Aziz Sunderji - Another Reason Mortgage Rates will Fall

Another Reason Mortgage Rates will FallAs rate vol dips and the yield curve steepens, prepayment risk will abateThis is the third in a three-part series where I argue that mortgage rates are headed lower. It’s a more technical post—paying clients can text me directly with any questions here. The data from the charts and background reading is in the usual spot. Yesterday was a great day. I won my tennis match, and even better—sent my opponent into an angry tailspin. He ended up smacking balls against the fence repeatedly in frustration. Few things bring me greater joy. To cap it off, I entered a lottery for the privilege of paying hundreds of dollars to see Taylor Swift play a year from now in Vancouver—and won (I’m a fan, and certain members of my entourage are full-blown Swifties). The price of similar tickets on Stubhub tells me I got very lucky. Great day. You know who pretty much never has a great day? Mortgage bond investors. Consider this: when interest rates rise, inflicting losses on bondholders of all kinds, mortgage investors suffer more. That’s because the “duration” of mortgage bonds—the measure of the sensitivity of a bond’s price to changes in interest rates—shoots up right when rates start moving in the wrong direction. And when interest rates fall—a good day for most bondholders—it’s only bittersweet for mortgage investors. That’s because lower interest rates raise the likelihood of mortgage prepayments, and the duration of mortgage bonds—their responsiveness to the boon of lower rates—drops. Here’s how Michael Lewis, in his book, Liar’s Poker, described this “heads I win, tails you lose” situation:

