Net Interest - Slicing and Dicing

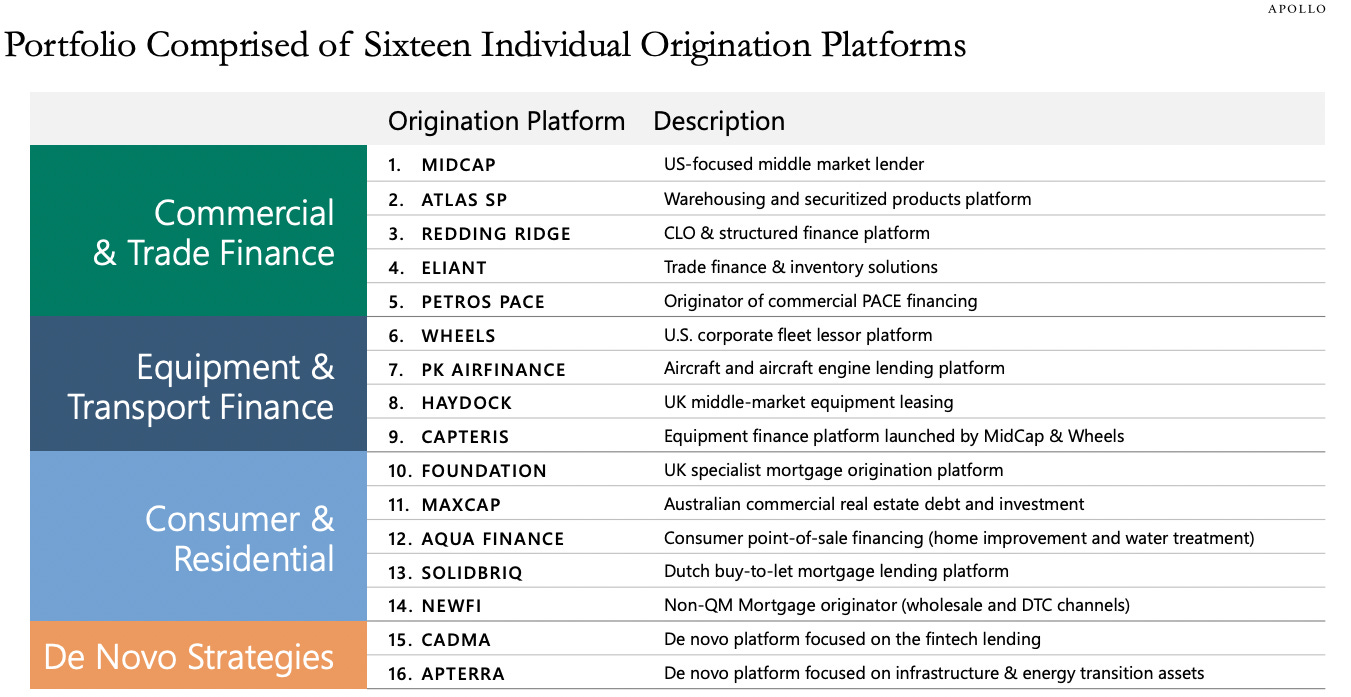

Not long after assuming the role of CEO of Merrill Lynch in 2002, Stan O’Neal made a decision to expand his firm’s mortgage securitisation business. Interest rates were low and investors were clamouring for additional yield; O’Neal recognised that repackaged mortgages could help to satisfy that demand. He made a series of hires in two high growth areas of the market – CDOs and subprime. Having done no subprime mortgage deals at all in 2002 and only four in 2003, with a new team on board the firm completed 31 deals in 2005 and 34 in 2006, placing it top among its peers. CDO underwriting volumes similarly ramped, from $3 billion in 2003 to $44 billion in 2006, allowing the firm to generate $800 million of fees. But O’Neal wasn’t satisfied. Since 2005, he’d wanted to own a mortgage company so that he could originate mortgages directly to feed the machine that was his securitisation business. Industry insiders called it an “originate to distribute” model. Lehman Brothers was making four times what Merrill was earning in mortgage, in part because it owned BNC Mortgage, the eighth largest subprime company in the country, and O’Neill was envious. One option was to build a competing business from the ground up, but executives warned that could take three or four years. “I’m fifty-four fucking years old, and I don’t have three or four year,” O’Neill responded, according to authors of All The Devils Are Here: The Hidden History of the Financial Crisis. So Merrill made an acquisition. In September 2006, it announced the purchase of First Franklin, one of the largest subprime mortgage originators in the country, for a consideration of $1.3 billion. Now it could originate mortgages, package them into structured products and sell them to investors, all under one roof. For a while, Merrill thought the integrated approach would also enable it to better manage the cycle. “The strategic importance of the First Franklin acquisition was clearly evident this quarter,” Merrill’s CFO told investors on his first quarter 2007 earnings call, “as having both origination and servicing capabilities enabled us to see trends emerge sooner and adjust underwriting standards and pricing more rapidly.” Merrill Lynch wasn’t alone. Other banks, including Deutsche Bank and Morgan Stanley, also embraced the “originate to distribute” model. Morgan Stanley acquired Saxon Capital to support its strategy of building a global, vertically integrated residential mortgage business. “The addition of Saxon to Morgan Stanley’s global mortgage franchise will help us to capture the full economic value inherent in this business,” said the firm’s global head of securitized products. “This acquisition facilitates our goal of achieving vertical integration in the residential mortgage business, with ownership and control of the entire value chain, from origination to capital markets execution to active risk management.” We know now of course that these acquisitions didn’t work. The subprime mortgage market collapsed with disastrous consequences shortly after they were completed. In the aftermath, both the structure of the mortgage market and the business model of investment banking changed irreversibly. But securitisation has not gone away. Over the past ten years, the market for asset-backed credit has grown from $12 trillion to $20 trillion, even as the residential mortgage share has shrunk from 40% to around 20%. And where investment banks once stood, alternative asset managers now operate in their place. One of them is Apollo Global Management. We’ve talked about Apollo a lot here before, most recently two weeks ago in Private Lending. As I wrote then, if you want to understand what’s going on inside the finance industry, a good place to start is with Apollo Global Management. This week, the firm hosted a “deep dive” for investors on its platform origination strategy. From its roots as an investor, initially using