The Generalist - What to Watch in India

Friends, I am here to make a suggestion: we should be paying greater attention to India’s startups. In today’s piece we make our case and – with the help of some domestic investment experts – highlight eight of the country’s promising companies. This is the first time we’ve chosen to focus on a particular geography for our “What to Watch” series. (Previous editions have centered around artificial intelligence and crypto startups.) Our goal with this series is to surface compelling startups that readers might not have heard of, delivered with a depth and detail that contextualizes the technologies bubbling up at the frontier. I’d love your feedback on this latest iteration and whether you’d like to see similar geographic-focused issues in the future. Today, you’ll learn how Indian startups are innovating in manufacturing and decarbonization, bringing credit cards to the masses, solving SaaS spend, and much more. Let’s get to it. P.S. What other Indian startups should readers know about? Who do you think is primed to be an ecosystem breakout? Send in your picks and I’ll choose my favorites and include them in next week’s email. Think of it as a kind of “stone soup” for startup intelligence. An ask: If you liked this piece, I’d be grateful if you’d consider tapping the “heart” ❤️ in the header above. It helps us understand which pieces you like most and supports our growth. Thank you! Brought to you by MasterworksA Banksy got everyday investors 32% returns? We know it may sound too good to be true. But thousands of investors have profited, thanks to the fine-art investing platform Masterworks. That Banksy return isn’t a one-off. Masterworks has built a track record of 16 exits, including net returns of +10.4%, +27.3%, and +35.0%, despite macroeconomic turbulence. For those skeptical of the value to be found in the art market, here are some compelling figures. Contemporary art prices…

Eager to diversify your portfolio? The Generalist readers can skip the waitlist with this exclusive link. Actionable insightsIf you only have a few minutes to spare, here’s what investors, operators, and founders should know about India’s most exciting startups.

