Astral Codex Ten - Your Book Review: The Laws of Trading

[This is one of the finalists in the 2023 book review contest, written by an ACX reader who will remain anonymous until after voting is done. I’ll be posting about one of these a week for several months. When you’ve read them all, I’ll ask you to vote for a favorite, so remember which ones you liked] A book about trading isn’t ever actually about trading¹. It is either:

With The Laws of Trading, Agustin Lebron has written something different: part love letter to trading, part philosophical treatise on epistemology and modeling the world around us, and part guide to applied decision-making. Lebron’s Laws are Laws of the Jungle, not Laws of Nature. He views financial markets as the most competitive Darwinian environment on Earth, where participants must adapt or die. According to Lebron, the book is for people working in finance and trading, as well as anyone in the business of making rational decisions. This explicitly rationalist bent is similar to Julia Galef’s The Scout Mindset or Annie Duke’s Thinking in Bets. Where The Laws of Trading sets itself apart is with the best description of financial market dynamics that I’ve ever seen while diving deep into philosophical concepts. Why trust Lebron? He is an engineer, worked as a quantitative trader and researcher at Jane Street, and has a deep understanding of trading. He has what Taleb would describe as skin in the game. You and I may read Astral Codex Ten in our spare time, post on LessWrong, and navel gaze about our epistemic certainty, but at the end of the day most of us are pursuing rationality for fun, as a hobby. Traders like Lebron pursue rationality as a profession: Their livelihood depends on having a better model of the world than their competition. There are lessons to learn from them that apply to our daily lives. 1: MotivationKnow why you are doing a trade before you trade.

Right now, you’re making a trade. You’re trading your time to read this book review. You have a cost: you could be spending time with your loved ones, exercising, working, sleeping. You might be hoping to learn something, to take away lessons that you can apply to your life, or simply to entertain yourself. Here, off the bat, are two key insights:

Lebron’s first law states that we must know ourselves and our motivations for trading before we trade. We tell ourselves many stories, but someone with intellectual honesty – the person with the most alignment between their motivations and actions – will take money from the person who didn’t go through the work to understand their own motivations. There is a reason that Citadel and other hedge funds pay millions of dollars to trade with retail. They know why they are trading: to maximize profit. And the dilettante who “trades for fun” will be eaten alive by a firm with a much better model of a) the world and b) the dilettante themself. Why did I write this book review? To test my intellectual mettle. I could easily have posted this book review elsewhere, but no, I wanted to see how I stack up against other ACX Book Review contest participants. Similarly, this is often the reason people get into trading. One motivation that Lebron explicitly calls out is intellectual validation. You can toil in obscurity for years as an academic. But in trading, there is a quick feedback loop. If your P&L showed $10M last year and the guy sitting next to you showed $8M, you have demonstrated who is “cleverer” and established a clear hierarchy. What lessons here transfer to our daily lives? Like Paul Graham, Lebron encourages us to keep our identities small. He gives the standard decision-making advice to write down your framework and reasoning for why you made a decision at a specific point in time, in order to avoid biases after the fact. This section of the book contained good general advice, but nothing that will be particularly new for the median ACX reader. 2: Adverse SelectionYou’re never happy with the amount you traded. Now we start to get into the good stuff. Financial markets are an information aggregation mechanism, relying on multiple parties’ beliefs and recursive Bayesian updates of an individual actor’s beliefs based on the beliefs of others². Market mechanics demonstrate Bayesian beliefs in action. The following quote is quite long, so skip over it if you don’t want to dive deep into the psychology of making a market. I retained it in full because this is quite literally the best description I’ve ever seen of the Bayesian dance between two market makers:

Whether or not you make money, you have regrets! If you profited, you could have made more. If you lost money, you shouldn’t have made the trade at all. Like death and taxes, you can’t avoid adverse selection. Lebron continues to highlight a few areas of trading that have adverse selection problems. First, IPOs. If you buy the stock in an IPO, you expect the share price to “pop” on the first day of trading. However, if others also have this expectation, the round will be oversubscribed. You can only get the quantity of shares that you bid for when the market doesn’t think the shares will go up. So if you are able to get the shares that you want, the IPO is likely a dud. See also: Venture Capital fundraising. Second, powerful entities that change the rules of the game while you’re playing. Exchanges nullify “erroneous” trades. Brokerages limit buying. Anyone who tried to buy GameStop stock on Robinhood on January 28, 2021, knows this form of adverse selection all too well. Lebron also highlights “special trades”, in which you should throw the “normal rules” out of the window. This advice generalizes to other areas of life:

