Stablecoins: The Next Financial Platform

Stablecoins: The Next Financial PlatformStablecoins are more than just an asset – they’re the foundation for a modernized financial system.Friends, A common (and often fair) criticism of the crypto sector is to question its utility. The technology is all very well and good, this argument goes, but what does it actually do? What tangible value, what meaningful improvement over the status quo, does it create? Stablecoins are, in my view, one of the most compelling answers to these questions. For people around the world, from Buenos Aires to Lagos, stablecoins offer an easy way to access a dollar equivalent. When your domestic currency rapidly fluctuates in value, diminishing your spending power, having access to an asset that retains its value is a game-changer. It also has the potential to be a faster, easier, and cheaper way of sending cross-border payments like remittances. Stablecoins also have utility for businesses. Though we’re earlier into exploring these use cases, companies like JPMorgan, PayPal, and Stripe are experimenting with the technology. In the coming years, more big-name players may enter the fold to take advantage of the technology’s native benefits. Rather than make this argument myself, I have invited someone I consider an expert on the subject. Basho (a pseudonym) is a long-time technology researcher and investor who counts stablecoins as a favorite topic. Through our conversations this past year, I’ve come to appreciate him as an unusually clear-eyed, pragmatic thinker about crypto’s utility. I have especially enjoyed his thoughts on the stablecoin landscape and felt it would be valuable to share with you all. This past week, Basho launched his new Substack, Deeper Knowing. I think he will be an important voice in the coming years, and I’m excited to follow along. As you’ll discover in this piece, stablecoins are not only an interesting asset but a platform that unlocks new use cases. Critically, stablecoin providers have a clear business model that may set them up as next-generation banks and payment providers. A quick ask: If you liked this piece and wouldn’t mind giving it a “heart” ❤️ from the header above, I’d be very grateful. It helps us understand which pieces are resonating, and what we should do more of. Thank you! Brought to you by TegusAre you spending too much time skimming expert transcripts or digging for insights so you can make powerful investment decisions? Powered by advanced AI and machine learning algorithms, Tegus’ platform supercharges your research process so you can extract valuable insights in seconds. We summarize each expert transcript so you can assess key questions and themes before digging deep. But that’s not all—Tegus now auto-tags topics discussed both within a transcript, and across transcripts for a company so you can quickly assess if you want to dive deeper into content. Increase your research efficiency and reduce your time to insight with Tegus’ latest innovations in AI. Stablecoins: The Next Financial PlatformNote from the editorThe Generalist occasionally invites guest contributors to share their thoughts. We do so when we believe the person in question has strong expertise in the subject matter and a thoughtful perspective. This piece comes from a pseudonymous contributor, Basho, a long-time researcher and investor. Through conversations and reviewing prior private work, we were impressed by Basho’s prudent but optimistic view on crypto. We especially enjoyed the manner in which he laid out the stablecoin landscape and felt it would be valuable for Generalist readers. We collaborated to adapt Basho’s research for this piece. You can see more work by Basho on their Substack, Deeper Knowing. As a final note, Basho’s identity and professional background is known by The Generalist team. Actionable insightsIf you only have a few minutes to spare, here’s what investors, operators, and founders should know about the promise of stablecoins.

