VC Monthly Report, the amount of funding saw a slight recovery, while the number continued to reach new lows, with…

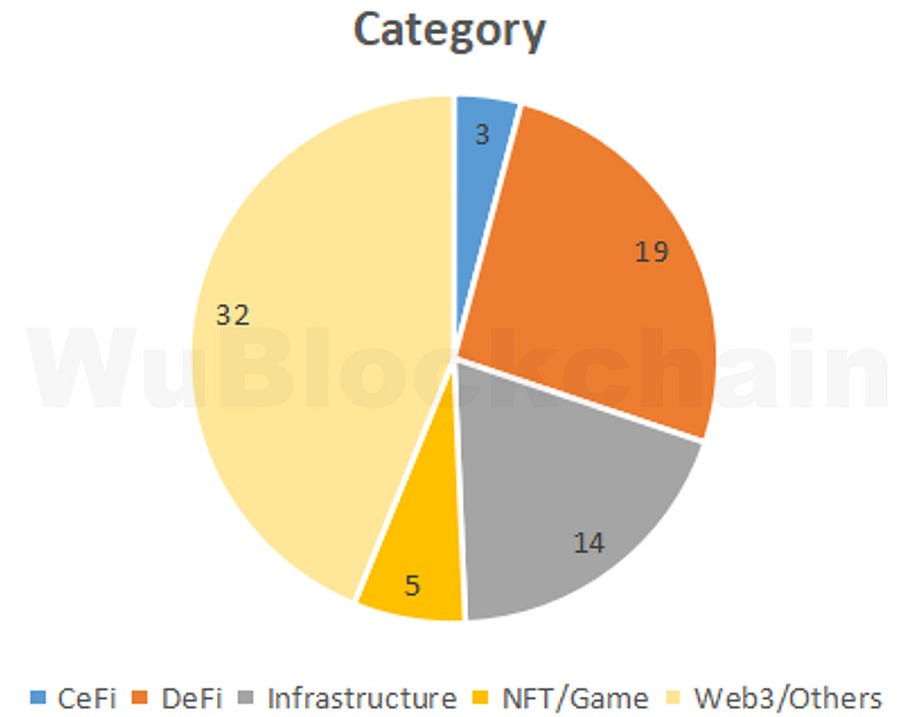

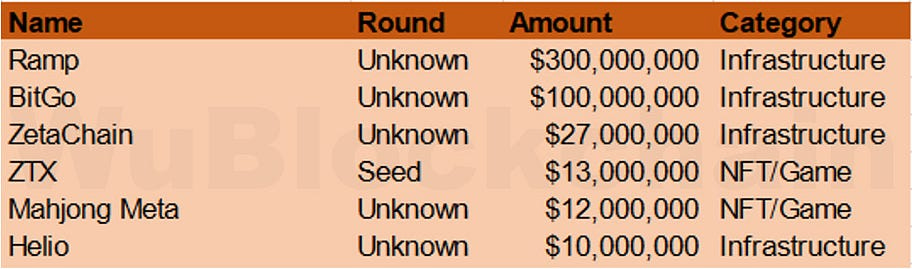

Author: WuBlockchain According to statistics from RootData, there were a total of 73 publicly announced investment projects in the cryptocurrency VC space in August, representing a 6% decrease compared to July 2023 (which had 78 projects) and a 45% decrease compared to August 2022 (which had 132 projects). Note: Since not all funding announcements are made in the same month, these statistics may increase in the future. The industry-level breakdown is as follows: In the cryptocurrency market for August, among various categories, the funding share for infrastructure projects accounted for approximately 19%, which represents a significant decrease of 32% compared to the previous month. DeFi’s share, on the other hand, was about 26%, marking a substantial increase of 12% compared to the previous month. Additionally, CeFi accounted for approximately 4%, and NFT/GameFi accounted for approximately 7%. The total funding amount in August was $660 million, marking a 20% increase compared to July 2023 (which had $550 million), but a 57% decrease compared to August 2022 (which had $1.54 billion). Here are some funding rounds exceeding $10 million: Payment company Ramp announced a $300 million funding round, valuing the company at $5.8 billion. Thrive Capital and Sands Capital led the investment, with participation from General Catalyst, Founders Fund, and others. The new capital will be used to accelerate product development and expand hiring in the second half of the year. Ramp is a non-custodial, full-stack payment infrastructure that allows users to purchase cryptocurrencies without leaving DApps or wallets. Cryptocurrency custody firm BitGo raised $100 million at a valuation of $1.75 billion. This funding will be used for strategic acquisitions, with at least two transactions currently in progress. BitGo is currently the custodian for FTX creditors and serves clients such as financial services company Swan Bitcoin, blockchain developer Mysten Labs, and apparel giant Nike. Cross-chain infrastructure project ZetaChain raised $27 million, with investors including Blockchain.com, Human Capital, VY Capital, and others. ZetaChain is an L1 public blockchain that connects different blockchains through its OmniChain functionality, enabling cross-chain capabilities. ZTX announced a $13 million seed round, led by Jump Crypto, with participation from Collab+Currency, Parataxis, MZ Web3 Fund, Everest Ventures Group, and others. ZTX is a collaborative project between South Korean metaverse platform Zepeto and Jump Crypto. Ethereum mainnet-based Web3 mahjong game Mahjong Meta completed a $12 million funding round, with joint leadership from Dragonfly and Folius Ventures. Helio Protocol secured a $10 million investment from Binance Labs. Helio is the issuer of the stablecoin HAY, currently built on the BNB Chain. This new funding is expected to help the platform expand to other networks, including Ethereum, Arbitrum, and zkSync. Helio Protocol combines over-collateralized lending, decentralized stablecoin borrowing, multi-chain StaaS (Staking as a Service), and LSD through its Synclub product on the BNB Chain. Follow us Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Global Crypto Mining News in August: KuCoin Mining Pool Shutdown, Kana Reports Earnings and Bitmain to Release S21…

