How do DeFi protocols adopt real-world assets ("RWA") - An overview of MakerDAO's RWA layouts

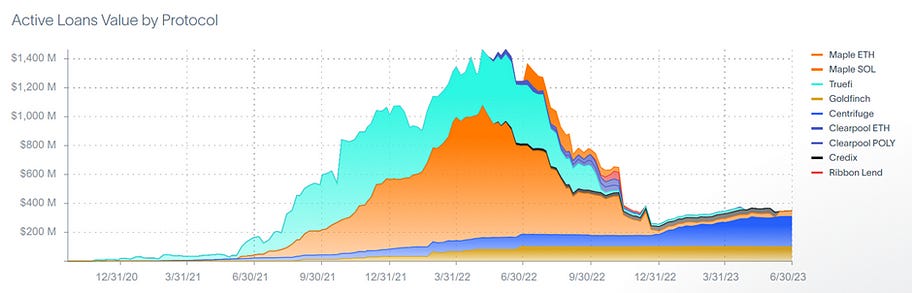

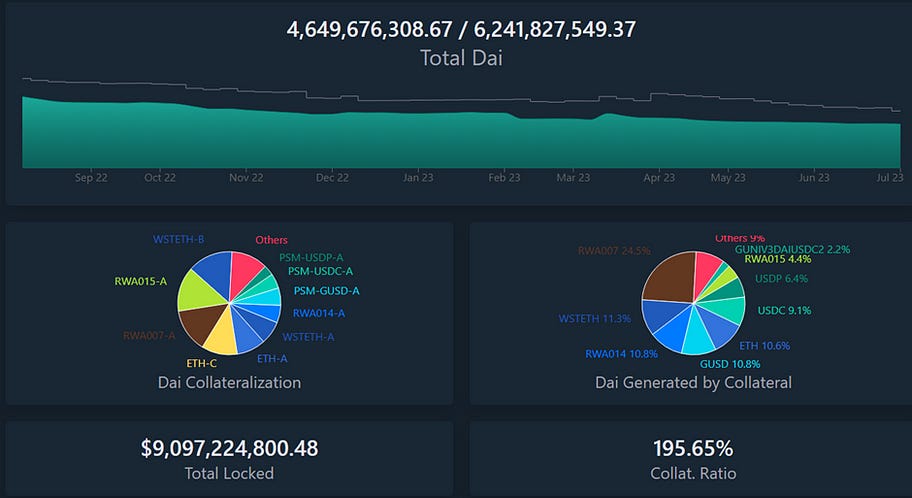

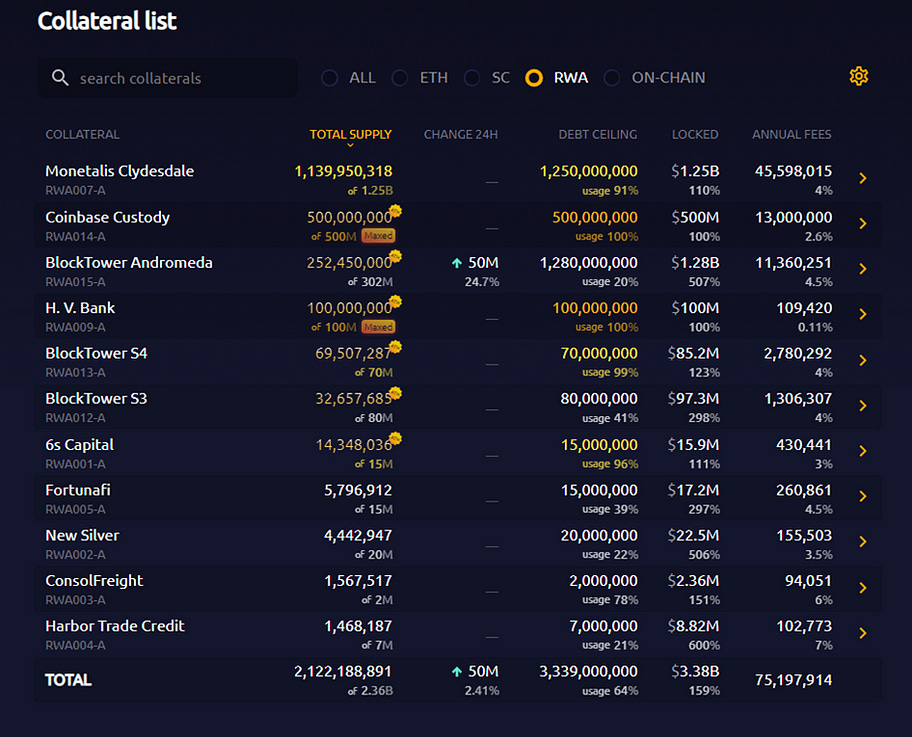

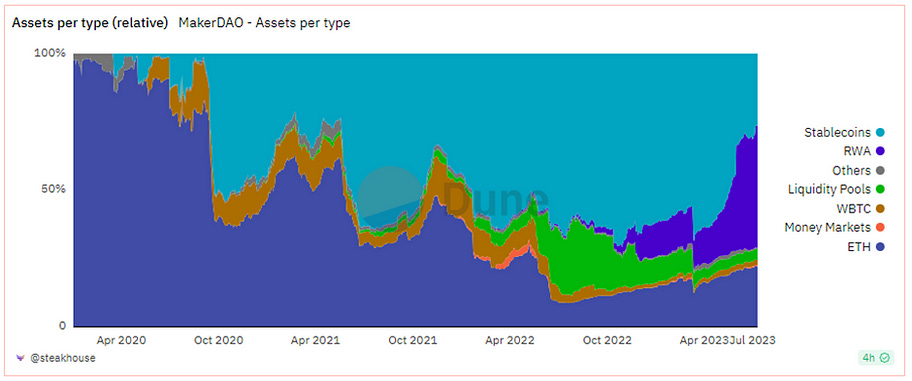

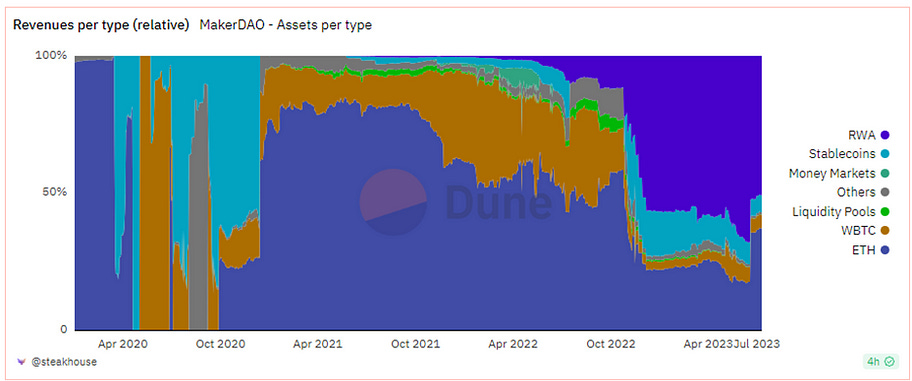

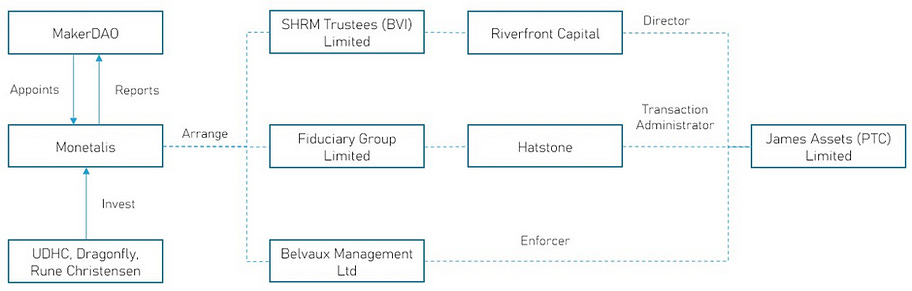

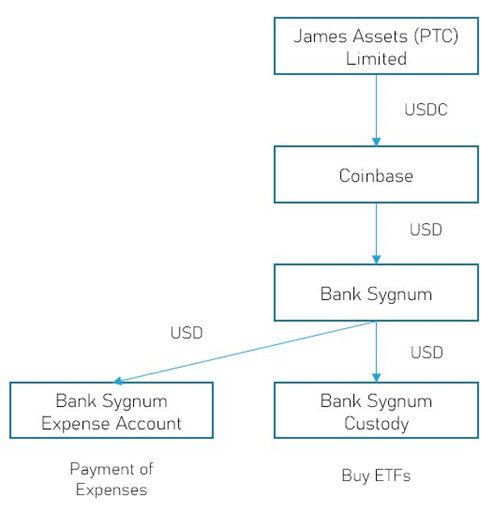

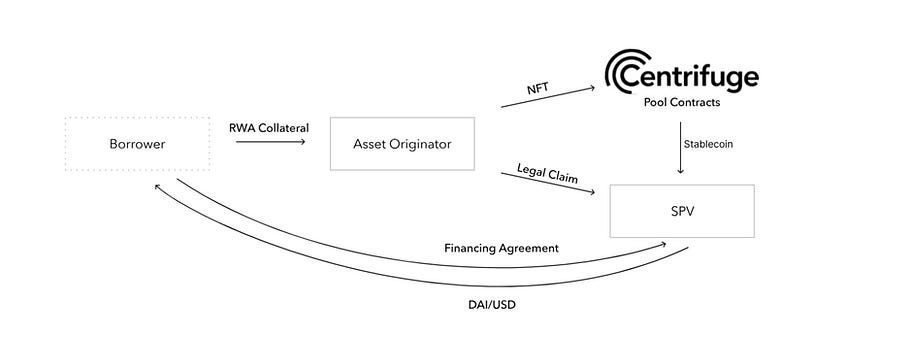

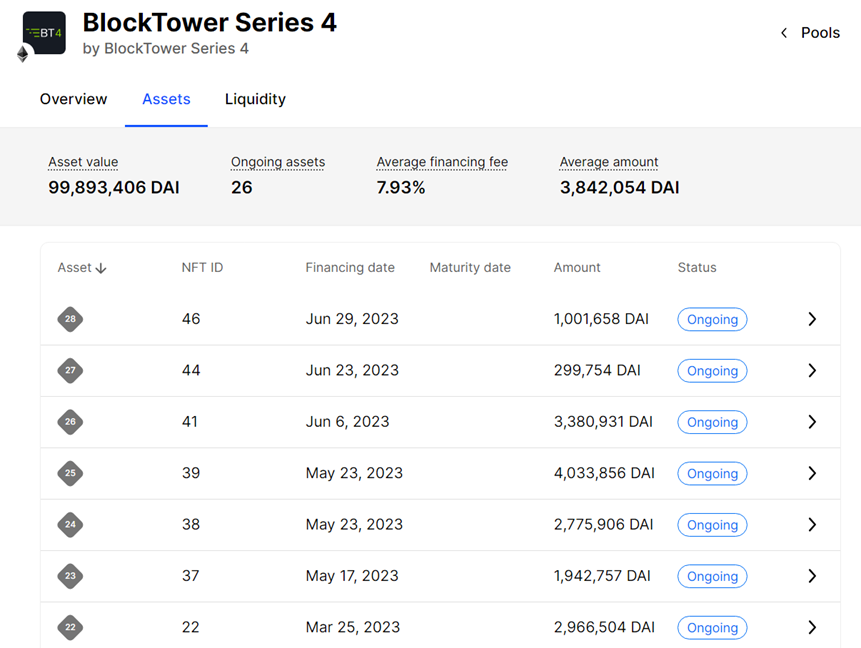

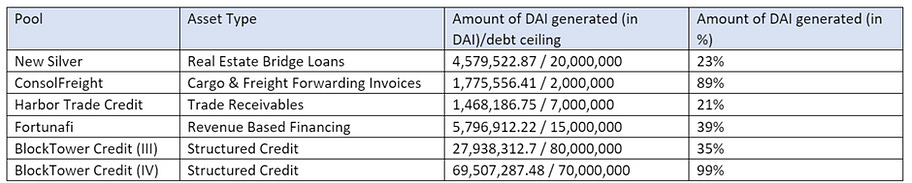

TLDR In the RWA sector, the first explosion is from fixed-income products, driven by the treasury management demands of DAOs and Web3 companies. The top TVL rankings in the RWA sector are dominated by tokenized U.S. Treasury Bill projects. By incorporating RWA, DAOs can retain high liquidity for their assets while generating stable income with low correlation to on-chain activities, thus achieving better quality returns and risk diversification. The governance and operations of DAOs are not necessarily more efficient than traditional corporate structures. MakerDAO incurs high costs to purchase U.S. Treasury Bill ETFs through a complex trust structure, which is not feasible for most other DAOs and Web3 companies. In comparison, it is more efficient and feasible for DAOs to purchase tokenized RWAs on-chain through professional/compliant asset issuers. RWA coming into mainstream crypto Against the backdrop of the crypto winter and rising US interest rates, the new wave of DeFi innovation has not yet arrived. Native DeFi protocols are experiencing a sharp decline in yields, with stable yield rates even lower than U.S. Treasury bonds, the so-called “risk-free rate.” Many DeFi projects are shifting their focus beyond the crypto world to real-world assets (RWA). Among the mainstream DeFi protocols, MakerDAO was one of the earliest to venture into RWA. As early as 2020, MakerDAO collaborated with 6s Capital, a real estate development collateralized loan project, to establish an RWA vault. Subsequently, in partnership with Centrifuge, a lending platform based on RWA, Centrifuge tokenized off-chain assets. MakerDAO purchased these tokens as collateral to generate the stablecoin Dai, diversifying the collateral for Dai. MakerDAO’s Endgame Plan, released in May 2022 by MakerDAO cofounder Rune Christensen, also includes using RWA as collateral to build a decentralized stablecoin system. In recent times, major DeFi protocols have made various moves in the RWA space. In June 2023, Robert Leshner, the founder of Compound, established a new company called Superstate and filed documents with the SEC, aiming to create a short-term U.S. Treasury bond fund on the Ethereum platform. MakerDAO’s new MIP65 (MakerDAO improvement proposal, “MIP”) proposal, which involves deploying a portion of MakerDAO funds to invest in short-term bond Exchange-Traded Funds (ETFs), passed in May 2023. The proposal increased the vault’s debt ceiling from $500 million to $1.25 billion, with plans to purchase the corresponding amount of bond ETFs in the coming months. Furthermore, prominent financial giants, including Goldman Sachs and Citigroup, have expressed their interest in this field and even entered the competition. Why now? In fact, there was a wave of STO (Security Token Offering, which is also one part of RWA) hype in 2018. However, the hype from that year fizzled out. Now, similar topics are being discussed again, but why at this particular time? What are the driving forces behind this development? - From an infrastructure perspective, the DeFi infrastructure has gradually improved, with well-established token standards, oracles, and peripheral development tools that can bridge the gap between on-chain and off-chain. - From an asset and yield perspective, Web3-native assets have reached a bottleneck, with assets becoming relatively homogeneous. In a bear market scenario, on-chain activities have been sluggish, and there is a lack of native stable sources of yield. - From a narrative perspective, after the collapse of CeFi, there is a heightened focus on compliance and risk management. The traditional financial sector has always been highly regulated, and RWA assets provide better investor protection compared to other crypto-native assets. - From a legal and regulatory perspective, regulators are also learning and progressing, leading to the improvement of legal and regulatory frameworks related to cryptocurrencies. In the previous market cycle, similar RWA platforms also made initial developments. These platforms operated by utilizing community governance to