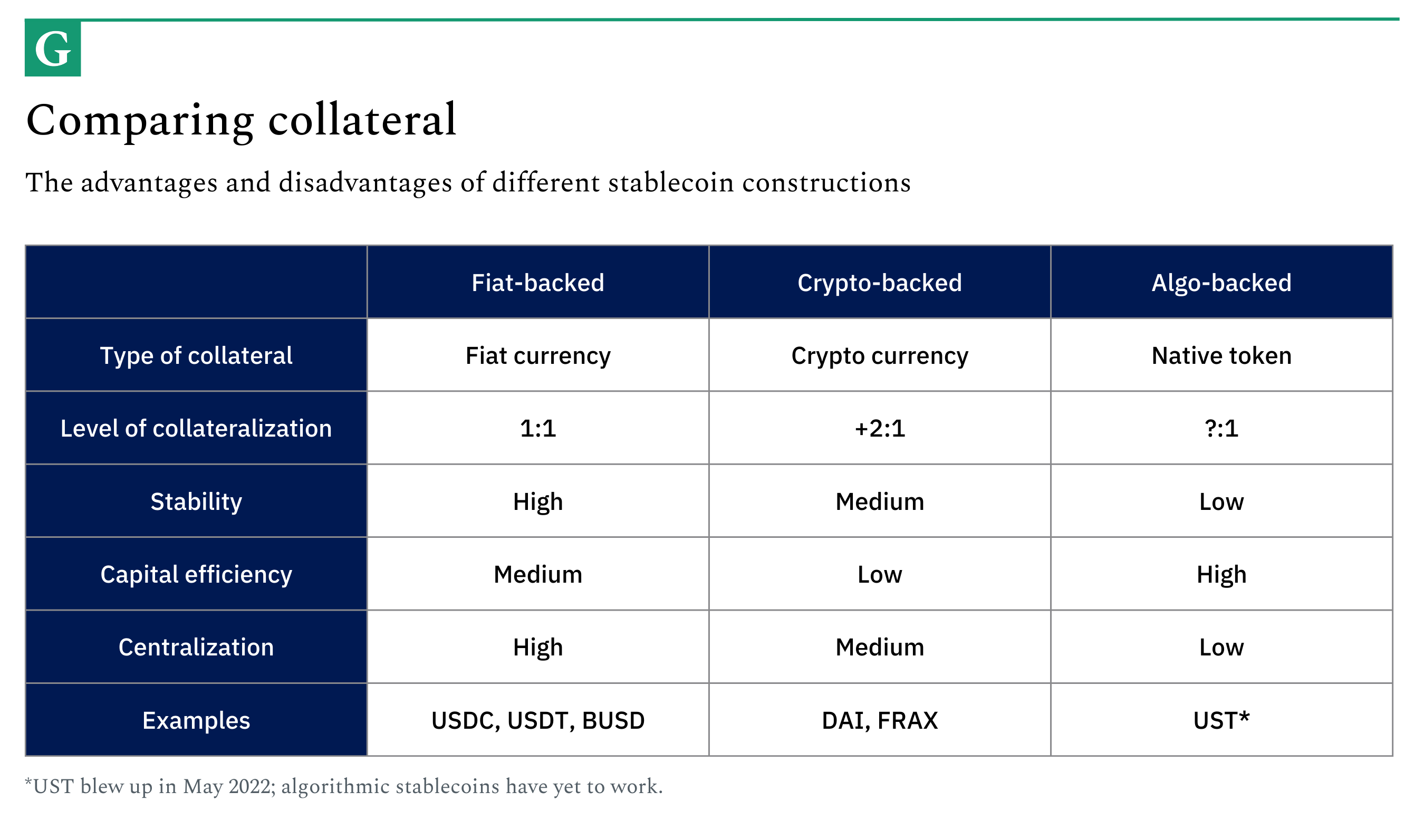

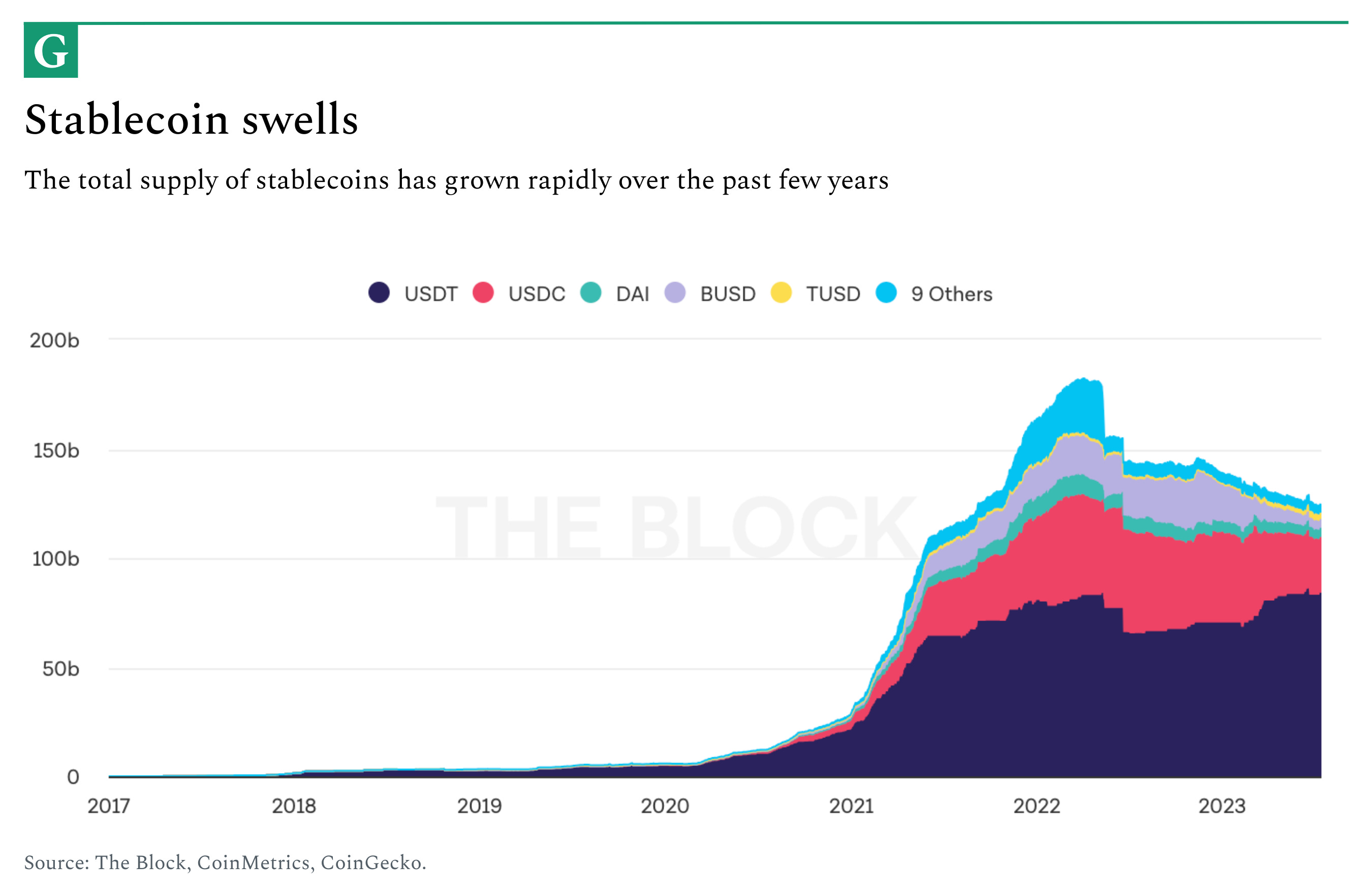

Few creations have stronger product-market fit than the US dollar. Though controlled by the American government, dollars are desired around the world, prized for their stability. The owner of a corner shop in Lagos or a hostel in Buenos Aires happily accepts payment in greenbacks because they hold their value much better than local currencies. While the purchasing power of the naira or peso fluctuates sharply yearly, the dollar holds. Given the opportunity, many would prefer to earn, spend, and save in USD – or something similarly robust. Domestic regulations and operational constraints typically make that dream either explicitly illegal or simply impossible. Stablecoins provide a solution. As the name implies, these digital currencies maintain a fixed price relative to a reference asset – typically the US dollar. Unlike much of the crypto landscape, stablecoins offer no dramatic run-ups and speculative gains. They are designed to maintain their value, to act like a dollar in digital form. Admittedly, it is a strange time to make a crypto* bull-case. The past 18 months have shown the sector in its worst light, revealing spectacular fraud and widespread gambling-esque behavior. Current headlines often make for bleak reading, foretelling irrational regulatory crackdowns and further debacles. There is good reason to be dismayed by the lack of real impact the category has made and to question the technology’s ability to solve genuine problems. Despite these issues, I believe crypto’s transformative promise remains intact. Though 99% of activity in the space may have been noise, the 1% of companies building meaningful products will, I believe, dramatically impact the world, creating significant enterprise value in the process. Understanding where this conviction comes from requires looking below the surface and examining the primitives being built and what they unlock. Stablecoins represent one of the most concrete examples of crypto’s promise, protecting individuals against currency devaluation, accelerating and reducing the cost of global payments for businesses, and building infrastructure for a more open, accessible financial system. At a fundamental level, stablecoins aren’t merely a new asset but a radical new platform. In today’s piece, we’ll explore what stablecoins are, how they work, and why almost a million crypto wallets transact with them daily. We’ll unpack how enterprises like Stripe play in the space and how the technology could impact both businesses and consumers. To conclude, we’ll analyze the main players and explore which models might win in the future. Stablecoins as a platformStablecoins are designed to maintain a fixed price, but not all are created equal. There are three primary types: “fiat-collateralized,” “cryptocurrency-collateralized,” and “algorithmic.” We’ll focus on the first category in today's piece, but it’s worth understanding all three. Fiat-collateralized stablecoins are the most straightforward. A corresponding, real dollar is held in a bank account for every synthetic dollar printed on a blockchain. A clear 1:1 ratio between the stablecoin and the fiat currency supports its