Net Interest - Guardians of the Rich

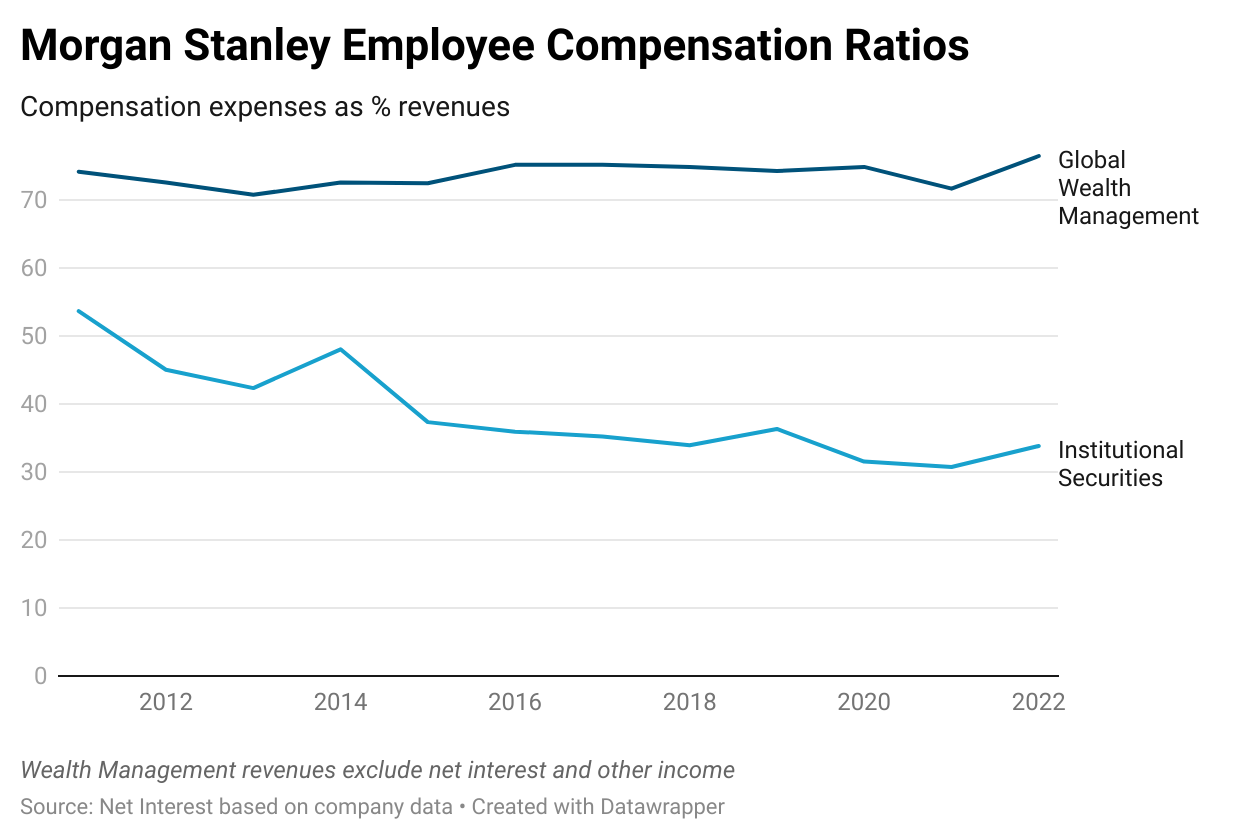

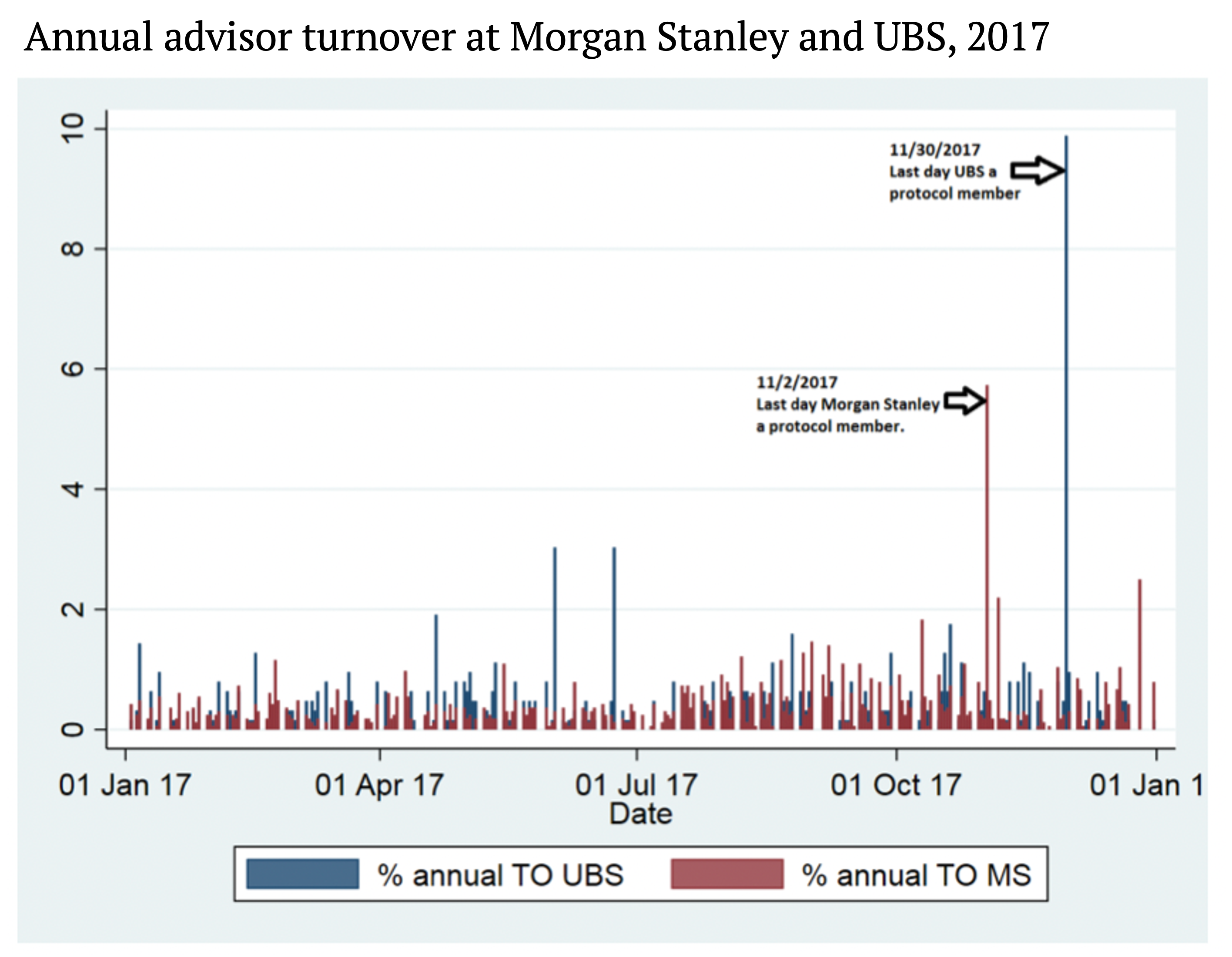

There are around 22.7 million dollar millionaires in America. In aggregate, they sit on almost $100 trillion of wealth. That’s a lot of money, and not all of those millionaires are equipped to deal with it, so they hire financial advisors to help them. Based on the most recent data, 330,000 personal financial advisors operate across the US. It’s a strange job, being a personal financial advisor. While it requires expertise in financial planning and knowledge of investment products, it also requires a mastery of psychology. People have diverse relationships with money, not necessarily logical and not always consistent. Financial advisors understand that. “Being a great advisor is all about understanding clients’ hopes, dreams, and fears,” says one. That makes it very personal. Like other jobs in financial services, providing financial advice is heavily trust-oriented, but whereas in other areas of the industry trust has become increasingly institutionalised, that’s less apparent in wealth management. Brand matters, and a small number of well-known firms dominate the industry, but a customer’s relationship is typically with their advisor rather than with the firm. “More than investment performance or asset allocation, your empathy and personal connection with your client will make all the difference in the world,” says the same financial advisor. “Nothing will replace empathy and personal connection.” This dynamic heavily influences the economics of the profession. One of the key trends in the institutional segment of the industry over the past ten years or so has been a shift in the balance of power between employee and firm. It used to be that a top research analyst or institutional salesperson could negotiate an escalating pay package by switching between firms. A combination of technology and capital discipline changed that. Stricter regulation around capital forced firms to account for its cost more diligently at the same time as they have had to invest more in technology. As a result, the share of revenue taken home by institutional employees has fallen. In Morgan Stanley’s case, the share declined from 45% in 2012 to 34% in 2022. Financial advisors, by contrast, have been able to command a stable, even increasing, share of revenue. Unlike colleagues on the institutional side of the business, they are paid an explicit share of