That Whole Applications vs. Infrastructure Bullshit

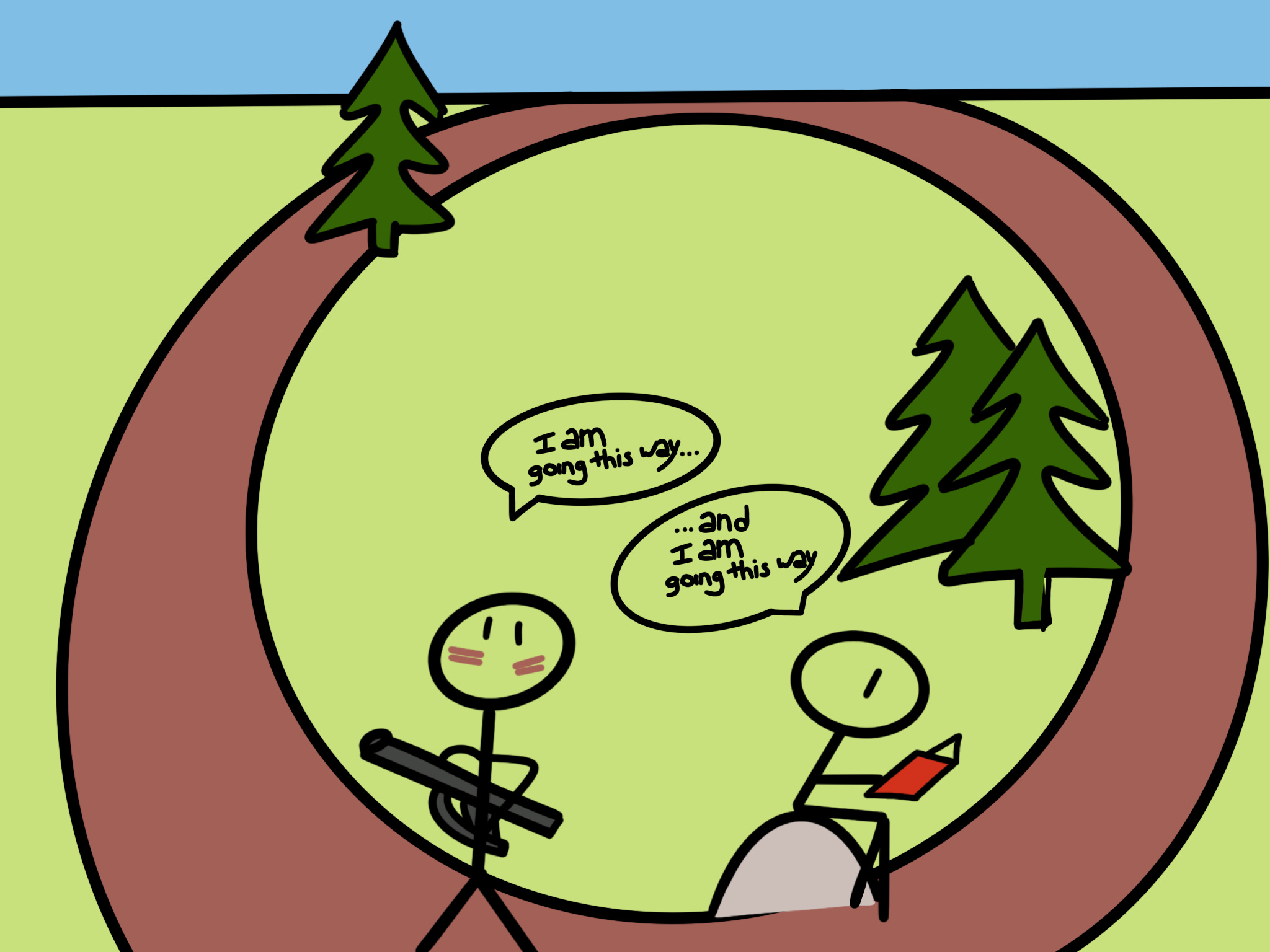

Hey there! If you want to join 1,493+ other readers learning about internet-native communities, make sure to subscribe to this newsletter. This week, everyone on Twitter seemed to argue about the importance of building applications instead of infrastructure. But I believe arguing in favor of one side or another is actually missing the point. The Story I Can’t Quite RememberThere’s this story I’ve heard over and over again as a kid. I can’t quite remember which book it was, but the story is still vividly in my head. The story starts with two friends, Mike and Alex, who decided to start hunting. Mike, the first of the two, before venturing into the wild, wants to make sure he has the best hunting gear possible. So he starts investing considerable time researching the finest hunting rifles he can buy, meticulously evaluating their performance and precision. He spends hours organizing his hunting gear and backpack, meticulously planning for the possibility of the catch of the year. After months preparing for this day, making sure everything is perfect, Mike is finally ready for the hunting escapade of a lifetime. However, as the hours pass by, his day doesn’t go as planned. He encounters no game - not even a trace of wildlife. And despite spending hours dealing with hypothetical theory, Mike has to face the sad reality - hunting is nothing compared to what he’d been preparing for… In contrast, Alex, the second friend, had taken a slightly different approach. In the story, instead of focusing on acquiring the finest hunting equipment, Alex grabbed a modest hunting rifle borrowed from his uncle and set off to the hunting grounds with a simple goal in mind: to learn and adapt. Obviously, with no experience, things didn’t go quite as he had planned and after a week, he still hadn’t seen anything. But after a month experimenting with various hunting techniques, observing how different animals reacted to different baits and calls, he started to gain insights. And as weeks turned into months, Alex's tactic paid off, allowing him to find the perfect combination of skills and techniques that worked perfectly with the wildlife in the region. To be honest, I always found this story fascinating. Partly because I was a kid, and partly because each time I tell this story, people believe the moral is something along the lines of “you should always get into action as quickly as possible and learn from direct experience vs. theory”. Which, I guess, is partly true. No need to optimize excessively if you haven’t proven the demand (btw, this is good life advice for many areas of your life). But the real lesson of the story for me is: Why on earth would two friends compete against each other vs. collaborate? Why don’t they simply work together? Share their best advice? We often like to see the world in black-or-white, all-or-nothing way. And the so very smart people arguing whether we should focus on infrastructure or applications make no exception to the rule. On one hand, we have the “pro-app” people arguing that we have too many developers over-optimizing infrastructures without knowing if (or how) the infrastructure is going to be used. On the other hand, we have the “pro-infrastructure” people arguing that none of the infrastructure is ready to safely onboard a large number of normie users, so working on mass retail crypto apps is an incredible waste of resources. And to this, I have something to add. Infrastructure And Apps Don’t CompeteThey’re complementary. Major innovation in crypto usually follows a specific cycle: Infrastructure > Application > Infrastructure For example, the