Millennials and Boomers are Competing for Homes. Guess Who’s Winning.

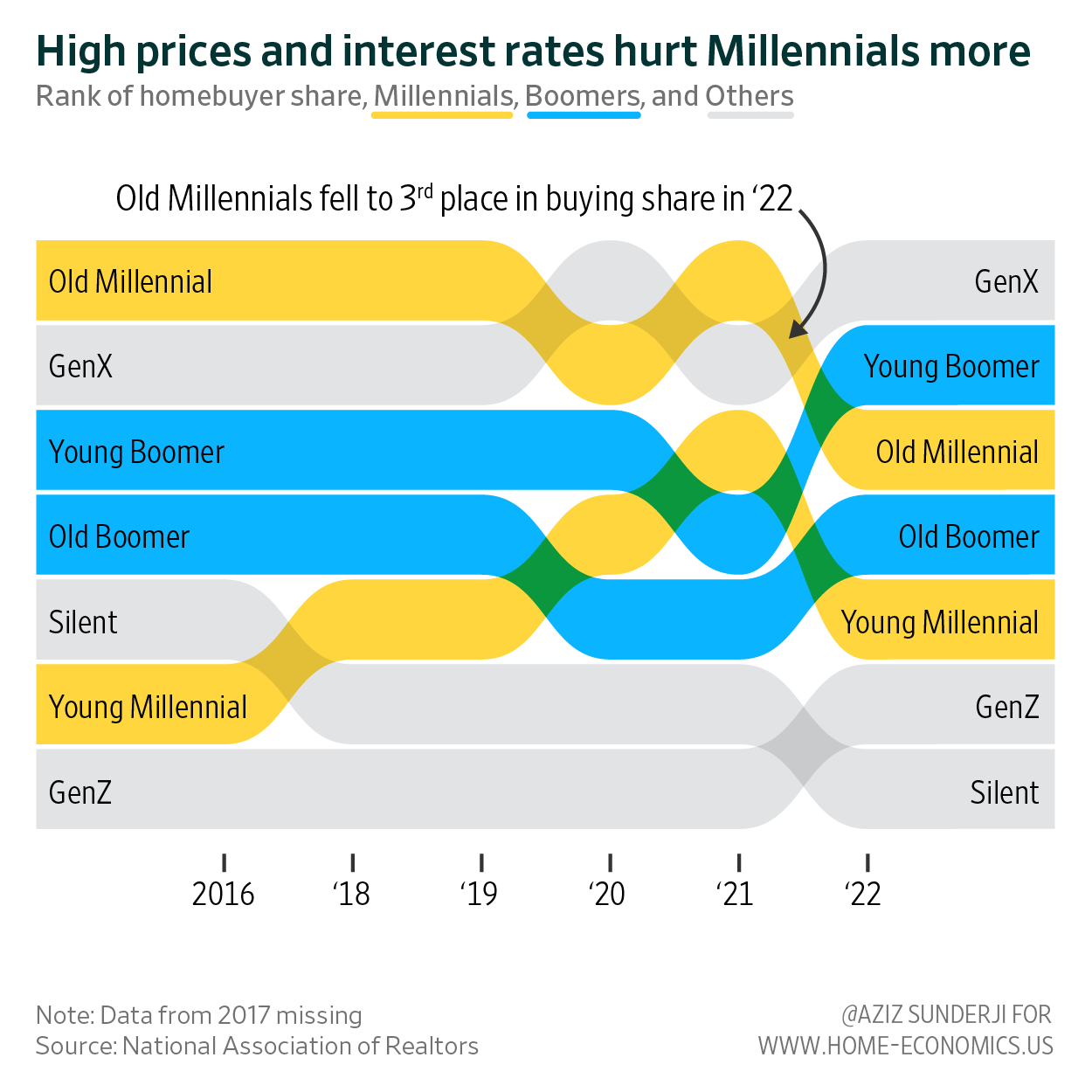

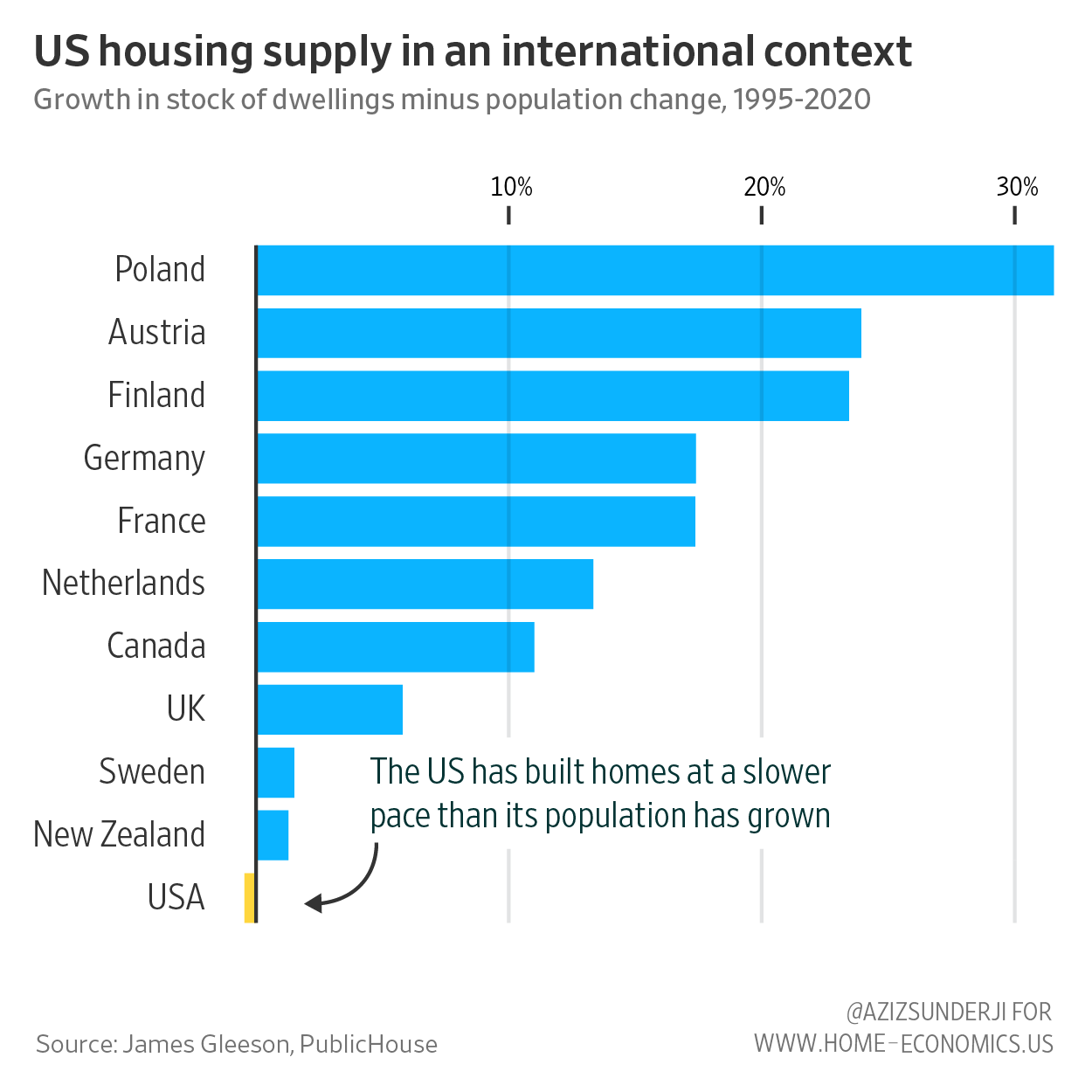

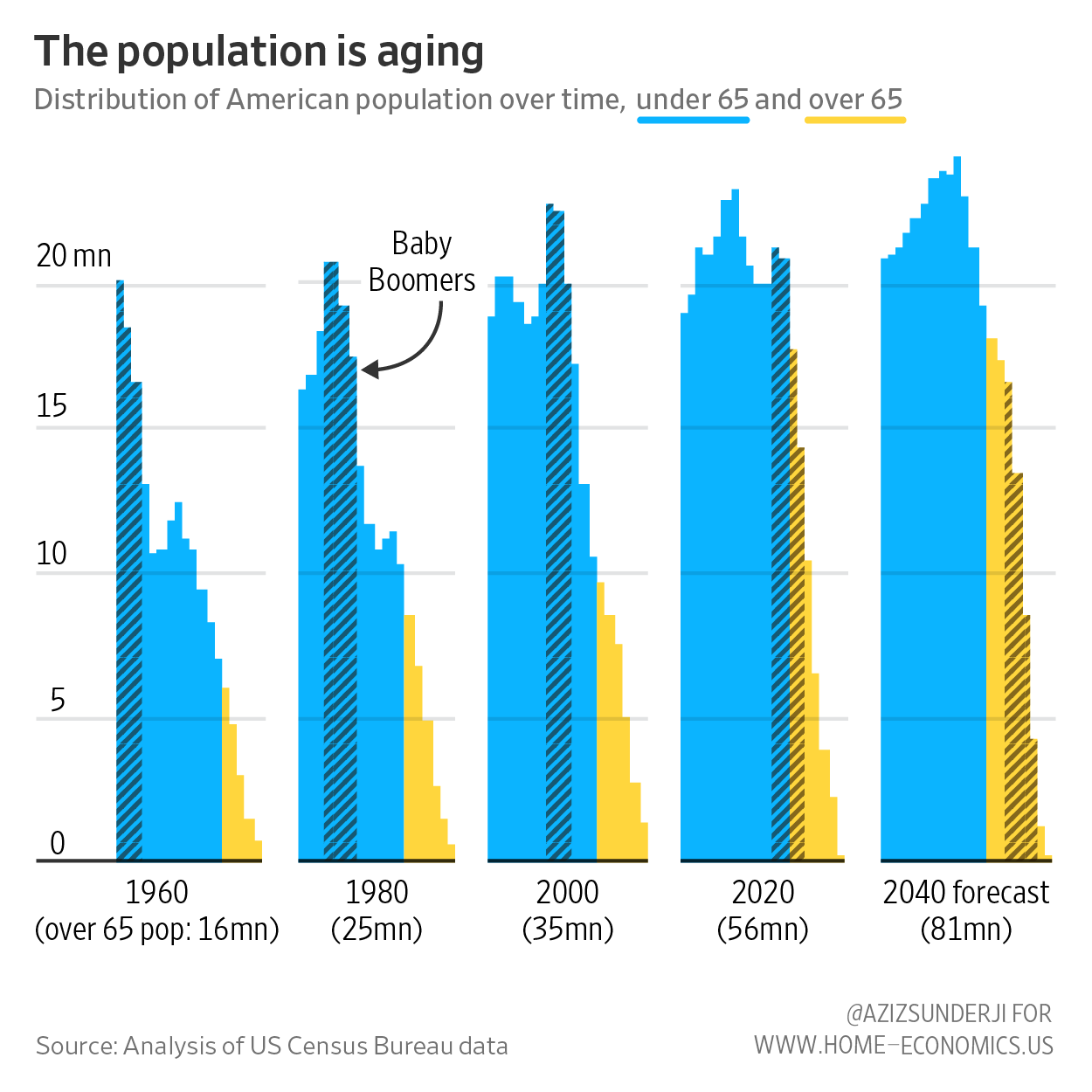

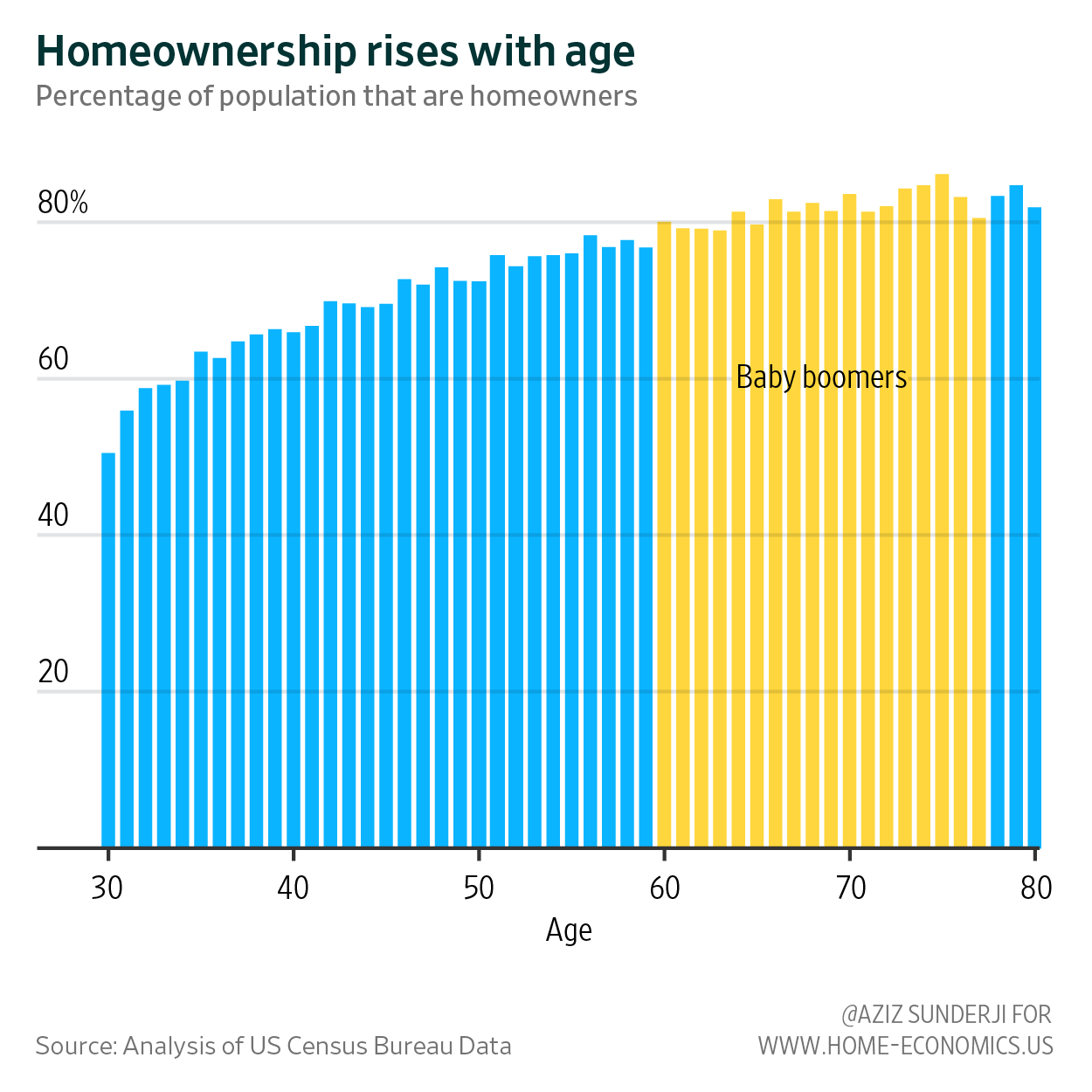

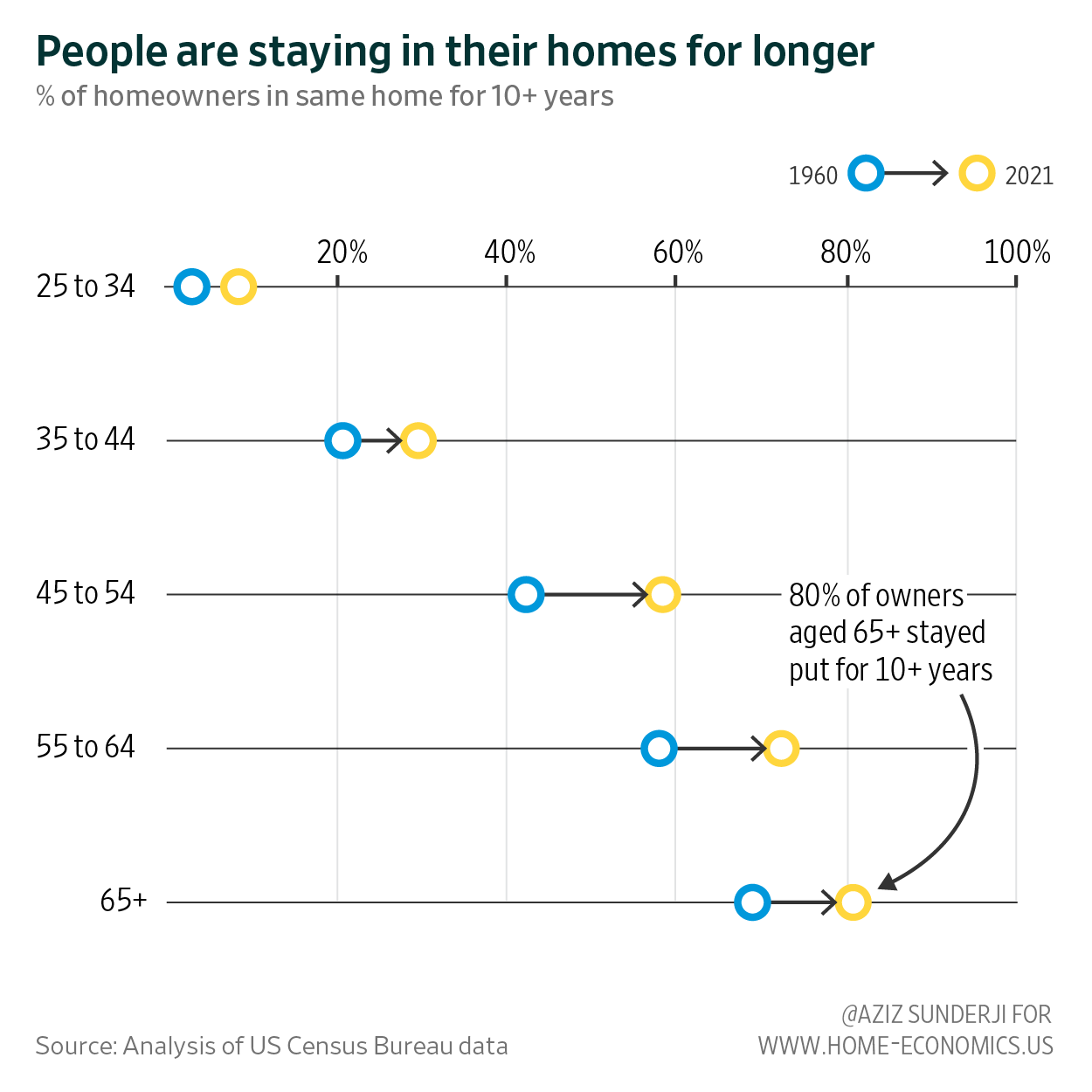

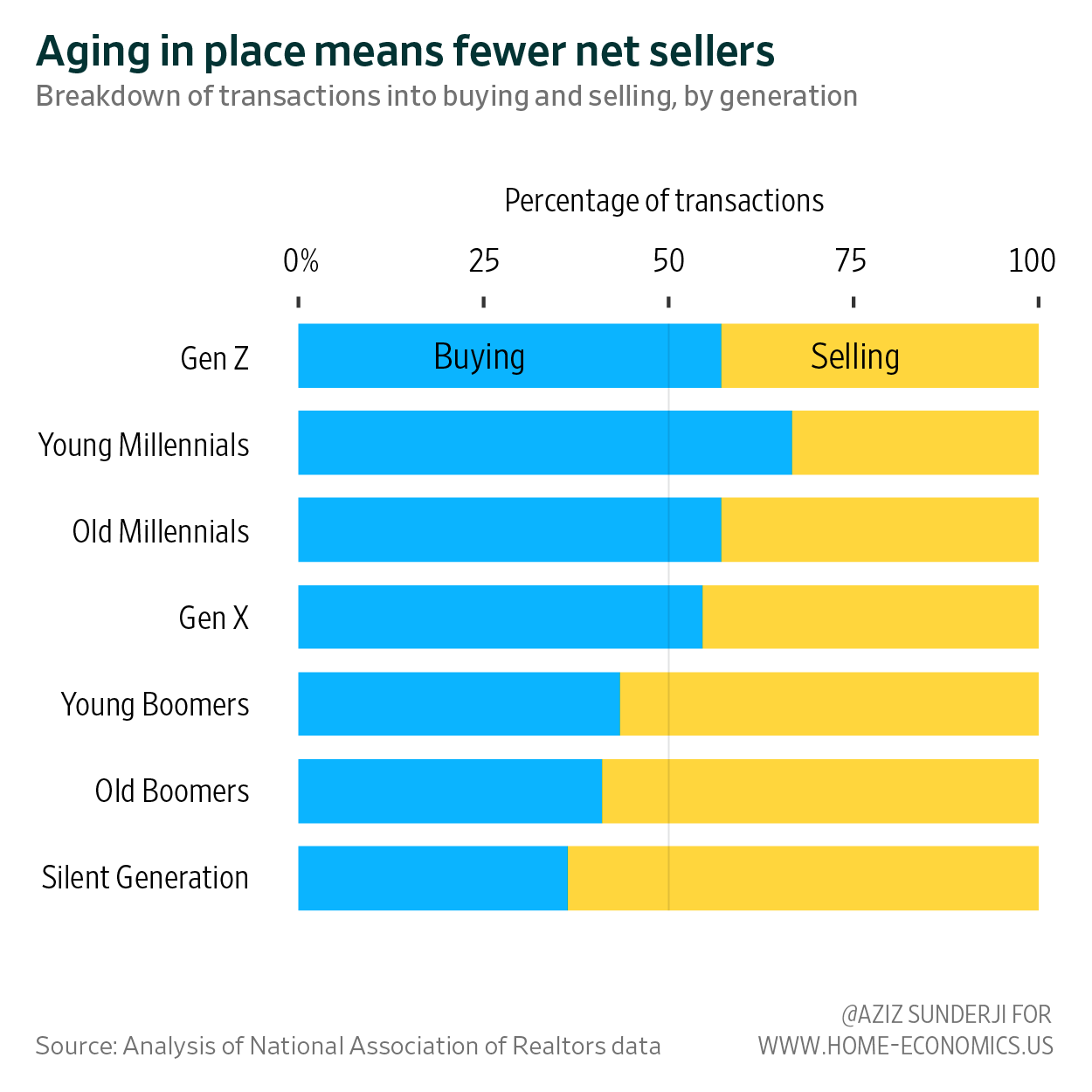

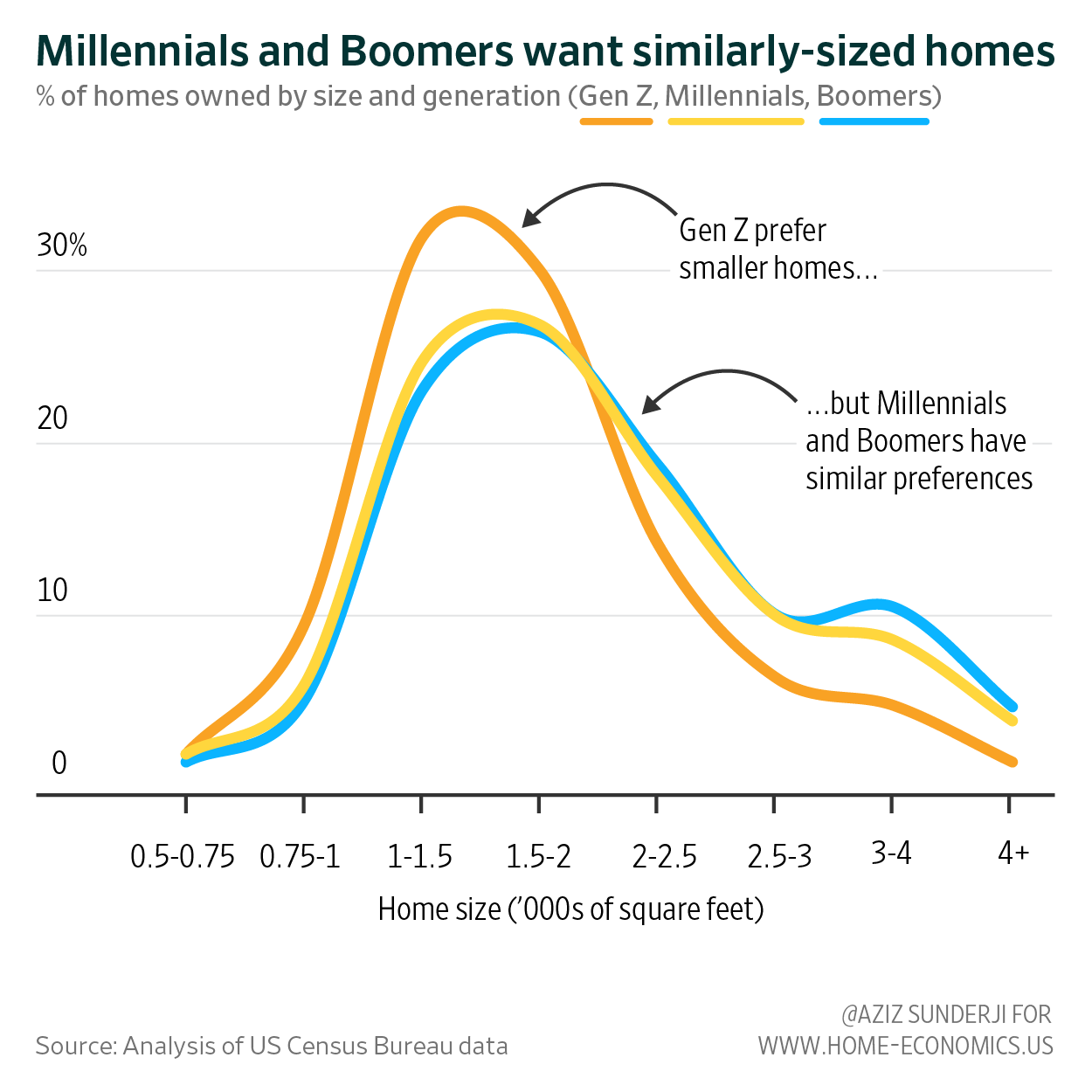

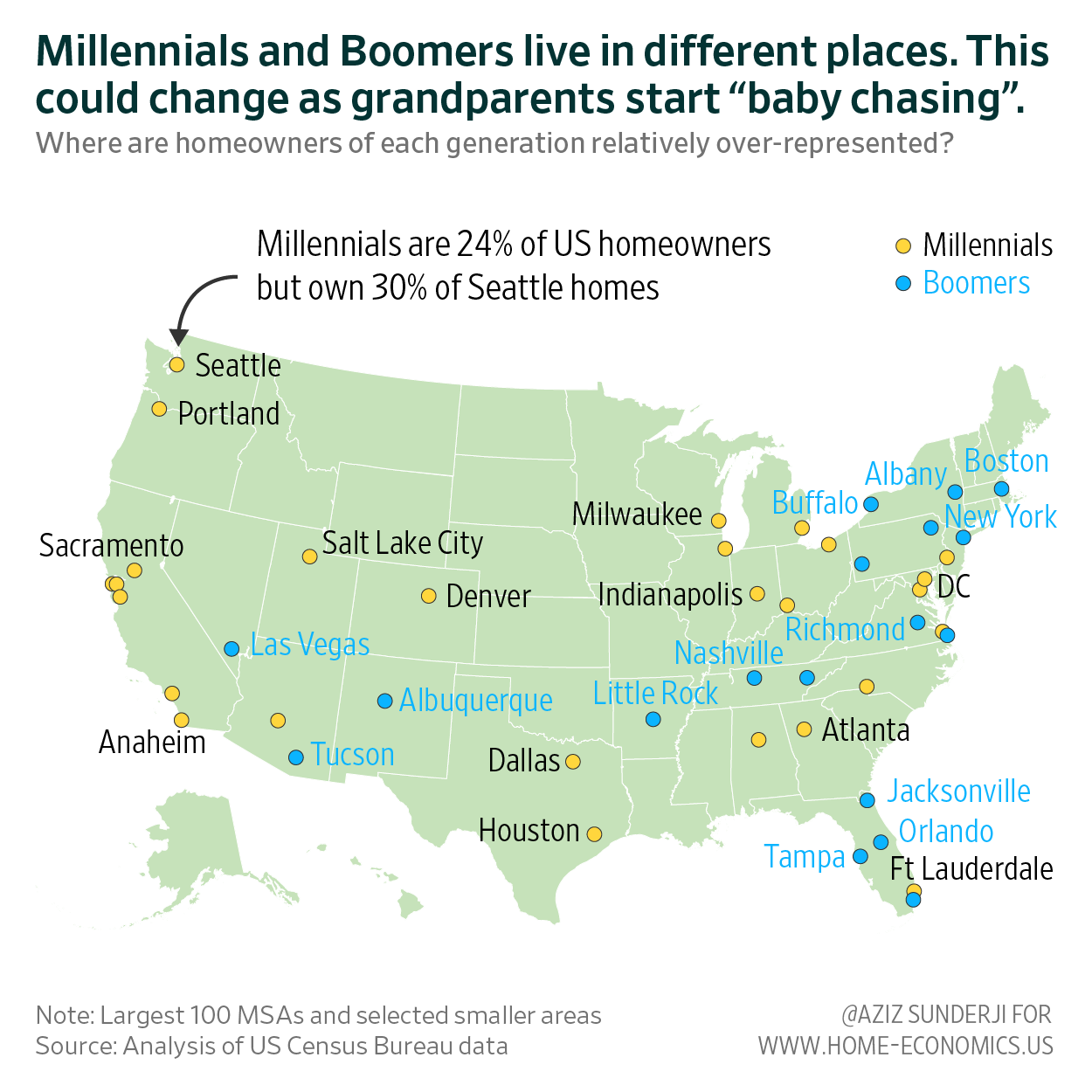

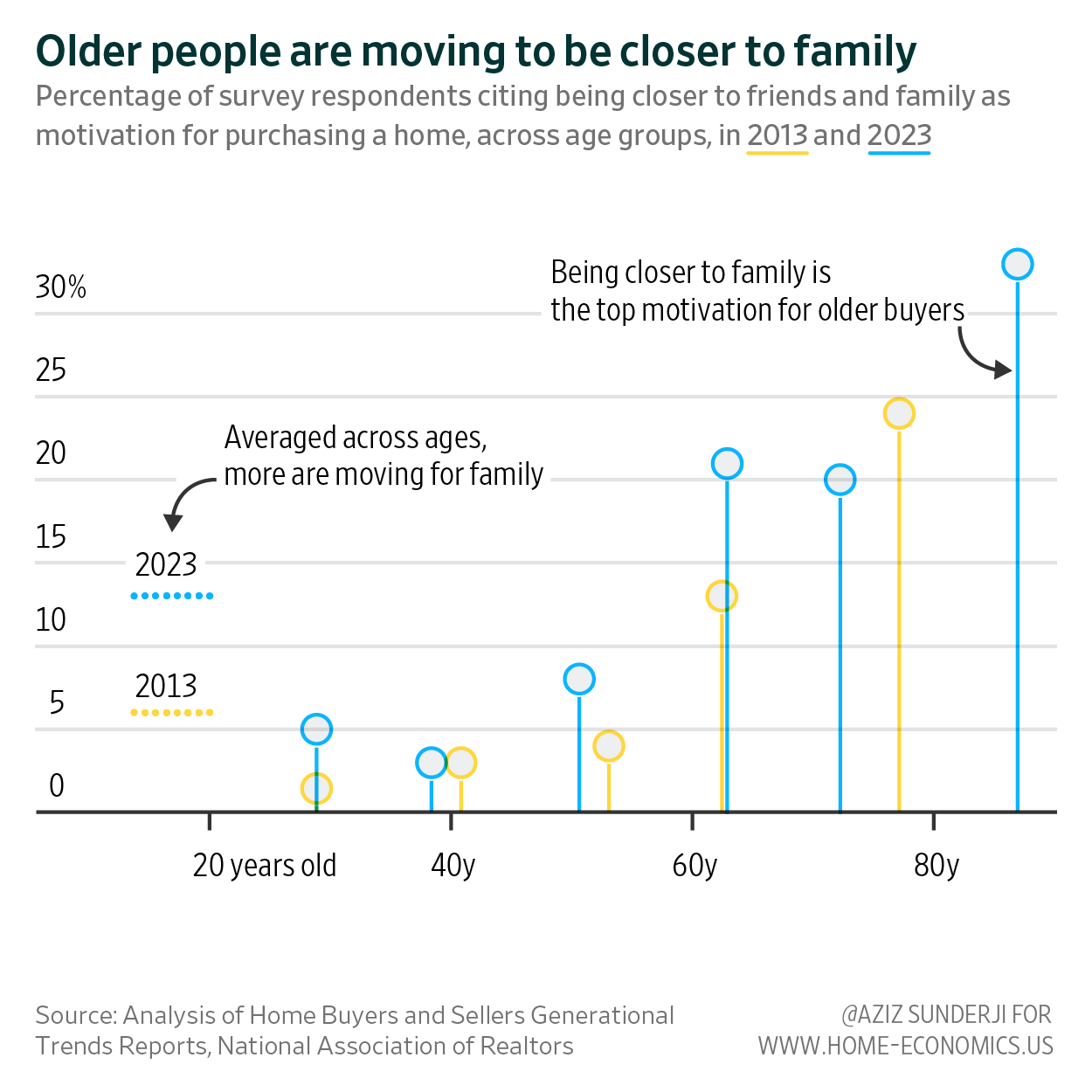

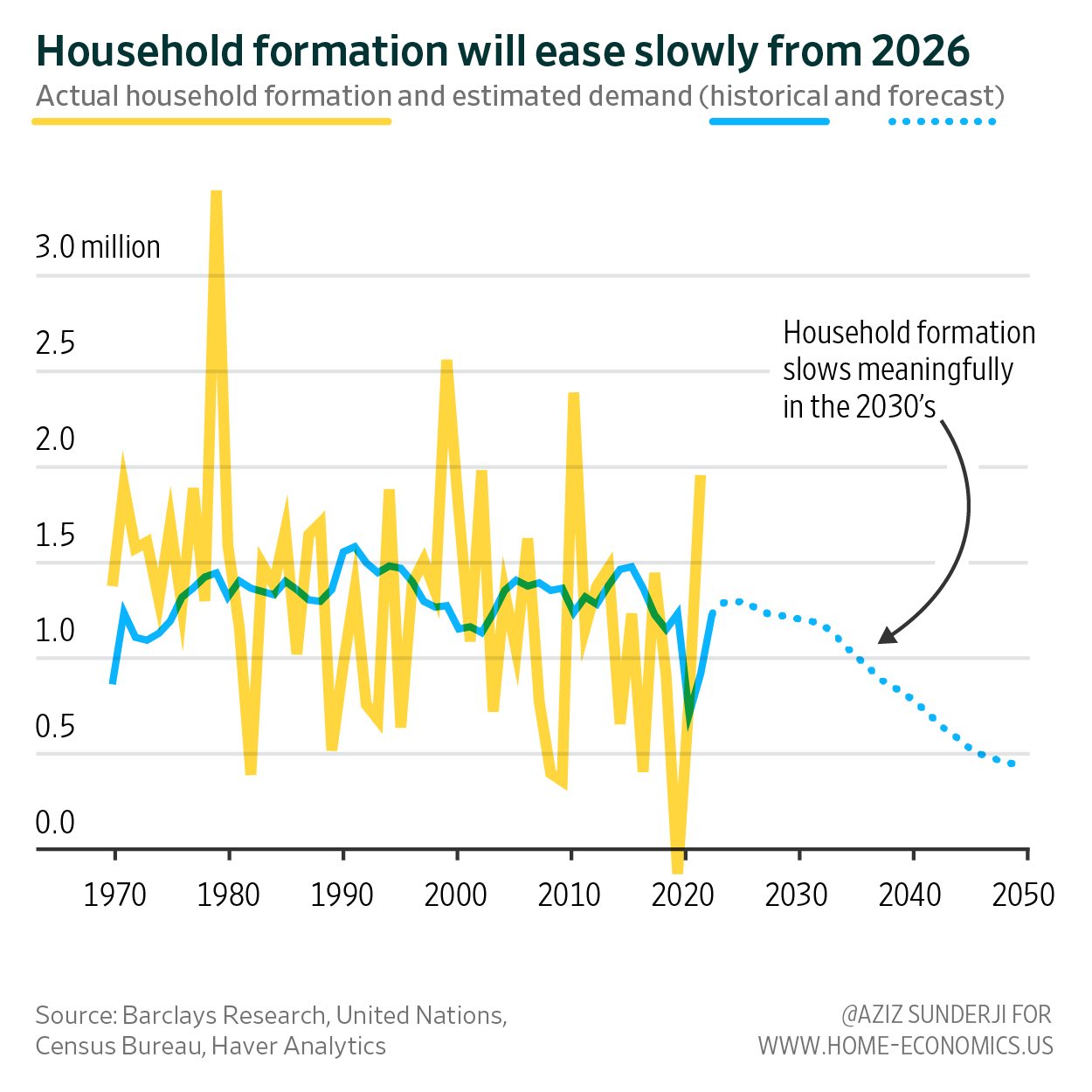

Millennials and Boomers are Competing for Homes. Guess Who’s Winning.Rising prices, high rates, and demographics are reversing Millennial gainsHi! I’m Aziz. My newsletter contextualizes America’s housing market using data visualization—hit reply and let me know what you think. This article was original published in the Financial Times on Oct 5, 2023. Home Economics paying subscribers can access the charts and data here. There has been a lot of hand-wringing about young people falling behind prior generations in terms of homeownership. This was true in the years following the Great Financial Crisis. It’s not anymore. Between 2013 and 2019, the vanguard of the Millennials (“older millennials”)—those born between 1980 (the same year as Kim Kardashian) and 1989 (the same year as Taylor Swift)—were the largest share of homebuyers. On the eve of the pandemic, Millennial homeownership was above 60%—a similar rate to where Gen X was at their age. But