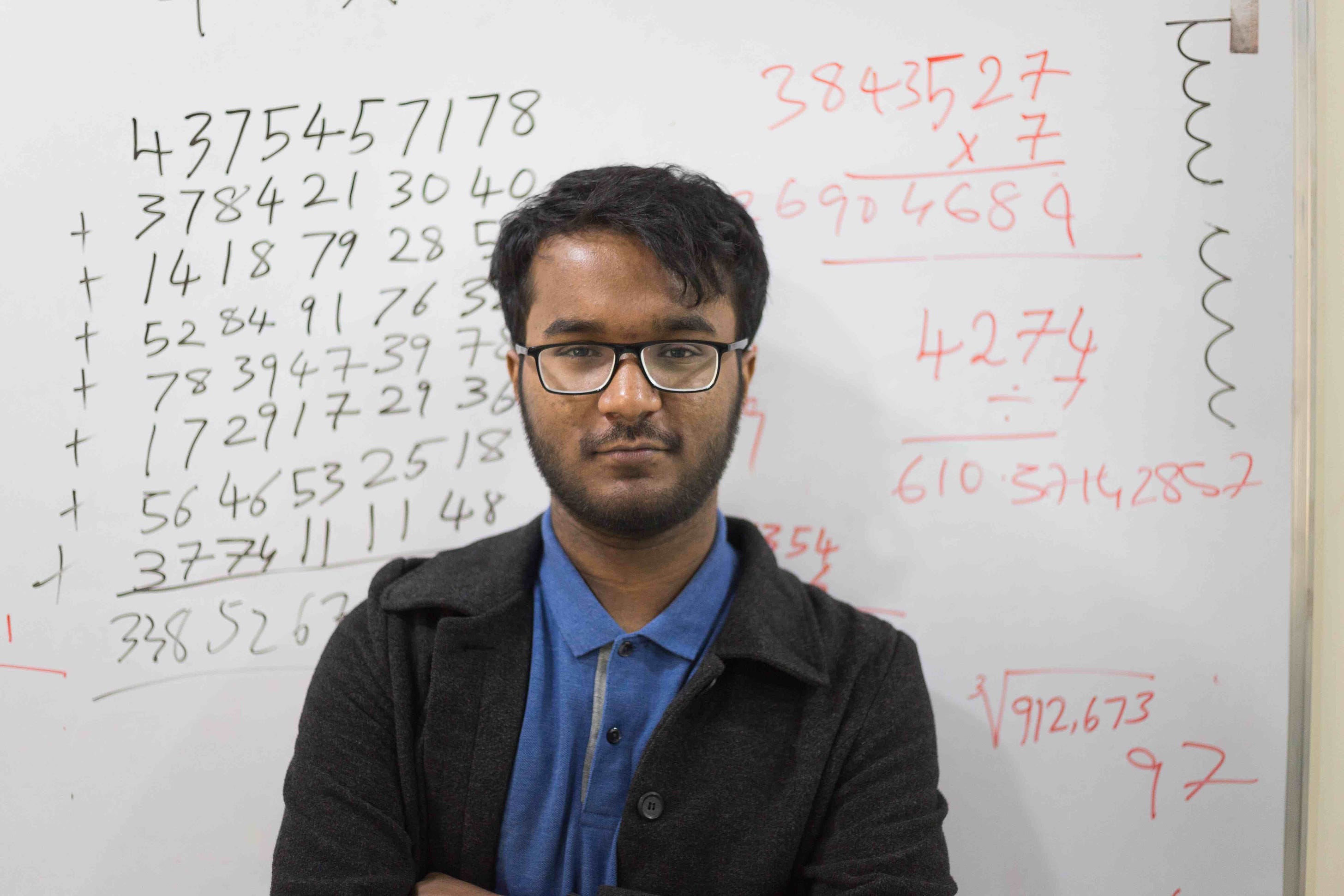

As startup funding has slowed from bull market highs, capital has ebbed from emerging markets. India is no exception. Funding in the first half of 2023 fell to $5.46 billion, a 68% decline from the same period year prior, and a 59% drop from that timeframe in 2021. Not all of this downturn can be attributed to smaller deal sizes, with the number of investments also tumbling year-on-year. But as megalodons like Softbank and Tiger Global have beat a hasty retreat from hotel conference rooms in Bengaluru, Hyderabad, Chennai, Mumbai, and Delhi, adventurous investors may see it as the right time to lean in. Those needing persuading may turn their attention toward three realities of the modern Indian tech ecosystem. Firstly, this is an increasingly self-reliant venture market. In 2022, funds like Lightspeed India, Blume Ventures, Fireside Ventures, and Artha Select raised funds in the hundreds of millions to continue backing startups in the ecosystem. Peak XV (formerly Sequoia India) amassed a war chest of $2 billion alone. While foreign capital will likely be needed as the country’s most successful companies scale, there’s a growing robustness from a capital availability perspective. Secondly, India is in the early stages of a top-down digital revolution. Starting in 2010, its government began an initiative termed “India Stack.” The goal was to construct digital building blocks for identity, data, and payment interactions across the country’s population (and perhaps) beyond. That initiative has borne fruit to a remarkable extent. Today, India Stack has created digital identities for 1.31 billion people (95% of the population), built a payments network processing trillions in rupees per month, and created a data governance structure. It’s one of the most impressive examples of a government-led technological initiative – it also provides the foundational infrastructure to empower a new generation of technological innovation. Finally, India’s demographic advantages are difficult to ignore. The country is now the most populous on earth, with a growing labor pool. More than 600 million Indians are between the ages of 18-35; by 2041, fully 59% of the country’s population will fall between the working ages of 20-59. Such statistics are no guarantee of innovation, of course. The US has lagged behind by these measures for some time but remains the world’s dominant technological force. Taken together, though, India is an increasingly compelling market worthy of greater attention. The problem then becomes: where exactly should that attention be directed? For the curious outsider, the well-intentioned interloper, where is the best place to start? To answer that question, we’ve asked eight of India’s best-respected venture capitalists to highlight a company they consider exceptional. Below, you’ll find their choices. Not only are they interesting depictions of individual companies, but an intriguing look into the unique challenges, opportunities, and traits of the Indian ecosystem. Note: Long-time readers will know we intentionally don’t preclude investors from mentioning companies they’ve backed. The benefits of increased knowledge and “skin in the game” outweigh the risk of facile book-talking. Across contributors, we do our utmost to select for expertise, originality, and thoughtfulness. Classplus: The “SaaSTra” pioneerIndia’s SaaS sector has long been one of the high points of the country’s startup ecosystem. The segment attracts 20% of venture funding and has contributed a similar proportion of unicorns, including players like Zoho and Freshworks. More winners are coming, contributing to Indian SaaS’s growing presence on the global stage. In time, it may become as significant a success for India as the IT sector. That industry powered the rise of giants like Infosys, TCS, Cognizant, and others. The SaaS sector is traditionally split across (i) horizontal SaaS, (ii) infrastructure and dev tools, and (iii) vertical SaaS. Historically, India has been strong on horizontal SaaS, which lends itself easily to international revenues (specifically from the US). Industry estimates point to 75% of SaaS revenue arriving from overseas. The remaining 25% primarily comes from the vertical SaaS segment – ranging from on-prem “mom-and-pop” SaaS to fast-growing cloud-first SaaS. A key challenge in India’s vertical SaaS sector has been monetization. While India has over 60 million establishments, only 19,500 have a paid-up capital of $1.25 million and