other people’s money and increasingly its own, Apollo has been expanding into asset origination. The firm now operates 16 different origination businesses across a range of asset classes, including mortgage but also aircraft financing, loans to fast food restaurants, auto fleet leasing and more. This year, it expects to originate $45 billion of loans off its platforms, a number it forecasts will grow to around $75 billion in two to three years. Unlike banks, which pivoted from underwriting to origination, Apollo is pivoting from investing to origination, absorbing a much greater share of the value chain along the way. The firm sees GE Capital as a closer analogy. “The best illustration of a platform is if you think about what GE Capital was before they lost their mind – that’s what we look like today,” said CEO Marc Rowan in June. Unfortunately, that model didn’t work out either. In fact, loan origination businesses generally have a poor track record of survival outside of banks. So can Apollo buck the trend? Can Apollo create a deconstructed bank inside its walls, a successor to the “originate to distribute” model where the firm eats a large part of its own cooking? To explore these questions, read on... Subscribe to Net Interest to read the rest.Become a paying subscriber of Net Interest to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

The Capital Cycle Hits Payments

Friday, November 10, 2023

Adyen's American Adventure

Private Lending

Friday, November 3, 2023

The Growth of an Asset Class

A Reckoning in Payments

Friday, October 27, 2023

First Adyen and now Worldline: Is this the end of Fintech?

Risk of Ruin

Tuesday, October 24, 2023

Plus: JPMorgan, BlackRock, Wells Fargo

Bad Office

Friday, October 20, 2023

The Credit Consequences of WFH

You Might Also Like

Longreads + Open Thread

Saturday, March 8, 2025

Personal Essays, Lies, Popes, GPT-4.5, Banks, Buy-and-Hold, Advanced Portfolio Management, Trade, Karp Longreads + Open Thread By Byrne Hobart • 8 Mar 2025 View in browser View in browser Longreads

💸 A $24 billion grocery haul

Friday, March 7, 2025

Walgreens landed in a shopping basket, crypto investors felt pranked by the president, and a burger made of skin | Finimize Hi Reader, here's what you need to know for March 8th in 3:11 minutes.

The financial toll of a divorce can be devastating

Friday, March 7, 2025

Here are some options to get back on track ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Too Big To Fail?

Friday, March 7, 2025

Revisiting Millennium and Multi-Manager Hedge Funds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The tell-tale signs the crash of a lifetime is near

Friday, March 7, 2025

Message from Harry Dent ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👀 DeepSeek 2.0

Thursday, March 6, 2025

Alibaba's AI competitor, Europe's rate cut, and loads of instant noodles | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March 7th in 3:07 minutes. Investors rewarded

Crypto Politics: Strategy or Play? - Issue #515

Thursday, March 6, 2025

FTW Crypto: Trump's crypto plan fuels market surges—is it real policy or just strategy? Decentralization may be the only way forward. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What can 40 years of data on vacancy advertising costs tell us about labour market equilibrium?

Thursday, March 6, 2025

Michal Stelmach, James Kensett and Philip Schnattinger Economists frequently use the vacancies to unemployment (V/U) ratio to measure labour market tightness. Analysis of the labour market during the

🇺🇸 Make America rich again

Wednesday, March 5, 2025

The US president stood by tariffs, China revealed ambitious plans, and the startup fighting fast fashion's ugly side | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March

Are you prepared for Social Security’s uncertain future?

Wednesday, March 5, 2025

Investing in gold with AHG could help stabilize your retirement ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