Second quarter notches up $2.8bn of deals

Second quarter notches up $2.8bn of dealsTransaction tracker details for Q2, what to expect from the second half of 2024 +MoreWelcome to the latest Deal Talk. In this issue we take a look at the activity in the past three months as well as run the rule over the potential activity that might take place later in the year.

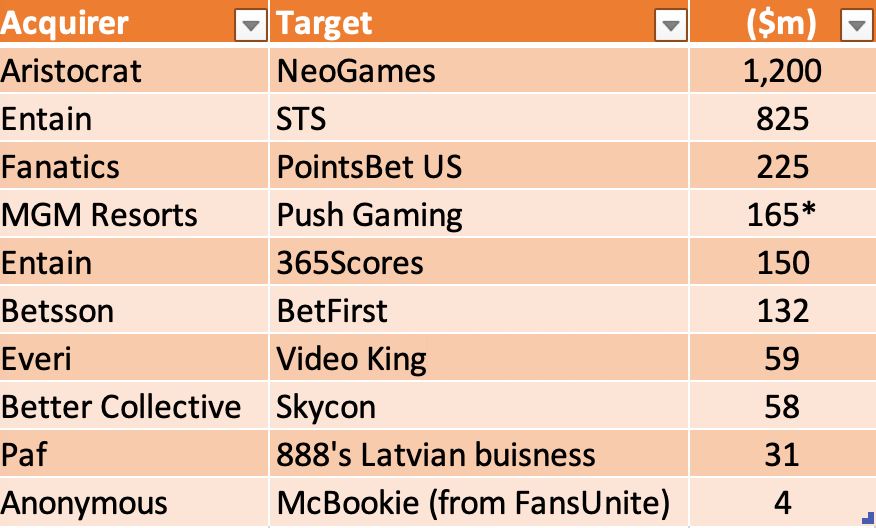

You've got to spend money to make money. Q2 reviewDeal flow continued into the second quarter with the highlights including Entain’s bid for STS and Fanatics second-bite winning bid for PointsBet US. You keep on knocking: The monetary value of the deals announced in the second quarter amounted to over $2.8bn as the sector appeared to shrug off worries over accessing finance in a tightening rate environment.

🍆 Money flowed in the second quarter * Rumored sale price ** SPONSOR’S MESSAGE ** Underdog: the most innovative company in sports gaming. At Underdog we use our own tech stack to create the industry’s most popular games, designing products specifically for the American sports fan. Join us as we build the future of sports gaming. Visit https://underdogfantasy.com/careers Big beastsGame, set and match: The most high-profile deal of the quarter – if not the biggest by value – was the sale of PointsBet’s US business, which engendered a bidding war between eventual buyer Fanatics and rival DraftKings.

Rich pickings: However, the biggest deal of the quarter was the $1.2bn acquisition of NeoGames announced by Aristocrat on the same day as the initial Fanatics/PointsBet US news broke.

Spit and Polish: Less welcomed, by investors at least, was Entain’s addition of Poland’s leading bookmaker STS to its portfolio of brands for €750m.

A new GIG: On a related issue, the latest news regarding the owners of STS, the Juroszek family, shows that they have now amassed an 11% stake in Gaming Innovation Group.

To be decidedTwo ongoing strategic reviews will help define the landscape going forward. Waiting room: The other action in the second quarter revolved around still unresolved strategic reviews at Kindred and IGT. At least with the latter, there is an indication of which way the cards will fall, but in the case of the former the future is as clouded as ever.

Gordian: A harder task would appear to confront the advisers attempting to sell Kindred. Having suffered a number of high-profile C-level departures, including CEO Henrik Tjernström, a sale appears to be no nearer a conclusion.

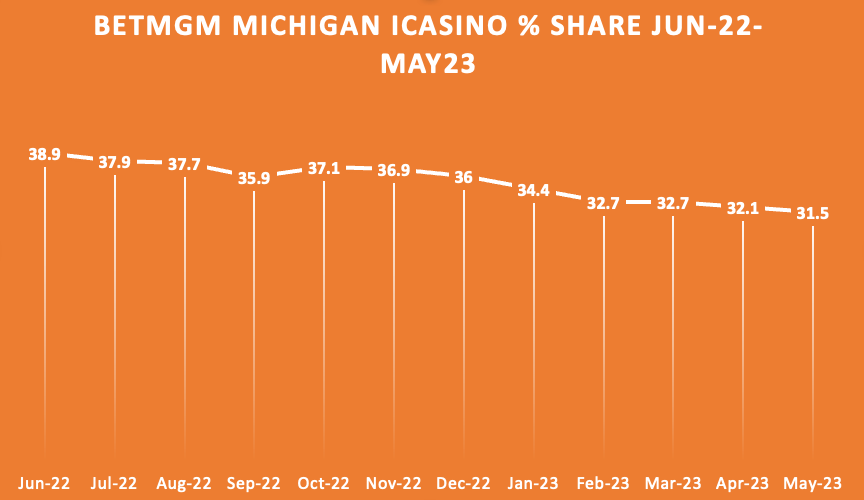

Joint is jumpin’Speculation over the future of the ownership of BetMGM continues. A note from Jefferies earlier this week suggested that “among the most active discussions” for the analyst team was what the “recent deceleration” on BetMGM’s performance might have on the future for the JV partners MGM and Entain.

