Earnings+More - The end of the road for Fox Bet

The end of the road for Fox BetFox Bet split, iCasino market share examined, the week ahead, Lottomatica call recall, analyst takes, startup focus – STX +MoreGood morning. On today’s agenda:

I should have forgotten you long ago. Fox Bet closureFox Corp. and Flutter have announced the winding down of Fox Bet. Let’s call the whole thing off: Fox Bet will be shuttered over the course of the next month, with Fox retaining the brand name and the rights to the Super 6 promotion. Flutter will inherit Fox Bet’s database and market access agreements, according to a Bloomberg story on Friday.

You can go your own way: The move marks the formal operational break between the two companies following the arbitration tribunal decision last November. That decided the price for Fox’s option to acquire 18.6% of FanDuel should be based on a valuation of $20bn.

Analyst takes: The team at JMP indicated the termination will be “welcome given the financial impact” to Flutter. They noted that in 2022 Fox Bet and PokerStars generated 3% of its revenue in the US but drove 30% of the EBITDA loss for the US unit.

What we’re reading: “Probably more than any other business in the FTSE, we understand the concept of liquidity.” Flutter’s CEO interviewed by Bloomberg. ** SPONSOR’S MESSAGE ** What would you do with $100k in cash? Are you game…? Strip head fakeJune’s 1% YoY Strip decline to $727m was due entirely to a switch in baccarat luck factor. Knights are golden: Excluding a very tough hold comparable on baccarat, the Strip enjoyed a 5.7% YoY increase helped by a 3.9% increase in slot win. The team at CBRE noted that for slots and mass market table win it was the highest June on record.

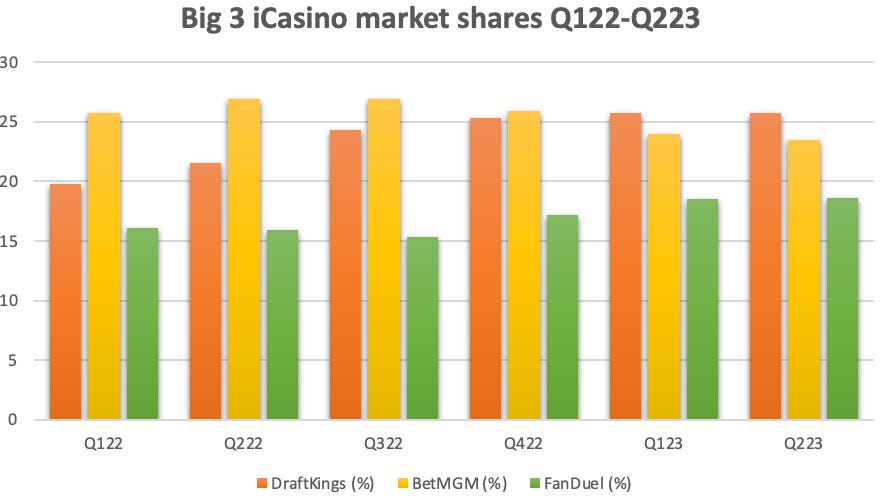

US iCasino examinedThe familiar duopoly dominates US online, but this time in iCasino. The old one-two: FanDuel and DraftKings are on their way to joint dominance of the iCasino market in the same way that they tower over the OSB landscape, according to analysts. Comparing YTD market shares, the team at EKG suggested the combined FanDuel and DraftKings market share stands at 46% vs. 33% for the same period in 2021.

Golden shot in the arm: As EKG noted, DraftKings’ rise – from under 20% in Q122 – can in part be ascribed to the augmenting of its share via the Golden Nugget acquisition, which completed in May last year. But EKG added that the launch in Connecticut back in Oct21 had also played a part.

For every winner: Claims abound over who is the iCasino market leader and as EKG pointed out BetMGM is defending share well. DB said it has fallen back to 23.5% in Q223 from 26.9% in Q222 and Q322.

🍰 What a carve up! The week aheadCaesars heads a blockbuster earnings schedule. Laurels drive: As part of its iCasino analysis, EKG noted that Caesars – which reports on Tuesday – could see some market share gains from the launch of its new standalone online casino app, which went live in mid-July in Michigan, Pennsylvania, West Virginia, Ontario and soon in New Jersey.

Mark my words: MGM follows on Wednesday and, as per last week’s analysis of BetMGM’s update, questions are certain to be asked about whether the company has any plans to resolve the issue of the JV.

Quantum leap: Expectations later in the week are that DraftKings will also proclaim profitability in Q2. The current FY guidance is for FY losses of $290m-$340m and the company is likely to provide a further upgrade given recent market share gains.

Calendar

Lottomatica call recallBolt-ons and more transformative M&A deals are on the agenda. Bolts-ons from the blue: CEO Guglielmo Angelozzi said the Italian betting and gaming market leader was working on a “mix” of potential M&A bolt-on deals. “This continues to be a very fragmented market,” he added. “Bolt-ons are easier.”