3: RiskTake only the risks you’re being paid to take. Hedge the others. In trading, as in life, you can make the right call in expected value terms but still lose due to randomness. Some of that randomness is avoidable. Some of it is not — and can be accounted for by hedging. Here, Lebron encourages us to rely on multiple risk measures and actively seek to understand the risks that we might be subject to. That’s all well and good in the world of finance, with derivatives contracts. But how might this apply in other areas of life? If you work for a publicly traded company and are compensated in stock, sell your shares as soon as you receive them. This is not because I don’t expect the share price of Microsoft/Meta/Apple/etc. to go up. The stock may very well outperform the market. But you are not being compensated for the added risk that you take on here. Your employment prospects at Microsoft/Meta/Apple/etc. are highly correlated with the share price. When the share price is down is when layoffs happen. Former Enron employees can chime in here. Similarly, it makes sense to hedge anything that is outside of your control. Let’s say you’ve decided the crypto bear market of 2023 is a great time to start a new crypto company. Your success depends on things within your control, such as:

As well as some things outside of your control, such as:

It might make sense to short the overall tech sector or a basket of publicly traded crypto-related companies so that your trade of time and foregone income to start your new crypto company is associated with only the risks you can control. But some risks you can’t hedge. These are the more interesting ones. There is counterparty risk (your trading partner blows up), liquidity risk (the market you used to hedge dries up), or even political risk:

Lebron is meticulous in the ways that he thinks about risk. He highlights that in the markets, you need to be exceedingly paranoid to survive:

I don’t think enough people consider risk and the hedges you can take in the context of a career. I’ve spent the past several years working at startups, where I’ve placed a hugely levered career bet. I’m trading my time and the opportunity cost of another job to work at my current employer. My salary, stock options, expertise, and social capital that I build from working 10 hours per day is fundamentally long (and has risks associated with):

It might make sense to hedge some of that risk – simply having friends that work at other companies and in other industries so that all of my social capital isn’t in one basket is a start⁴. My only gripe here is that I would have liked to see Lebron call out ergodicity more explicitly. Blowing up your account might be fine as a trader – if you have a decent prior track record, you can probably just get a job at a different firm – but in life other losses are less reversible. As far as we know, this is the only universe we have access to. It doesn’t matter if your bet was positive EV and you won in 51% or 75% or even 99% of universes. You should place a high premium on staying alive and having enough bankroll to play the next round of the game. This is more important outside of finance than in the world of trading. 4: LiquidityPut on a risk using the most liquid instrument for that risk. Liquidity isn’t something I think about in daily life. But I probably should. A personal example: I gave up the liquidity of a month-to-month gym contract in New York City in February 2020. I paid one year upfront for a 10% discount. Oops. Lebron also reminds us that the 30-Year Mortgage is an Intrinsically Toxic Product, a concept that will resonate with all of the Georgists here.

Among other issues:

But I’m not so sure that these lessons are directly applicable to other areas of life. Some of the best things in life come from lashing yourself to the mast, burning the boats behind you, willingly giving up liquidity. The deepest monogamous relationships are built from an irrational investment in one other person, saying “In sickness and in health, until death do us part.” How many scientific problems were solved because one person had an irrational willingness to: Just. Keep. Going. Sometimes it’s powerful to use the sunk cost fallacy to your advantage. Investing in relationships, subject matter expertise, even putting down roots via *gulp* homeownership reduces your liquidity, but also leads to some of the best (if intangible) things in life. 5: EdgeIf you can’t explain your edge in five minutes, you don’t have a very good one. OR The long-term profitability of an edge is inversely proportional to how long it takes to explain it. The Efficient Market Hypothesis is one of the core concepts taught in Finance 101. The Efficient Market Hypothesis is a lie. The person that better understands the nature of a small sliver of the world (e.g. Apple’s share price) will make more money than others. Modern financial markets are exceedingly competitive. This means that the bigger you think your edge is, the more likely it is that you’re wrong.

Lebron here warns us of getting too cute with data, of changing variables. Enough randomness will produce an “edge” that is likely to break down the second a trading strategy hits the real world. You can always find a statistical correlation if you change enough variables. But this is fundamentally the same problem facing the replication crisis in social sciences. Lebron argues that we need stories here. Edge is expressed in stories: an edge does not exist without a clear mental representation of that edge. Pure linear algebra does not suffice. I’m not so sure. It seems like AI companies are pushing forward technology in a way that suggests that mental representations are not the only path to intelligence. Lebron discounts “black box” trading strategies without much discussion of their potential merits. Are all of RenTech’s models explainable by a story? The firm is notoriously secretive, so I don’t know, but I’d guess not.

