Ask Mario: The VC bubble, the value of specialization, and business case studies.

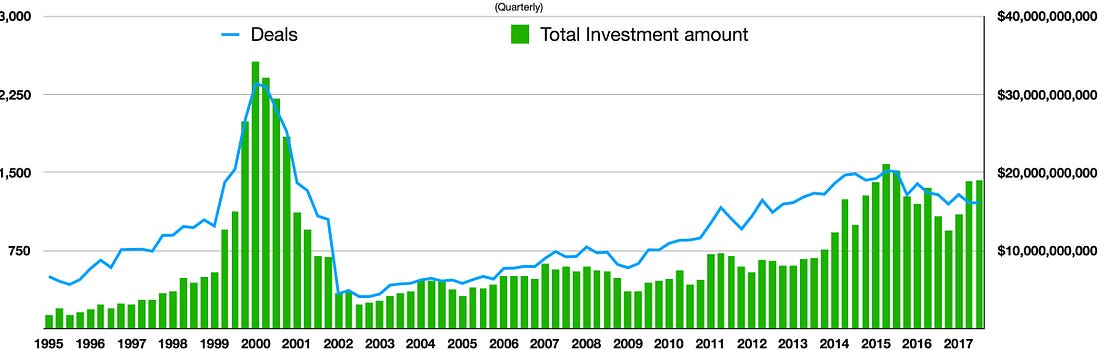

Ask Mario: The VC bubble, the value of specialization, and business case studies.The first edition of our new Q&A series.🌟 Hey there! This is a subscriber-only edition of our premium newsletter designed to make you a better investor and technologist. In addition to learning from exceptional investors and founders, members also get access to private Q&As with me. The first question in today’s Q&A is available to all subscribers (about whether or not we’re in a VC bubble). There are two bonus questions behind the paywall for premium subscribers (covering Generalists vs. Specialists and what’s lost in a business case study). I hope you enjoy it! Friends, Many of our most important lessons and fiercest obsessions arise from conversation. It is through discussion that we discover new ideas and fresh perspectives. It is also how we sharpen our perspectives, using articulation as a whetstone. As the poet David Whyte said, “A real conversation always contains an invitation. You are inviting another person to reveal herself or himself to you, to tell you who they are or what they want.” I hope you will consider our new series to be exactly that: an invitation. “Ask Mario” gives members of Generalist+ an opportunity to have their questions answered by me. They may be pressing matters related to a piece of news or a recently launched product. They may be timeless, covering the infinite games of writing, investing, or building. They may be tactical or theoretical, pragmatic or personal, straightforward or perhaps rather strange. While I cannot promise to be an expert in all of these things (heed the name of this publication), I will think deeply and give you my most thoughtful appraisal. In doing so, I hope we will have a chance to reveal something of ourselves, learn new lessons, and find fresh obsessions together. Our first three questions come from long-time readers and supporters Sajith Pai, David Salmon, and Rohit Krishnan. Below, I tackle their queries on the venture capital bubble, generalists versus specialists, and the nature of business case studies. If you’re a premium subscriber and would like to ask a question for me to answer in our next edition, fill out the form at the end of this piece. If you’re not a premium subscriber yet – today’s the perfect day to hop aboard! Follow the link below to subscribe and unlock the strategies and tactics of some of the world’s best investors and founders. Is the VC asset class a bubble?What’s your sense for the health of venture capital as an asset class, given projections of a higher-for-longer interest rate environment and the massive paper losses many VC firms are currently sitting on? Do you think that the explosion of venture in the past decade was a ZIRP phenomenon, or justified given the ever-expanding size and relevance of the tech sector? – David Salmon, EVP at Tubi An excellent question, David. I think many firms are in for significant pain in the short term. Plenty of investors deployed heavily into the last bull run and are now sitting on stakes of companies that are likely to close, or will be forced to raise at much lower valuations. Neither are likely to entice LPs to invest in a future fund, which means that less durable firms will be forced to close down. In that respect, I think we’ll see (and probably have already witnessed) a classic flight to quality in which LPs curtail their “experimental” checks and limit capital to tried-and-true managers. While much of this process may be necessary, there will be some unfortunate casualties. Young managers who might have benefitted from a little more time won’t get it; potentially gifted investors may see the market headwinds and take a different career path. (“Won’t someone think of the asset managers?” is not a rallying cry likely to elicit much sympathy.) So it goes. While the incontinent fever dream of 2021 has hopefully taught us some lessons to carry into the coming years, it hasn’t dulled my high-level belief in the power of technology and its universal importance. It’s startling how youthful many disruptive technologies are. It was scarcely sixteen years ago, for example, that Steve Jobs strode on stage and revealed the iPhone. It helped spawn the mobile internet and has changed our lives in innumerable big and small ways. While the form factor may change, the magic of having constant access to a global, connecting, multifarious superbrain won’t. Surely, its impact has just begun. Even more cutting-edge movements deserve a mention, too. Who knows what artificial intelligence, biotech, crypto, and beyond will manifest? (For better and worse.) That fundamental belief in the technology story contributes to my optimism about the venture capital asset class. As long as there are entrepreneurs taking risks and pushing the horizon forward, risk capital will be needed. That is not to say there won’t be bumps in the road. I do think ZIRP contributed to unhealthy inflation over the past few years. However, over a long enough time horizon, I suspect the sector will continue to grow. In that respect, the dotcom boom and bust offers an interesting analogy. Low-interest rates in the years leading up to the turn of the millennium were a part of that episode, too. As many will know, it fuelled a sharp spike in venture investing in 1999, followed by a gut-wrenching drop in 2000.  Venture activity, 1995-2017 (Wikipedia) In the years that immediately followed, venture investing fell to 1995-era levels. However, bit by bit, the sector regained momentum and grew steadily. I suspect we’ll see something similar here – a few years of dampened activity followed by a return to continued (if irregular) growth. Case studies and realityWhat do you think you've learnt by diving deeper into individual companies and their stories that is different to learning from business cases outside-in or academic sources? – Rohit Krishnan... Subscribe to The Generalist to read the rest.Become a paying subscriber of The Generalist to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