the headwinds that perennially buffet aspiring young homeowners—big down payments and high monthly costs compared to incomes—are now gusting more strongly. In 2022, older Millennials bought fewer homes than either Gen Xers or Boomers. Even if prices stabilize and interest rates decline, Millennials will find it harder to continue to make inroads into homeownership. That’s because a major demographic shift underlying the tight housing market—increasing competition for homes from aging Boomers—won’t recede for years. To be fair, it’s rarely never been a worse time to be a prospective home buyer of any generation. Mortgage rates haven’t been this high since 2000. Home prices have climbed 30% over the past three years. As a result, affordability has tanked. Adding to the misery, there are unusually few homes on offer. Would-be sellers are reluctant to give up their pre-2022 cheap mortgages and reset at current, much higher rates. This is exacerbating the dearth of supply resulting from decades of under-building for a growing population. But Millennials have it worseUnfortunately, two factors have made homeownership especially difficult for young buyers today. The first is the unusual acceleration in home prices—they’ve climbed at a pace not seen since the early 1970s. That’s a challenge for younger people in particular, most of whom are first time buyers and have no equity to roll into the transaction. In recent years, 70 per cent of Millennials climbing onto the property ladder have been first-time buyers. A second factor that prior generations didn’t have to contend with is today’s unique demographics—this is the tectonic force influencing housing supply and demand. Boomers are ageing, and making it much harder for their children to buy a home. Retirement? Yes. Retirement home? No. At first glance, one might have thought that an aging population would mean a big cohort of older people looking to exit home ownership—to move in with family, into a retirement home, or a smaller rental. This would lead to a drop in demand. But Census data show that homeownership increases with age. Only at the ripe old age of 75 do Americans evince a declining desire to own their home. Sure, some older people are unable or unwilling to cope with the demands of home ownership, but this is far outweighed by the desire and ability of others of that same generation to own the home they live in. Household formation is the dominant driver of home demand, and it’s the over 65 cohort driving the bulk of household formation—recently, and in years to come—rather than Millennials. Ageing in place Older people are also living in their current homes longer than they used to. While this is true across ages, the trend is most pronounced for older households. In 2021, 80 per cent of homeowners over the age of 65 had lived in their homes for more than 10 years. Whether by choice or