provide lending pools for institutions. Users could invest in these pools to earn pre-determined yields, while institutions could utilize the funds for related investment activities and repay the interest and principal as agreed upon. Examples of such platforms include Maple Finance, Clearpool, and TrueFi. However, with the collapses of Luna and FTX, several related institutions went bankrupt. The early RWA platforms lacked compliance processes and risk management. Some borrowers defaulted, leading to the inability to repay the borrowed assets, resulting in significant losses for investors. Developers have learned from these experiences to avoid similar pitfalls in the future. Figure 1: RWA active loans value by protocol, Source: RWA.xyz, data as of 2023.07.06 As seen in the chart above, at the time of the Luna collapse in mid-2022, the active loan volume reached its peak and then sharply declined. One of the most significant events occurred was the TPS Capital lending pool opened on Clearpool. TPS Capital was partnered with Clearpool Finance as a borrower pool in Q2 of 2022. During their partnership, TPS Capital had a complicated corporate structure that obscured its relationship with Three Arrows Capital, leading to claims of independence from the latter. With Luna’s collapse, Three Arrows Capital went bankrupt. However, court filings prepared by Three Arrows’ liquidators showed the two were tightly connected, with Three Arrows acting as a guarantor for TPS for loans on which it later defaulted. In June 2022, Clearpool removed TPS Capital from its lending pool, and Clearpool’s data partner, X-Margin, downgraded TPS Capital’s rating to B, reducing the lending limit to $0. Clearpool and X-Margin announced that they would work together to ensure the repayment of TPS Capital’s borrowed funds, safeguarding users from losses. Those millions of losses are lessons learned for RWA developers, and now they realized to focus more on compliance and legal structure while building RWA. What is a Real-World Asset (“RWA”) RWA refers to various assets that exist outside the blockchain but can be tokenized and integrated with existing DeFi protocols through certain methods. Currently, the main types of RWA projects are focused on the following categories: - Bonds, including private bonds, corporate bonds, and government bonds. - Real estate. - Equities. - High-value collectibles. - Carbon credit scores. We believe that the earliest RWA products to enter DeFi will be bond-based products, including government bonds and corporate bond products. The demand side is primarily driven by the adoption of RWA by DeFi protocols and Web3 protocol treasury management. Currently, according to data from DefiLlama, the top two RWA platforms in terms of Total Value Locked (TVL) are tokenized U.S. Treasury Bill platforms (OpenEden and MatrixDock), followed by real estate related RWA platforms (Tangible and RealT). However, the overall size of the RWA market, with a few hundred million dollars in total value, is still very small compared to both DeFi and the traditional financial industry, indicating significant room for growth. Figure 2: RWA TVL rankings, Source: DefiLlama, data as of 2023.07.10 The driving force behind RWA Generally, existing DeFi protocols have three ways to integrate RWA assets: 1. Treasury management: Some RWA demand for MakerDAO, for example, comes from treasury management. 2. Collateralization: RWA assets can be used as collateral in protocols. Some examples are MakerDAO and UXD protocol (a stablecoin protocol in the Solana ecosystem, bought $5M U.S. Treasury Bill token from OpenEden as collateral for its USD stablecoin) 3. Introducing new asset types for DeFi scenarios: DeFi protocols integrated with those assets, such as Curve (allow MatrixDock’s STBT to trade) and Flux Finance (enable lending for Ondo Finance’s OUSG). Why do DeFi protocols need RWA? There are multiple motivations for introducing RWA, including: - On-chain asset management demand: On-chain asset management seeks stable returns and better liquidity. RWAs such as government bonds are widely recognized as investment targets with good liquidity and low risk. - Alternative yield source: Native on-chain yields primarily come from staking, trading, and lending activities. However, the volatile nature of the crypto market can lead to decreased yields during market downturns, as we are currently experiencing. Mainstream platforms are now offering stablecoin yields that are even lower than U.S. government bonds. Introducing RWA-related assets can provide relatively higher yields that