|

|

This cold email approach brings in one client for every 50 emails sent: - **Start with an icebreaker,** tell folks what you do, and differentiate yourself from competitors. Include your pricing and the ask. Link your socials. - **Acquiring a media as

This cold email approach brings in one client for every 50 emails sent:

-

Start with an icebreaker, tell folks what you do, and differentiate yourself from competitors. Include your pricing and the ask. Link your socials.

-

Acquiring a media asset, like a newsletter or Instagram page, can be a shortcut towards building your audience. Run a test post before committing.

-

Tim Schumacher purchases SaaS businesses, currently grossing $50M ARR. If you're looking to get acquired, just run a good business, he says.

I paid almost $1K to place Unicorn Platform in this newsletter. So, here is the deal: 1. Use our tool to build a landing page for your project (it's free). 2. Send it to us at @unicornplatform. 3. We will promote your website! (8K eyes). — Alexander Isora, founder of Unicorn Platform. #ad

Want to grow your business? Try running a promo in the Indie Hackers newsletter to get in front of 80,000+ founders.

Breaking Down a Cold Email 📧

by Sveta Bay

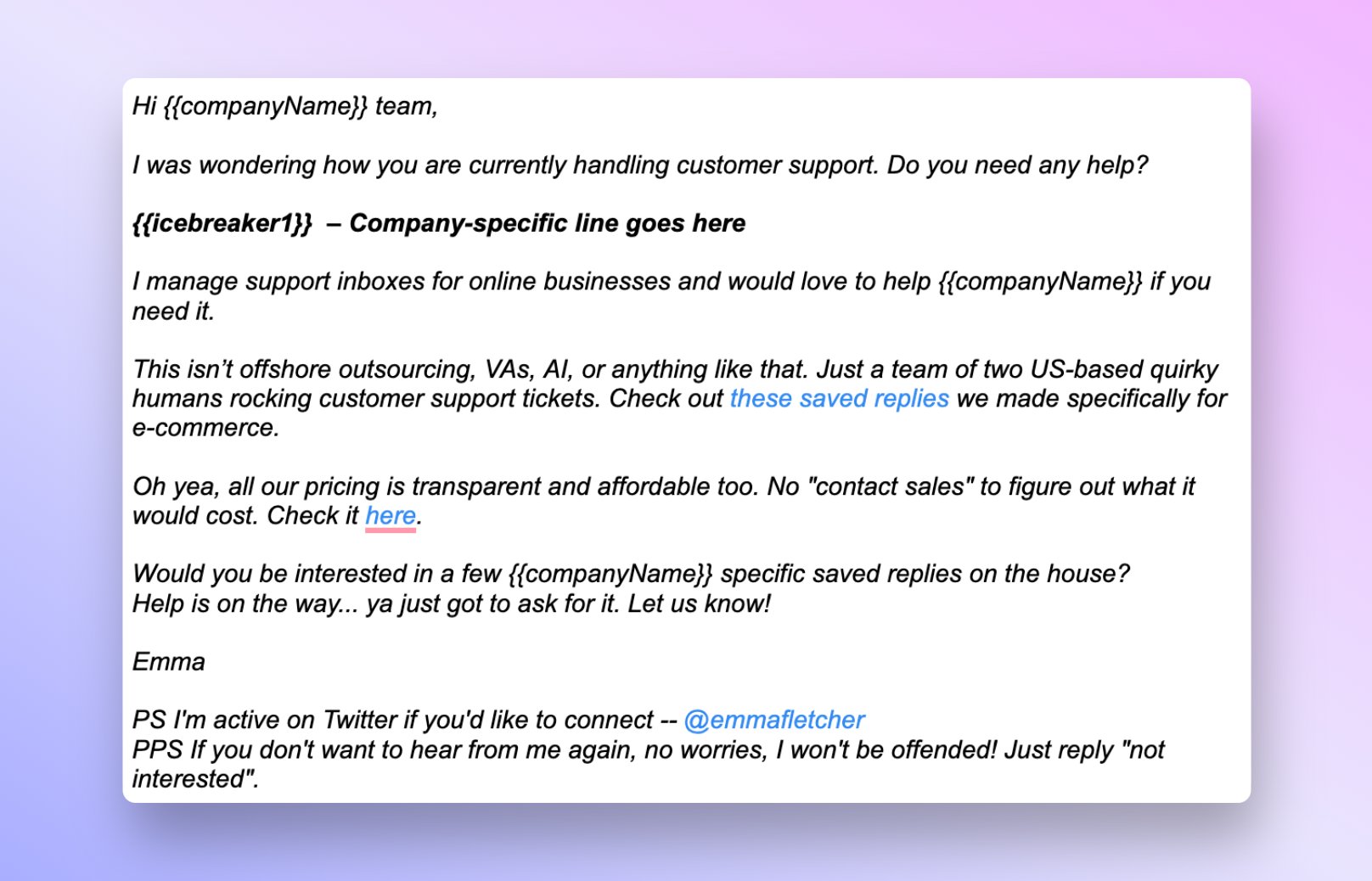

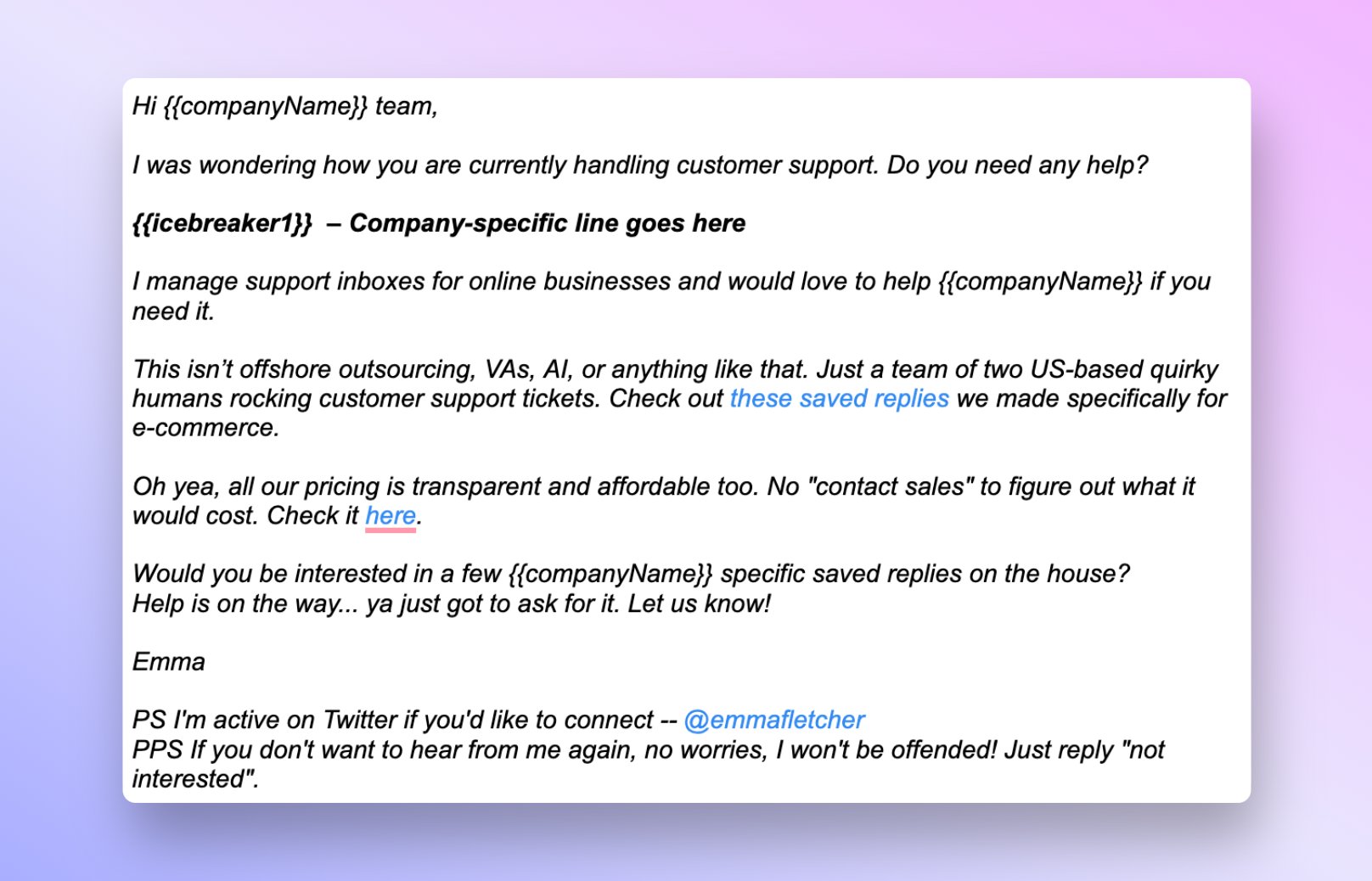

Have you ever gotten a really good cold email? I haven't. But I have a masterpiece example that Emma Fletcher, founder of Evergreen Support, kindly shared in the last Marketing Bay issue.

This cold email approach gets Emma one client for every 50 emails sent.

Stats match

We only just started with cold emails in the past few months, but the results have been promising.