necessity, fewer Boomers are moving into retirement homes and other forms of elderly community living. More of them are “ageing in place”. This has a larger effect on supply and prices than other factors like “mortgage lock-in”. Housing is a game of musical chairsIf this sounds surprising, consider the difference between a young seller delaying putting their home up for sale due to mortgage lock-in, and an older seller deciding to delay their sale because of ageing in place. Young and middle-aged sellers are usually buyers of another home—their home listings add gross supply, but not net supply. But when an older person lists their home, they are more likely to be exiting the market entirely—in the process, providing the market with net supply (the same as a new unit of construction). A declining number of older sellers removes this source of net supply and puts more pressure on prices than a younger buyer staying put. If housing is mostly a game of musical chairs, mortgage lock-in slows the music down: it results in fewer transactions. But when an older person decides not to sell, it’s like removing a chair from the game. The players left standing are disproportionately younger buyers. The common battlegroundAside from their lower incomes and home equity, there is another reason younger buyers are bearing the brunt of Boomers ageing in place: the two are in competition for the same kinds of homes. Whereas Gen Z buyers tend to look for smaller dwellings (under 1500 square feet), Millennials are now starting families and want homes that are 1500 to 2000 square feet. Meanwhile, though most Boomers no longer have kids at home, they show no desire to downsize—they also tend to live in 1500-2000 sq ft homes. As Jessica Lautz, the deputy chief economist of the National Association of Realtors, recently told The Hill, “boomers are not downsizing and Millennials—first-time buyers in particular—are buying later in life. This puts both generations of buyers in head-to-head competition for similarly sized properties”. Millennials get some reprieve from the fact that Boomers have—so far—largely bought in different cities from those that younger buyers have flocked to. US Census data shows there is little overlap between the metro areas in which Millennials and Boomers own a higher share of homes than their population weight. Boomers are over-represented in cities in Florida like Orlando and Tampa, sleepy sunbelt towns like Little Rock and Albuquerque, and expensive north-east cities like New York and Boston. Millennials cluster in natural playgrounds like Salt Lake City and Denver, culturally vibrant smaller cities like Portland, and affordable second-tier cities like Milwaukee and Sacramento. This could now change: Boomer and Millennial hotspots are set to converge, for two reasons. Firstly, Millennials are now mostly in their 30s, and they’re displaying the