Understanding Flooring Protocol: A New NFT Fragmentation Solution, Pondering Rare NFT Liquidity

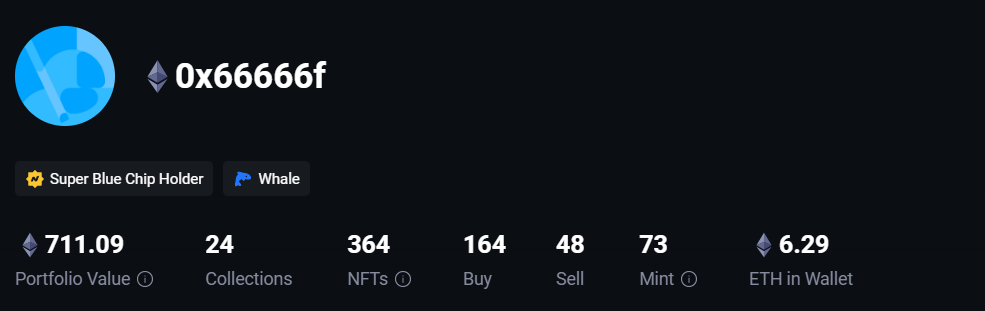

Author: defioasis On October 15th, the NFT liquidity solution Flooring Protocol went live. By fragmenting NFTs into ERC-20s, it quickly attracted participation from Azuki Elementals, Pudgy Penguins, and y00ts holders (currently supporting only these three NFT collections). Flooring Protocol also became the largest "holder" of these three NFT collections and significantly increased their trading volume on the NFT Marketplace. As of 4:00 PM on October 16th, Flooring Protocol has attracted 914 Azuki Elementals, 191 Pudgy Penguins, and 365 y00ts, with a TVL exceeding 1,800 ETH. Project Background Flooring Protocol is an NFT liquidity solution created by NFT OG player FreeLunchCapital. FreeLunchCapital is the previously undisclosed identity of the mysterious whale address 0x66666f, which still holds NFTs worth over $1.1 million. Additionally, Flooring Protocol has completed an audit by the security firm Halborn. (Source: https://nftgo.io/account/ETH/0x66666F58dE1bcD762A5E5c5aFf9cc3C906D66666/NFT) NFT Fragmentation into ERC-20: 1 NFT = 1,000,000 μTokens NFT fragmentation is not a new concept. In August 2021, Paradigm led a $2 million seed funding round for the NFT fragmentation protocol Fractional (later renamed Tessera). However, in May of this year, Tessera ceased operations, claiming it failed to meet commercial profitability requirements. Tessera's fragmentation solution involved breaking down high-value NFTs into smaller units called "Raes." Raes were still NFT, representing collective ownership and governance of a high-value NFT, tradable on NFT Marketplaces. Fragmenting NFT into smaller NFT has not gained significant traction in the past two to three years. It is widely believed that fragmenting NFT into smaller parts may also face the possibility of liquidity depletion and may not necessarily provide sufficient liquidity for whole NFT. Additionally, it could potentially introduce value ambiguity issues for whole NFT. There are two key differences with Flooring Protocol. First, Flooring Protocol fragments high-value NFT into 1,000,000 ERC-20 μTokens. For example, when a user deposits one Pudgy Penguins NFT into Flooring Protocol, they receive 1,000,000 μPPG tokens (the μTokens are not linked between NFT collections, but the fragmented μTokens are the same for all NFTs in the same NFT collection). Users can trade these μTokens on DEX. Second, there are two scenarios of giving up and retaining the ownership of NFT after fragmentation of μTokens. Based on these two different user requirements, Flooring Protocol categorizes the fragmentation modes into Valut and Safebox. When a user deposits an NFT into the Vault, they receive 1,000,000 μTokens and relinquish ownership of the NFT. If a user wishes to retain ownership of the fragmented NFT, they must choose Safebox, specify a storage period, and stake a certain amount of Flooring Protocol's native token FLC. In return, they receive 1,000,000 μTokens and a Safebox Key to verify ownership. The Safebox Key can be traded independently of the NFT collection's floor price in the future. Both Vault and Safebox allow users to redeem their fragmented NFTs by burning 1,000,000 μTokens corresponding to the NFT collection. However, for Safebox, the Safebox Key is also required. Since the original holders of all NFT stored in the Vault have given up their ownership, this means that burning 1,000,000 μTokens to redeem NFT in the Vault has an unpredictable randomness. User will randomly redeem to one of the Vault NFT, just as in the minting stage, which is full of surprises before the jpg is revealed. Due to the fact that the total μTokens corresponding to Vault NFT are always less than the circulating supply of μTokens, there is a reserve ratio for Vault NFT. The reserve ratio is calculated as Vault NFT quantity / (Vault NFT quantity + Safebox NFT quantity). A higher reserve ratio indicates that