are less correlated with on-chain activities. - Portfolio diversification: Investing solely in crypto-native assets can lead to a highly concentrated and volatile portfolio. By introducing stable RWA assets that are less correlated with native on-chain assets, investors can achieve diversification and build a more robust and effective investment portfolio. - Introducing diversified collateral: The high correlation among crypto-native assets can result in potential runs on lending protocols or large-scale liquidations, exacerbating market volatility. Introducing RWA assets that have a lower correlation with on-chain crypto-native assets can effectively mitigate such issues. Let’s take MakerDAO as an example to analyze how DeFi protocols adopt RWA. MakerDAO’s RWA layouts MakerDAO is a decentralized autonomous organization (DAO) that aims to create and manage the Ethereum-based stablecoin Dai. Users lock Ethereum (ETH) as collateral to generate Dai stablecoins. The current goal of Dai is to maintain a 1:1 peg to the US dollar, stabilizing its value through smart contracts and algorithms, then it will try to build a decentralized stable currency according to MakerDAO’s Endgame Plan. Due to the high volatility of the cryptocurrency market, relying on a single collateral asset can lead to significant liquidations. Therefore, MakerDAO has been actively exploring ways to diversify its collateral, and RWA is an important component, even being mentioned in the Endgame Plan proposed by MakerDAO Cofounder Rune Christensen. Figure 3: Current Dai stats, Source: daistats.com, data as of 2023.07.10 From the figure above, the current total supply of Dai is approximately 4.6 billion. MakerDAO has set a total supply cap of 6.2 billion Dai. Currently, the collateral backing Dai has become more diversified, including a portion of RWA and various other stablecoins. Aftermath of single collaterals On March 12, 2020, the crypto market experienced a market collapse. On one hand, due to limited Ethereum network performance and Ethereum network congestion, the Liquidation Module powered by the Maker system functioned inadequately, leading to a low level of engagement of liquidators; on the other hand, the market price plunge of various crypto assets caused Vault owners to repay Dai debt and close their Vaults, coupled with the increasing market demand for Dai, resulting in Dai liquidity on the verge of depletion. The above two reasons led to a substantial amount of bad debt of up to 5.67 million Dai surfacing in the MakerDAO system, resulting in the first Debt Auction taking place in MakerDAO since its inception. MakerDAO commenced a total of 106 Debt Auctions, which lasted from March 19 to March 28, 2020, raising a total of 5.3 million Dai with 20,980 MKR. MakerDAO’s Endgame After experiencing such events, MakerDAO has continuously attempted to diversify its collateral. However, it is inherent that native crypto assets have a high degree of correlation. The goal of the MakerDAO system is to gradually establish a decentralized stablecoin and to build a monetary system. To achieve this, it needs to use currently accepted assets as collateral and leverage their credibility. Native cryptocurrencies naturally play an important role as collateral. Additionally, to diversify the risks in the current crypto market, MakerDAO has introduced some RWA assets as collateral for the stablecoin Dai. The Endgame Plan is a series of future visions and plans for MakerDAO proposed by Rune Christensen, the co-founder of MakerDAO, in May 2022. It outlines the path for building a decentralized stablecoin. This ultimately requires two types of collateral: decentralized assets that can ensure fairness on a physical level, and RWAs that can provide reliable liquidity and stability. Furthermore, specific impacts need to be created to demonstrate the benefits that DeFi, Maker, and the Dai stablecoin can bring to the world, gradually integrating the world’s economic system with DeFi and adopting Dai as a tool for payment and settlement. Endgame has three phases, and each phase is called stance, with each stance categorized based on the composition of collateral, aiming to ultimately establish Dai as a decentralized stable currency: - Pigeon stance (Current stance): no ceiling for RWA as collaterals, and stablecoin Dai stays pegged to the US dollar. - Eagle stance: Dai will have a negative target interest rate and Dai might become unpegged from the dollar. - Phoenix stance: The collateral for the stablecoin Dai no longer includes any other types of RWA besides physical resilience RWAs. Specific