Why My Opensea account was suddenly blocked due to U.S. sanctions?

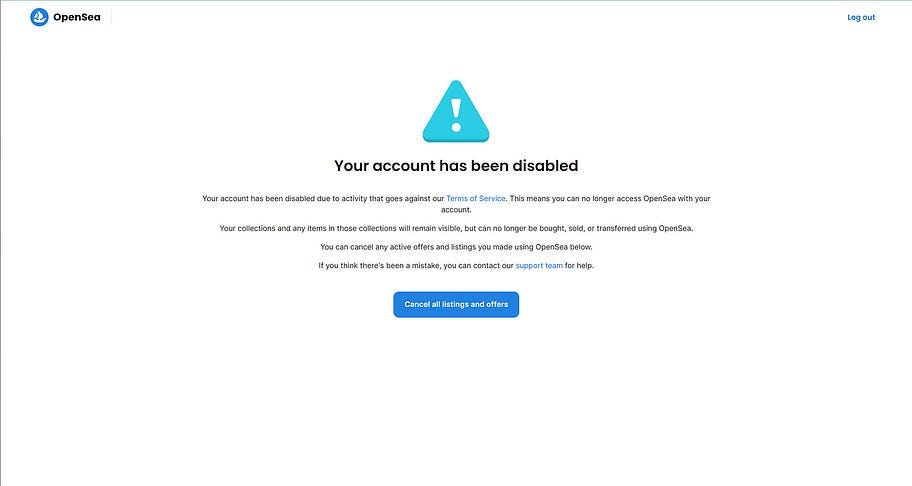

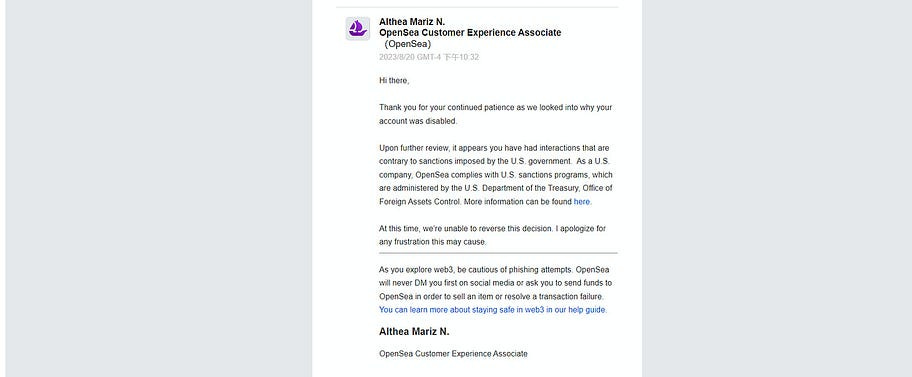

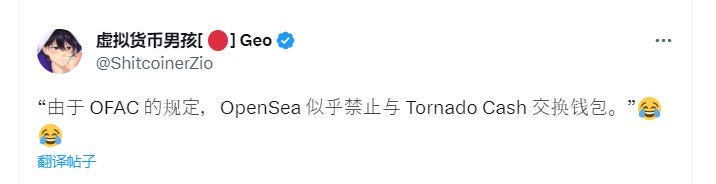

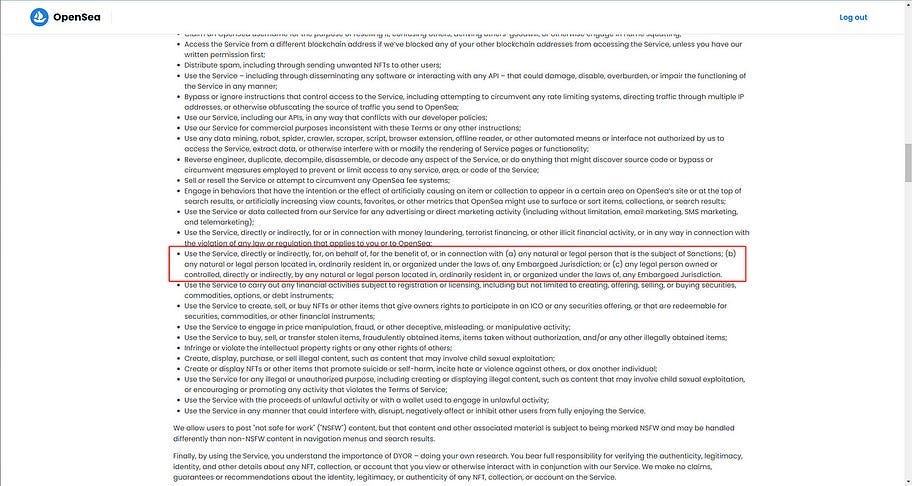

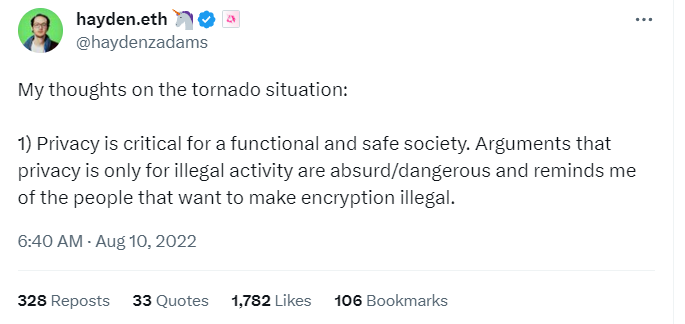

Author | Cats Editor | Coin Wu Blocking Process On August 20th, while logging into Opensea to check the NFT market, I found that I couldn’t access my account. It displayed that the account had been banned due to activities violating their terms of service, making it impossible to use Opensea to buy, sell, or transfer. Since I hadn’t used Opensea to purchase NFTs or engage in related activities for several months, I sent an email to Opensea asking for the specific reason for the ban. Opensea’s explanation was that it was in violation of U.S. government-imposed sanctions, and as a U.S. company, Opensea needs to comply with the U.S. sanctions program managed by the Office of Foreign Assets Control (OFAC) of the U.S. Treasury Department. Possible Reason First, I checked the SDN sanctions list published by OFAC according to Opensea’s statement, and I did not find my name on that list. Then, by reviewing Twitter and my own transaction records, I speculated that the ban might have been caused by using Tornado.Cash in July, as other users on Twitter have had similar experiences. By looking through Opensea’s terms of service, I found the possible reason for being banned: Use the Service, directly or indirectly, for, on behalf of, for the benefit of, or in connection with (a) any natural or legal person that is the subject of Sanctions; (b) any natural or legal person located in, ordinarily resident in, or organized under the laws of, any Embargoed Jurisdiction; or © any legal person owned or controlled, directly or indirectly, by any natural or legal person located in, ordinarily resident in, or organized under the laws of, any Embargoed Jurisdiction. Background Introduction The U.S. Department of the Treasury added Tornado Cash to the sanctions list on August 8, 2022, prohibiting all U.S. individuals and entities from interacting with Tornado Cash or any Ethereum wallet addresses associated with the protocol. Subsequently, major U.S. crypto entities joined in sanctioning Tornado Cash. Circle blacklisted wallet addresses controlled by Tornado Cash, and wallets that had participated in Tornado Cash mining were banned by Aave. Later, the Tornado Cash official website and Discord were shut down one after the other, and the Github page also disappeared. On August 10, Alexey Pertse, a Tornado Cash developer, was arrested in Amsterdam by the Dutch Financial Intelligence and Investigation Services. The latest development in the