Aziz Sunderji - Growing Pains for Home Prices

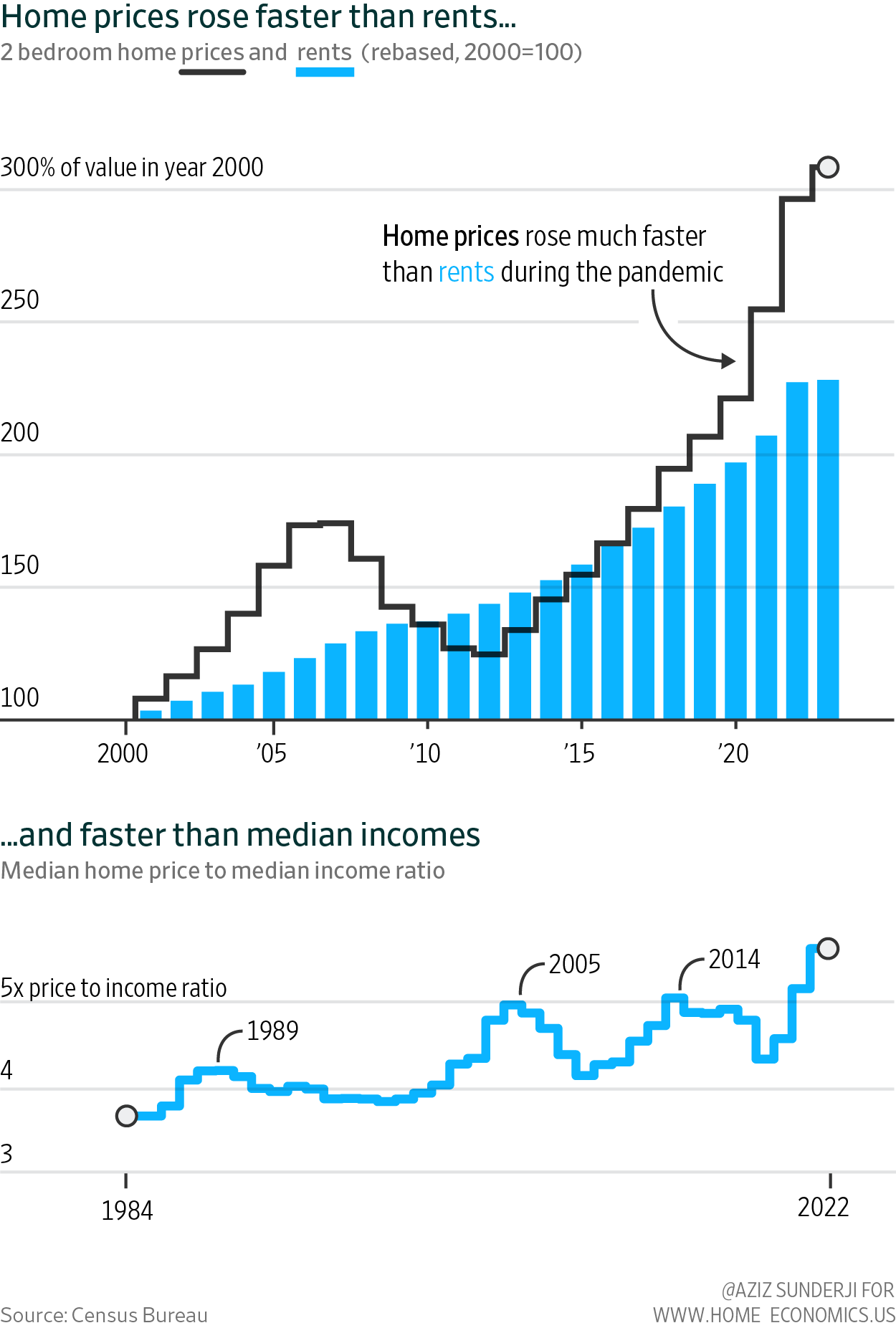

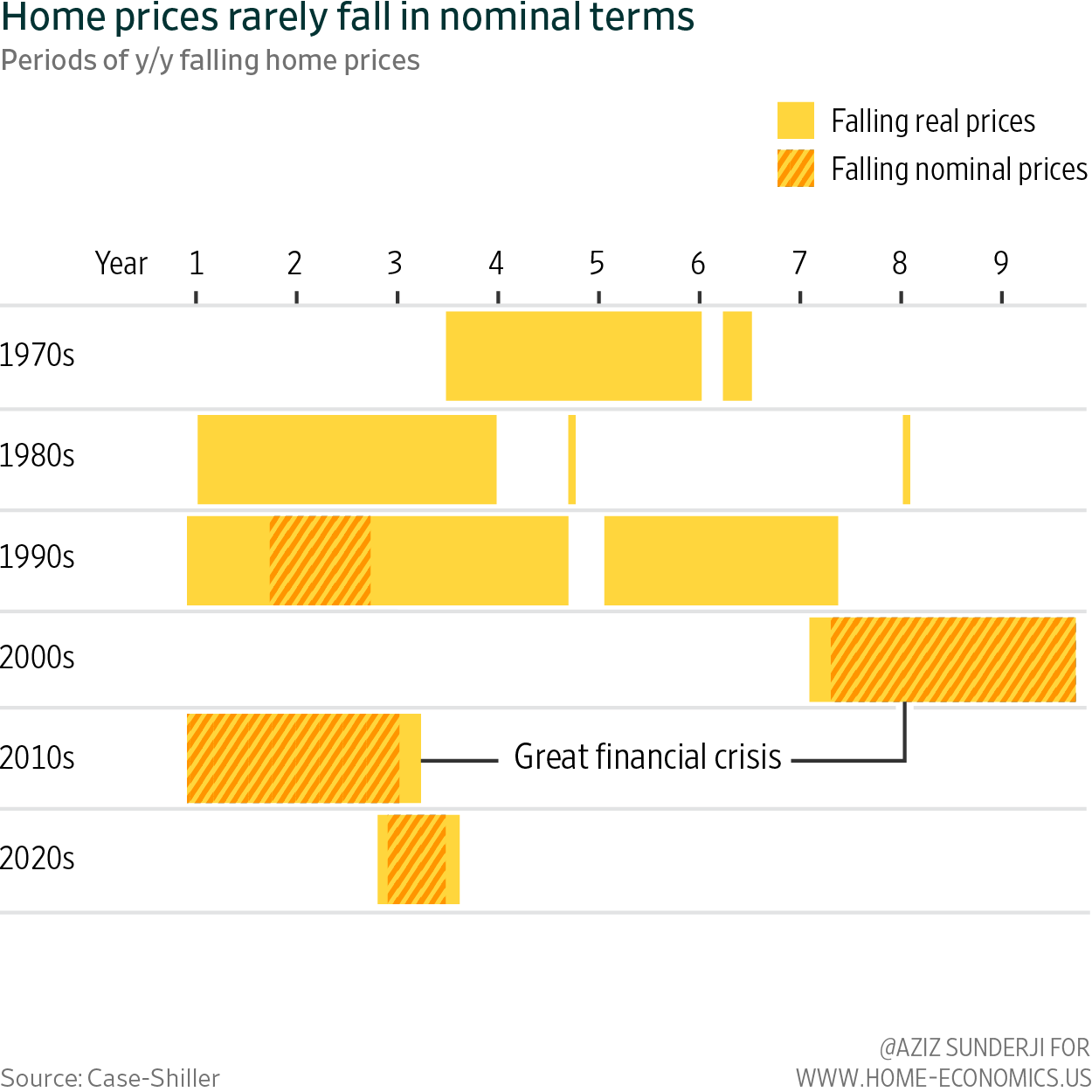