ratios for the collateral in each phase were designed in the detailed plan. For specific details, please refer to the original text, as it is not further elaborated here. Endgame Plan v3 complete overview — Legacy / Governance — The Maker Forum (makerdao.com) Composition of MakerDAO’s RWA Throughout the history of currency, we have seen the progression from early commodity money, where consensus was formed around scarce resources like shells and gold, to the issuance of paper money backed by collateralized scarce resources, and eventually to the issuance of credit-based currencies backed by military force. Although MakerDAO’s Dai has a significant volume in the billions, it is still relatively small in the larger context. It needs to leverage the credit of other assets and demonstrate its strengths to gradually solidify its position. This is why RWA is introduced as an intermediate transitional state in the Endgame roadmap proposed by MakerDAO’s cofounder: in a crypto asset world that is not yet solid enough, real-world assets are needed as an anchor for building a stable currency. According to data from MakerBurn.com, there’s 11 RWA-related projects are used as MakerDAO’s collaterals, with 2.7 billion TVL. Figure 5: MakerDAO RWA, Source: MakerBurn.com, data as of 2023.07.10 Figure 6: MakerDAO asset composition, Source: Dune.com, data as of 2023.07.10 The blue section in the middle on the right-hand side represents the proportion of RWA in MakerDAO’s treasury, which currently stands at 41.5%. Figure 7: MakerDAO revenue, Source: Dune.com, data as of 2023.07.10 And the profit from RWA accounts for 51.1% as shown in the upper-right section. In June 2023, through a proposal, MakerDAO increased the Dai Saving Rate (the risk-free rate for Dai) from 1% to 3.49%, providing attractive returns for Dai holders. The yield source comes from those RWAs. MakerDAO’s RWA mainly consists of four parts: - RWA 001, 6s capital, providing real estate loans. - MIP81, known as RWA014, proposed by Coinbase Institutional, which involves depositing a portion of MakerDAO’s USDC into Coinbase USDC Institutional Rewards, offering a 1.5% APY based on USDC. - Assets tokenized by the decentralized lending platform Centrifuge, with MakerDAO purchasing related tokens, including New Silver (real estate lending) and BlockTower (structured credit), among others. - MIP65, known as Monetalis Clydesdale, proposed by Monetalis, which involves using MakerDAO’s stablecoins to purchase short-term bond ETFs. The proposal was initially passed in October 2022 (with $500 million), and the debt ceiling was increased in May 2023 (to $1.25 billion). Among these, 6s capital and Coinbase are separate partnership cases. This research will focus on discussing Centrifuge and Monetalis Clydesdale to explore how DeFi protocols integrate with RWA. The related issues involve not only smart contracts and business models but also governance frameworks, legal frameworks, asset ownership, and more. How can a DAO invest in U.S. Treasury Bill? MakerDAO’s Monetalis Clydesdale MIP65, known as Monetalis Clydesdale, was proposed by Allan Pedersen, the founder of Monetalis, in January 2022. It was passed by the MakerDAO community and implemented in October 2022, with an initial debt ceiling of $500 million. In May 2023, a subsequent proposal increased the ceiling to $1.25 billion. In the community discussion of MIP13, which was proposed in February 2022, it was noted that approximately 60% of MakerDAO’s balance sheet consisted of various stablecoins (with the Peg Stability Module or PSM mechanism ensuring the stability of Dai’s value, primarily backed by USDC). Over the past 18 months, more than 50% of the assets were stablecoins, but they did not generate profits for MakerDAO. The main counterparty risk was associated with Circle (the issuer of USDC). The community wanted to find ways to invest in stablecoins and generate profits while diversifying risk. One of the ideas proposed was to invest in short-term U.S. Treasury bonds. In the final vote among the participants of the MIP65 proposal, 71.19% supported the proposal, and it was ultimately approved. MIP65 will establish an RWA-related vault, where funds from MakerDAO’s PSM mechanism will be invested in high-liquidity bond strategies through a trust structure. Monetalis is a consulting firm founded by Allan Pedersen and Alessio Marinelli. It provides consulting services and solutions to traditional finance and DeFi institutions. Both founders have extensive experience in traditional finance, consulting, and venture capital. Monetalis’ investors