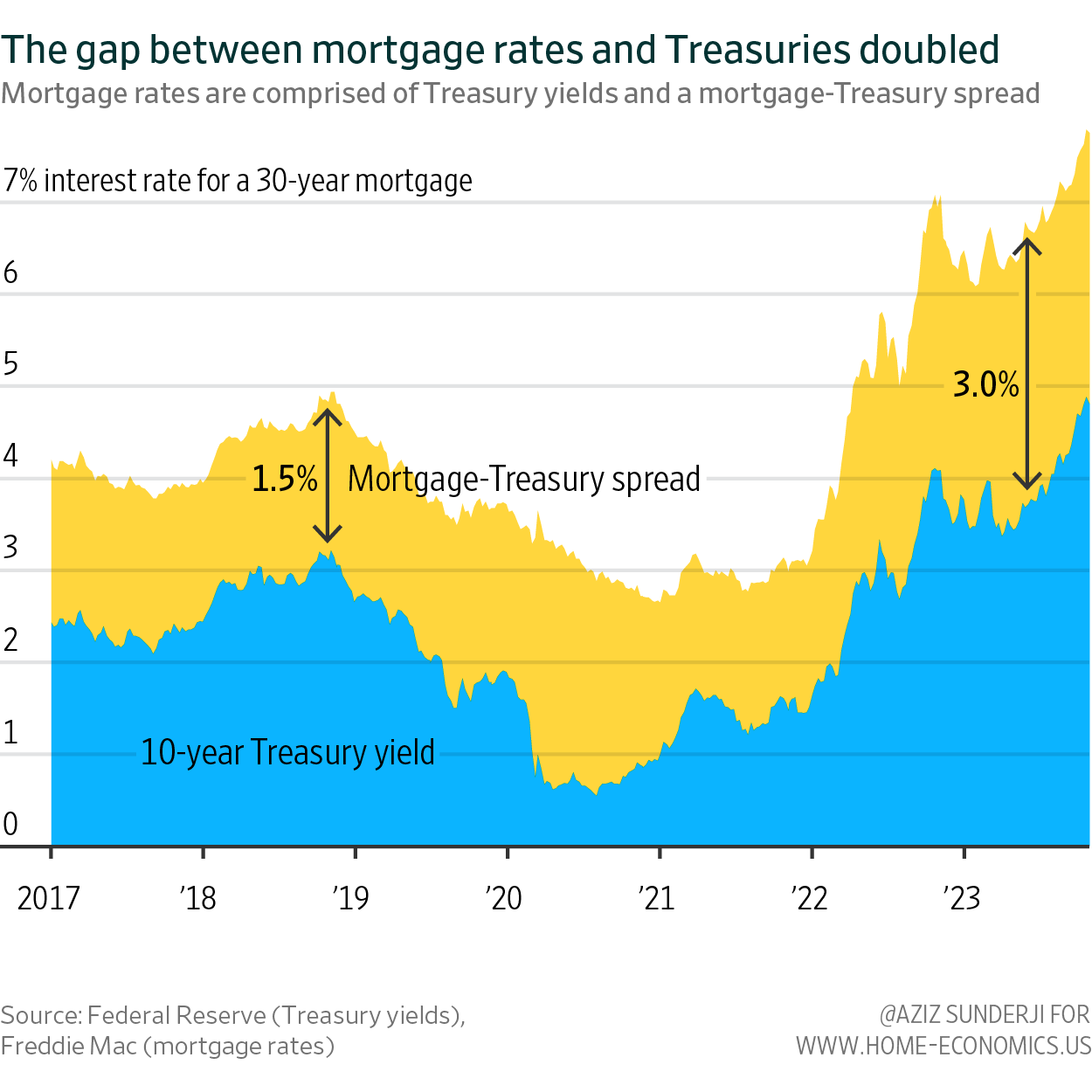

Of course, financial markets are efficient, and the flipside of every risk is a reward. Mortgage investors are rewarded with an interest rate spread over US treasuries for taking on prepayment risk. In fact, rising prepayment risk—and higher mortgage spreads to compensate mortgage bondholders for shouldering it—is one important explanation for how we got to near-8% mortgage rates. They’ve declined over the past two weeks, but mortgage rates are still more than 5% higher than this time three years ago. It’s hard to imagine the housing market returning to a semblance of normality—with homes frequently trading hands, a healthy stock of inventory, and affordability off multi-decade lows—unless mortgage rates subside further. Happily, I think that’s exactly what we’re in for. One reason—and the subject of today’s article—is that prepayment risk is set to decline, and along with it the compensation in the form of extra spread that mortgage bondholders have until now demanded. Most forecasters argue this spread will stay as thick as it is today. I disagree—I think it will compress, adding to the tailwinds from declining US Treasury yields that I described in parts one and two of this series—and helping propel mortgage rates towards 6% by the end of 2024. The rest of today’s article is for paying subscribers of Home Economics only. If having an informed view on the path for mortgage rates is part of your business, I hope you consider subscribing. In doing so you’ll unlock this article and future ones, and you’ll gain access to more data, forecasts, and the full Home Economics archive. Most importantly, you’ll be joining a community of data-driven housing professionals whose subscriptions support our work. Keep reading with a 7-day free trialSubscribe to Home Economics to keep reading this post and get 7 days of free access to the full post archives.A subscription gets you:

|

Older messages

A Smaller “Term Premium” means Lower Mortgage Rates

Friday, November 3, 2023

Especially after Wednesday's announcement from the Treasury

Mortgage rates are set to fall

Wednesday, October 25, 2023

Everyone's done with hiking

Zillow launches 1% downpayment mortgages. What could go wrong?

Thursday, October 19, 2023

The company's real risks have more to do with liquidity and execution

Introducing Home Economics

Thursday, October 19, 2023

Using data visualization to contextualize America's housing market

Millennials and Boomers are Competing for Homes. Guess Who’s Winning.

Tuesday, October 10, 2023

Rising prices, high rates, and demographics are reversing Millennial gains

You Might Also Like

Dads, You Can Get in the Best Shape of Your Life With This Workout Program

Monday, March 10, 2025

View in Browser Men's Health SHOP MVP EXCLUSIVES SUBSCRIBE Dads, You Can Get in the Best Shape of Your Life With This Workout Program Dads, You Can Get in the Best Shape of Your Life With This

Meghann Fahy’s Master Plan

Monday, March 10, 2025

Today in style, self, culture, and power. The Cut March 10, 2025 CUT COVERS Meghann Fahy's Master Plan After breaking out on TV, Fahy stars in a big-screen thriller this April. She won't

EmRata Flaunted Pelvic Bone Cleavage, Aka "Pelvage," In The Tiniest Skirt

Monday, March 10, 2025

Plus, your love life this week, your daily horoscope, and more. Mar. 10, 2025 Bustle Daily Chet Hanks EXCLUSIVE Chet Hanks Has The Last Laugh It's easy to make assumptions about Chet Hanks, namely

The 20 best cookbooks of spring

Monday, March 10, 2025

NYC steakhouse sues Texas over attempted “Texts Strip” rebranding.

(sorry)

Monday, March 10, 2025

now with the link this time ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

an equinox stretch

Monday, March 10, 2025

everything you need for Wednesday's workshop ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

9 Strange Tax Deductions You Might Actually Qualify For

Monday, March 10, 2025

Easiest Ways to Spot an Unpaid Tolls Scam Text. Good news: The IRS might allow you to deduct all those gambling losses. Not displaying correctly? View this newsletter online. TODAY'S FEATURED STORY

Maybe You Fund The People Who *Will Start* Families

Monday, March 10, 2025

At best, the DOT's new funding priorities get causation wrong ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

“In this Poem, We Will Not Glorify Sunrise” by Sarah Freligh

Monday, March 10, 2025

nor admire the apples that blossom / during a February heat wave ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Glen Powell to the (couture) rescue

Monday, March 10, 2025

— Check out what we Skimm'd for you today March 10, 2025 Subscribe Read in browser But first: our editors' cult-status products Update location or View forecast Good morning. While we might