Modern Meditations: Danny Rimer

Thursday, November 9, 2023

The Index Ventures partner on art, investing, and destiny.

The Braintrust: What should you have invested in sooner?

Tuesday, November 7, 2023

Eight unicorn founders reflect on product/market fit, working on Capitol Hill, hiring leaders, and maintaining mental health.

Last chance! Early bird pricing ends in 24 hours.

Sunday, November 5, 2023

Act now to lock in our best pricing for Generalist+, our new premium newsletter.

What makes a great acquisition?

Thursday, November 2, 2023

The common wisdom is that most M&A goes south, with reported failure rates of up to 90%. How can CEOs tip the scales in their favor?

Letters to a Young Investor with Reid Hoffman

Tuesday, October 31, 2023

The legendary investor shares stories on Airbnb, Stripe, avoiding mistakes, and developing a “theory of the game.”

You Might Also Like

🚀 Ready to scale? Apply now for the TinySeed SaaS Accelerator

Friday, February 14, 2025

What could $120K+ in funding do for your business?

📂 How to find a technical cofounder

Friday, February 14, 2025

If you're a marketer looking to become a founder, this newsletter is for you. Starting a startup alone is hard. Very hard. Even as someone who learned to code, I still believe that the

AI Impact Curves

Friday, February 14, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. AI Impact Curves What is the impact of AI across different

15 Silicon Valley Startups Raised $302 Million - Week of February 10, 2025

Friday, February 14, 2025

💕 AI's Power Couple 💰 How Stablecoins Could Drive the Dollar 🚚 USPS Halts China Inbound Packages for 12 Hours 💲 No One Knows How to Price AI Tools 💰 Blackrock & G42 on Financing AI

The Rewrite and Hybrid Favoritism 🤫

Friday, February 14, 2025

Dogs, Yay. Humans, Nay͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 AI product creation marketplace

Friday, February 14, 2025

Arcade is an AI-powered platform and marketplace that lets you design and create custom products, like jewelry.

Crazy week

Friday, February 14, 2025

Crazy week. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

join me: 6 trends shaping the AI landscape in 2025

Friday, February 14, 2025

this is tomorrow Hi there, Isabelle here, Senior Editor & Analyst at CB Insights. Tomorrow, I'll be breaking down the biggest shifts in AI – from the M&A surge to the deals fueling the

Six Startups to Watch

Friday, February 14, 2025

AI wrappers, DNA sequencing, fintech super-apps, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How Will AI-Native Games Work? Well, Now We Know.

Friday, February 14, 2025

A Deep Dive Into Simcluster ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