Net Interest - Private Lending

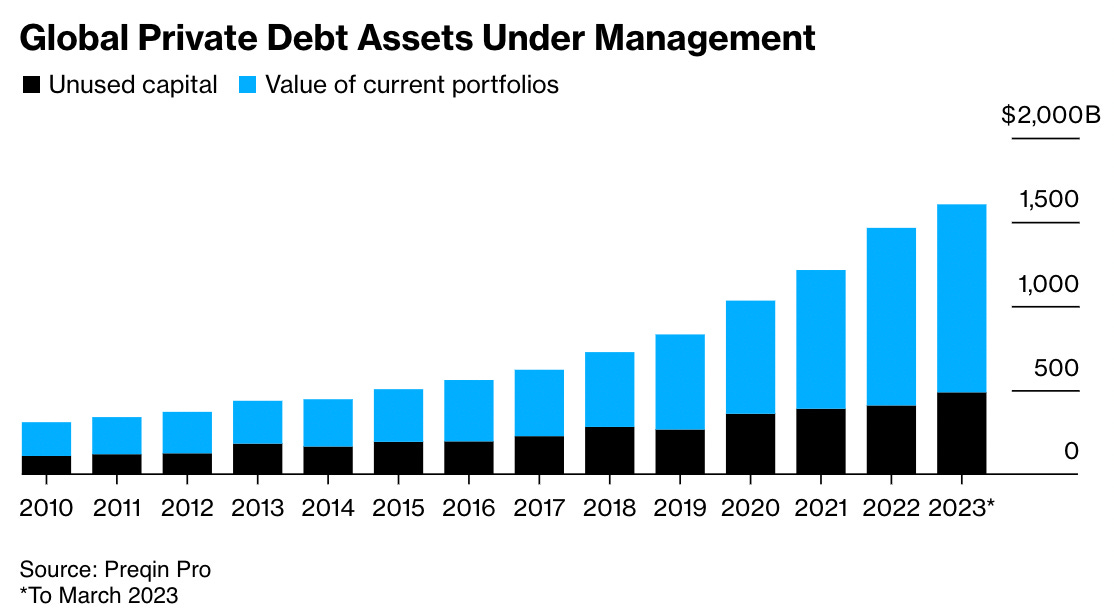

If you want to understand what’s going on inside the finance industry, a good place to start is in the filings of Apollo Global Management. We’ve talked about Apollo here before. Founded in 1990 as a private equity firm, it has grown its assets under management to $630 billion while shifting its focus towards private credit, where over three-quarters of its assets now sit. As a private equity firm, it offered companies an alternative source of equity to what was available in public markets. As a private credit firm, it offers companies an alternative source of debt to what is available at banks. The firm is led by co-founder Marc Rowan. Razor sharp, charming and unpretentious, he’s well worth listening to and this week, he updated investors on his views of the sector. On his latest earnings call, Rowan identified three big changes in market fundamentals, the foundations for which were laid in the aftermath of the global financial crisis although “we just didn’t notice because right after we changed the rules, we printed $8 trillion, and everything went up and to the right.” With money printing having stopped and interest rates back up to where they were before the crisis, Rowan reckons the impact of these changes is now surfacing. The first shift concerns public market liquidity. “By some estimates, dealer capital – the capital that facilitates trading – is roughly 10% today of what it was in 2008.” Yet markets are three times the size. Rowan sees last year’s breakdown in the UK liability-driven investment (LDI) pension industry as the kind of thing that’s inevitable in a less liquid public market. “It will not surprise me going forward to see liquidity challenged, public markets challenged, and investors beginning to understand that liquidity only exists on the way up and does not exist on the way down,” says Rowan. “We should expect a more volatile, less liquid world in public markets.” Second is the creeping marginalisation of banks as tighter regulatory capital requirements make it more expensive for them to hold assets. “Banks today in the US markets are roughly 20% of debt capital to consumers and businesses.” He echoes Jamie Dimon’s observation that the latest rules will cause banks to shrink further. “Debanking…is at its very early infancy,” he says. “As investors…you will see over the next decade a series of financial products that you’ve never seen before because they have historically been resident only on the balance sheets of large banks, and they are on their way to you as investment product.” Third, Rowan is cautious about the march of indexation and the concentration it has caused in markets. He points out that just ten stocks currently make up nearly 35% of the S&P 500 index, and that these ten stocks are responsible for 100% of the market’s year-to-date performance. But they’re not cheap! “Not many of you come in every day looking to buy 50 P/E stocks, yet we feel really comfortable with a massive portion of our country’s retirement system assets and fiduciary assets in 50 P/E stocks,” he says. “We have literally never had so much concentration in so few instruments since the NIFTY 50 going back and [that] predates my career. But if one looks at the data from that period of time, a decade later, investors lost nearly 90% of their money.” Unsurprisingly, Apollo positions itself as a beneficiary of these changes. Last September, the firm picked up over $1 billion of assets dumped by UK pension plans in the LDI crisis and its dry powder gives it capacity to take advantage of similar market dislocations in the future. As banks shed assets, Apollo is similarly ready to pick up the slack. “They’re dancing in the streets,” said Jamie Dimon this summer about Apollo, Blackstone and firms like them. But it’s in private credit that the trends converge. Already a $1.6 trillion market, up from $0.25 trillion in 2009, it is expected to grow significantly. Brookfield Asset Management, another player in the space, reckons it can grow to $2.3 trillion by 2027; BlackRock projects $3.5 trillion by 2028; Rowan simply says “we are in the first inning, the infancy of private credit”. So what is private credit? Can the growth be sustained and what are the risks? To find out, read on... Subscribe to Net Interest to read the rest.Become a paying subscriber of Net Interest to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

