Hot in Enterprise IT/VC - What's 🔥 in Enterprise IT/VC #363

What's 🔥 in Enterprise IT/VC #363Thoughts + 🙏🏼 on 🇮🇱 ... b4 regularly scheduled programming: Loom exit, seed valuations...Hi all, before I dive into my usual thoughts and rants on enterprise IT/VC, I wanted to zoom out and discuss humanity. The situation in Israel 🇮🇱 is not about politics; it’s about being human and condemning heinous acts of terrorism by Hamas on Israeli civilians. Here’s the official statement from my firm. If you want to know what it’s like to grow up in 🇮🇱, read this from Ohad Maishlish, co-founder of Env0, one of our portfolio companies. To that end, it’s nice to see the venture community supporting in the little ways that we can first by speaking out and second by taking action. Recently over 500 VC firms joined together to support Israel and condemn terrorism and Hamas - more from Alex Konrad at Forbes:

If you want to join me in donating to humanitarian relief efforts, please contribute to United Hatzalah and the Israel rescue efforts. If you want to volunteer any time to Israeli startups who are short-staffed, please sign up here. Now back to our regularly scheduled program… IMO the big startup news of the week was Atlassian announcing the acquisition of Loom for a whopping $975M! Ok, let’s just call it $1B for arguments sake. There are lots of thoughts on the subject from it’s a smashing success to wow, it’s a down round from the last reported $1.53B valuation. IMO any company that goes from zero to $975M exit in 8 years on $175M raised should be 👏🏼👏🏼👏🏼 and is a smashing success! Insane metrics and user growth…so who made money? Here’s the breakout from Phil Haslett:

These are impressive numbers for the early investors, and of course, for the founders since after accounting for the approximate $562M of investor returns, the remaining $413M is to be distributed to founders and employees. This is not dissimilar from Instacart numbers where the early investors up to Series B were in the money at the initial IPO price. IMO, the Series C also wins with a return of capital. First, I strongly believe that many 🦄 will never return all of the capital invested so a 1x return is huge. Second, venture firms have a “recycling” clause which allows them to reinvest distributions received up to 15-20% of the fund size which allows these funds to be fully invested to account for management fees paid over the life of the fund. By returning capital quickly after only 2.5 years, these growth investors can reinvest this into another company that may be more appropriately priced to seek a better return. If the best you will ever get is 1x from an overpriced growth investment, it’s better to get the capital back sooner to have a chance to get a return somewhere else. Everybody wins here - huge congrats to Loom! There is one other lesson here for founders. While I don’t know what the revenue numbers are for Loom, I’m assuming that Atlassian paid a hefty “strategic” multiple for the business because it plans on incorporating Loom into every single one of its products!

Founders if you want a strategic price, let me remind you how you do that 👇🏼 As Vinay states:

Founders if you haven’t been staying in touch with the handful of potential strategic buyers in the future, play the long game and start building those bridges now…just in case. As always, 🙏🏼 for reading and please share with your friends and colleagues. Scaling Startups

Enterprise Tech

What's Hot in Enterprise IT/VC is free today. But if you enjoyed this post, you can tell What's Hot in Enterprise IT/VC that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

What's 🔥 in Enterprise IT/VC #362

Saturday, October 7, 2023

What's ahead in Q4 from LPs and VCs (Origins Podcast) - more shutdowns?, hard choices for seed funds?, net new company funding 🔥, default 1st 10 in office, TVPI vs. DPI