Before Sam Bankman-Fried was the face of Why Effective Altruism is Bad, before he even founded FTX, he made money arbitraging the difference between Bitcoin prices on Japanese and American exchanges. I’m reminded of that trade here. It isn’t a particularly elegant trade, it doesn’t require deep technical knowledge or any models. It was a schlep. It was all operational work: figuring out how to open a Japanese bank account, transferring money between the US and Japan, standing in line for hours every day at both US and Japanese banks (presumably this wasn’t the same person). In as technical a field as trading, sheer willpower is often what gets things done in the end. 6: ModelsThe model expresses the edge. Lebron drills into us that a model is the tool for expressing an edge. The model is not the edge. The model does not give us unique knowledge about the world. The map is not the territory. He dives into the difference between generative (G) and phenomenological (P) models. G models express a worldview and fit data into that way of thinking, whereas P models solely look at the empirical data to build a worldview. Models of the world differ from models of markets, though. Markets have quick feedback loops, are explicit in terms of what they measure, and are easy to quantify at a specific point in time. Most of our models for the world, though, are ill-defined and explicit. Models are only as good as our assumptions. As an aside, this is a common criticism of rationality or Effective Altruism – you can justify any worldview if you assign your model input weights in just the right way⁵. I also tend to think that “traditional” EA is overly dependent on P models, and doesn’t embrace the G models that led to economic reforms in India in the 1990s or the economic policies that led to rapid economic development in Southeast Asia in the second half of the 20th Century. Interestingly, I think a lot of longtermist EA, specifically AI alignment, leans the other way, relying on G models which explicitly assume a certain P(doom) and work backwards from there. (Though I won’t pretend to be an expert here or to understand everything, so take this with a grain of salt.) Overall, startups and tech seem to take heed to Lebron’s lesson much better than the folks hanging out on this part of the internet: “Even if a model makes good predictions about some future value or event, that knowledge is useless without also knowing how to take advantage of that prediction.” Now we get a bit philosophical. By acting, you change the nature of the market. Your model predicts things that might not be true as soon as you start trading (and changing the environment) based on it. When you’re right, everyone else sees the same trades that your model does and will beat you to them. When your model is wrong, others don’t act, meaning adverse selection rears its ugly head once again. So your model shows you with an edge, but in practice you only make the trades where you don’t have an edge. Lebron closes by arguing that G models are best for understanding other people, and are good in and of themselves:

7: Costs and CapacityIf you think your costs are negligible relative to your edge, you’re wrong about at least one of them. This section of the book displayed a good amount of epistemic humility, words that I didn’t expect to be typing in the context of a book about trading. Lebron tells us that trades don’t exist independently in the universe — in the n-dimensional space of all possible trades seeking to optimize profitability, if you have a gigantic mountain of profitability, someone else has probably at least discovered the base. So you probably don’t have a profitable trade; rather, you are misunderstanding something about your trade. You’ve either overestimated profitability or underestimated cost. Lebron highlights four types of trading costs: [graph that didn’t show up correctly here: two axes and four quadrants, with the axes being visible ←→ invisible costs and linear ←→ nonlinear costs] Here, we’ll focus on Quadrant 4, where he highlights a few interesting phenomena. Herding. It’s likely that if you have a profitable trading strategy, either:

Lebron highlights Long Term Capital Management (LTCM) as an example here, which suffered a famous blowup in 1998. This hedge fund is often discussed in the context of betting on Russia just before it defaulted on its debt, but an under-discussed aspect is the market mechanics. Other firms were copying LTCM’s trades, so there was a liquidity issue and a cascade of failures when the firm’s margin positions needed to be unwound. Lebron also discusses opportunity cost, a concept with which most will be familiar. But here, he discusses the cost in the context of trading. Ultimately, this is an explore/exploit problem. How should a trading firm weigh maximizing profit for today’s strategies, as opposed to working on organizational efficiencies so that you can have the capacity to work on tomorrow’s strategies? There is a clear career parallel here: I’ve seen so many people get locked into their current role due to inertia, whereas the ones who succeed long-term appear to prioritize their own learning and exploration. As a case study, Lebron discusses how Bell Labs (AT&T) maintained a position of dominance for half a century. He attributes this to four things: First, they hired the best. There was interaction between three groups that did not interact at most organizations.

