Full Transcript of Former Alibaba CSO Ming Zeng's Speech: AGI and Cryptocurrency - A Promising Future

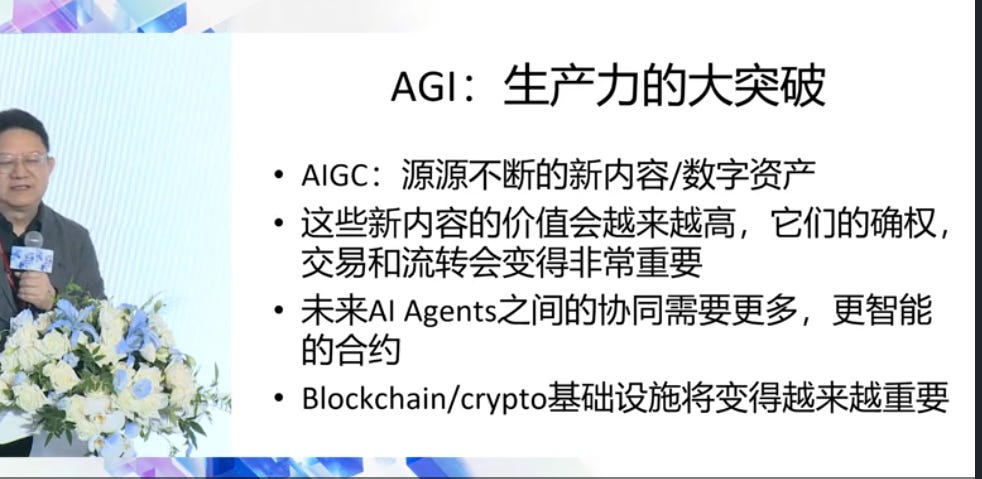

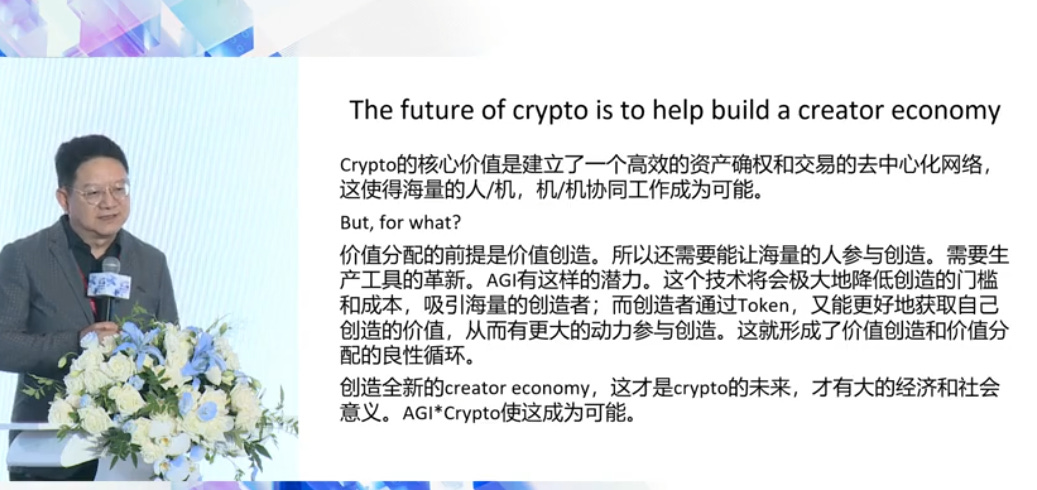

Author: Ming Zeng Source: https://www.wu-talk.com/index.php?m=content&c=index&a=show&catid=6&id=18555#backTop This article is the full transcript of the keynote speech titled "The Future of Web3?" delivered by former Alibaba Chief Strategic Officer, Ming Zeng, at the 9th Annual Blockchain Global Summit hosted by WanXiang Blockchain Lab on September 19th. The following is the complete speech: Today, I'd like to share some thoughts on Web3. I've spent some time contemplating the theme of this speech and finally decided to name it with a question mark. This is because we all know that the next destination is Web3, but where will this stop be? How long will it take to get there? Will it be in 2 years or 5 years? This question, in reality, has many confusing aspects, including the ambiguity surrounding the specific definition of "Web3." However, two main sources of Web3, namely Cryptocurrency and the Metaverse, are driving the concept of Web3 forward. Everyone believes that cryptocurrency and the Metaverse are essential directions for the future. Still, over the past two years, both of these fields have faced significant challenges. This has left many practitioners confused. For instance, in Silicon Valley, many friends involved in cryptocurrency have possibly seen two-thirds or even more transition to Artificial Intelligence (AI). So, what is the future of Web3? I think this is a topic worth discussing again. Today, my speech will mainly focus on Blockchain and Crypto because I believe these are crucial parts. Now, let's briefly summarize the achievements of cryptocurrency so far. There are two very solid consensuses that have been practically achieved. The first is Bitcoin (BTC), and the second is Ethereum (ETH). Ethereum is essentially a platform for smart contract technology, which has gone through three to four significant stages: the first was during the ICO phase, which established Ethereum's position and the importance of smart contracts; then, there were the first-generation important applications like exchanges and user applications such as wallets. The second significant breakthrough started in the summer of 2020 with DeFi, GameFi, and NFTs. But now, one of our biggest confusions is, what's the next step? Everyone expects significant applications, but it's challenging to predict what these applications will be and when they will appear. So, why have cryptocurrencies achieved so much success? It's fundamentally a Value Network, not just an Information Network, and it enables digital assets to circulate more efficiently. One of the associated breakthroughs is the design of Tokenomics, which allows incentive mechanisms to be more efficiently applied. As Professor Lan mentioned earlier regarding the relationship between Web3 and AI, effectively combining the open-source community and incentive mechanisms will be an important innovation area in the future. Essentially, I believe this is an innovation in production relations. Although this term is somewhat traditional, I think it still captures the essence of the problem because it promotes collaboration, cooperation, asset trading, and circulation. It has significant potential in value creation. But what's particularly interesting is that, in a more extensive economic context, finance is a production relationship. It's a tool for improving efficiency. Still, financial products, especially consumer products like savings accounts or assets, are the application of productivity and closely related to technology. Therefore, why is finance one of the lowest applications of blockchain and cryptocurrency? Another application of blockchain and cryptocurrency is one of the earliest applications, which is finance. Finance is a breakthrough in production relations within a more extensive economic scope. It leverages blockchain technology, but innovations in financial products can gain many advantages from a technological perspective. So, finance is a relatively unique field. But from a broader perspective, for the next billion users we expect, cryptocurrency is stuck in an essential direction: it doesn't directly improve the consumer experience, and it's not a tool to enhance productivity. The second issue is that the digitization of traditional assets, including Real-World Assets (RWA), hasn't