value. The result is a high-stability currency with reasonable capital efficiency since you can scale the circulation of your stablecoin linearly with the dollars you have on hand. This method also comes with a high centralization risk. Your real dollars are held by a financial institution somewhere, which could be frozen. If that were to happen, your stablecoin might take a hit. USDT (Tether), BUSD (Binance and, until recently, Paxos), and USDC (Circle in partnership with Coinbase) are all examples of fiat-collateralized offerings. Cryptocurrency-collateralized stablecoins make different trade-offs. Rather than securing the currency’s value with fiat, this category relies on crypto. For every synthetic dollar added to the blockchain, cryptocurrencies like ETH are secured in a smart contract worth more than the stablecoin. For example, for every $1 of value added to the blockchain, $2 in crypto might be used to back it. Smart contracts automatically liquidate holdings when ratios fall below certain thresholds to manage collateralization. This type of stablecoin has moderate stability, low capital efficiency (given the over-collateralization), and lower centralization risk. Currencies like DAI (MakerDAO) and FRAX (Frax) fit this group. Finally, we have algorithmic stablecoins. Synthetic dollars added to the blockchain are backed by nothing – except the native token of the stablecoin itself. Yes, it’s as wild as it sounds, which is why it hasn’t worked to date. UST (Terra) was the leading example until May 2022, when it blew up in spectacular fashion. In theory, algorithmic stablecoins have low stability, high capital efficiency (you effectively print money!), and minimal centralization risk. While crypto-collateralized and algorithmic stablecoins are interesting and have valuable applications, most current usage is in fiat-collateralized. This category also represents the largest opportunity for the foreseeable future, though some crypto-native readers might take issue with that claim.* BenefitsBefore considering adoption, it’s worth noting how this asset improves upon traditional money and financial systems. In short, stablecoins make money programmable, permissionless, borderless, and interoperable. Meanwhile, stablecoin infrastructure allows money movement to happen faster and cheaper. Let's spell out these transformations to avoid sounding like empty buzzwords. Firstly, stablecoins make money programmable. When money is natively embodied in code, it can be manipulated like software. This unlocks a wave of new uses and applications. Suddenly, you can tell money to do things – to act or interact with other applications in certain ways. In the future, application developers will use smart contracts to program money into fascinating, valuable configurations. Next, stablecoins make money permissionless. Owning a stablecoin is like holding cash in digital form. That’s very different than having money in a bank account. You can give it to anyone you want without relying on third parties. It is the equivalent of handing someone a $20 bill, but over the internet. That’s powerful not only for consumers that use stablecoins, but for developers that want to build financial applications freed from the legacy