above. This means that India’s undersized and underformalised enterprise sector typically doesn’t like to (or can’t afford to) pay for software. One of India’s OG software plays, the accounting platform Tally, estimated that only a third of their six million users were paying for the product. The rest used pirated versions of the software. Keep in mind this is for an annual subscription under $50! Unsurprisingly, none of India’s SaaS unicorns have come from serving the domestic market. Zoho, Freshdesk, Druva, Postman, and Zenoti – all of them are global players, with more than 90% of their revenue coming from global customers. Who could be India’s first domestic SaaS unicorn? Is a Bharat SaaS play possible – one in which all your customers are based in India? We at Blume think so. Our belief comes from the growth we have seen at Classplus (a portfolio company of ours), a vertical SaaS player in the education space. Classplus helps tutors (of which India has many) manage their business. It provides an intuitive Learning Management Software (LMS) product that includes communication features (like letting parents know when their child misses class) and links to payment APIs. The software is not cheap: yearly subscriptions are over $100. Yet more than 50,000 tutors have paid an annual fee. And it is not just tutors now – about a fifth of Classplus’s new customers are creators or influencers outside education. About 10% of the company’s user base leverages its distinctive marketplace, which allows it to sell content (practice examples, advanced tests, video lectures) to consumers. Classplus takes a share of the $150 million-plus in annualized marketplace spending it facilitates. The playbook that Classplus has pioneered, which is emerging as the distinctive playbook for domestic SaaS play, is a SaaS-plus-Marketplace model. Essentially, these companies use SaaS as a hook to fashion a marketplace, then take a cut of the transactions that occur. Some even sell fintech or loan products via this avenue. I like to call this model “SaasTra” — a portmanteau of “SaaS” and “Transactions.” The thesis that a large segment of India's SaaS would use a SaaSTra model (rather than pure-SaaS like the West) inspired our bet on Classplus. In general, Classplus is one of the most innovative, yet under-the-radar SaaS startups in India. Given its sector, it is perceived as an ed-tech play. While that’s true, it is as much a vertical SaaS play – and a business model pioneer. The distinctive SaaSTra approach has worked – growth has been on a tear, with 10x growth in revenues over the past few years, and about 4x growth over the past year and a half. In Classplus’s rise and tearaway growth, we see a model that will inspire and underpin the next wave of India’s vertical SaaS plays. - Sajith Pai, Partner at Blume Venture Advisors Bhanzu: Cultivating a love of mathMathematics is core to the learning universe. Its principles have far-reaching applications that extend into virtually every sphere of human activity, teaching children to think logically, apply theories, and use objective reasoning to solve problems. The universal relevance of mathematical thinking makes it an important life skill, with implications far beyond academic and professional success. Despite the numerous benefits that learning math offers and the growing need for these skills in the workforce, many students still find it intimidating and thus struggle with truly understanding its concepts. This fear of math is what Bhanzu aims to change. Bhanzu is an ed-tech startup with a vision to eradicate math phobia globally by making the subject fun and relatable and promoting it as a sport, art form, and human experience. The organization is bridging the gap between dreams and competence by enabling students to realize their full potential and introducing them to science, coding, and AI through the lens of math. To accomplish this, Bhanzu utilizes the world’s “most thought-through” math curriculum. It’s been formulated and designed by the company’s founder, Neelakantha Bhanu Prakash, known as the “World’s Fastest Human Calculator.” With his skill and passion for mathematics, he inspires not only his students, but his team of committed educators as well. Bhanzu's journey started through various non-profit numeracy projects, impacting over 30,000 students in India. In the process, over 25 variants of curriculum trajectories were trialed and honed. After extensive research spanning over three years, Bhanzu launched its first online live-class