No means no: Of vital importance here is the extent to which the market should believe MGM Resorts’ official line that it is no longer interested in acquiring Entain, as articulated by MGM CEO Bill Hornbuckle at the start of February. But that hasn't stopped speculation over the future of the JV, given MGM’s not necessarily contradictory statements about wishing it could obtain sole ownership of BetMGM.

☹️ Brewer’s droop: BetMGM’s declining MI iCasino market share Yes, butNo easy games: A resolution to the ownership of BetMGM might help with refocusing the company, although, as one source pointed out, with DraftKings and FanDuel both recently upping their respective games when it comes to iCasino, it is by no means a given that BetMGM can regain that early gaming dominance.

Money tree: Yet, as one source put it, there “clearly needs to be a resolution” to the ownership of BetMGM because “these two just don’t get along”. Or as Chris Grove, partner at Acies Investments, pointed out, the logic that some kind of deal is likely is what’s keeping the flame alive among the multitude of corporate advisors who would see a mega-merger as a payday like no other.

** SPONSOR’S MESSAGE ** What would you do with $100k in cash? Are you game…? M&A chatterKickabout: One of the stranger ways to announce a piece of corporate news came courtesy of an appearance on the online gaming streamer Gamers Update by Stake.com’s co-founder and CEO Ed Craven.

What we’re readingPlastic fantastic: The New Yorker on how a need for newer materials for billiard balls spurred innovation.

Calendar

** SPONSOR’S MESSAGE ** Venture capital firm Yolo Investments manages in excess of €600m in capital across 80 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem. An +More Media publication. For sponsorship inquiries email scott@andmore.media. |

Older messages

Bet365 taking US share

Monday, July 10, 2023

Bet365 on the march, DraftKings profit prediction, Betfred's 2022 bounce, Gambling.com and Genius Sports analyst takes +More

Hard Rock Florida restart in the balance

Friday, July 7, 2023

Hard Rock's choices, William Hill figures, Better Collective and EveryMatrix M&A, GM and MeridianBet merger terms +More

Betr tidings lift funding figures

Monday, July 3, 2023

Second quarter funding review, a guide to bootstrapping, inside the raise – PayNearMe +More

PointsBet US sale gets the go-ahead

Friday, June 30, 2023

Fanatics Betting & Gaming buyout waved through, streamer Kick is the subject of sector watch, Nevada's tough comps +More

PointsBet accepts improved $225m bid from Fanatics

Wednesday, June 28, 2023

M&A extra: PointsBet accepts new offer from Fanatics, DraftKings pulls out of the race, betr fundraise

You Might Also Like

Join Jason Lemkin and Sam Blond for Workshop Wednesday!

Tuesday, March 18, 2025

LIVE Wednesday, March 18th at 10AM To view this email as a web page, click here workshop wednesday Live TODAY Hey SaaStr Fans, SaaStr Workshop Wednesdays is back again tomorrow and we've got an

😬Weeping and gnashing of teeth

Tuesday, March 18, 2025

Our paid ads team tests a Reddit strategy View in browser Masters In Marketing In a seismic time for SEO marketing, an unlikely winner emerged last year: Reddit. And while nobody seems happy about that

🤯 Get your business up and running faster with AI

Tuesday, March 18, 2025

Discover the AI tools you should start using. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Only 3 spots!

Tuesday, March 18, 2025

Agency owners have been asking for this for a long time ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

$164,449 In 15 Days (His side-income SECRET)

Tuesday, March 18, 2025

5-step action-plan to build a brand-new "side-income" View in browser ClickBank Hi there, This Friday (21st March) a top ClickBank client is running an online Strategy Lab where he'll

Canadian Ecom Seller? A New Course Just for You

Tuesday, March 18, 2025

How independent agencies are staying ahead of the curve

Tuesday, March 18, 2025

Elevating growth amid surging demand for digital media

It's time to bet on emerging platforms

Tuesday, March 18, 2025

Tips to keep your brand adaptable and embrace change ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Elon vs. Sora

Tuesday, March 18, 2025

Google's Veo 2 is in the race too!

The secret to CTAs that convert

Tuesday, March 18, 2025

Your call-to-action (CTA) is the final push that turns visitors into customers. But if it's weak, unclear, or generic, you're leaving money on the table. The best CTAs don't just say “Buy