Our clients are people who answer emails daily. When they see our email telling them that we’ll take care of their inboxes, they’re often ready to talk about it!

We meet them where their pain point is. Here are the stats from our last cold email campaign:

- Emails sent: 54.

- Open rate: 80%.

- Click rate: 5.6%.

- Conversion to sales: 1.9%.

In this example, we sent 54 emails and got one client. The thing I am most impressed with is the 80% open rate!

Sequence ball

I spend a lot of time looking for highly qualified leads, which can take hours. But it is worth it if I only need to send 50 emails to get one client.

I’ve tweaked my cold email sequence a lot. I make changes pretty much with every round of 50 emails I send. I’m currently running a three email sequence, with this as the first email:

The part of this email I consistently get positive feedback about is linking my X account at the bottom.

Most of the people reading it aren’t active on X, but they like seeing that I am a real human. It makes it more personable.

I’d recommend linking your most active social account at the bottom of the email. It doesn’t need to be X, just wherever you hang out online so people can see you’re real!

If you enjoyed this information, check out the whole issue here!

Discuss this story.

In the News 📰

The Audience Building Shortcut 👥

from The Hustle newsletter

Acquiring a media asset like a newsletter, Facebook Group, or Instagram page can be an effective alternative to building your own, or paying to advertise on someone else's.

Acquisition mission

Trendster Chandler Woodward, cofounder of media asset marketplace MediaAcquire, has bought and monetized all kinds of media assets. He says he'll never build a following from scratch again.