courseware in 2021 and has been educating thousands of students across more than ten countries. Bhanzu has built a curriculum that runs the gamut of math: from foundational to curricular, through to real-world applied problems. This holistic approach builds students' math confidence, ignites curiosity, and enhances their learning and cognitive abilities. Bhanzu’s overall goal is not just to create skilled mathematicians but to cultivate a love for math and create the thought leaders of tomorrow. The company frames it as a sport or game, something to be enjoyed, rather than just another subject. This gamified approach to teaching mathematics has already changed the lives of tens of thousands of students and parents, with more to come. With a mission to impact the learning trajectories of 100 million students within the next five years, Bhanzu is already changing students’ lives worldwide by cultivating a love for mathematics and learning itself. - Shuvi Shrivastava, Partner at Lightspeed India Allo Health: Transforming sexual wellness in IndiaIn the vast healthcare landscape, some critical areas remain overlooked, overshadowed by stigma and misinformation. Sexual health is one such example. Allo Health, a pioneering digital-first health clinic, has undertaken a noble mission: to destigmatize sexual wellness and extend the reach of quality healthcare to all individuals. Founder Pranay Jivrajka brings deep operating experience, having served as one of Ola’s founding partners. During nearly a decade at Ola, Pranay served as COO and CEO of the company’s food division. Critically, Pranay comes from a family with healthcare experience and has a deep passion for impacting the lives of millions with Allo. So, what does Allo do? The company operates as a comprehensive platform that provides holistic solutions for sexual wellness, from erectile dysfunction to relationship concerns. Its offerings encompass expert consultations, personalized treatment plans, medication supply, diagnostic tests, and discreet healthcare delivery. It does so through a mixture of online and offline interventions. We’ll discuss this in more detail, but first, it’s worth reflecting on why Allo Health’s offering is so needed in India. Bluntly, sexual health concerns are widespread in the country, with over 200 million individuals grappling with disorders like erectile dysfunction and premature ejaculation. This issue becomes even more pronounced as individuals age, impacting a substantial portion of the population between 20 and 55. Unfortunately, the sexual wellness landscape in India faces significant hurdles. One of the primary challenges is the severe shortage of credible clinicians specializing in sexual medicine. India has fewer than 600 (!) trained modern medicine practitioners in this field, meaning there’s limited access to quality care. While effective science-backed treatments exist for sexual disorders, they are often underutilized due to the scarcity of qualified clinicians. Instead, alternative medicines and self-medication have become widespread, fostering misinformation and misconceptions. Allo Health has identified the need and unique opportunity this landscape presents. Pranay’s team has built a powerful and comprehensive system to address the void. The company integrates clinicians into its platform rather than offering placebos or generic solutions. It relies on robust triaging systems, scalable Decision Support Systems (DSS), and training mechanisms, ensuring higher plan conversions and adherence and a robust defense against potential competition. Furthermore, Allo Health's ability to scale across various channels is notable. It seamlessly transitions from online to offline channels, enhancing credibility and setting it apart from potential competitors, utilizing alternative approaches to address similar patient needs. In the Indian landscape, having a hybrid approach is essential: consumers frequently discover healthcare services online, but average order values (AOV) and repeat engagements often involve offline interventions. Allo Health is built for this reality. Pranay's business is riding broader market trends as well as offering a much-needed set of products. Its mission to destigmatize sexual wellness aligns with broader movements in the Indian healthcare ecosystem. As India advances and healthcare access becomes a central concern, innovative companies like Allo Health have the potential to make a profound and lasting impact. Allo is also benefitting from wider trends in India:

