Cryptocurrency Dark Forest Survival Tactics: Wallet Security Strategies and Risk Tier Management

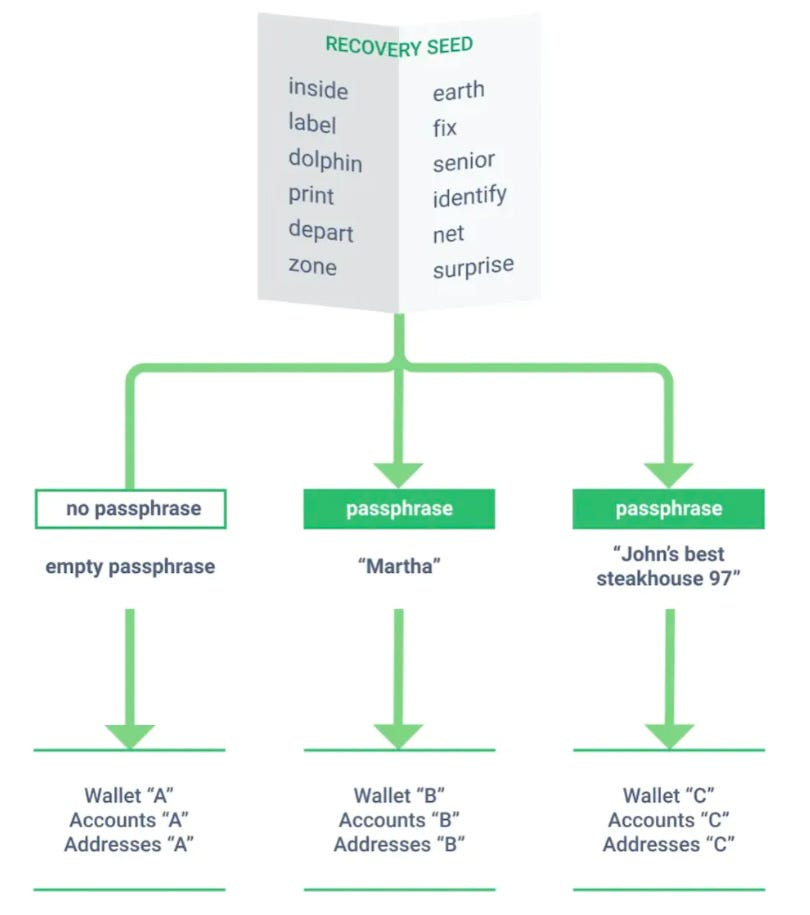

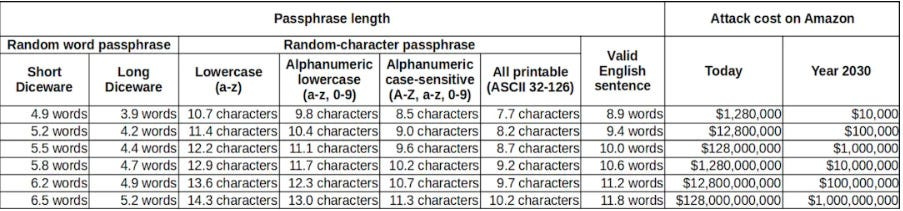

Source: https://mirror.xyz/darkforest.eth/jpYj0mOk-2RA8tLeYYjVYpKW2djN4lUznBBsIlnhao0 In the realm of cryptocurrency’s dark forest, a vigilant stance on asset security is indispensable. This article will delve into my strategies for managing wallet private key security and implementing tiered management for various assets. Relevance of Hardware Devices ● Apple MacBook Pro + Trezor or Other Hardware Wallets Whenever possible, refrain from using Windows-based computers. While Apple systems are not immune to computer virus attacks, their frequency and likelihood are significantly lower. Hierarchical Risk Management for Cold and Hot Wallets 1. Outermost Layer for Airdrops (Google Account 1 or Computer 1) Functioning as the least secure level of hot wallets, these are designated for interaction with various potential airdrop projects. As these wallets require installation of diverse Chrome wallet plugins for purposes such as learning, translation, AI, and more, the security of some plugins cannot be guaranteed. To mitigate this risk, I’ve created a less frequently used Google account to install these plugins. Furthermore, if you have entertainment or gaming requirements, it’s best to use a separate computer to avoid mixing gaming and wallet interactions on the same device. 2. Outermost Layer for Interaction (Google Account 2 or Computer 2) Unlike the outer layer for airdrops, this layer involves several hot wallets for legitimate DeFi trading. Personally, I use the MetaMask Chrome browser plugin. Under this Google account, apart from MetaMask, I only use the essential 1Password password management plugin. Assets in this tier constitute <5% of the portfolio and are utilized for various DeFi operations, signature approval, NFT trading, etc. Allocate funds you can afford to lose to these outer layer hot wallets. Generally, these hot wallets are also ranked by risk level. You can have “risk-tolerant” wallets for basic projects, wallets for premium airdrops, and wallets exclusively for interacting with major blue-chip DeFi platforms like Curve, Convex, Uniswap, Liquity, Lido, etc. Regardless of the project, caution is advised against phishing websites. I’ve previously encountered a phishing website resembling RocketPool. It appeared identical but would prompt you to sign a transaction upon connecting your wallet, transferring all your ETH. Therefore, it’s imperative to carefully review transaction details, including amounts and target addresses, before signing any transactions. 3. Outer Layer for Cold Wallets A cold wallet, also known as an offline wallet, keeps your private keys isolated from the internet. Feasible options include paper wallets, brain wallets, steel plate mnemonic phrases, or old smartphones. A secure and convenient method I recommend is combining a hardware wallet with a paper wallet or steel plate mnemonic phrase. A paradox exists in offline storage of private keys or mnemonic phrases: while dispersing storage across multiple locations reduces the risk of loss, it makes them more susceptible to being breached at a single point and more prone to leakage. To address this dilemma, cryptographers have devised a private key fragment backup scheme based on cryptography — Shamir’s Backup. This scheme allows you to divide your original private key into multiple fragments and use only a subset to recover the private key. This concept is also utilized in the cryptography of recent Distributed Validation Technology (DVT), albeit with validator keys for Ethereum staking. As far as I’m aware, the only hardware wallet currently supporting Shamir’s Backup is Trezor Model T. Even though the security of hardware wallets is robust, the funds in this layer should also remain below 5%. After all, in the event of a personal security threat, it’s essential to prioritize personal safety (most hardware wallets also provide solutions for such situations). Therefore, it’s recommended not to flaunt hardware wallets or wealth. 