He shares his advice for businesses looking to buy an audience.

*Source: MediaAcquire

Why buy an audience?

Building an audience from scratch is time-consuming and expensive. You can skip that part of the process by buying a thriving asset, often affordably.

"Renting" an audience (i.e., paying for ads or promoting in a group) can be pricey, and offers limited control. Owning an audience gives you full control and free access to your members.

If your competitors are promoting in a Facebook Group, becoming an owner allows you to ban all promotions other than your own. It's a two-for-one: You gain access to your customers and block out the competition (not an easy feat online).

Pick a channel

Go with the channel you're most familiar with, but here are two of Chandler's favorites:

-

Facebook Groups: Inexpensive. Easy to manage. Often moderated by enthusiastic volunteers.

-

Instagram: Helps you get in front of a lot of people, fast. Easy to monetize through sponsored posts. Easy to shift followers over to a newsletter.

Kick the tires

-

Find out how much engagement the asset is getting: If you're buying a Facebook Group, get the seller to do a screen recording that walks you through their Facebook Insights dashboard to make sure their stats are legit.

-

Do a test post: Offer a prize or downloadable gift, or craft an engaging post asking members about their pain points, for a taste of the kind of engagement you'll get.

-

Avoid buying a face: An audience centered around a topic is a better investment than one centered around a person.

Decide what it's worth

Estimate the cost of building an audience from scratch. You can do this by running a few ads to work out what it would cost to acquire a new member.

