Tomasz Tunguz - What the New Relic Sale Means for SaaS

Tomasz TunguzVenture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. What the New Relic Sale Means for SaaS

Earlier today, New Relic announced its sale to Francisco Partners & TPG for $6.5b. The acquisition is notable for two reasons. First, it accelerates the momentum within the technology buyout space.

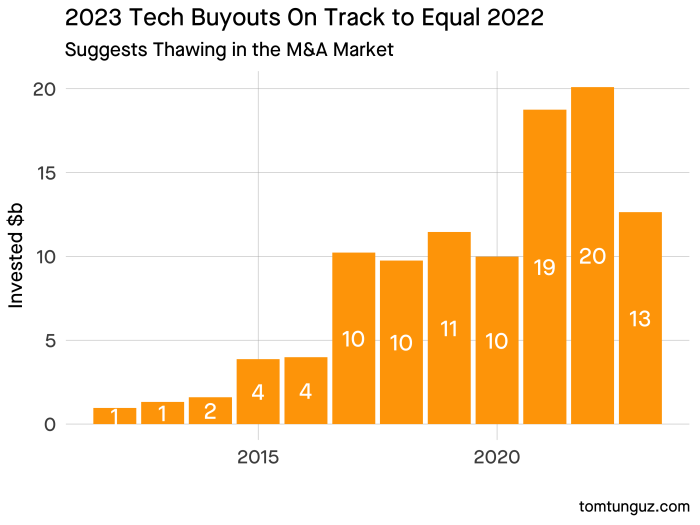

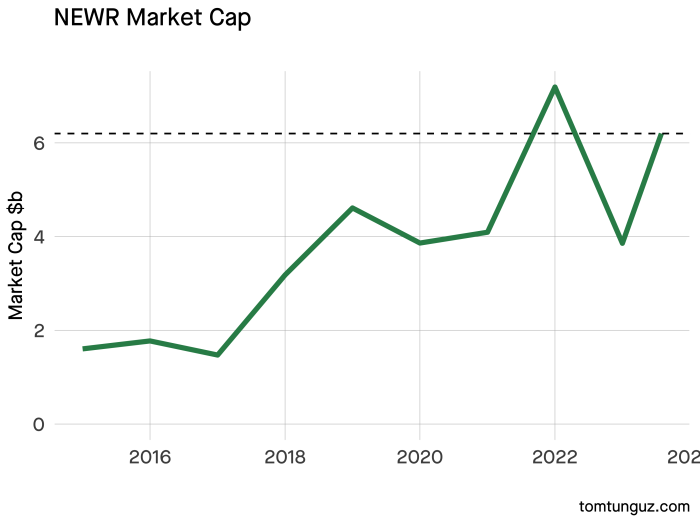

At its current pace, technology buyout volumes of venture-backed technology companies will tie or exceed the ten year high, charted in 2022 of about $20b. PE buyouts provide 2023’s slower M&A market liquidity & activity, perhaps will begin to spur strategic/corporate acquirers into action. Second, New Relic’s sale price is close to the recent highs measured on January 1st of each year

New Relic benefitted from multiple expansion that pushed its valuation higher - admittedly less than the top quartile. Within 18 months, the company attained a sale price within 5% of the high.