been as smooth as we imagined. We recently discussed these issues, but they've been talked about for years. The process of transferring assets has been challenging. This is easy to understand because any new technology trying to migrate traditional business into a new field usually isn't very successful because the value it creates isn't substantial enough, but the costs are high. A similar example is what traditional companies call digital transformation, one of the main topics in the last five years. But very few companies have succeeded because new technology creates new applications, new assets, and that's the future. But currently, in the entire cryptocurrency field, we don't have new digital assets; we only have Ethereum and peer-to-peer networks (P2P). Most financial innovations are centered around these two points. Therefore, I personally believe the entire cryptocurrency field needs innovation, an acceleration towards Web3. We need to create new digital assets, and there are three possible ways to do that. The first path is continuous innovation in the financial sector because finance itself is a massive industry, and it's also a critical industry. It integrates cryptocurrency and blockchain, combining the advantages of technological innovation in productivity and production relations. Therefore, I believe financial innovation remains a significant direction for the next step. This includes the development of Bitcoin, which is relatively successful to some extent at the moment. Its success lies in the role of alternative assets, similar to digital gold. But what everyone has been anticipating, such as payment networks and inclusive finance, making financial services available to billions of people in impoverished areas currently lacking financial services, will still take a long time to achieve. It's a key focus for the next breakthrough. The second significant area is that blockchain itself can still achieve technological innovation in finance, such as the latest developments in international payments. In the future, we may see it playing a more substantial role. Therefore, financial innovation will be a vital component of Web3. The second step is the new applications we have been anticipating, such as gaming. In the past two years, most innovation has focused on infrastructure, particularly the development of Layer 2 and knowledge about Layer 2, which has made significant technical progress in scalability, usability, and convenience. But when will these applications break through, such as GameFi, is something we are eagerly anticipating. Many specialized teams have entered this field over the past two years, and it typically takes about two years for development. Therefore, this year and early next year, we are eagerly anticipating some remarkable products in the GameFi sector that will delight consumers. Social media is certainly an area everyone is looking forward to, just like the recent trend caused by friend.Tech. It includes whether there will be more significant breakthroughs in the next step, which is highly anticipated. Therefore, based on the development of the current blockchain and cryptocurrency infrastructure, how to nurture the next generation of applications is undoubtedly one of the community's current focus areas. But what I want to emphasize today is the third path. From the end of last year to the beginning of this year, I have become increasingly clear that I believe Artificial General Intelligence (AGI) and cryptocurrency are a match made in heaven. Cryptocurrency primarily represents a revolution in production relations, while AGI is a technological breakthrough in productivity, and AGI will create a large number of new digital assets. Now let's take a brief look at why I say this. AGI is General Artificial Intelligence. Since the explosion of chatGPT, we have all realized that this is a significant breakthrough in the field of artificial intelligence. Its first most crucial application area is called AIGC, which stands for AI-generated content. This means AI can create a large amount of new content at a low cost and extremely quickly. Moreover, this content is essentially digital, and the value of this field changes very quickly. We have just seen technology that goes from text to text and text to image. Next, there will be a breakthrough in text to video. As soon as technology for text to 3D video takes a leap, we will undoubtedly see an explosive development in the