banking systems’ constraints. Third, when replaced by stablecoins, money becomes borderless. Blockchains create what looks like a globally unified financial system. There are no international borders in stablecoin payments, allowing wallets across the world to interact with each other easily. A user in Mexico can send money to a friend in Egypt seamlessly. Fourth, stablecoins introduce interoperability to the financial system. Suddenly, your “dollar” can interact with any application. You can send money freely from Venmo to Cash App and back again without going through intermediary steps. Walled gardens no longer exist. Not only is this a radical improvement for consumers, it’s an unlock for developers and opens up a rich design space for financial application development. Finally, stablecoin infrastructure makes money movement faster and cheaper. The removal of intermediaries results in the near-instantaneous transfer of funds and settlement. The idea of a wire transfer or international payment being pending doesn’t exist with stablecoins. Moreover, such capabilities are available 24-7-365. That beats the hours of operation for every bank on Earth. The removal of banks – and their associated cost structures – should dramatically drop the cost of money transfers. At full scale, blockchains should facilitate value transfers that cost just fractions of a penny. Such economic benefits are good for customers, of course. They also open up new business models like micropayments. These are all compelling benefits, but what would a mature stablecoin ecosystem feel like in practice? My hope is that it would resemble an open, cheap, and programmable version of Venmo that spans the globe. It would provide the ability to send money to anyone, anywhere, regardless of what application they were using. It would offer low fees and enhanced functionality, powered by the wide range of dynamic applications built on top. If executed correctly, it would be financial infrastructure that appealed to everyone: retail consumers (think WeChat Pay for the entire world), enterprises (imagine B2B payments on stablecoins), and financial institutions (streamlined operations across the board). And while it’s fair to say that stablecoin infrastructure has yet to fulfill all these promises, they are within reach if development continues at its current pace. Adoption and usageThough still in its early stages, stablecoins see widespread usage. There are roughly $125 billion of stablecoins in circulation, of which over 90% are fiat-collateralized. Approximately $80 billion of the total exists on Ethereum, while most of the remaining $45 billion exists on Tron, a blockchain popular outside of the US that sees heavy usage of USDT. As demonstrated by the graph below, stablecoins have grown rapidly over the past few years: In case you missed itOn Thursday, we published an 11,000-word case study of Brex as part of our partner program. I’ve been researching the all-in-one financial platform for months and working on the piece for quite a while. It is, I believe, the most comprehensive analysis of the $12.3 billion company’s origins, strategy, culture, and future. Learn more about Brex’s business here. PuzzlerRespond to this email for a hint.