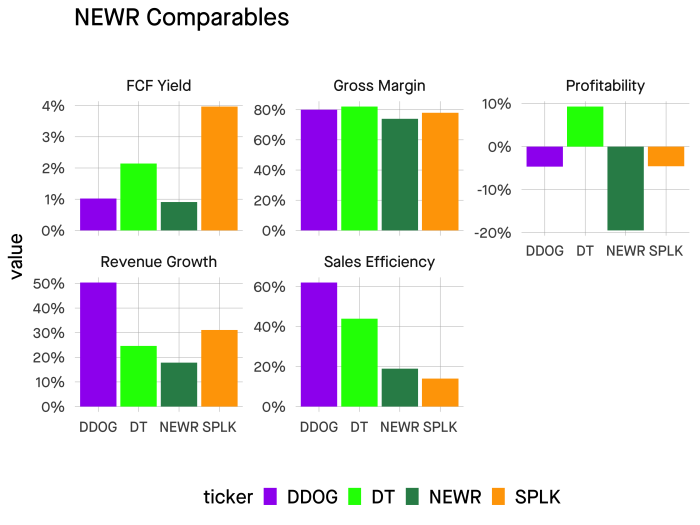

New Relic’s financials relative to its peers are important to bear in mind. The company generated similar free-cash flow yield (free cash flow / price per share). This cash pays the interest costs of the transaction debt. In buyouts, the acquirers invest some cash, but borrow 50-75% of the transaction value. The company’s excess cash flows pay those interest payments. In addition, the company operates with lower profitability & worse sales efficiency than its peers. This acquisition is a bet that the company can be run more efficiently. If we are in the nadir of multiple expansion & acquirors expect improved future results, the M&A market should re-invigorate. |

Older messages

The Paradox of AI and Data Roles: How Automation Will Increase Demand for Data Professionals

Friday, July 28, 2023

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. The Paradox of AI and Data Roles: How Automation Will Increase

The Pilgrims Raised 4 Rounds of Financing

Monday, July 24, 2023

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. The Pilgrims Raised 4 Rounds of Financing The Pilgrims who

Operating in the Dark

Thursday, July 20, 2023

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. Operating in the Dark For many startups today feel like they

Producing Charts with AI

Tuesday, July 18, 2023

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. Producing Charts with AI Last Monday, I published a chart that

The Fracking of Information

Sunday, July 16, 2023

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. The Fracking of Information Large language models enable

You Might Also Like

Game of Loans

Thursday, February 27, 2025

+ stacks of cash; how to build with AI View in browser Vanta_flagship Good morning there, Embattled fintech Lanistar doesn't always pay its debts, according to documents seen by Sifted. The London-

Develop adjacent skills to become a better operator

Thursday, February 27, 2025

The best marketers might call themselves marketers... But they are secretly strong in other disciplines. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Justin Moore — Becoming a Sponsor Magnet — The Bootstrapped Founder 376

Thursday, February 27, 2025

Justin Moore (@justinmooretfam) knows a thing or two about sponsors. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI agents in retail

Thursday, February 27, 2025

how generative AI is transforming the customer experience Hi there, AI agents are about to change how customers buy – recommending products, deciding where to search, and even making purchases for them

“I just found another $10K/month AI app”

Thursday, February 27, 2025

Read time: 56 sec It's an AI gold rush. Every single day, I'm seeing more insane success stories. This weekend alone, my team sent me 15 DMs. Every single one said the same thing: “Pat, I just

12 Hours Left – 85% Off + A Free Course

Thursday, February 27, 2025

Friend , Just 12 hours left to save 85% and get a free course—don't miss out! Hey Friend , This is it—just 12 hours left to grab our best ecommerce courses for 85% off, plus a bonus course for free

BrowserAgent, Amber, Shmelo, Overbooked, Apse, and more

Thursday, February 27, 2025

Smart document sharing with real-time analytics. BetaList BetaList Weekly BrowserAgent Exclusive Perk Build and run AI agents inside your browser, private and 0 cost Kantoku Learning kanji with TikTok-

The AI Elbow's Impact : What Reasoning Means for Business

Thursday, February 27, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. The AI Elbow's Impact : What Reasoning Means for Business

73 new Shopify apps for you 🌟

Thursday, February 27, 2025

New Shopify apps hand-picked for you 🙌 Week 7 Feb 10, 2025 - Feb 17, 2025 New Shopify apps hand-picked for you 🙌 What's New at Shopify? 🌱 Improved privacy features simplify your path to compliance

Europe’s most active angels

Thursday, February 27, 2025

+ A16z's Anjney Midha's on Mistral and Black Forest Labs; energy software startups View in browser Flagship_Navan Good morning there, What do a podcast host, a World Cup winner and a molecular