What's 🔥 in Enterprise IT/VC #361

Saturday, September 30, 2023

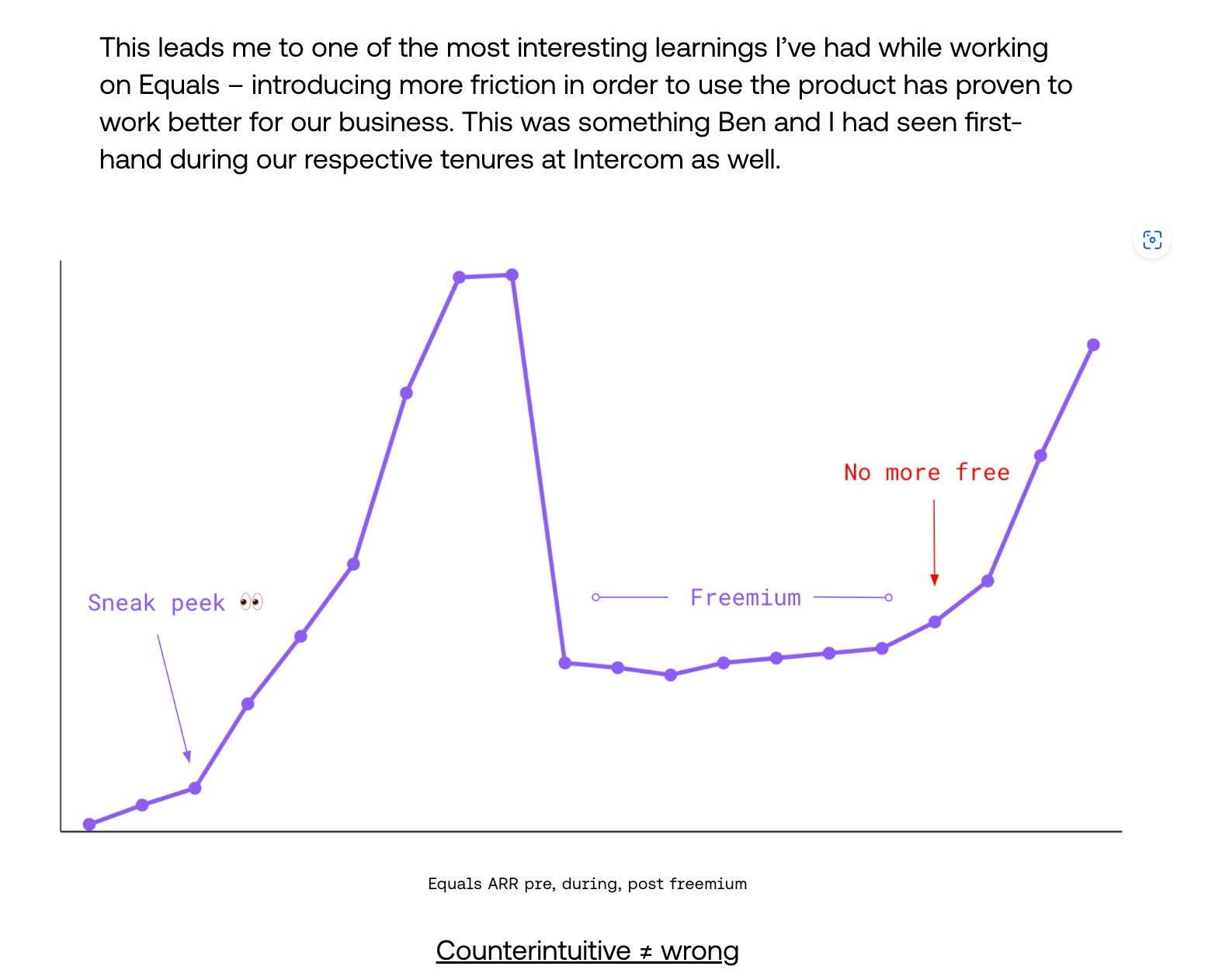

PLG, PLS, Sales led 🤯 - enough acronyms, build a product, sell it efficiently

What's 🔥 in Enterprise IT/VC #360

Saturday, September 23, 2023

IPOs, Splunk for $28B, mega funding rounds + M&A - are we back or is this just a mirage?

What's 🔥 in Enterprise IT/VC #359

Sunday, September 17, 2023

Going from Non-obvious to $100M ARR - the Security Scorecard journey

What's 🔥 in Enterprise IT/VC #358

Saturday, September 9, 2023

OK, we get it, you're an AI co but isn't everyone?

You Might Also Like

🚀 Ready to scale? Apply now for the TinySeed SaaS Accelerator

Friday, February 14, 2025

What could $120K+ in funding do for your business?

📂 How to find a technical cofounder

Friday, February 14, 2025

If you're a marketer looking to become a founder, this newsletter is for you. Starting a startup alone is hard. Very hard. Even as someone who learned to code, I still believe that the

AI Impact Curves

Friday, February 14, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. AI Impact Curves What is the impact of AI across different

15 Silicon Valley Startups Raised $302 Million - Week of February 10, 2025

Friday, February 14, 2025

💕 AI's Power Couple 💰 How Stablecoins Could Drive the Dollar 🚚 USPS Halts China Inbound Packages for 12 Hours 💲 No One Knows How to Price AI Tools 💰 Blackrock & G42 on Financing AI

The Rewrite and Hybrid Favoritism 🤫

Friday, February 14, 2025

Dogs, Yay. Humans, Nay͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 AI product creation marketplace

Friday, February 14, 2025

Arcade is an AI-powered platform and marketplace that lets you design and create custom products, like jewelry.

Crazy week

Friday, February 14, 2025

Crazy week. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

join me: 6 trends shaping the AI landscape in 2025

Friday, February 14, 2025

this is tomorrow Hi there, Isabelle here, Senior Editor & Analyst at CB Insights. Tomorrow, I'll be breaking down the biggest shifts in AI – from the M&A surge to the deals fueling the

Six Startups to Watch

Friday, February 14, 2025

AI wrappers, DNA sequencing, fintech super-apps, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How Will AI-Native Games Work? Well, Now We Know.

Friday, February 14, 2025

A Deep Dive Into Simcluster ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