If the media asset is already monetized, the value is probably roughly equivalent to the last 12 months in profit.

Monetize

There are many ways to monetize an audience:

-

Use it to sell your products or services.

-

Charge for advertising and promotions.

-

Charge a subscription fee if it's a newsletter or podcast with high-value, original content.

You can also buy an audience to supplement another media asset. For example, Chandler:

- Bought an Instagram account for ~$2.5K.

- Offered followers a downloadable gift to subscribe to a newsletter.

- Generated 170 newsletter subscribers on day one.

- Gains 5-15 newsletter subscribers a day from that account.

An audience that fits your niche can be a very special opportunity!

Subscribe to The Hustle newsletter for more.

Landing Page Hot Tips 🔥

from the One Page Love newsletter

Strengthen your landing page with these design, development, and conversion tips:

Place copy before images on mobile.

Having a legible, responsive design is great, but are you ordering your content for a seamless scrolling experience on mobile?

- Include intro copy before the main image.

- Include feature copy before the demo image.

Landing page images without context are difficult to decipher.

Subscribe to Rob Hope's One Page Love newsletter for his favorite UI, design, and development finds.

A $50M ARR Portfolio of Saas Products 💰

by James Fleischmann

Tim Schumacher of saas.group purchases SaaS businesses. His portfolio is currently grossing $50M ARR.

Getting started

In 2011, I started cofounding and investing in new startups. We started saas.group in 2017 as an alternative investment for ourselves. Following our interest in SaaS products, we initially invested our own money ($5M+) to test our assumptions.

Angel investments and cashflow made us aim higher, and a few friends invested another $5M. We managed to acquire larger companies with higher growth rates, while keeping margins. Over the last two years, we've mainly financed further acquisitions through debt.

Debt is a lot cheaper than equity, but it comes with risk, and you have to have a proven business model before you can aim for debt. So, we need to balance both. A good ratio is one where you can sleep well at night, but you still use debt as a primary ratio.

On vetting businesses

We look for SaaS companies with pure subscription-based pricing models. Our ideal company is around $1M-$5M ARR, has a niche (but growing) product, and is supported by product-led growth. We like low-touch self-serve models.

We also look at the cultural fit and the reason a founder wants to sell.

To find them, we scrape various sources on the web (using our own product, ScraperAPI), analyze multiple factors (traffic, social signals, etc.) to gauge revenues, then email founders whose products we like.

Around 50% of the time, we get a response. We talk to a few hundred founders every year. We really admire bootstrappers, but also do occasional VC-funded acquisitions.

Debt and the sale

Not all of our projects have the same tech stack, but we try to keep variations limited. It just makes things more manageable. Minor technical debt is not a problem, though. That’s very common, and can easily be fixed.

The main factor is the company profits, or potential profits. We usually apply a multiple of 2-7x on profits. I know this is a wide range, but most projects are somewhere in the middle (4-5x).

We work with brokers for the acquisition. If there's a general agreement on price and terms, there's usually a handshake agreement in the form of a letter of intent. This is followed by deeper due diligence. After this, a contract is drafted and executed, usually in the form of an asset deal.

I strongly believe that the best businesses aren't the ones where the founder is gunning towards an exit, but the ones with no end goal. Just run a good business that gives you plenty of options!

Check out our guide to getting acquired if you want to know more.

Discuss this story.

The Tweetmaster's Pick 🐦

by Tweetmaster Flex

I post the tweets indie hackers share the most. Here's today's pick:

Enjoy This Newsletter? 🏁

Forward it to a friend, and let them know they can subscribe here.

Also, you can submit a section for us to include in a future newsletter.

Special thanks to Jay Avery for editing this issue, to Gabriella Federico for the illustrations, and to Sveta Bay, Darko, Caitlin Macleod, Rob Hope, and James Fleischmann for contributing posts. —Channing

|

|

Indie Hackers | Stripe | 120 Westlake Avenue N, Seattle, Washington 98109

|

|

You're subscribed to the Indie Hackers Newsletter. Click here to unsubscribe.

|

|

|