content industry. Furthermore, another crucial point is that, in the past, cryptocurrency was relatively on the periphery because many digital contents, including NFTs, weren't fundamentally important, and their value wasn't significant. However, the value of these new digital contents will become increasingly high in the entire economy. If the value of these assets is high, people will genuinely pay attention. At that point, the focus will shift to whether transaction costs can be reduced, whether privacy can be protected, and whether efficiency can be increased. If, like many traditional contents, in the past one or two years, many contents themselves didn't have value, people's attention to their asset properties naturally wasn't very high. At the same time, a crucial point is that the development of the AI field will be very rapid. From the current assistant role to the agent role, which means there will be more and more AI teachers, AI doctors, AI designers, etc., who will directly replace humans. The collaboration between machines will significantly replace the collaboration between machines and humans and between humans. Smart contracts are originally prepared for the collaboration between machines. So, as AI further develops, the complexity and importance of smart contracts will also take a qualitative leap. Therefore, based on these three points, I believe that the infrastructure of cryptocurrency will become increasingly important. Not because cryptocurrency itself has strong driving force, but because the development of AI requires cryptocurrency and infrastructure. So, the term "Creator economy" and words like "Metaverse," although they might have seemed a bit outdated over the past two years, I personally believe that there are no better terms found yet. I think the Creator economy is undoubtedly a very important part of the future economy, even the core feature of the economy. Therefore, the core value of cryptocurrency is to establish a decentralized network for efficient asset rights and transactions, making it possible for a massive number of people, machines, and machine collaborations to work together. But before value distribution, there must be value creation. So, how to get a large number of people involved in creation, how to make a large number of AIs collaborate better, how to solve incentive mechanism issues, how to solve asset trading and distribution issues, all of these are very critical. Therefore, creating a completely new Creator economy with participation and creation permissions is the real opportunity for the future, and it has significant economic and social significance. It will become the mainstream of the economy rather than the periphery. Therefore, AI, AGI, and cryptocurrency make this digital economy's future possible and are the true Web3. At the same time, an important point is that infrastructure and applications develop together. Since the listing of Landscape in 1993, we can clearly see that every breakthrough in infrastructure is closely related to the emergence of killer applications. So, today, we see the infrastructure construction of the past two years, and it will indeed make us look forward to the emergence of the next killer application. Therefore, I think in the next two years, what we most anticipate is the emergence of AI Crypto Native Services. Although we don't know what its specific product form will be or where it will appear, it is inevitable from the trend. When such applications appear, they will bring in a large number of new users and set the direction for the future development of the infrastructure, driving the entire ecosystem's development. The current challenge is that true AI localization has not yet been achieved. Although many Web3 cryptocurrencies are turning to AI entrepreneurship, many AI locals, as Professor Lan just mentioned, still have inadequate understanding of cryptocurrencies. Therefore, what we need next is a deeper integration between people in the AI and cryptocurrency fields and people in the infrastructure field. It also somewhat returns to what Professor Cao mentioned earlier. Starting from the infrastructure, how to continuously integrate technologies like AI and cryptocurrency into the top layer of applications is the future of Web3 and a more exciting future. Thank you all. Follow us Twitter: https://twitter.com/WuBlockchain Telegram: https://t.me/wublockchainenglish Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