Upping the ante: The company’s increased guidance for the year was largely due to the success Lottomatica was having with its online arm. It noted that in both sports betting and iCasino it was increasing its online share, up to 19% and 20.5% respectively. REIT reviewVICI talks wellness while GLP points to gaming REIT differentiators. Holistic: The evolution of VICI away from a 100% focus on gaming and into other business areas was highlighted by management conducting the Q2 earnings call from the Canyon Ranch Lenox, “in the beautiful Berkshires in Massachusetts”, as CEO Ed Pitoniak put it, one of new partner Canyon Ranch’s portfolio of wellness resorts.

Weathercock: Gaming REITs appear to be weathering the current rate environment better than other areas of commercial real estate. Matthew Demchyk, CIO at Gaming & Leisure Properties pointed to GLP’s “differentiators”. “We're different by design compared to banks, private equity or other public REITs,” he added.

** SPONSOR’S MESSAGE ** Venture capital firm Yolo Investments manages in excess of €600m in capital across 80 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem. Startup focus – STXE+M revisits an exchange business first featured in July last year as it reaches a milestone launch. Take a trip: “I knew it would be hard, but the journey blew my expectations out of the water,” says STX founder Justin Deutsch of the three-year journey from inception to launch in Ontario.

At your service: Eschewing bonuses and promos, Deutsch says he hopes STX will reach a new demographic among the North American gaming audience but says liquidity is crucial. “We plan to achieve that by offering the best white-glove customer experience alongside strong educational materials.”

** SPONSOR’S MESSAGE ** Tried, tested and proven over a decade in the highly-regulated US market, and continuing to expand across Europe, Latin America, Asia and Africa. GeoComply harnesses the power of its market-leading geolocation technology to protect against fraud, including fake account creations, bonus abuse, account takeovers, stolen identities, money laundering, and more. Visit geocomply.com. Career pathsMGM Resorts has appointed Daniel Yang as chief customer and innovation officer. Yang previously worked for Aristocrat Leisure as chief strategy officer. Flutter CFO Paul Edgecliffe will resign from his role as non-executive director of Schroders to focus on his position at Flutter. Meanwhile, the company has appointed Kevin Harrington as PokerStars CEO. He is currently chief commercial officer of FLTR. Novomatic Africa has adjusted its management structure following the departure of Sonya Nikolova to take on a new strategic role in global sales at the company’s headquarters in Austria. Muriel Loftie-Eaton will now serve as MD. NewslinesA ~20% fall in the Evolution share price since mid-June has caused the board to decide not to proceed with its 2023-26 incentive program, saying it is “no longer in line with its intended conditions”. An +More Media publication. For sponsorship inquiries email scott@andmore.media. |

Older messages

PointsBet: We can do more with less

Friday, July 28, 2023

PointsBet's new focus, Boyd's mixed bag, Churchill Downs' Derby boost, analyst takes on BetMGM +More

BetMGM hits profitability in Q2

Wednesday, July 26, 2023

BetMGM's milestone achievement, Kambi's parting shot, Raketech earnings in brief +More

Has BetMGM stalled?

Tuesday, July 25, 2023

888's appointment, Kindred's return, BetMGM market share examined, Women's World Cup offerings weighed up +More

BetMGM’s bet booster

Monday, July 24, 2023

BetMGM leads the week ahead, predicted H2 GGR struggle, analyst takes on Barstool and Gambling.com, startup focus – Scrimmage +More

Evolution’s ‘crooked path’ on RNG

Friday, July 21, 2023

Evolution's pathway, PlayUp shuts up NJ shop, 888's share price spotlighted, sector watch – financial trading +More

You Might Also Like

Canadian Ecom Seller? A New Course Just for You

Tuesday, March 18, 2025

How independent agencies are staying ahead of the curve

Tuesday, March 18, 2025

Elevating growth amid surging demand for digital media

It's time to bet on emerging platforms

Tuesday, March 18, 2025

Tips to keep your brand adaptable and embrace change ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Elon vs. Sora

Tuesday, March 18, 2025

Google's Veo 2 is in the race too!

The secret to CTAs that convert

Tuesday, March 18, 2025

Your call-to-action (CTA) is the final push that turns visitors into customers. But if it's weak, unclear, or generic, you're leaving money on the table. The best CTAs don't just say “Buy

ET: March 18th 2025

Tuesday, March 18, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 A Pup Above (trends) Chart A Pup Above is a

Newsletters are Dying... But Yours Doesn’t Have To.

Tuesday, March 18, 2025

The 5-Minute Hack to Save Your Dying Newsletter.

31% of All VC Money Last Year Went Into Just 20 Deals

Tuesday, March 18, 2025

Lots of venture capital is going to the same names To view this email as a web page, click here saastr daily newsletter Redpoint: 31% of All VC Money Last Year Went Into Just 20 Deals By Jason Lemkin

Bay Area's AI funding bonanza—or waste?

Tuesday, March 18, 2025

HR tech lawsuit alleges spy scheme; healthtech VC inches toward recovery; Alphabet back in talks for cyberscurity specialist Wiz Read online | Don't want to receive these emails? Manage your

The Art of Being a Great Teammate: How Great Teams Are Built, One Person at a Time

Tuesday, March 18, 2025

Great teammates commit to a standard of excellence, lift each other up, and work toward something bigger than themselves—focusing on we, not me.