include UDHC, Dragonfly, and Rune Christensen, the co-founder of MakerDAO. In the case of MakerDAO, Monetalis is the proposer and project manager. The overall business architecture of the proposal is as follows: - MakerDAO delegates the design of the overall architecture to Monetalis through voting, and Monetalis is required to provide periodic reports to MakerDAO. - Monetalis designs the overall structure of the trust, where: - Riverfront Capital Ltd (SHRM Trustee (BVI) Limited) serves as the sole director. - Hatstone (Fiduciary Group Limited) acts as the transaction administrator, responsible for monitoring and approving transactions within the trust. - Belvaux Management Ltd serves as the trustee enforcer. It must monitor the activities of the Share Trustee to ensure that it is using the assets subject to the Share Trust in such a way that achieves or furthers its purpose(s) and that the Share Trustee is otherwise properly administering the Share Trust. - Each holder of Dai and each holder of MKR is a beneficiary of the Trust. MKR token holders, by a resolution, will direct JAL to acquire and/or dispose of the ETFs. - James Asset (PTC) Limited, also known as JAL, is a simple shell company to hold trust. The company was created and the original shareholder was SHRM Trustees (BVI) Limited. - Coinbase provides exchange services for USDC and USD. - Sygnum Bank facilitates the trading and custody of trust assets, and a separate account is set up for the operational expenses of the trust. The funds are invested in two types of ETF products: Blackrock’s iShares US$ Treasury Bond 0–1 yr UCITS ETF and Blackrock’s iShares US$ Treasury Bond 1–3 yr UCITS ETF. Among those: - JAL is a shell company that holds the trust and was newly established in the British Virgin Islands (BVI). - SHRM Trustee (BVI) Limited is a company established in the 1990s that provides professional trust services. - Hatstone (Fiduciary Group Limited) has over $1 billion in total assets and offers services such as fund management, corporate services, and investment funds. - Monetalis, acting as the project manager under the delegation of MakerDAO, is responsible for establishing the overall architecture. The situation of Monetalis does not affect the assets of MakerDAO. Monetalis receives an annual management fee of 0.15%, paid quarterly. - Sygnum Bank is the world’s first regulated digital asset bank and a digital asset specialist with a global reach, headquartered in Switzerland and Singapore. Its products include regulated cryptocurrency trading. With Sygnum Bank AG’s Swiss banking license and Sygnum Pte Ltd’s capital markets services (CMS) license in Singapore, Sygnum empowers institutional and private qualified investors, corporates, banks, and other financial institutions to invest in the digital asset economy with complete trust. Figure 8: Structure of the Trust, Source: DigiFT Research, MakerDAO MIP65 The trust operation flow is as below: Figure 9: Operation flow of the trust, Source: DigiFT Research, MakerDAO MIP65 JAL acts as the holder of various bank accounts, and each transaction is initiated online. Approval from both Riverfront Capital (the sole director of JAL) and Hatstone (the transaction administrator of the trust) is required for each transaction. Under this legal framework design, MIP65 of MakerDAO aims to achieve the following goals: - No ability by third parties or Monetalis to access the funds or change the terms of the legal structure. - Maker Governance has the complete ability to trigger a liquidation with a successful executive vote encoding an instruction to the trustee of the structure. - It should not be possible for a single third party to block the ability of Maker Governance to make decisions or modify the structure. - There must be no apparent weak links or edge cases that allow funds to get misappropriated or stuck. - An asset purchase and allocation restriction, ensuring only appropriate bond assets and strategies can be acquired by the structure. - All surplus generated by the legal structure must be manually sent to the Maker surplus buffer every quarter. To achieve the inclusion of DAO-held RWA assets, MakerDAO has designed a complex trust structure and introduced new legal frameworks. As part of this design, $950,000 has been pre-allocated to Sygnum Bank for various expenses related to legal and trust services. In addition, a recent community proposal called Project Andromeda was introduced at the end of May. This proposal suggests BlockTower as the project manager responsible for purchasing short-term U.S. government bonds on