In-Depth Analysis of the Friend.tech Economic Model: Game Theory, Expected Value, and Demand Curves

Tuesday, September 26, 2023

Author: Loki Source: https://mirror.xyz/lokiz.eth/w1WKevEM3AAHaS-eDXIiRPU0DtzY6TCiQ_a8eX3tlIA I. How to Create a Successful Ponzi Social Product The Friend.tech economic model seems straightforward: 1.

TaxDAO’s Response to Committee on Finance on the Taxation of Digital Assets

Monday, September 25, 2023

Author: TaxDAO On July 11, 2023, the US Senate Committee on Finance released a letter seeking answers from the digital asset community and other interested parties on appropriate treatment under

Asia's weekly TOP10 crypto news (Sep 18 to Sep 24)

Sunday, September 24, 2023

Author:0xMingyue Editor:Colin Wu 1. Hong Kong's Weekly Summary 1.1 Hong Kong SFC: JPEX Listed on Unlicensed Firms and Suspicious Websites List Since July Last Year link On September 19th, the Hong

Weekly Project Updates: Arbitrum Reboots Odyssey, Optimism Announces Third Airdrop, OpenSea Set to Launch Creator …

Saturday, September 23, 2023

1. Arbitrum Announces Odyssey Reboot on September 26th link On September 20th, Arbitrum announced that it will relaunch Odyssey on September 26th. Arbitrum Odyssey, in collaboration with Galxe, will

Why Does Binance Wallet's Gas Skyrocket? Exploring the Technical and Security Factors

Saturday, September 23, 2023

Author: Haotian Original Link: https://twitter.com/tmel0211/status/1704869126949539947 Exchanges manage a large number of EOA Deposit recharge addresses. Every time a user deposits cryptocurrencies,

You Might Also Like

Bitcoin’s realized volatility surges in as traders face extreme price swings

Sunday, March 9, 2025

Volatility clustering in Bitcoin reveals the impact of turbulent rallies and sharp pullbacks. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Mar 3 to Mar 9)

Sunday, March 9, 2025

Ms. Sun Xueling, Minister of State, Ministry of Home Affairs of Singapore, said that cryptocurrency fraud cases accounted for a quarter of the total loss amount involved in fraud last year. ͏ ͏ ͏ ͏ ͏ ͏

Trump declares end to ‘war on crypto,’ vows to propel America to Bitcoin supremacy

Saturday, March 8, 2025

Trump brands the Biden era as a crypto setback, .President Trump vows to make America the Bitcoin leader, ending Operation Chokepoint 2.0 and bolstering crypto strategies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡ incentive → click → sale

Saturday, March 8, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: World Network Launches Chat Feature, Zora Set to Introduce Its Native Token, and Trump Ann…

Saturday, March 8, 2025

Sam Altman's blockchain project, World Network, has launched World Chat, a “mini-app” integrated into the World App wallet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Treasury Secretary Scott Bessent hints at future US Bitcoin reserve acquisition plans

Friday, March 7, 2025

Federal government considers expanding Bitcoin holdings without taxpayer funds; official discussions underway in Washington. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

NFT & Gaming - 🦁 Loaded Lions’s LION went live and was the top gainer on CoinGecko; Trump-owned company DTTM Oper…

Friday, March 7, 2025

Loaded Lions's LION token went live on the Cronos and Solana. Trump-owned company filed a trademark for a metaverse and NFT marketplace. Hamster Kombat introduced a Layer-2 blockchain on TON ͏ ͏ ͏

WuBlockchain Weekly: Trump Officially Signs Executive Order for U.S. National Bitcoin Reserve, White House Hosts C…

Friday, March 7, 2025

David Sacks, the “Crypto Tsar” and the White House's AI and Crypto Affairs Chief in the United States, tweeted that Trump has signed an executive order to establish a strategic Bitcoin reserve. ͏ ͏

Cardano’s Charles Hoskinson reacts to White House crypto summit snub

Thursday, March 6, 2025

Hoskinson focuses on legislative progress, unfazed by his absence from Trump's crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Monthly Update on Blockchain Technology: Pectra testnet activation, zero-knowledge gossip, BNBChain roadmap

Thursday, March 6, 2025

Written by: GaryMa, WuBlockchain ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