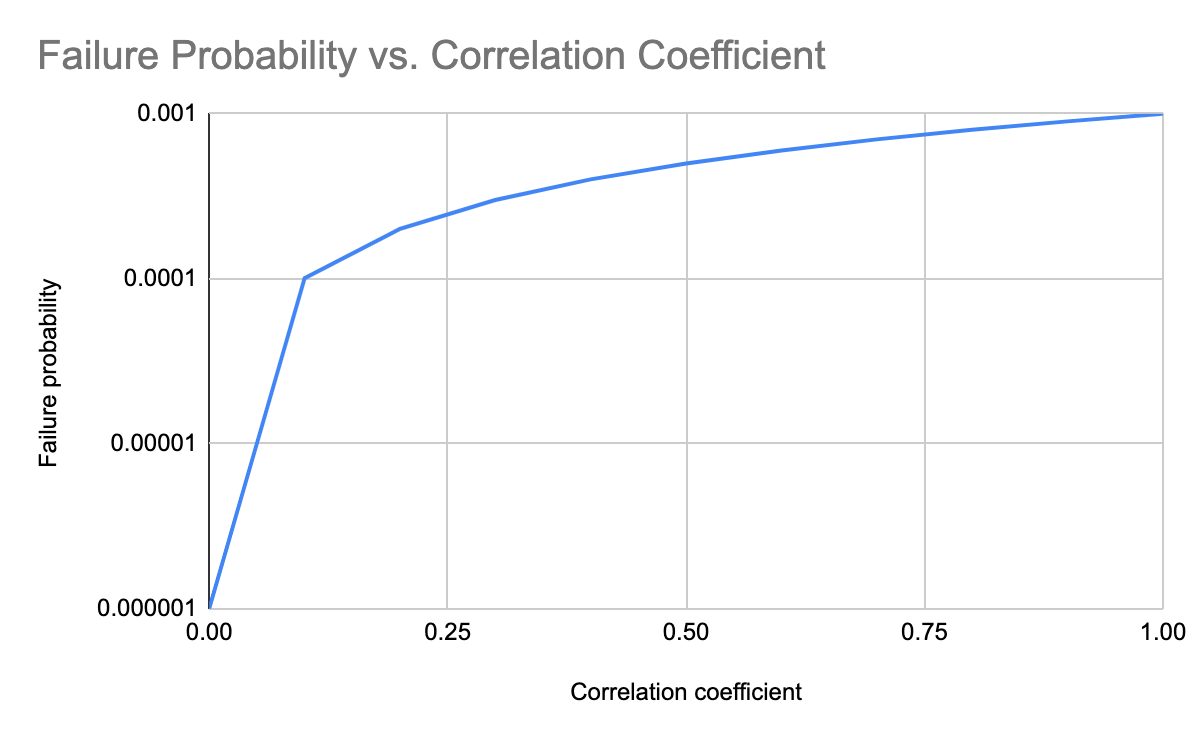

This seems to have been cargo-culted at most modern tech companies. Ping-pong tables and nap pods don’t replace a true culture of cross-pollination of ideas in a boring cafeteria. I’m reminded of the story of Richard Feynman in academia⁶. His colleagues who kept their office doors closed made progress on their research in the short-term, but hit stumbling blocks. Those who kept their doors open didn’t seem to make much progress initially, but eventually outpaced the “closed door” scientists. They had new ideas and research directions based on all the interesting conversations they were having with others. The simple lesson here is to get outside of your bubble a bit more. Maybe the normies have something valuable to say once in a while. Second, an emphasis on continuing education. This blew me away: Bell Labs developed a syllabus of graduate-level courses and taught it to any interested employee. They didn’t outsource the curriculum or the teaching. Third, a technical staff that was held in just as high of an esteem as the PhDs who managed them. This seems to be why there is little innovation in government: talented engineers are treated as second-class citizens in research labs, so they work for Stripe and OpenAI instead. Similarly, one can attribute the lack of innovation in hospitals to doctors holding all of the institutional power. Often, all a hospital needs to save lives is simple practices that other businesses figured out long ago, but the hubris of MDs prevents this from happening. But I digress. Fourth, a culture that embraced failure. While many companies say they have a culture of “failing fast”, how many actually mean it? Some of the best parts of this book are the diversions. This book is in a sense nostalgic – edges are lost over time, trading firms come and go, entire markets disappear. All you have along the way is the knowledge that for one instant, in one market, you had knowledge that the rest of the world didn’t and used it to make one profitable trade. 8: PossibilityJust because something has never happened doesn’t mean it can’t. Corollary: Enough people relying on something being true makes it false. “Impossible” and “25-standard deviation” events sure seem to happen awfully often in the financial industry. Consider an airplane engine that has a 1/1,000 chance of failing. Each plane has two engines, so that if one fails the other can still operate and get everyone to the ground safely. That’s great if the engines act as completely independent variables, but what if failures are correlated? The key insight here is that small correlations create large changes in failure probabilities. Namely, a relatively “small” correlation of 0.1 increases the probability of engine failure 100x. The feedback loop of markets is great at hiding these correlations until something goes wrong. When it does, you have highly-correlated mortgage-backed securities kicking off the 2008 Financial Crisis. One of Lebron’s more interesting insights is that markets are stochastic, self-organized feedback systems, which means that both momentum trades (a price that is going up will continue to go up) and mean-reversion trades (the exact opposite) are valuable at different points in time. I found this to be a good framework for thinking about AI. Some folks are clearly betting on momentum – that GPT-X products will continue to improve, reaching AGI (if it hasn’t already). The other side of the coin is bets on mean-reversion, which focus on the S-curves of technology and take a historical view. I’m old enough to remember that in 2016 everyone was talking about how self-driving cars would mean the end of truckers, and there’s more demand than ever for them today. 