Wednesday, September 6, 2023

1. Bitfarms reported its financial results for the second quarter, with revenue of $35 million, net loss of $25 million. Bitfarms increased their hashrate by 10% during Q2 2023 to 5.3 EH/s and mined a

A Retrospective Review: MakerDAO's Disagreement with Vitalik, Solana's Selection - Why?

Tuesday, September 5, 2023

Author: GaryMa WuBlockchain MakerDAO founder Rune expressed a preference for using the Solana codebase for its new, stand-alone blockchain (codename NewChain). The next day, Vitalik sold his $MKR

2 Billion TVL in One Day: A Detailed Explanation of Aerodrome's Core Mechanism Ve(3,3) and the Flywheel Effect

Monday, September 4, 2023

Author: 0xMingyue WuBlockChain As described in the official Aerodrome documentation: Aerodrome Finance is a next-generation AMM designed to serve as Base's central liquidity hub, combining a

Asia's weekly TOP10 crypto news (Aug 28 to Sep 3)

Sunday, September 3, 2023

On September 1st, an article titled 'Recognition of the Property Nature of Virtual Currency and Issues Related to the Disposal of Property Involved in Cases' was published in the People's

Weekly Project Updates: Braavos Announces the Imminent Launch of STRK Token, Uniswap v4 Set to Be Released Followi…

Saturday, September 2, 2023

1. Ethereum's Weekly Summary a. Ethereum Foundation Officially Launches Ethereum Execution Layer Specification link On August 30th, the Ethereum Foundation announced the official release of the

You Might Also Like

Bitcoin’s realized volatility surges in as traders face extreme price swings

Sunday, March 9, 2025

Volatility clustering in Bitcoin reveals the impact of turbulent rallies and sharp pullbacks. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Mar 3 to Mar 9)

Sunday, March 9, 2025

Ms. Sun Xueling, Minister of State, Ministry of Home Affairs of Singapore, said that cryptocurrency fraud cases accounted for a quarter of the total loss amount involved in fraud last year. ͏ ͏ ͏ ͏ ͏ ͏

Trump declares end to ‘war on crypto,’ vows to propel America to Bitcoin supremacy

Saturday, March 8, 2025

Trump brands the Biden era as a crypto setback, .President Trump vows to make America the Bitcoin leader, ending Operation Chokepoint 2.0 and bolstering crypto strategies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡ incentive → click → sale

Saturday, March 8, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: World Network Launches Chat Feature, Zora Set to Introduce Its Native Token, and Trump Ann…

Saturday, March 8, 2025

Sam Altman's blockchain project, World Network, has launched World Chat, a “mini-app” integrated into the World App wallet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Treasury Secretary Scott Bessent hints at future US Bitcoin reserve acquisition plans

Friday, March 7, 2025

Federal government considers expanding Bitcoin holdings without taxpayer funds; official discussions underway in Washington. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

NFT & Gaming - 🦁 Loaded Lions’s LION went live and was the top gainer on CoinGecko; Trump-owned company DTTM Oper…

Friday, March 7, 2025

Loaded Lions's LION token went live on the Cronos and Solana. Trump-owned company filed a trademark for a metaverse and NFT marketplace. Hamster Kombat introduced a Layer-2 blockchain on TON ͏ ͏ ͏

WuBlockchain Weekly: Trump Officially Signs Executive Order for U.S. National Bitcoin Reserve, White House Hosts C…

Friday, March 7, 2025

David Sacks, the “Crypto Tsar” and the White House's AI and Crypto Affairs Chief in the United States, tweeted that Trump has signed an executive order to establish a strategic Bitcoin reserve. ͏ ͏

Cardano’s Charles Hoskinson reacts to White House crypto summit snub

Thursday, March 6, 2025

Hoskinson focuses on legislative progress, unfazed by his absence from Trump's crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Monthly Update on Blockchain Technology: Pectra testnet activation, zero-knowledge gossip, BNBChain roadmap

Thursday, March 6, 2025

Written by: GaryMa, WuBlockchain ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