Tornado Cash incident is the U.S. Department of the Treasury adding Tornado Cash co-founder Roman Semenov to the SDN sanctions list on August 23, and another co-founder, Roman Storm, being arrested by the FBI and IRS on charges of conspiring to launder money, conspire to operate an unlicensed money transmitting business, and conspiring to violate sanctions regulations. At the same time, U.S. Deputy Secretary of the Treasury Wally Adeyemo stated that they would continue to pursue those who recklessly operate and support mixing services that threaten U.S. national security. However, the Tornado Cash case has not yet reached a final judgment, and there is significant opposition within the U.S. to the sanctions against Tornado Cash. For example, Blockchain Association Chief Policy Officer Jake Chervinsky tweeted, “Privacy is universal, code is speech, and the right to anonymity is vital to a free society. These principles are deeply embedded in the U.S. Constitution, and I firmly believe that over time, even if these principles are overlooked by the executive branch today, they will ultimately be affirmed by the judiciary.” Previously, Uniswap founder Hayden Adams also expressed his views on the U.S. Treasury’s sanctions against Tornado Cash on Twitter: “Privacy is vital to a normal and safe society. Sanctioning an immutable smart contract, rather than an individual or organization, raises a significant issue of free speech and sets a bad precedent. Sanctioning companies to make them comply with the law is often less effective than devising reasonable laws or policies.” Actual Impact Similar to Aave’s banning of wallets that have participated in Tornado Cash mining, Opensea’s ban on users who have used Tornado Cash is aimed at the frontend, and the ban also includes other products under its umbrella, such as Opensea Pro. Other NFT markets like Blur, X2Y2, and LooksRare have not banned the address, allowing for regular NFT buying and selling. Other DeFi projects such as AAVE have not banned the address either, and normal trading can still take place. In summary, this banning is due to Opensea itself taking a proactive, positive, and strict control policy. It has front-end banned addresses that have used Tornado Cash, but this will not affect the trading of the assets themselves or the use of other crypto applications. Although the actual impact is limited, if users habitually use Opensea for NFT trading or wish to retain certain Opensea usage records for an address, they should avoid interacting with Tornado Cash using that address or using other mixing services. Follow us Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Unveiling the Dark Cryptocurrency Underworld in Southeast Asia

