Eliot's Crypto Newsletter - The Onchain Creator Dilemma

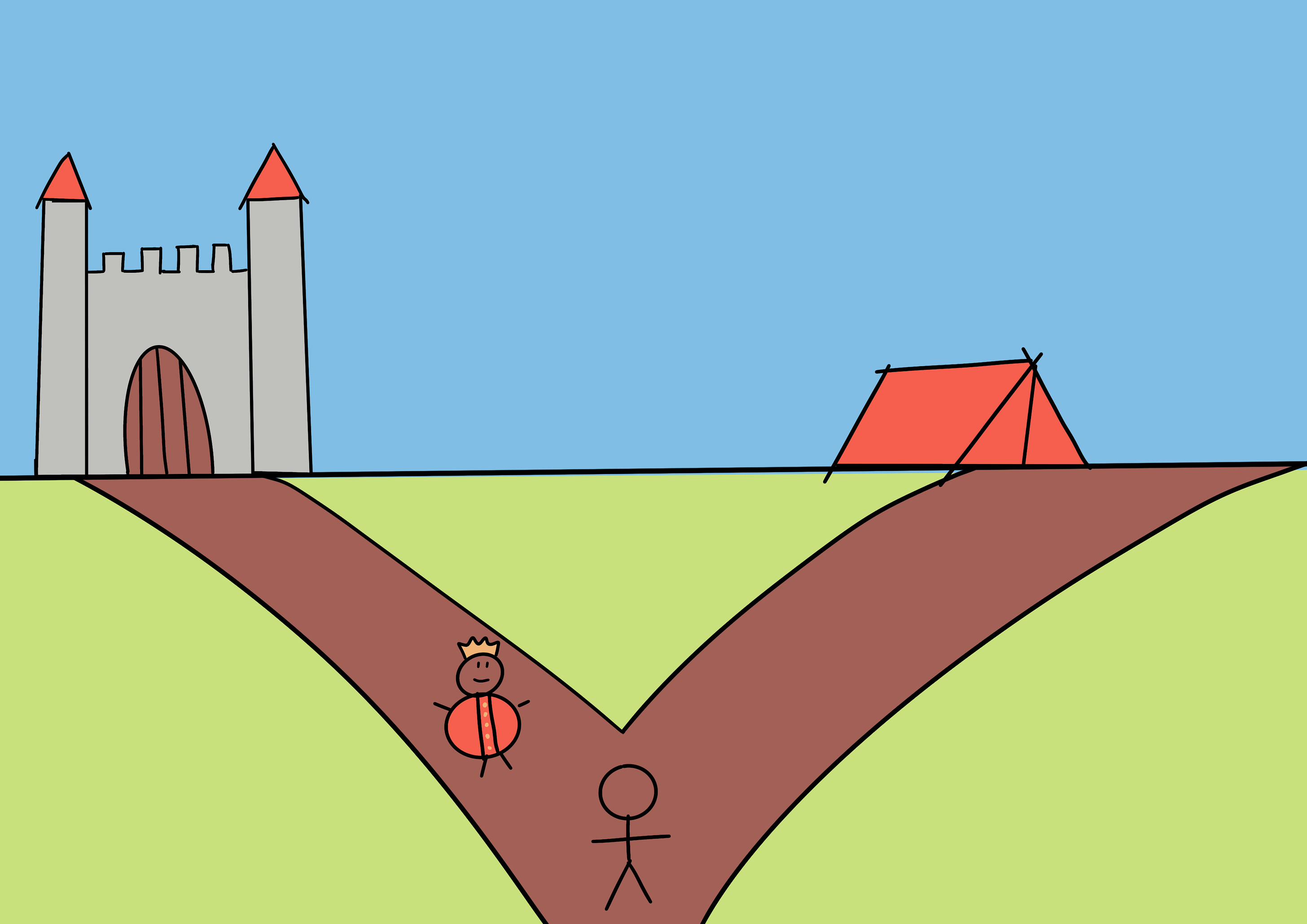

Hey there! If you want to join 1,493+ other readers learning about internet-native communities, make sure to subscribe to this newsletter. In 2023, as a creator, you have two options for posting content: 1) Do it on centralized content platforms (like millions before you). 2) Do it onchain on decentralized platforms (like an adventurer). But what are the real pros and cons of fleeing from centralized platforms? The King and the adventurersPicture this. You're one of the first humans in the history of the world to show up at the intersection in front of a big and luxurious castle. And because you're one of the firsts, the King himself comes to you. After understanding you're looking for somewhere to sleep, he gives you two choices: Choice 1: With his belly sticking out of his pants, the King offers you an entire apartment in his castle - for free. However, there are some rules you have to accept:

And those are pretty much the rules you have to follow. It's pretty hard, but hey, you get a hell of an apartment for free, so think about it. So you let him finish, and as you turn your head to the right, you see another path leading to a deserted land. You ask him what's your second choice. Choice 2: The King looks into the distance, sees the deserted land, and tells you this land can be yours for free - but this time, also free of rules. Yep, you can do whatever you want with it, invite whoever you want, build as many castles as you want, and throw parties like never before. But for now, it's far from desirable. But at least it will be yours. But really, there's almost nothing there. And as he finishes to talk, you give yourself a second to think about it: On the one hand, by accepting his first option, you know you never will be homeless, but you also set yourself up for a future where you'll never be the owner. On the other hand, by following the second option, you can create your own castle and out-king the King, but you also know you have a chance to go bust. Tough call, huh? Unlimited Downside vs. Unlimited UpsideMillions of creators these days are facing the same dilemma. Which is: The cost of going on-chain and setting themselves for potential unlimited upside is the potential for absolute failure. Maybe they become millionaires, maybe they go bust. Who knows. Because, see, for creators on Web2 platforms, the network effect will always get them a few friends, and Twitter's recommendation system will always make sure that their old buddies from college follow them and give them a like or two. On the other hand, those creators will never be able to control who sees their content, be safe from being banned, and bring their audience to other platforms. Worst, the distribution of centralized platforms has the power to push their content to millions - but the money out of those millions of views is short. You'll always get a safety guard but will never be able to reach unlimited upside. Meanwhile, a home run career as a Web3 creator pays handsomely, and if you succeed when posting onchain, the upside will outperform the "normal" creator path by a magnitude. Onchain, you only need 100 fans buying your NFTs at 0,03 ETH to get the same revenue that 1,000,000 streams would bring you on Spotify, and I believe there will be many more onchain creators making a living from their art since the barriers are way lower. But again, if you're wrong, no one is there to save you. There's no built-in discovery onchain (yet), and you can only count on yourself. But that's the price you have to pay to potentially become a millionaire. Closing thoughtsSee, Web3 bros and critics of Web2 content platforms exclaim: "You'll never be free and rich unless you own your content. You need to stop renting your audience to Facebook or YouTube." And then critics of Web3 cry: "It's far too risky to strike out on your own. There isn't a 10x use case, and the monetization/ownership aspects are nice, but realistically, they don't move the needle. Just because there are successful case studies doesn't mean the model itself works." And to this, I'd say that both parties are right. It only depends on how much you care about unlimited upside and if you're ready to take on the risk associated with it. Speak soon, - Eliot PS: What did you think of this article? If you enjoyed today's edition, let me know here - It'll help me understand what you want me to write about (and it only takes you 10sec). Invite your friends and earn rewardsIf you enjoy The Modern World Builder ✧Tips For Collective Lorecraft, share it with your friends and earn rewards when they subscribe. |

Older messages

The Hidden Pattern Of Community Building

Thursday, August 24, 2023

Pattern recognition is a special kind of superpower

Are You Stupid To Buy NFTs?

Sunday, August 20, 2023

The reason critics hate crypto is the exact same reason fanboys love it.

Your False Beliefs Hold Your Community Back

Thursday, August 17, 2023

If you want to build a community that lasts, you need to overcome them first.

Don’t Giving A Fuck Is The New Flex

Monday, August 14, 2023

The hustle-party-rinse-repeat signaling culture is over

That Whole Applications vs. Infrastructure Bullshit

Sunday, July 30, 2023

It's not all-or-nothing, you know.

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