Ultimately, we’re excited by Allo Health’s product, potential, and deep focus on patient outcomes. Long-term trust can only happen with a maniacal focus on outcomes. - Pratik Poddar, Partner at Nexus Venture Partners Kiwi: A virtual credit card built on UPIIn India, like elsewhere, credit cards are a much-loved financial product. Monthly card spending has grown 3x in five years to $16 billion today. Issuers love them, too – they are among the most profitable products for Indian banks, offering up to 5.5% net return on assets. That’s why it is puzzling that an economy the size of India has only 30 million credit card holders. Even in a “consuming population” of 400 million, this is tiny. There are three broad reasons why:

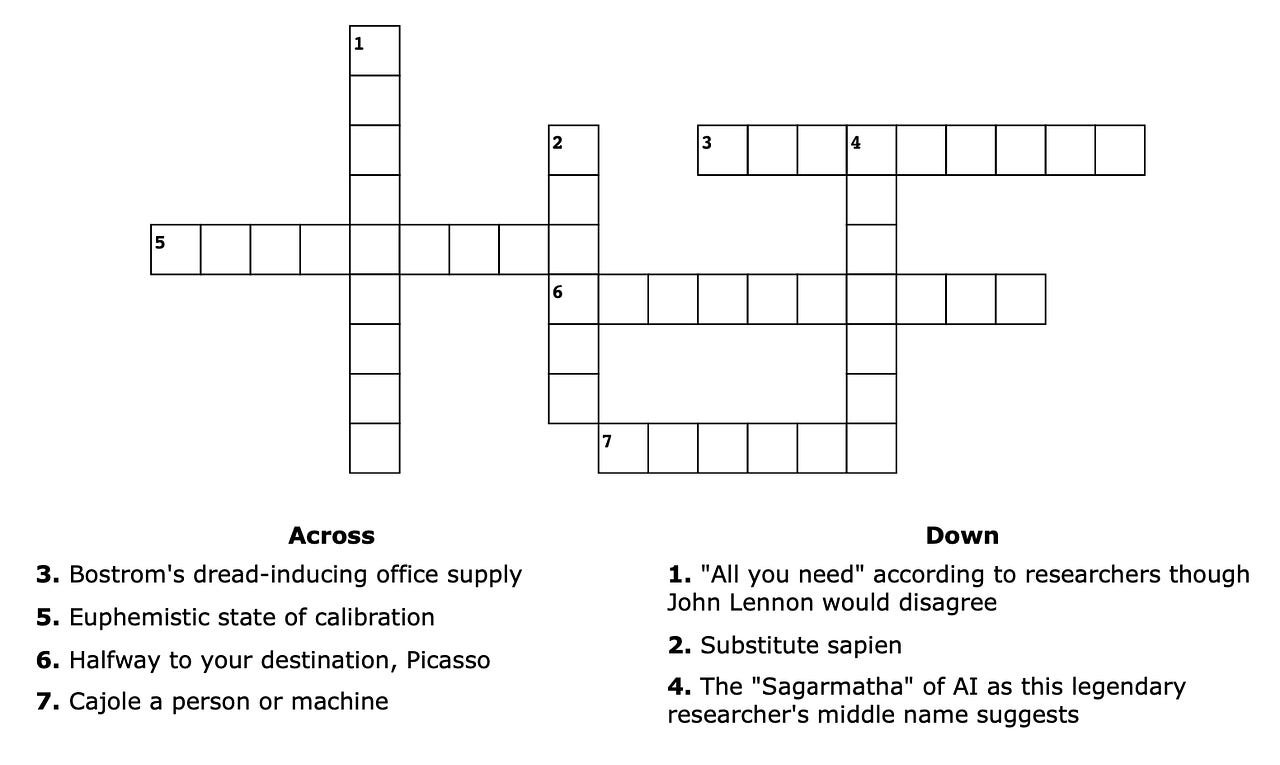

Consequently, credit cards are a bit of a plaything for the rich in India. You can use them at the Apple Store but not to buy Granny Smiths from a street vendor. If only there were a low-cost, low-risk way to take this product to hundreds of millions of Indians! But there is an Indian network that already connects 400 million Indians with 50 million merchants. India’s universal payment network – the Unified Payments Interface (UPI) – processes more than $2 trillion worth of transactions yearly at a fraction of the cost of card networks. Virtually the entire transaction volume on UPI today is for debit transactions, but late last year, India’s central bank opened the network up for credit. Three senior fintech executives – Anup Agrawal, Mohit Bedi, and Siddharth Mehta – took notice. Like most credit card holders in India, they were frustrated that their cards had only an eighth of the acceptance of UPI and were unusable anywhere else. They decided to do something about this with their new company, Kiwi. Kiwi provides its customers with a virtual credit card that works on UPI rails. Their virtual card offers all the benefits of a regular credit card: up to 50 days of interest-free credit, monthly payments, reward points, and merchandise discounts. Unlike a regular credit card, it allows you to scan-and-pay at any of the 50 million UPI merchants. This allows the user to buy a 10-rupee (12¢) cup of chai with their new Kiwi card. Kiwi’s offering unlocks a massive new market for banks. Because the offering works on inexpensive UPI rails and is outside the Visa/Mastercard networks, the transaction costs are much lower and can support smaller-value transactions and users. Low distribution and servicing costs also open up an entire category of low-limit cards for banks, which was previously unviable. Credit is far more monetizable than debit (the regulator allows a charge of up to 1.7% from the merchant depending on transaction size), so it can finally make UPI profitable for banks. The app launched in June and is already seeing a massive transaction velocity – the average user makes 17 monthly transactions on Kiwi and spends $300. Kiwi is expanding its banking partnerships to be able to underwrite new customer segments that never had access to cards previously. Of course, there are risks. It remains to be seen if this UPI credit card is as profitable for issuers as a regular card, because of lower limits and smaller spends on UPI. There will inevitably be competition from more established UPI apps, some of whom will spend vast amounts to market their cards. However, with such a vast network of consumers and merchants to be tapped, credit-on-UPI is a once-in-a-generation opportunity to bring consumer credit to hundreds of millions of Indians. As their seed investors, we are rooting for Kiwi to get there first. - Ritesh Banglani, Managing Partner at Stellaris Venture Partners In case you missed it…Last week, we published an in-depth case study on A24, the New York-based firm behind box office wins like Moonlight, Lady Bird, Hereditary, Uncut Gems, and Midsommar. Indeed, the company behind so many films we’ve enjoyed is arguably as fascinating as the projects it produces. In an industry dominated by slow-moving heavyweights, A24 is the nimble disruptor, bringing a fresh, tech-forward playbook to the world of film. PuzzlerPlus ça change. So the long-time puzzler may respond to this week’s volte-face, presumably while puffing on a cigarette and staring at the Seine. Rather than a riddle, we’re bringing you a piping hot crossword. What do you think? Does the sight of winking word-tiles fill you with a certain ennui or deliver a renewed joie de vivre? Let us know by responding to this email. On that note, today’s mini-crossword is on the theme of artificial intelligence. Send in your answers for the glory of being declared right next week. As for last week's riddle: very well done to Shashwat N, Austin V, Emerson K, Amitoj N, Scott M, Radhika S, Michael O, and Geoff N. All got this puzzler correct:

The answer? A violin. Until next time, Mario PS - A special thank you to Sajith Pai who was instrumental in making this piece a reality. As well as being a wonderful investor, he is an excellent writer and thinker. You can find his work here. __ See important disclosures at masterworks.com/cd You're currently a free subscriber to The Generalist. For the full experience, upgrade your subscription. |

Older messages

A24: The Rise of a Cultural Conglomerate

Friday, September 22, 2023

The indie studio is behind some of Hollywood's biggest hits and critical darlings. It has designs on becoming media's answer to LVMH.

Modern Meditations: Rebecca Kaden (Union Square Ventures)

Sunday, September 17, 2023

The Union Square Ventures managing partner on stories, ancient structures, and technological salvation.

Life in a Kingdom of Dangerous Magic

Sunday, September 10, 2023

Or, why regulating artificial intelligence is so difficult.

Introducing our newest writer

Thursday, August 31, 2023

Welcoming a fresh voice to The Generalist and what that means for readers.

Modern Meditations: Claire Hughes Johnson

Sunday, August 20, 2023

The Stripe executive on leadership, linguistics, and literature.

You Might Also Like

🚀 Ready to scale? Apply now for the TinySeed SaaS Accelerator

Friday, February 14, 2025

What could $120K+ in funding do for your business?

📂 How to find a technical cofounder

Friday, February 14, 2025

If you're a marketer looking to become a founder, this newsletter is for you. Starting a startup alone is hard. Very hard. Even as someone who learned to code, I still believe that the

AI Impact Curves

Friday, February 14, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. AI Impact Curves What is the impact of AI across different

15 Silicon Valley Startups Raised $302 Million - Week of February 10, 2025

Friday, February 14, 2025

💕 AI's Power Couple 💰 How Stablecoins Could Drive the Dollar 🚚 USPS Halts China Inbound Packages for 12 Hours 💲 No One Knows How to Price AI Tools 💰 Blackrock & G42 on Financing AI

The Rewrite and Hybrid Favoritism 🤫

Friday, February 14, 2025

Dogs, Yay. Humans, Nay͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 AI product creation marketplace

Friday, February 14, 2025

Arcade is an AI-powered platform and marketplace that lets you design and create custom products, like jewelry.

Crazy week

Friday, February 14, 2025

Crazy week. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

join me: 6 trends shaping the AI landscape in 2025

Friday, February 14, 2025

this is tomorrow Hi there, Isabelle here, Senior Editor & Analyst at CB Insights. Tomorrow, I'll be breaking down the biggest shifts in AI – from the M&A surge to the deals fueling the

Six Startups to Watch

Friday, February 14, 2025

AI wrappers, DNA sequencing, fintech super-apps, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How Will AI-Native Games Work? Well, Now We Know.

Friday, February 14, 2025

A Deep Dive Into Simcluster ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