behalf of MakerDAO. The proposed debt ceiling for this project is $1.28 billion in Dai, further expanding MakerDAO’s involvement in RWA assets. BlockTower has a history of collaboration with Centrifuge and MakerDAO, and the team also have extensive experience in traditional finance. Considering the successful implementation of Monetalis’ processes, if MakerDAO is expected to significantly increase its engagement with RWA assets, this proposal has a high likelihood of being approved. Tokenizing RWA into DeFi protocol — MakerDAO <> Centrifuge Stableswap Centrifuge is a decentralized lending platform that provides a set of smart contracts to create a transparent market for the decentralized financing of RWA assets, eliminating unnecessary intermediaries. The goal of the protocol is to reduce borrowing costs for businesses while providing stable RWA collateralized income for DeFi users. Currently, MakerDAO is the predominant purchaser of debt on the Centrifuge platform. However, Centrifuge is also working towards diversifying its buyer base. For example, Centrifuge is exploring the issuance of AAVE’s stablecoin GHO using RWA assets as collateral within the AAVE community. Figure 10: Centrifuge financing flow chart, Source: Centrifuge Docs In fact, the process of issuing assets on Centrifuge is just like the process of issuing Asset-Backed Securities (ABS). The flow of funds operates as follows: - The asset originator (such as BlockTower) creates a Special Purpose Vehicle (SPV) as the issuer, which serves as a separate legal entity for each fund pool, ensuring the independence of each pool. The Centrifuge contracts create corresponding fund pools on the Ethereum blockchain, which are associated with the respective SPVs. - A borrower decides to finance their RWA, such as invoices or properties, by using them as collateral. The asset originator issues RWA tokens corresponding to the collateral and validates them. An NFT is minted as the on-chain representation of the collateral, with legal contracts associated with the assets. - The borrower and SPV agree on the financing terms. The asset originator locks the NFT within the Centrifuge fund pool associated with the SPV and withdraws stablecoin Dai from the pool’s reserves. This Dai can be transferred directly to the borrower’s wallet or converted to USD and deposited into the borrower’s bank account. - On the maturity date, the borrower repays the financing amount and fees. They can choose to repay directly in Dai on-chain or initiate a bank transfer, which is then converted to Dai by the SPV and paid to the Centrifuge fund pool. Once all NFTs are fully repaid, they are unlocked and returned to the asset originator, where they can be burned. The SPV is created by the asset originator, and the borrower typically has a business relationship with the asset originator. Figure 11: Part of the NFTs in Centrifuge BlockTower series 4 asset pool, Source: Centrifuge The image shows the Centrifuge App page, specifically a screenshot of BlockTower Series 4. The list below displays NFTs that serve as on-chain collateral, with each NFT representing a RWA that has been verified by the asset originator. In this case, the assets are structured credits. Centrifuge provides tools and a marketplace for projects/users who want to purchase RWAs directly, allowing assets to be integrated into the DeFi world while offering higher returns compared to typical stablecoin yields. However, there are risks involved, which come from Centrifuge itself and from borrowers acting as counterparties. Figure 12: The amount purchased by MakerDAO on Centrifuge, Source: Daistats, data as of 2023.07.10 Currently, the loan data adopted by MakerDAO from Centrifuge is shown above. Compared to the Treasury Bill ETF project (Monetalis Clydesdale), the RWAs tokenized through Centrifuge have relatively smaller volumes, with the largest-scale BlockTower reaching just over a hundred million dollars. The advantage of this approach, compared to MakerDAO directly purchasing government bonds, is that it has a simpler process and does not require MakerDAO to build complex legal structures. In the recent community discussion, Centrifuge charges a fee of 0.4% to assist these projects in obtaining loans. MakerDAO does not incur any additional expenses in this regard. However, there is significant counterparty risk, and there is a possibility that these projects may default. Conclusion MakerDAO, as one of the largest DeFi projects, has explored two approaches in the integration of TradFi and DeFi in its community operations related to RWAs: direct