4. Middle Layer for Cold Wallets The outer cold wallet layer doesn’t house your core assets; it merely serves as a decoy. Ensuring the safety of assets in this layer implies the security of your private key. Even if compromised, the loss is minimal, and there’s time to transfer assets from this middle layer. So, what distinguishes this middle layer from the outer cold wallet layer? It’s the use of a hidden wallet employing passphrase technology. Passphrases are not exclusive to Trezor; they can also be used with Ledger. The method involves adding a word or any string (even a space) to the existing 24-word (or 12-word) mnemonic phrase. The passphrase can be up to 50 characters long. This prompts the hardware wallet to derive a new address from the existing private key. Since this passphrase isn’t stored on any physical medium, its only repository is your mind or the mind of a family member. Whether dealing with hackers or real-life thieves, this remains an enduring secret shared between you and your family. Assets in this layer constitute approximately 50% of the portfolio. Asset Type: LSD assets, native Ethereum through SAAS-style POS staking. Operational Strategy: No DEFI interaction, approval; only transfers between this wallet and the outer cold wallet address (for transferring LSD assets). The only operations conducted on this wallet are signatures during the Ethereum staking process and interactions with the Ethereum POS deposit contract. Additionally, the withdrawal address for Ethereum staking is the same as this wallet’s address. This strategy ensures that hackers have to overcome multiple obstacles to access your assets: obtaining a majority of your private key fragments, knowledge of your asset details, extracting the passphrase from you, understanding your Ethereum POS staking, signing the un-staking sequence, and patiently waiting for the 4 to 5 days needed for unstaking. Only after these five steps can they potentially gain access to your assets. 4. Core Layer for Cold Wallets Constructing the core cold wallet layer follows the same principles as the middle layer. However, the middle layer’s vulnerability lies in the potentially inadequate strength of the passphrase. If a hacker gains direct access to your private key, cracking a passphrase of a relatively low length would take a very short time. Hence, the necessity of establishing a deeper-layer, higher-security cold wallet. I could further extend passphrase1 from the middle layer of the cold wallet, perhaps opting for a sequence stored in my family’s minds rather than a single word. Assets in this layer constitute approximately 40% of the portfolio. Asset Type: Native BTC and ETH. Operational Strategy: Restricted to transfers between wallets. In the End The path of simplicity is profound. As they say, the simplest approach is often the most secure one. The fewer actions you undertake, the fewer intricacies you engage with, the more secure your wallet becomes. However, you must strike a balance and not become overly rigid, rejecting new concepts and experiences. What you can do is akin to what this article describes: risk stratification, asset isolation. Occasional theft of an asset isn’t the primary concern; the true fear lies in losing everything in one fell swoop. In a way, this approach resembles a gamble where you’re all in every time. Prolonged gambling leads to losses; a slight deviation could determine who ultimately claims the profits you’ve accumulated. Follow us Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Wang Yang: Issue a Government-Supported Hong Kong Dollar Stablecoin to Challenge the U.S. Dollar Status