A Reckoning in Payments

Friday, October 27, 2023

First Adyen and now Worldline: Is this the end of Fintech?

Risk of Ruin

Tuesday, October 24, 2023

Plus: JPMorgan, BlackRock, Wells Fargo

Bad Office

Friday, October 20, 2023

The Credit Consequences of WFH

Vernon's Legacy

Friday, October 6, 2023

What Republic First and Metro have in common. Plus: Equity Research, Bank Bashing, Crypto Lit

Guardians of the Rich

Friday, September 29, 2023

Inside Morgan Stanley's Wealth Management Business

You Might Also Like

Longreads + Open Thread

Saturday, March 8, 2025

Personal Essays, Lies, Popes, GPT-4.5, Banks, Buy-and-Hold, Advanced Portfolio Management, Trade, Karp Longreads + Open Thread By Byrne Hobart • 8 Mar 2025 View in browser View in browser Longreads

💸 A $24 billion grocery haul

Friday, March 7, 2025

Walgreens landed in a shopping basket, crypto investors felt pranked by the president, and a burger made of skin | Finimize Hi Reader, here's what you need to know for March 8th in 3:11 minutes.

The financial toll of a divorce can be devastating

Friday, March 7, 2025

Here are some options to get back on track ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Too Big To Fail?

Friday, March 7, 2025

Revisiting Millennium and Multi-Manager Hedge Funds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The tell-tale signs the crash of a lifetime is near

Friday, March 7, 2025

Message from Harry Dent ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👀 DeepSeek 2.0

Thursday, March 6, 2025

Alibaba's AI competitor, Europe's rate cut, and loads of instant noodles | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March 7th in 3:07 minutes. Investors rewarded

Crypto Politics: Strategy or Play? - Issue #515

Thursday, March 6, 2025

FTW Crypto: Trump's crypto plan fuels market surges—is it real policy or just strategy? Decentralization may be the only way forward. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What can 40 years of data on vacancy advertising costs tell us about labour market equilibrium?

Thursday, March 6, 2025

Michal Stelmach, James Kensett and Philip Schnattinger Economists frequently use the vacancies to unemployment (V/U) ratio to measure labour market tightness. Analysis of the labour market during the

🇺🇸 Make America rich again

Wednesday, March 5, 2025

The US president stood by tariffs, China revealed ambitious plans, and the startup fighting fast fashion's ugly side | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March

Are you prepared for Social Security’s uncertain future?

Wednesday, March 5, 2025

Investing in gold with AHG could help stabilize your retirement ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