Well done to Ash P, Meir V, Austin V, Michael O, Bruce G, Alexander M, Asif Z, Emerson K, Adam N, Charlie R, all Morihiko Y. All successfully cracked last week’s riddle:

The answer? Dutch favorite Edam, of course. Reverse the letters and it is, quite literally, “made.” Until next time, Mario |

Older messages

Brex’s Second Act

Sunday, July 16, 2023

The $12.3 billion fintech is hitting new heights and entering a new growth phase. It's a dividend of the firm's clear-eyed decision-making.

Modern Meditations: Sam Lessin

Sunday, July 9, 2023

The Slow Ventures GP on philosophy, empowering metrics, AI hype, and John Wick.

AI and The Burden of Knowledge

Sunday, June 25, 2023

A story of superior intelligence and possible obsolescence.

Modern Meditations: Scott Belsky

Tuesday, June 20, 2023

The Adobe CPO on innovating from within, shipping slow, and AI.

Intercom’s AI Evolution

Sunday, May 21, 2023

An interview with co-founder and Chief Strategy Officer, Des Traynor.

You Might Also Like

🚀 Ready to scale? Apply now for the TinySeed SaaS Accelerator

Friday, February 14, 2025

What could $120K+ in funding do for your business?

📂 How to find a technical cofounder

Friday, February 14, 2025

If you're a marketer looking to become a founder, this newsletter is for you. Starting a startup alone is hard. Very hard. Even as someone who learned to code, I still believe that the

AI Impact Curves

Friday, February 14, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. AI Impact Curves What is the impact of AI across different

15 Silicon Valley Startups Raised $302 Million - Week of February 10, 2025

Friday, February 14, 2025

💕 AI's Power Couple 💰 How Stablecoins Could Drive the Dollar 🚚 USPS Halts China Inbound Packages for 12 Hours 💲 No One Knows How to Price AI Tools 💰 Blackrock & G42 on Financing AI

The Rewrite and Hybrid Favoritism 🤫

Friday, February 14, 2025

Dogs, Yay. Humans, Nay͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 AI product creation marketplace

Friday, February 14, 2025

Arcade is an AI-powered platform and marketplace that lets you design and create custom products, like jewelry.

Crazy week

Friday, February 14, 2025

Crazy week. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

join me: 6 trends shaping the AI landscape in 2025

Friday, February 14, 2025

this is tomorrow Hi there, Isabelle here, Senior Editor & Analyst at CB Insights. Tomorrow, I'll be breaking down the biggest shifts in AI – from the M&A surge to the deals fueling the

Six Startups to Watch

Friday, February 14, 2025

AI wrappers, DNA sequencing, fintech super-apps, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How Will AI-Native Games Work? Well, Now We Know.

Friday, February 14, 2025

A Deep Dive Into Simcluster ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