largest heists in British history. As well as storing and moving cash and other valuables, the company offers cash counting, sorting, wrapping and bill checking services. Last year, it earned $3.8 billion in revenue in its cash and valuables management business. Unlike banknote manufacturing, cash transit is a more consolidated industry. Brink’s has around a quarter of the global market by revenue – it is the number one or two player across most geographies. Part of its scale has arisen through acquisition. In 2020, it acquired most of the global cash management operations of UK-based G4S at a purchase price of $826 million (1x revenues). Customer contracts in the cash transit business typically last one to three years, although they tend to remain in effect until cancellation so revenues are broadly recurring. Revenue growth has historically been quite consistent (the company is guiding to 9% this year) and even when revenues fell 7% in 2020 during the pandemic, operating margin was held at 10.3% versus 10.6% the prior year due to the large variable base of the cost structure: Labour, fleet and freight expenses make up around 70% of total costs and can flex based on revenue. In an effort to fend off its ultimate demise, Brink’s has devised a solution to prolong the use of cash. “Our digital retail solutions aim to make cash as easy to use as debit cards, credit cards and other digital payments and allow our retailers to create full value stream visibility for all payment methods, especially cash,” says the company’s CEO. The solution works by allowing retailers to deposit cash in a secure tech-enabled device which is able to validate the deposit and immediately credit the retailer’s bank account, before the cash is picked up by a Brink’s transit at a later time. “Brink’s brings the bank branch to you,” says the company’s Chief Information Officer. Brink’s estimates that in the US alone there are 1.8 million retail locations doing monthly cash volume in excess of $5,000 not currently serviced by Brink’s or one of its peers, representing a sizable addressable market for this service. So far, the solution is gaining traction, accounting for a part of the pick up in Brink’s growth. It’s also a higher margin business because it allows a subscription-based fee to be added to the core cash management charge. It may therefore provide Brink’s with a longer runway as cash usage dwindles, during which time it can generate considerable free cash flow (guidance for this year is $350 million). But to halt the trend altogether, the company would need to tackle the consumer end of the equation, and that means ATMs. Distributing MoneyIf Brink’s operates at the wholesale end of cash distribution, ATMs operate at the retail end. Brink’s itself is active in the market – it owns, operates or manages more than 11,000 ATM terminals in the US. “They serve as both an on-ramp for pushing cash into the economy and an off-ramp for moving cash into a digital form factor,” says the company. But compared with others, it is small. The largest ATM vendor in the world is Diebold Nixdorf. Founded in 1859 – the same year as Brink’s and a year before De La Rue began printing banknotes – it has a rich history, tracing its roots back to a safe and vault manufacturing business founded in Cincinnati, Ohio by Carl Diebold. In 1966, the company presented its ATM concept to the world, a year before the very first one was installed in London.¹ Last year, it generated $2.4 billion in its ATM business at a 12.8% operating margin. Sadly, Diebold Nixdorf filed for bankruptcy protection earlier this month. In an effort to achieve scale, Diebold acquired Germany-based Wincor Nixdorf in 2016 but merger benefits didn’t come through. Following the acquisition, the company faced flat or declining sales growth and gross margins while supporting a significantly higher debt burden. At the same time, it incurred large expenses attributable to post-merger capital investment and restructuring costs, which contributed to a cash burn of more than $500 million since 2018, stressing its liquidity. A credit rating downgrade to CCC+ in May last year due to what the rating agency identified as an unsustainable capital structure tipped it over the edge. Diebold Nixdorf is currently working on a restructuring. But investors looking for exposure to the ATM industry have an alternative – NCR is in the final throes of spinning out its ATM business, the world’s second largest. The company owns and operates 85,000 units and manages a further 700,000. Revenues were $4.1 billion last year, of which around a quarter was from hardware and software licences and three-quarters from maintenance, implementation services, cloud, payments processing and the like. NCR’s strategy is to wrap other services inside its ATMs so that its units do more than simply process cash and increasingly become the delivery channel underpinning the majority of touch points for banking customers. In particular, NCR is excited about its “ATM-as-a-Service” solution which delivers fully outsourced ATM management to bank customers allowing them to accelerate branch transformation and optimisation strategies. The company currently has 17,500 ATMs commissioned on this basis and estimates revenues from them is two times what it can achieve from a traditional ATM hardware and maintenance contract. However, while it has been ramping up this strategy, free cash flow has been weak. Last year, the company generated just $204 million of free cash flow, equivalent to 5% of revenue, down from 13% in 2020. With $2.7 billion in debt, NCR isn’t as leveraged as Diebold Nixdorf but by betting that ATMs can survive beyond cash, it is hoping not to run out of road. The End of CashIf there’s one factor that can preserve cash beyond its useful life, it’s social pressure. The decline in cash usage is not evenly distributed across populations, with some segments heavily reliant on cash. In the UK, surveys suggest that 1.1 million consumers continue to mainly use cash for day-to-day shopping. Governments are cognisant of this and, in many jurisdictions, have committed to protect cash well into the future. Just this week, the European Commission adopted a legislative proposal on the legal tender of euro banknotes and coins, to safeguard the role of Euro cash, which must be accepted as a means of payment everywhere in the EU. But governments also continue to flirt with central bank digital currencies (CBDCs). We discussed CBDCs here in October 2020 – in essence, they are a digital representation of cash. While they carry many challenges that have yet to be addressed, CBDCs don’t need printing, transporting or distributing. For participants in the cash industry, therefore, they remain the ultimate threat... Subscribe to Net Interest to read the rest.Become a paying subscriber of Net Interest to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

