Hot in Enterprise IT/VC - What's 🔥 in Enterprise IT/VC #349

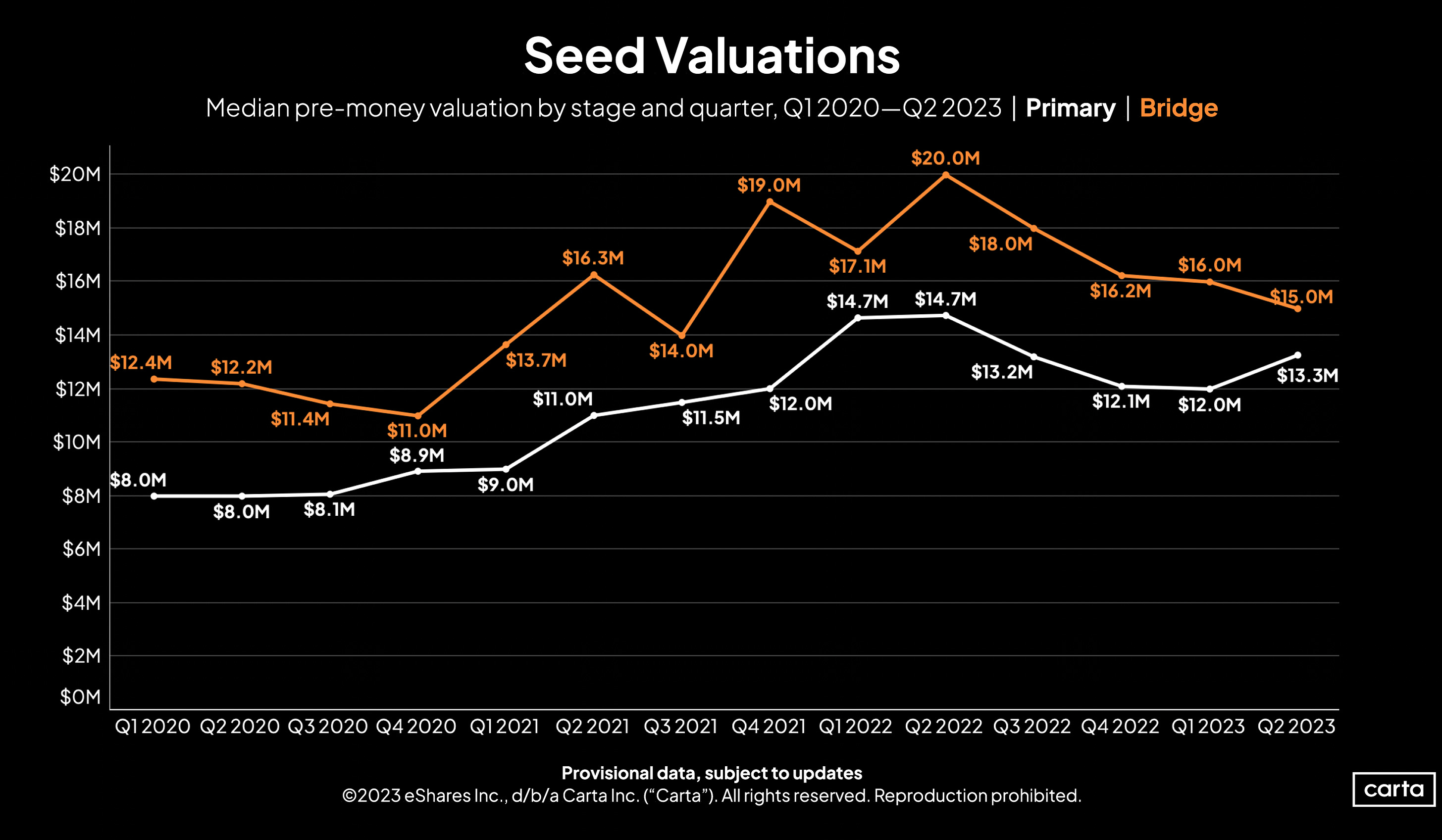

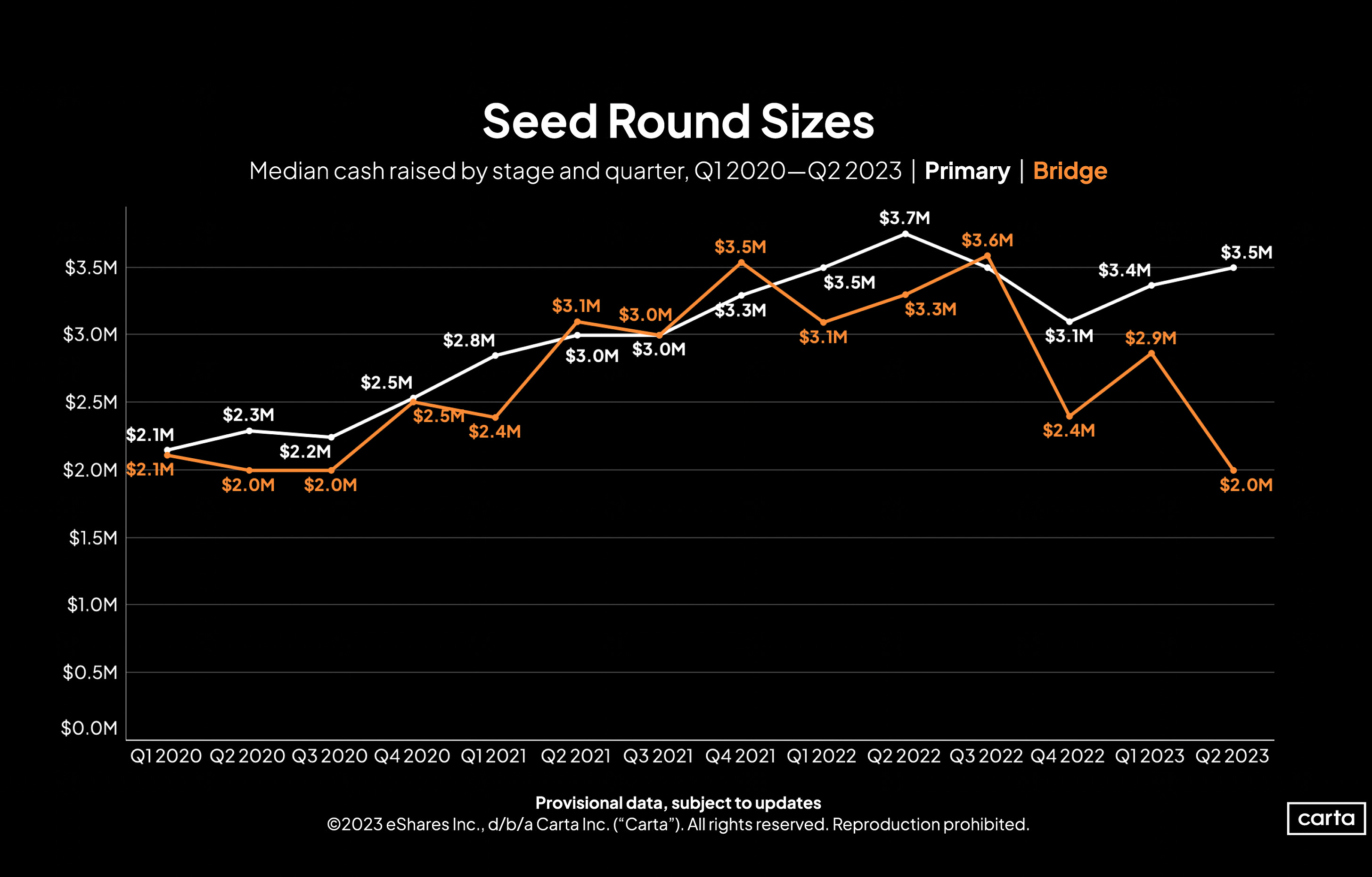

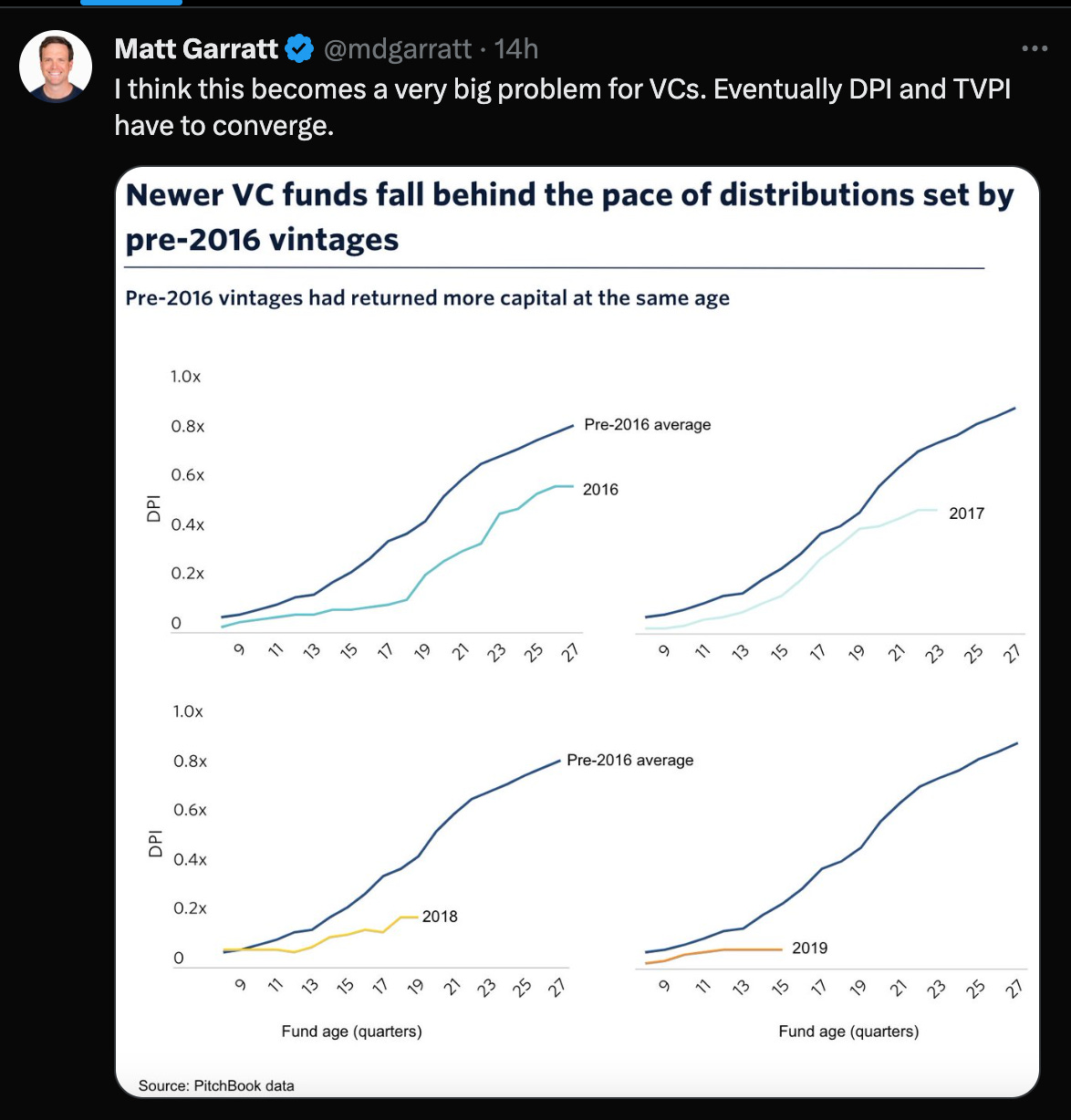

What's 🔥 in Enterprise IT/VC #349VC is hard to come by but how are pre-money valuations for seed rounds higher than 2021?This was a short, uneventful week other than with the launch of a new social network and Twitter competitor, Threads from Meta, which had 70 million sign ups after one day 🤯. There are lots of kinks to work out, but I must say I’ve been pleasantly surprised, and it’s been super fun bootstrapping a new network. If you want to try it out and talk dev tools, infra, cybersecurity and What’s 🔥, you can find me here: Ed Sim (@edsim9) on Threads If you look at who I follow, you’ll find other startup founders, investors, and developer types so let’s try to create a new place to have discussions. So far, the algorithmic feed has a bit too