purchase and holding of assets through DAO + trust (MIP65) and purchasing tokenized RWAs through Centrifuge. If we consider DeFi protocols’ acceptance of RWAs, MakerDAO has the financial strength to establish an innovative legal framework directly, ensuring the safety of MakerDAO community assets and providing benefits to Dai and MKR holders. It pre-pays $950,000 in expenses and Monetalis charges an annual project management fee of 0.15% of the total amount. The other three companies involved in the trust will also incur respective expenses. Reports indicate that MakerDAO paid $2.1 million in expenses to Monetalis for the first phase of a $500 million government bond project in January 2023. If we liken MakerDAO to a company and MKR tokens to company equity, it is intuitive to establish ownership rights and manage the treasury under traditional legal frameworks. However, the MKR token holders behind the scenes cannot be fully integrated into the existing corporate governance structures of the real world due to the nature of the DAO’s anonymity, lack of KYC, and different national and regional jurisdictions (subject to different laws and regulations). As a result, DAOs are fundamentally incompatible with the existing legal frameworks to ensure the safety of token holders’ assets (especially RWAs), necessitating the design of the complex legal structuring set out above. The stability of this legal approach remains to be seen. Most DeFi protocols and projects, do not have the resources, capabilities, and capacity to build a complete system. The second approach of directly purchasing tokenized assets is more feasible, especially if there are compliant asset issuers (traditional financial asset issuers typically require relevant licenses or permits). It only requires a simple community vote, followed by the purchase and transparent on-chain storage of the assets through multi-signature mechanisms. The risk primarily lies in the counterparty risk of the issuer. The market opportunity for RWA token issuance, as mentioned earlier, has seen a greater demand for bond-like RWAs in the medium term. Projects such as OpenEden, MatrixDock, Maple Finance, and Ondo Finance are exploring the tokenization of government bonds, as mentioned in the previous research report “Exploring RWA Use Cases: 5 Attempts at On-Chain U.S. Treasuries.” According to DefiLlama data, the two projects with the highest RWA TVL also belong to government bond projects. As DeFi development faces bottlenecks, the DeFi community has begun to further consider asset security. Previously, the focus was solely on smart contract vulnerabilities, but now there is increased attention to compliant assets. Traditional finance is inherently highly compliant, mitigating system risks caused by minor vulnerabilities through asset segregation, governance process and isolation, operation process standardization, and regulatory restrictions. In the future, we can expect to see more protocols and projects incorporating RWAs into their balance sheets to achieve diversified asset allocation. In this context, compliant asset issuers will be indispensable, and better governance structures combining on-chain and off-chain elements will be gradually discovered and explored. We look forward to the transition from the virtual to the real world in the crypto space. Reference: Overview — Maker Endgame Documentation (makerdao.com) Endgame Plan v3 complete overview — Legacy / Governance — The Maker Forum (makerdao.com) Introduction to MakerDAO Collateral Onboarding — Collateral Onboarding RWA (Real-World Asset) in MakerDAO — Innovation and Strategy in Fintech — MakerDAO (daogov.info) Real-World Asset Report — 2023–05 — Maker Core — The Maker Forum (makerdao.com) RWA Case Study — US T-bill Tokenization | DigiFT MakerDAO — MIP65 — Monetalis Clydesdale (dune.com) MakerDAO — Dashboard (dune.com) About DigiFT DigiFT aims to provide regulated decentralized finance solutions on the Ethereum public blockchain. We are operating the first regulation-abiding decentralized digital asset exchange where asset owners can issue blockchain-based security tokens efficiently and cost-effectively. Investors can trade with continuous liquidity via an AMM mechanism and retain control over digital asset tokens in their own wallets. We are a global outfit backed by well-established venture partners. The founding team originates from international financial institutions and has deep blockchain technology knowledge. Follow us Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Asia's weekly TOP10 crypto news (July 17 to July 23)