Deutsche's Near Miss

Friday, June 23, 2023

Plus: PayPal/KKR, Stress Tests, Tokenisation

Nasdaq's Pivot

Tuesday, June 20, 2023

Plus: Aladdin, China NPLs, Isybank

Whisky and Oranges (and Coinbase)

Monday, June 12, 2023

Plus: Sequoia, Monzo, Podcast

Creating a Monster

Friday, June 2, 2023

When innovation goes wrong

The Most Important Bank in the World

Friday, May 26, 2023

Plus: Starling Bank, Norinchukin, Citigroup

You Might Also Like

Longreads + Open Thread

Saturday, March 8, 2025

Personal Essays, Lies, Popes, GPT-4.5, Banks, Buy-and-Hold, Advanced Portfolio Management, Trade, Karp Longreads + Open Thread By Byrne Hobart • 8 Mar 2025 View in browser View in browser Longreads

💸 A $24 billion grocery haul

Friday, March 7, 2025

Walgreens landed in a shopping basket, crypto investors felt pranked by the president, and a burger made of skin | Finimize Hi Reader, here's what you need to know for March 8th in 3:11 minutes.

The financial toll of a divorce can be devastating

Friday, March 7, 2025

Here are some options to get back on track ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Too Big To Fail?

Friday, March 7, 2025

Revisiting Millennium and Multi-Manager Hedge Funds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The tell-tale signs the crash of a lifetime is near

Friday, March 7, 2025

Message from Harry Dent ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👀 DeepSeek 2.0

Thursday, March 6, 2025

Alibaba's AI competitor, Europe's rate cut, and loads of instant noodles | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March 7th in 3:07 minutes. Investors rewarded

Crypto Politics: Strategy or Play? - Issue #515

Thursday, March 6, 2025

FTW Crypto: Trump's crypto plan fuels market surges—is it real policy or just strategy? Decentralization may be the only way forward. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What can 40 years of data on vacancy advertising costs tell us about labour market equilibrium?

Thursday, March 6, 2025

Michal Stelmach, James Kensett and Philip Schnattinger Economists frequently use the vacancies to unemployment (V/U) ratio to measure labour market tightness. Analysis of the labour market during the

🇺🇸 Make America rich again

Wednesday, March 5, 2025

The US president stood by tariffs, China revealed ambitious plans, and the startup fighting fast fashion's ugly side | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March

Are you prepared for Social Security’s uncertain future?

Wednesday, March 5, 2025

Investing in gold with AHG could help stabilize your retirement ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