there are enough NFT in the Vault to support the redemption of 1,000,000 μTokens. In order to maintain a stable Vault reserve rate, Flooring Protocol has introduced dynamic Vault redemption fees and Safebox rentals (additional FLC staking). The reserve ratio is inversely proportional to Vault redemption fees and Safebox rentals. Of course, redemption is free when the Vault reserve ratio is above 40%, and dynamic increases in redemption fees in terms of FLC staking begin only when it falls below 40%. For additional FLC staking (rent) for Safeboxes, when the reserve rate is above 60%, an additional 2,000 FLC must be collateralized for each additional day. When the reserve ratio falls below 60%, the FLC staking starts to increase dynamically by 2% for every reduction in the reserve ratio. As the reserve ratio approaches 0%, the required additional FLC staking for each extra day increases. When the reserve ratio is below 2%, an additional 576,000 FLC is required for each extra day. Due to the predetermined storage time for Safeboxes, some users may face the inability to redeem NFT in the Safebox (the staked FLC can be retrieved) due to factors such as the price of FLC and Vault reserve ratio. Within 24 hours after a Safebox expires, any user can initiate an auction for the expired Safebox using FLC, and the highest bidder obtains the Safebox Key but is required to pay a 20% fee to the protocol. Within 24 hours after the auction ends, the new owner can directly unlock the NFT or extend the storage time. If no one participates in the auction within 24 hours after expiration, any user can use 1 million μTokens to unlock the Safebox and exchange for the NFT, which means the value of the Safebox Key no longer exists. Tokenomics The Flooring Protocol platform token, FLC, was launched alongside the protocol yesterday and briefly surpassed a $4 billion FDV before retracting. FLC has a total supply of 25 billion tokens, with 40% allocated for community support, 25% as reserves, 20% distributed to core contributors, 5% allocated to strategic investors, 5% for DEX liquidity, and 5% for CEX market making. Within the 40% allocated to the community, 50% is dedicated to μTokens liquidity incentives. As of October 16th, at 16:00, μPPG, μY00T, and μELEM collectively hold approximately $2.9 million in liquidity. Additionally, FLC not only provides Safebox and liquidity incentives through staking but also unlocks various VIP privileges and auction privileges. Overall, from Vault and Safebox, the relinquishment and retention of ownership, it can be observed how different NFT within the collection have distinct use cases. For floor NFT, users tend not to retain ownership but prioritize liquidity, making Vault their preferred choice. For rare NFT, users lean towards striking a balance between liquidity and ownership, thus prioritizing Safebox. The value of the Safebox Key represents the premium between rare NFT and floor NFT. Flooring Protocol's Safebox is one of the few solutions on the market that considers liquidity for rare NFT. Furthermore, the vision of fragmenting NFT into μTokens could ultimately lead to major centralized exchanges, significantly enhancing NFT liquidity. The integration of μTokens with Uniswap V3 could bring about more efficient NFT capital efficiency, and the upcoming V4 hook's combination with μTokens is also highly anticipated. However, in the current backdrop of a bear market for NFT and the outflow of on-chain funds, ample liquidity inevitably leads to continued declines, as evidenced by the Blur Bid Pool. Currently, the enthusiasm for Flooring Protocol seems to be more focused on acquiring FLC incentives. Whether μTokens can bring more off-chain capital to NFT and lead NFT out of the predicament remains to be observed. Follow us Twitter: https://twitter.com/WuBlockchain Telegram: https://t.me/wublockchainenglish Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Opinion: The Fed Will Not Lower Interest Rates in the Short Term, But a Recession is Inevitable