much entertainment content for my taste but as more of us join the community, it will get better and better at filtering for startup and infrastructure discussions. In other news, here’s the latest investment data fresh off the press from Carta for Q2 2023. As you can see below, seed valuations now are higher than they were during the 2021 funding boom. There is lots of 💰 still waiting to be deployed and many multi-stage funds pointed their $billion guns at the seed market increasing round size and valuation. The median seed round is now $3.5M which is equal to or higher than all of the data points in 2021. If you hear founders lament about having a hard time raising this can still be true as there are less seed rounds done now than in 2021, but these are also more competitive. I can tell you from my personal experience for the 4 rounds we are closing now, these were all competitive and 3 out of 4 had the larger multistage funds hovering around to invest in founders with a well formed idea. IMO, multi--stage funds investing at the pre-product stage never ends well as these investors have too many companies to support and these checks mostly amount to option value for the next round. Another point regarding seed valuation and round size is that you still have to be slightly insane to start a company now. As I mentioned a couple of weeks ago, we at boldstart are seeing an insane quality of founders finally taking the leap of faith to start a new company and these more experienced founders tend to raise larger first rounds at higher prices than first time founders. As always, 🙏🏼 for reading and please share with your friends and colleagues. Scaling Startups

Enterprise Tech

Markets

What's Hot in Enterprise IT/VC is free today. But if you enjoyed this post, you can tell What's Hot in Enterprise IT/VC that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