same proclivities towards suburban living as prior generations at that age. Remote working suggests that, if anything, this trend will accelerate. And, as they move to the suburbs, Millennials are competing with the majority of Boomers who live in medium and low density metro areas. Second, Millennials and Boomers are increasingly moving to the same cities. In recent years, the most commonly cited reason for Boomers to move is that they want to be closer to their kids and grandkids. In a recent NAR survey, 20 per cent of 68 to 76 year old buyers said proximity to family was a motivation for their move. Family was the most frequently cited reason—far more than, for example, better weather (which was cited by only 4%). This has prompted some real estate economists to develop “baby chaser” indices. They identify cities—mostly in the South, like Austin, Dallas, Charlotte, and Jacksonville—where both Millennial and Boomer populations are now rapidly rising. Family proximity is a less meaningful driver for younger households. But—perhaps driven by the rising cost of hiring childcare—being close to family and friends has been growing in importance, even amongst Millennials, over time. Relief is in sight, but not until Millennials are middle-agedIn some respects, it’s hard to estimate exactly when things will improve. Most economic forecasters expected a recession by the end of this year. This would have led to Fed cuts, lower mortgage rates, less mortgage lock-in, and lower demand. For those with still-strong-enough financials to buy a home, a recession would have relieved some of the pressure on affordability. A downturn now seems much less likely, at least in the near term. But to the extent that a lot of the affordability problem in the housing market stems from demographic change—which is slow-moving and predictable—we can quite precisely estimate when things will improve. The answer is 2026. That’s when forecasters predict the swell of demand for household formation coming from Boomers will peak and then gently start to decline, before decelerating more rapidly in the 2030s (the Barclays forecast is shown below). If this coincides with accelerating construction (perhaps catalyzed by the growing clout of the YIMBY movement), prices might grow more slowly than incomes for an extended period of time. This doesn’t help the average Millennial much, since she will be in her late 30s by then. But, what Marty McFly said in Back to the Future about Rock and Roll music applies to Millennial housing affordability today: "I guess you guys aren't ready for that yet. But your kids are gonna love it." Paying subscribers can access the charts, detailed sources, and underlying raw and calculated data on the Home Economics data sets page. Thanks for reading. If you’d like to support my work, please follow me on Twitter and consider becoming a paying subscriber. |