Sunday, July 23, 2023

Author:Crescent Editor:Colin Wu 1. Hubei Police Cracks the First National “Virtual Currency Case” in China link On July 18th, according to a publication by Ping An Hubei, the Shaoyang County

Weekly Project Updates: EthCC Held in Paris、zkSync Airdrops NFTs, Linea Mainnet Goes Live, etc

Saturday, July 22, 2023

1. Etherum's Weekly Summary a. Annual Ethereum Community Conference (EthCC) Held in Paris link The annual Ethereum community conference (EthCC) was held in Paris from July 17th to 20th, featuring

WuBlockchain Weekly: U.S. Senate Proposes Stringent Regulation for DeFi, Binance Cuts Benefits and Top10 News

Friday, July 21, 2023

1. US Senate Plans to Enact Strict Regulation on DeFi Through Legislation link On July 19th, according to Coindesk, the US Senate is preparing to pass a new bill that aims to regulate the

Hong Kong's Largest Online Bank Discusses How to Welcome New Cryptocurrency Policies

Thursday, July 20, 2023

Write By Techub News Translate By ChatGPT4 https://mp.weixin.qq.com/s/PsVchR5at6X9nkkZSwrfgg As a virtual bank in Hong Kong, ZA Bank is more receptive to new technologies and industries than its Hong

Opportunities in AI and Blockchain: Investors' Perspectives on Prospects and Opportunities

Tuesday, July 18, 2023

By ABCDE LAOBAI A combination of AI with Web3 was not recommended because AI is relatively centralized whereas Web3 is focused on decentralization. While the NFT secondary market is declining, the

You Might Also Like

What is DeFAI? The AI-enabled DeFi narrative looking to take 2025 by storm

Wednesday, January 15, 2025

AI-driven DeFi projects aim to simplify finance with real-time insights, trading, and personalized strategies, but face hurdles in transparency and security. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈Solana’s daily DEX trading volume beat Ethereum’s by 84%; Sony launched its L2 blockchain, …

Wednesday, January 15, 2025

Solana's daily DEX trading volume beat Ethereum's by 84%. Sony launched its L2 blockchain, Soneium. Compound integrated Ethena's stablecoin and Mantle's liquid staking token. ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈Solana’s daily DEX trading volume beat Ethereum’s by 84%; Sony launched its L2 blockchain, …

Wednesday, January 15, 2025

Solana's daily DEX trading volume beat Ethereum's by 84%. Sony launched its L2 blockchain, Soneium. Compound integrated Ethena's stablecoin and Mantle's liquid staking token. ͏ ͏ ͏ ͏ ͏

OKX Founder's Full Speech: "Always Hold Bitcoin"

Wednesday, January 15, 2025

January 14, 2025, OKX CEO Star delivered a speech via video link. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

JPMorgan believes Solana, XRP ETPs could attract $15 billion in net inflows

Tuesday, January 14, 2025

Both assets register $2.5 billion in assets under management currently, with a little over $500 million in inflows registered last year. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Coin Metrics’ 2025 Crypto Outlook

Tuesday, January 14, 2025

Key Trends & Outlooks Shaping Digital Assets in the Year Ahead ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin’s sharp rise and fall starts week with $418 million in liquidations

Monday, January 13, 2025

Crypto positions unwind with $245M in longs liquidated across major exchanges. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

₿ US-based entities hold 65% more BTC reserves than non-US entities; Crypto.com launched stocks and ETFs trading i…

Monday, January 13, 2025

US-based entities hold 65% more BTC than non-US entities; Crypto.com launched stocks and ETFs trading in the US; South Korea is reportedly planning to gradually allow institutional crypto trading ͏ ͏ ͏

Crypto Crash Imminent As US DOJ Sells Over 69K BTC

Monday, January 13, 2025

Monday Jan 13, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Crypto Crash Imminent As US DOJ Sells Over 69K BTC Senator Lummis To Head New Crypto Subcommittee Dogecoin Fails To Break

2024 Cex Annual Report: Binance's lead narrowed, while Bybit spot and Bitget contracts grew significantly

Monday, January 13, 2025

In December, major exchanges recorded a 14% increase in spot trading volume, with Bitget leading at 102% growth, and a 6% rise in derivatives trading volume, where Gate saw the largest increase at 111%