Wednesday, August 23, 2023

Authors: Wang Yang, Wen Yizhou Compile:WuBlockchain Original Link: Ta Kung Pao http://www.takungpao.com/opinion/233119/2023/0822/884381.html In our previous article titled “Proposing Hong Kong to Issue

Asia's weekly TOP10 crypto news (Aug 14 to Aug 20)

Sunday, August 20, 2023

Author:Crescent Editor:Colin Wu 1. Singapore's Weekly Summary 1.1 Singapore Police Arrest Over 10 Individuals and Seek 8 Others Allegedly Involved in Scam, Gambling, and Money Laundering Activities

What is 'Friend Tech'? The Impact of Paradigm's Endorsement & the Rise of Decentralized Social Networks

Sunday, August 20, 2023

On August 10th, Base on-chain social application friend tech caused a sensation in community, with users clamoring for invitation codes to join. Tens of thousands of users poured into this new L2

Weekly Project Updates: Sei Airdrop Unveiled, Opensea to Discontinue Mandatory Royalties, friend tech Previously R…

Saturday, August 19, 2023

On August 15th, Sei launched an open airdrop query webpage, allowing users to check their eligibility for the airdrop through the official website. Whitelisted users must bridge their eligible assets

WuBlockchain Weekly: SpaceX's Previous Sale of BTC, First Ethereum Futures ETF in the US, Singapore's Regulatory F…

Friday, August 18, 2023

On August 18th, according to The Wall Street Journal, SpaceX recorded holdings of $373 million worth of Bitcoin on its balance sheets in 2021 and 2022, which were subsequently sold. Additionally,

You Might Also Like

🖊️ Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO …

Monday, March 10, 2025

Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO for a Cronos Strategic Reserve; Texas's Senate passed bitcoin reserve bill SB-21 ͏ ͏ ͏

Vitalik TAKO AMA: ETH Positioning, Sequencer Centralization, L1 vs L2, Governance, and Success Metrics

Monday, March 10, 2025

On the evening of February 19th at 12 PM UTC and lasting until 12 PM UTC on February 20th, Vitalik Buterin, the founder of Ethereum, was invited to participate in a flash text interview on Tako (a

Donald Trump Creates U.S. Bitcoin Reserve

Monday, March 10, 2025

March 10th, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Donald Trump Creates US Bitcoin Reserve Diddy Shows 'Kindness' To Sam Bankman-Fried Robinhood Conducts $1M Crypto Trivia

Bitcoin’s realized volatility surges in as traders face extreme price swings

Sunday, March 9, 2025

Volatility clustering in Bitcoin reveals the impact of turbulent rallies and sharp pullbacks. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Mar 3 to Mar 9)

Sunday, March 9, 2025

Ms. Sun Xueling, Minister of State, Ministry of Home Affairs of Singapore, said that cryptocurrency fraud cases accounted for a quarter of the total loss amount involved in fraud last year. ͏ ͏ ͏ ͏ ͏ ͏

Trump declares end to ‘war on crypto,’ vows to propel America to Bitcoin supremacy

Saturday, March 8, 2025

Trump brands the Biden era as a crypto setback, .President Trump vows to make America the Bitcoin leader, ending Operation Chokepoint 2.0 and bolstering crypto strategies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡ incentive → click → sale

Saturday, March 8, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: World Network Launches Chat Feature, Zora Set to Introduce Its Native Token, and Trump Ann…

Saturday, March 8, 2025

Sam Altman's blockchain project, World Network, has launched World Chat, a “mini-app” integrated into the World App wallet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Treasury Secretary Scott Bessent hints at future US Bitcoin reserve acquisition plans

Friday, March 7, 2025

Federal government considers expanding Bitcoin holdings without taxpayer funds; official discussions underway in Washington. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

NFT & Gaming - 🦁 Loaded Lions’s LION went live and was the top gainer on CoinGecko; Trump-owned company DTTM Oper…

Friday, March 7, 2025

Loaded Lions's LION token went live on the Cronos and Solana. Trump-owned company filed a trademark for a metaverse and NFT marketplace. Hamster Kombat introduced a Layer-2 blockchain on TON ͏ ͏ ͏