Older messages

Visualizing Home Sales

Friday, September 22, 2023

Untangling seasonality without losing the plot

Why Denmark's Housing Market Works Better than Ours

Wednesday, September 20, 2023

Danish borrowers can buy back their loans at market prices

One Explanation for Booming US Growth

Monday, September 11, 2023

Weak home construction was hurting the economy last year—not anymore

Home Price Whiplash

Tuesday, September 5, 2023

A normal housing cycle plays out over a decade. This one took three years.

Inventory Squeeze to get even Squeezier

Friday, August 25, 2023

People are aging and staying in their homes longer

You Might Also Like

Where are you now?

Wednesday, January 15, 2025

Where do you want to be? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

WIN $2,500 to put toward your very own warm weather getaway!

Wednesday, January 15, 2025

Warm Weather Getaways Sweepstakes

Tinee, But Part Of The Story

Wednesday, January 15, 2025

What Do You Think You're Looking At? #197 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

treehouse

Wednesday, January 15, 2025

on endings ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Why Didn't Voters Care About Biden's Many Accomplishments?

Wednesday, January 15, 2025

Biden did a lof of really important things, yet the public never gave him any credit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What I’m Re-Reading, No.1

Wednesday, January 15, 2025

On Arendt, Céline, Juvenilia Studies ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Duck face walked so this pout could run

Wednesday, January 15, 2025

— Check out what we Skimm'd for you today January 15, 2025 Subscribe Read in browser Header Image But First: Did Travis spill some Taylor tea? Update location or View forecast Quote of the Day

“Centaur over Tomer Butte” by Robert Wrigley

Wednesday, January 15, 2025

Tomer Butte, named for George Washington Tomer, January 15, 2025 donate Centaur over Tomer Butte Robert Wrigley Tomer Butte, named for George Washington Tomer, who arrived in 1871 to formalize its

#66: What The Notches Said – No. 06

Wednesday, January 15, 2025

Interview with 'Z', who's from my səxual past ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Katie Holmes’ Monochrome Outfit Debuts Winter’s New *It* Color

Wednesday, January 15, 2025

We're major fans. The Zoe Report Daily The Zoe Report 1.14.2025 Katie Holmes' Monochrome Outfit Debuts Winter's New *It* Color (Celebrity) Katie Holmes' Monochrome Outfit Debuts