the revenue they bring in. The model stems from the days of the retail stockbroker, when brokers would take a cut of the commissions they generated. Recognising that this placed a big wedge between the interests of brokers and the interests of their customers, Merrill Lynch shifted towards a fee structure in the 1990s where clients pay according to the assets they maintain at the firm rather than on the turnover of their portfolio. Nevertheless, the principle of revenue-sharing remained. At Morgan Stanley, financial advisors take home between 20% and 55.5% of the revenues they produce. The individualised nature of the business creates challenges for large firms. Financial advisors can build up a lot of autonomy. Raj Sharma, the source of the quotes above, has been a wealth advisor at Merrill Lynch (now Bank of America) for 36 years. He had a lot of doctors in his family growing up and used that as the foundation for a business providing financial advice to medical professionals. Later in his career he shifted focus towards corporate executives with stock options and, as his client list grew, he gradually raised his minimum threshold from $1 million to $2.5 million, then to $5 million and finally to $10 million. He currently manages around $5.6 billion of client assets. “As an advisor, you are an entrepreneur in the truest sense of the word,” he says. “Nobody hands you clients on a gilt-edged platter – you must convert prospects into clients and build a team that can serve your clients effectively to accomplish their goals and dreams.” Bank of America provides support, but as far as clients are concerned, they are with “the Sharma Group” rather than Bank of America. This is reflected in a stand-alone website hosted by the bank. Sharma’s personal brand is heightened by his standings in league tables of wealth advisors. Forbes recently placed him tenth nationwide and number one in Massachusetts. Among the top 250, Sharma is a big fish, but he’s by no means the biggest. A Menlo Park based team at Morgan Stanley manages $44.9 billion of client assets and many teams manage $10 billion+. Sharma has been at Bank of America for a long time and, having written a book about his experiences, he seems unlikely to move. But other teams do move, their personal brand giving them scope to take clients with them. A recent research paper suggests that when advisors change firms, 40% of client assets typically follow. For some advisors, this can be quite lucrative. An