What's 🔥 in Enterprise IT/VC #348

Saturday, July 1, 2023

Summer of fun 😎 - floodgate 💰 for enterprise infra has opened

What's 🔥 in Enterprise IT/VC #347

Saturday, June 24, 2023

A new wave of dev tools startups built on first principle thinking

What's 🔥 in Enterprise IT/VC #346

Tuesday, June 20, 2023

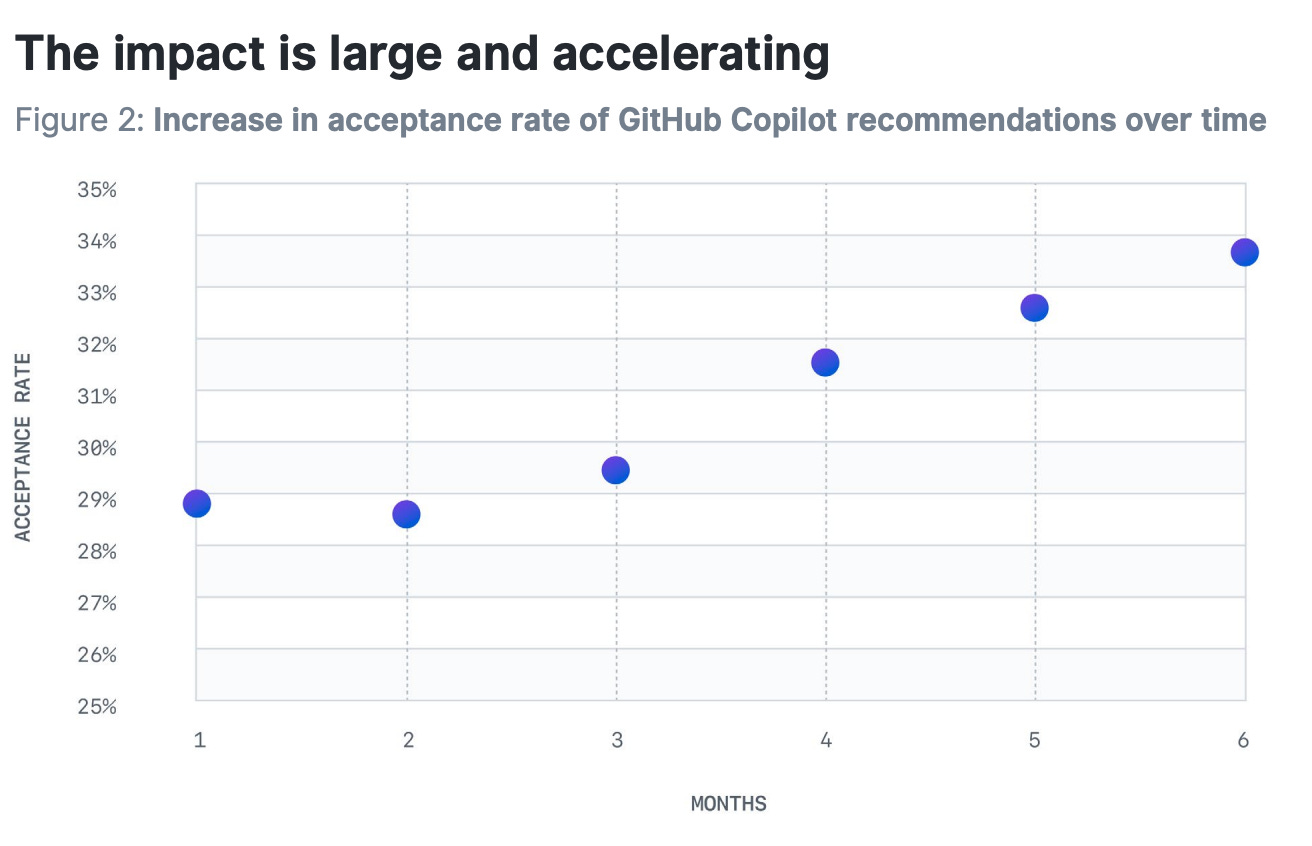

Do professional developers 👩🏼💻 use and trust AI (Github, StackOverflow surveys)? What does it mean for devtools startups?

What's 🔥 in Enterprise IT/VC #345

Monday, June 12, 2023

Developers + buyers aka "Users and Choosers" - Hashicorp sandwich 🥪 model + practical advice selling dev tools in 2023

What's 🔥 in Enterprise IT/VC #344

Saturday, June 3, 2023

The seed to A fundraising log jam and the importance of Big Mo

You Might Also Like

🚀 Ready to scale? Apply now for the TinySeed SaaS Accelerator

Friday, February 14, 2025

What could $120K+ in funding do for your business?

📂 How to find a technical cofounder

Friday, February 14, 2025

If you're a marketer looking to become a founder, this newsletter is for you. Starting a startup alone is hard. Very hard. Even as someone who learned to code, I still believe that the

AI Impact Curves

Friday, February 14, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. AI Impact Curves What is the impact of AI across different

15 Silicon Valley Startups Raised $302 Million - Week of February 10, 2025

Friday, February 14, 2025

💕 AI's Power Couple 💰 How Stablecoins Could Drive the Dollar 🚚 USPS Halts China Inbound Packages for 12 Hours 💲 No One Knows How to Price AI Tools 💰 Blackrock & G42 on Financing AI

The Rewrite and Hybrid Favoritism 🤫

Friday, February 14, 2025

Dogs, Yay. Humans, Nay͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 AI product creation marketplace

Friday, February 14, 2025

Arcade is an AI-powered platform and marketplace that lets you design and create custom products, like jewelry.

Crazy week

Friday, February 14, 2025

Crazy week. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

join me: 6 trends shaping the AI landscape in 2025

Friday, February 14, 2025

this is tomorrow Hi there, Isabelle here, Senior Editor & Analyst at CB Insights. Tomorrow, I'll be breaking down the biggest shifts in AI – from the M&A surge to the deals fueling the

Six Startups to Watch

Friday, February 14, 2025

AI wrappers, DNA sequencing, fintech super-apps, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How Will AI-Native Games Work? Well, Now We Know.

Friday, February 14, 2025

A Deep Dive Into Simcluster ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