9: AlignmentWorking to align everyone’s interests is time well spent. This is the principal-agent problem. Whenever the person investing the money is not also providing the capital, you’re going to have problems. Follow the incentives. When a fund manager is paid 2% of assets under management (AUM), the incentive is to raise as much money as possible. When they are paid 20% of profits, they’re incentivized to make high-risk investments, as their upside is uncapped but their downside is capped at $0. High-water mark provisions help with this. Basically if your fund had $1 billion AUM last year and you lost 30% this year, you now have $700 million. As the fund manager, you don’t get paid until you’re back to the $1 billion mark. But…then you just shut down your fund, return the $700 million, and start a new fund. Lebron argues that the only way to resolve this problem is to perfectly align capital and labor. I wonder how much of the Renaissance Medallion fund’s success comes from a) this perfect alignment of incentives vs. b) capital limits, meaning that strategies can be executed that would not work at a larger scale. Lebron argues that everyone acting as an owner is a good thing. And I tend to agree! But there’s a free-rider problem here that he doesn’t address. I’m writing this book review instead of working at my day job as a tech employee. I’m an owner — but my salary and equity was negotiated a few years ago when I signed my job offer. If I were a salesperson working on commission, perhaps I’d be singing a different tune. Aligning incentives is easier when you’re working at a job where performance is a) easily measurable and b) a direct output of your labor (say, as the Portfolio Manager at a hedge fund). Lebron also argues that, within an organization, consistency of culture is more important than the specific culture. I fully agree – this is particularly egregious at tech companies. Many claim to support work-life balance but then ask you to work weekends, or say “we’re a family” but then lay off employees the second they have trouble raising the next round of funding. Employees can see right through this. Put your flag in the ground and say what you actually stand for. If you stand for everything, you stand for nothing. 10: TechnologyIf you don’t master technology and data, you’re losing to someone who does. This point is self-explanatory and I don’t think it needs further exploration for the average Astral Codex Ten reader. Will machines take over the world? Lebron straddles the line here and states in the context of trading, a human-machine hybrid still does the best work, given our complementary skill sets. Humans have higher-level thinking and understanding context, whereas computers possess the speed and iteration ability necessary to implement models. This book was released in 2019 — I’d love to see if Lebron has updated his priors at all based on recent developments in AI. There’s also an interesting diversion here into software development. Specifically, Lebron tries to quantify technical debt, which I haven’t seen done before. 11: AdaptationIf you’re not getting better, you’re getting worse. The markets are a very scary place, and you are in an existential arms race with your competitors. Adapt or die. At the individual level, group (trading desk/business unit) level, firm level, and market level. Adapt or die. That may seem harsh. But no – Lebron praises trading as a positive-sum game. International financial markets allow the flow of capital from rich to poor countries, giving rich investors a return and raising the standard of living in the developing world. This is a striking perspective to have on trading. I’ve heard traders describe the work they do as “net neutral” and “adding no value to the world”. Conversely, Lebron views trading as an act of creativity, a way to make the world, in one small way, a better place through creating efficiencies in markets. His philosophical approach to markets is best demonstrated through this story of a trader named Mark,