invention of the ERC721, the non-fungible token standard (infrastructure), powered the 2021 NFT craze (app). The NFT craze made us realize that paying hundreds of dollars in gas fees to buy a monkey jpeg was not something sane people outside of crypto would do, so we started working on cheaper options. This is actually so interesting to witness the playbook unfolding in real-time. Zora, one of the major NFT marketplaces (think Instagram, but instead of likes you get real money), first achieved product-market fit on Ethereum. It quickly reached its limits and had to get creative with how it used Ethereum’s capabilities to continue to grow and provide high-quality services to its users. So a few weeks ago, they launched their own solution that executes hundreds of transactions outside of Ethereum, rolls them up into a single piece of compressed data, and then posts the data back to Ethereum for anyone to review and dispute if deemed suspicious - increasing speed and lowering costs for users wanting to transact on their platform. Again, both the infrastructure and the application were needed: The application provided the context the infrastructure needed to matter. See, assuming you have only two options in life - either go hunting directly without any knowledge or optimizing everything without ever getting real life experience - is a very one-sided narrative. In the real world, things rarely happen this way and are often a mix of options. My girlfriend and I, for example, have two very different brains. I’m more of let’s-go-try-it-out-now, and she is more the kind of person to optimize everything. There’s obviously no good or bad way here, simply two different approaches, and combining strengths is the best way to succeed. Closing ThoughtsThere is surely plenty left to do on the infrastructure side, just as there is, indeed, a real need for more consumer applications. The real question, in this case, isn’t if people should stop working on infra and start building apps, but rather: How can both sides help each other? Traditional consumer brands have shown that it's possible to build for millions of people through experiments like Reddit Collectibles and Nike .SWOOSH - and we’ll surely learn a lot from those to build better infrastructure. On the other hand, for the first time in crypto's history, crypto protocol development is at a level of maturity that allows us to do more than what we need to onboard the million users - which will inevitably fuel the growth of more consumer apps. We've got the potential, the know-how, and the drive – now it's time to roll up our sleeves and make it happen - whatever it is we want to build. Speak soon, - Eliot PS: What did you think of this article? If you enjoyed today's edition, let me know here - It'll help me understand what you want me to write about (and it only takes you 10sec). PPS: Substack just launched their Referral program. If you want to help me spread the world, I want to reward you:

|

Older messages

4 simple ways to win every crypto argument

Sunday, July 23, 2023

What? Crypto Twitter is an echo chamber?

The Paradox Of Crypto Success

Sunday, July 16, 2023

You're supposed to pour in endless effort, but it's also supposed to seem effortless.

For The Love Of God, Can We Write Better Web3 Stories?

Sunday, July 9, 2023

Crypto doesn't have to be that complicated, really.

How To Start Writing Online?

Sunday, July 2, 2023

Explaining the tactical side of the writing game.

Creativity Is An Underrated Performance Booster

Sunday, June 25, 2023

Simply put, creativity ultimately leads to innovation, innovation creates value, and value makes you stand out

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