advisor generating $400,000 a year in fees is eligible for $128,000 in compensation at UBS, say, but could get more elsewhere. The same level of production would be worth $144,000 at Morgan Stanley, $162,000 at Bank of America and $184,000 at Stifel. “If Stifel’s entrepreneurial culture and lack of red tape wasn’t convincing enough, let us put our money where our mouth is,” says Stifel in its marketing literature. In addition, signing-on bonuses can be generous. Firms offer new hires loans at attractive rates linked to the revenues they bring in. These loans have maturities of up to 12 years and are forgiven over that time – an incentive for the new hire to stick around. Loan terms vary between firms but amounts disbursed can be as large as 3-4 times annual production revenues. So an advisor doing $400,000 a year of revenue could lock in a payout of $1.2–1.6 million. As at the end of June, Morgan Stanley had $4.3 billion of such loans on its balance sheet. Assuming they are half-way through their life (remaining repayment term averages 5.9 years), some $2.5 billion of revenue may have been recruited via these loans, equivalent to around 10% of wealth management revenues. Given this dynamic, it’s no surprise that financial advisors jump around. Historically, around 12% of advisors have changed firms every year. Morgan Stanley just lost “the Francis Group” – a California-based team overseeing $1.2 billion of client assets – to independent firm LPL. The same week, it recruited “the Harris Rao Group” from Bank America, an Arizona-based team managing $630 million of assets. Last year, it produced a recruitment video aimed at wooing advisors away from Bank of America. In the past, firms would legislate heavily to prevent advisors taking clients with them, but this became an expensive, zero-sum game – a “circular firing squad” – and so in 2004, three large firms set up what they called the Protocol for Broker Recruiting. It was designed as a ceasefire and allowed departing advisors to take with them basic client information such as name, address and telephone number, although not documentation. However, the benefits of the scheme soon tipped in favour of smaller firms. At its peak, the accord had 1,700 firms signed up, but smaller firms, including many new independent firms, would opportunistically join to make a strategic hire before dropping out. Beginning to lose more advisors than they were recruiting, the large firms, led by Morgan Stanley, withdrew.