Tuesday, October 10, 2023

Authors: Anna Wong, Tom Orlik Editor: Joey, WuBlockchain This article excerpts a piece from Bloomberg to summarize some key economic data, and from this, makes a subjective judgment about whether the

Inventory of the Smart Contract AA Wallet: Is this the 'Future Wallet' Vitalik is Most Optimistic About

Monday, October 9, 2023

Author: defioasis Note: This article is for informational sharing only and does not endorse any projects. It is not affiliated with the mentioned projects in any financial way. In August, the number of

Asia's weekly TOP10 crypto news (Oct 2 to Oct 8)

Sunday, October 8, 2023

Author:0xMingyue Editor:Colin Wu 1. Hong Kong's weekly summary 1.1 Hong Kong Financial Secretary: Retail Trading of Stablecoins Not Allowed Until Official Regulation link According to Ming Pao,

Weekly Project Updates: StarkWare Delays Token Unlock Date, Jeffrey Huang Joins Friend Tech, Yuga Labs Announces R…

Saturday, October 7, 2023

1. StarkWare Token Unlock Date Postponed from Late November to Mid-April Next Year link On October 4th, according to The Block's report and Etherscan data, StarkWare has postponed the initial

WuBlockchain Weekly: Ethereum Futures ETF Faces Lukewarm Reception Upon Launch, Multiple MPI Licenses Granted in S…

Friday, October 6, 2023

1. Cleveland Federal Reserve Chair: Potential for Further Interest Rate Hikes This Year link On October 3rd, President of the Cleveland Federal Reserve, Loretta Mester, delivered a speech in which she

You Might Also Like

Bitcoin’s realized volatility surges in as traders face extreme price swings

Sunday, March 9, 2025

Volatility clustering in Bitcoin reveals the impact of turbulent rallies and sharp pullbacks. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Mar 3 to Mar 9)

Sunday, March 9, 2025

Ms. Sun Xueling, Minister of State, Ministry of Home Affairs of Singapore, said that cryptocurrency fraud cases accounted for a quarter of the total loss amount involved in fraud last year. ͏ ͏ ͏ ͏ ͏ ͏

Trump declares end to ‘war on crypto,’ vows to propel America to Bitcoin supremacy

Saturday, March 8, 2025

Trump brands the Biden era as a crypto setback, .President Trump vows to make America the Bitcoin leader, ending Operation Chokepoint 2.0 and bolstering crypto strategies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡ incentive → click → sale

Saturday, March 8, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: World Network Launches Chat Feature, Zora Set to Introduce Its Native Token, and Trump Ann…

Saturday, March 8, 2025

Sam Altman's blockchain project, World Network, has launched World Chat, a “mini-app” integrated into the World App wallet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Treasury Secretary Scott Bessent hints at future US Bitcoin reserve acquisition plans

Friday, March 7, 2025

Federal government considers expanding Bitcoin holdings without taxpayer funds; official discussions underway in Washington. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

NFT & Gaming - 🦁 Loaded Lions’s LION went live and was the top gainer on CoinGecko; Trump-owned company DTTM Oper…

Friday, March 7, 2025

Loaded Lions's LION token went live on the Cronos and Solana. Trump-owned company filed a trademark for a metaverse and NFT marketplace. Hamster Kombat introduced a Layer-2 blockchain on TON ͏ ͏ ͏

WuBlockchain Weekly: Trump Officially Signs Executive Order for U.S. National Bitcoin Reserve, White House Hosts C…

Friday, March 7, 2025

David Sacks, the “Crypto Tsar” and the White House's AI and Crypto Affairs Chief in the United States, tweeted that Trump has signed an executive order to establish a strategic Bitcoin reserve. ͏ ͏

Cardano’s Charles Hoskinson reacts to White House crypto summit snub

Thursday, March 6, 2025

Hoskinson focuses on legislative progress, unfazed by his absence from Trump's crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Monthly Update on Blockchain Technology: Pectra testnet activation, zero-knowledge gossip, BNBChain roadmap

Thursday, March 6, 2025

Written by: GaryMa, WuBlockchain ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