Tuesday, August 29, 2023

In recent times, the Chinese anti-fraud promotional film “No More Bets” has gained immense popularity. Within the plot, overseas fraud syndicates employ an attractive female persona to deceitfully

Friend.Tech Roundtable Summary

Monday, August 28, 2023

Author | AMBERBELLA Compilation | Wu Blockchain This article is based on a discussion about Friend.Tech conducted at 21:00 GMT+8 on 8/23 in Twitter Space, WuBlockchain has compiled part of the content.

Asia's weekly TOP10 crypto news (Aug 21 to Aug 27)

Sunday, August 27, 2023

Author:Crescent Editor:Colin Wu 1. The Mainland of China's Weekly Summary 1.1 China Court Network Releases “Characterization of Illegal Acquisition of Virtual Currency Activities” link On the 24th

Weekly Project Updates: PEPE Team's Coin Sale Controversy, Decentralization Plans for Base, etc

Saturday, August 26, 2023

1. Ethereum's Weekly Summary a. The 116th Ethereum All Core Developer Consensus Meeting (ACDC) link On August 25th, Christine Kim, the Vice President of Galaxy Research, posted a summary of the

WuBlockchain Weekly: US Authorities Arrest Co-Founder of Tornado Cash, HashKey to Open Retail Trading Next Monday …

Saturday, August 26, 2023

1. US Government Arrests Co-Founder of Tornado Cash and Includes in Sanctions List link On August 23rd, the US Department of the Treasury announced a new addition to the OFAC's SDN sanctions list,

You Might Also Like

Bitcoin’s realized volatility surges in as traders face extreme price swings

Sunday, March 9, 2025

Volatility clustering in Bitcoin reveals the impact of turbulent rallies and sharp pullbacks. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Mar 3 to Mar 9)

Sunday, March 9, 2025

Ms. Sun Xueling, Minister of State, Ministry of Home Affairs of Singapore, said that cryptocurrency fraud cases accounted for a quarter of the total loss amount involved in fraud last year. ͏ ͏ ͏ ͏ ͏ ͏

Trump declares end to ‘war on crypto,’ vows to propel America to Bitcoin supremacy

Saturday, March 8, 2025

Trump brands the Biden era as a crypto setback, .President Trump vows to make America the Bitcoin leader, ending Operation Chokepoint 2.0 and bolstering crypto strategies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡ incentive → click → sale

Saturday, March 8, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: World Network Launches Chat Feature, Zora Set to Introduce Its Native Token, and Trump Ann…

Saturday, March 8, 2025

Sam Altman's blockchain project, World Network, has launched World Chat, a “mini-app” integrated into the World App wallet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Treasury Secretary Scott Bessent hints at future US Bitcoin reserve acquisition plans

Friday, March 7, 2025

Federal government considers expanding Bitcoin holdings without taxpayer funds; official discussions underway in Washington. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

NFT & Gaming - 🦁 Loaded Lions’s LION went live and was the top gainer on CoinGecko; Trump-owned company DTTM Oper…

Friday, March 7, 2025

Loaded Lions's LION token went live on the Cronos and Solana. Trump-owned company filed a trademark for a metaverse and NFT marketplace. Hamster Kombat introduced a Layer-2 blockchain on TON ͏ ͏ ͏

WuBlockchain Weekly: Trump Officially Signs Executive Order for U.S. National Bitcoin Reserve, White House Hosts C…

Friday, March 7, 2025

David Sacks, the “Crypto Tsar” and the White House's AI and Crypto Affairs Chief in the United States, tweeted that Trump has signed an executive order to establish a strategic Bitcoin reserve. ͏ ͏

Cardano’s Charles Hoskinson reacts to White House crypto summit snub

Thursday, March 6, 2025

Hoskinson focuses on legislative progress, unfazed by his absence from Trump's crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Monthly Update on Blockchain Technology: Pectra testnet activation, zero-knowledge gossip, BNBChain roadmap

Thursday, March 6, 2025

Written by: GaryMa, WuBlockchain ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