In its place, firms have begun to legislate again. Earlier this year, JPMorgan asked a court to order one of its former employees to stop poaching customers for his new employer, Morgan Stanley. The advisor had a $161 million book of business, and had taken $28 million with him before JPMorgan shot back. Firms have also introduced deferred compensation agreements. Depending on the revenue produced by the advisor, a proportion of the associated compensation is put aside for a few years. A $400,000 producer at Morgan Stanley would have 3.5% of their compensation deferred; a $4 million producer would have 14% deferred. A group of former Morgan Stanley advisors is currently pursuing a class action case against the firm for withholding payments after they left. With so much of the business invested in assets that walk out the door each day, it’s a wonder that it is considered so attractive. Morgan Stanley has made growth in wealth management a central plank of its strategy over the last ten years, and it’s paid off – its stock has outperformed over the period and its valuation stands at a premium to Goldman Sachs. Part of it is that wealth management is a lot less capital intensive than the institutional securities business, throwing off 1.5 times more profit per unit of equity. It is also more stable, its profit before tax demonstrating half the variance of institutional securities earnings. But how does Morgan Stanley harness the pull of a bunch of autonomous teams into a coherent growth strategy? How does it reconcile the interests of its advisors with those of the overall firm?... Subscribe to Net Interest to read the rest.Become a paying subscriber of Net Interest to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

Out with the Old

Friday, September 22, 2023

The Changing Face of the Insurance Industry

Peak Pod

Sunday, September 17, 2023

The Industrialisation of Alpha

The Five Families

Friday, September 8, 2023

Inside the Brokerage Industry

Rising Beta

Friday, August 25, 2023

Plus: Beal Bank, Sculptor

LTCM: 25 Years On

Friday, August 18, 2023

The (real) reasons Long-Term Capital Management failed

You Might Also Like

Longreads + Open Thread

Saturday, March 8, 2025

Personal Essays, Lies, Popes, GPT-4.5, Banks, Buy-and-Hold, Advanced Portfolio Management, Trade, Karp Longreads + Open Thread By Byrne Hobart • 8 Mar 2025 View in browser View in browser Longreads

💸 A $24 billion grocery haul

Friday, March 7, 2025

Walgreens landed in a shopping basket, crypto investors felt pranked by the president, and a burger made of skin | Finimize Hi Reader, here's what you need to know for March 8th in 3:11 minutes.

The financial toll of a divorce can be devastating

Friday, March 7, 2025

Here are some options to get back on track ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Too Big To Fail?

Friday, March 7, 2025

Revisiting Millennium and Multi-Manager Hedge Funds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The tell-tale signs the crash of a lifetime is near

Friday, March 7, 2025

Message from Harry Dent ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👀 DeepSeek 2.0

Thursday, March 6, 2025

Alibaba's AI competitor, Europe's rate cut, and loads of instant noodles | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March 7th in 3:07 minutes. Investors rewarded

Crypto Politics: Strategy or Play? - Issue #515

Thursday, March 6, 2025

FTW Crypto: Trump's crypto plan fuels market surges—is it real policy or just strategy? Decentralization may be the only way forward. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What can 40 years of data on vacancy advertising costs tell us about labour market equilibrium?

Thursday, March 6, 2025

Michal Stelmach, James Kensett and Philip Schnattinger Economists frequently use the vacancies to unemployment (V/U) ratio to measure labour market tightness. Analysis of the labour market during the

🇺🇸 Make America rich again

Wednesday, March 5, 2025

The US president stood by tariffs, China revealed ambitious plans, and the startup fighting fast fashion's ugly side | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March

Are you prepared for Social Security’s uncertain future?

Wednesday, March 5, 2025

Investing in gold with AHG could help stabilize your retirement ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