One can imagine Lebron, in a previous life, penning the words “One must imagine Sisyphus happy.” Beyond the philosophy, while reading this book I was struck by the fact that trading is one of the few true apprenticeship systems that remains for white-collar work. You can career switch into the technology industry without a degree. There is a clear educational path to becoming a doctor or a lawyer. But trading is a bunch of dudes (and it’s almost always men) behind closed doors working on intellectually challenging problems. Lebron recognizes this as well:

The Laws of Trading opens the door to this world a crack and allows the rest of us to peek in, ever so slightly. 1 The book actively used by traders is perhaps the driest thing that Nassim Taleb has ever written: Dynamic Hedging: Managing Vanilla and Exotic Options. 2 Like any good Bayesian, he introduces us to Bayesian statistics and its merits over Frequentism, then points us to the work of Eliezer Yudkowsky to learn more. 3 You’re offering to buy 1,000 shares at 54.25 and to sell 1,000 shares at 54.45. 4 As an aside, this seems to sometimes be a failure mode for Rationalists and EAs. They hang out in the same circles, leading to correlated career paths, social networks, and groupthink. 5 This is also the entire field of Investment Banking: build a model, then massage the inputs to get the multiple that the Managing Director tells you to. 6 No luck finding this story via Google or ChatGPT, but I think I’m getting the details broadly correct. You're currently a free subscriber to Astral Codex Ten. For the full experience, upgrade your subscription. |

Older messages

Highlights From The Comments On British Economic Decline

Thursday, July 20, 2023

...

The Extinction Tournament

Thursday, July 20, 2023

...

Berkeley Meetup On Sunday, Special Guest Philip Tetlock

Wednesday, July 19, 2023

...

Contra The xAI Alignment Plan

Monday, July 17, 2023

Machine Alignment Monday 7/17/23

Open Thread 285

Monday, July 17, 2023

...

You Might Also Like

Strategic Bitcoin Reserve And Digital Asset Stockpile | White House Crypto Summit

Saturday, March 8, 2025

Trump's new executive order mandates a comprehensive accounting of federal digital asset holdings. Forbes START INVESTING • Newsletters • MyForbes Presented by Nina Bambysheva Staff Writer, Forbes

Researchers rally for science in Seattle | Rad Power Bikes CEO departs

Saturday, March 8, 2025

What Alexa+ means for Amazon and its users ADVERTISEMENT GeekWire SPONSOR MESSAGE: Revisit defining moments, explore new challenges, and get a glimpse into what lies ahead for one of the world's

Survived Current

Saturday, March 8, 2025

Today, enjoy our audio and video picks Survived Current By Caroline Crampton • 8 Mar 2025 View in browser View in browser The full Browser recommends five articles, a video and a podcast. Today, enjoy

Daylight saving time can undermine your health and productivity

Saturday, March 8, 2025

+ aftermath of 19th-century pardons for insurrectionists

I Designed the Levi’s Ribcage Jeans

Saturday, March 8, 2025

Plus: What June Squibb can't live without. The Strategist Every product is independently selected by editors. If you buy something through our links, New York may earn an affiliate commission.

YOU LOVE TO SEE IT: Defrosting The Funding Freeze

Saturday, March 8, 2025

Aid money starts to flow, vital youth care is affirmed, a radical housing plan takes root, and desert water gets revolutionized. YOU LOVE TO SEE IT: Defrosting The Funding Freeze By Sam Pollak • 8 Mar

Rough Cuts

Saturday, March 8, 2025

March 08, 2025 The Weekend Reader Required Reading for Political Compulsives 1. Trump's Approval Rating Goes Underwater Whatever honeymoon the 47th president enjoyed has ended, and he doesn't

Weekend Briefing No. 578

Saturday, March 8, 2025

Tiny Experiments -- The Lazarus Group -- Food's New Frontier ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Your new crossword for Saturday Mar 08 ✏️

Saturday, March 8, 2025

View this email in your browser Happy Saturday, crossword fans! We have six new puzzles teed up for you this week! You can find all of our new crosswords in one place. Play the latest puzzle Click here

Russia Sanctions, Daylight Saving Drama, and a Sneaky Cat

Saturday, March 8, 2025

President Trump announced on Friday that he is "strongly considering" sanctions and tariffs on Russia until it agrees to a ceasefire and peace deal to end its three-year war with Ukraine. ͏