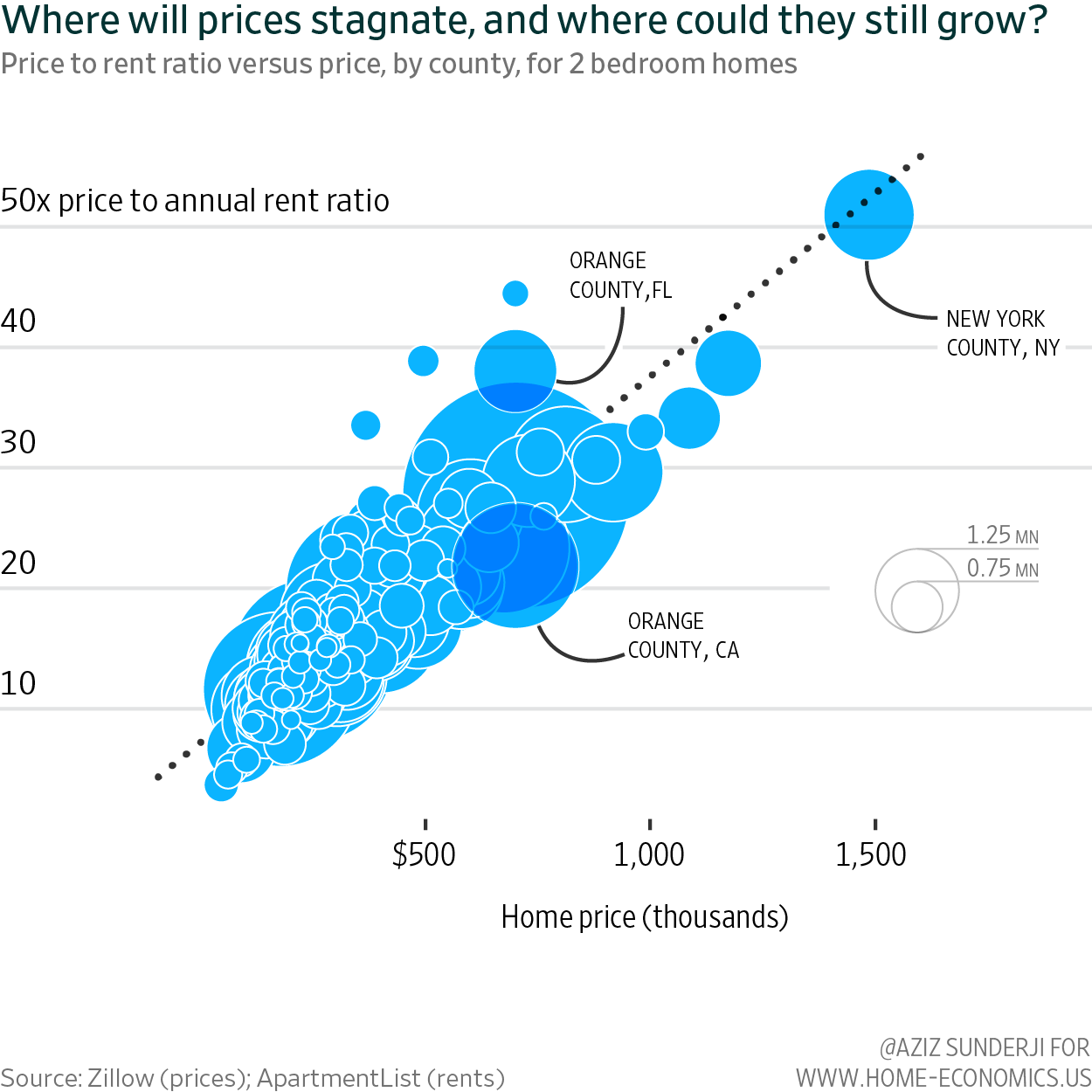

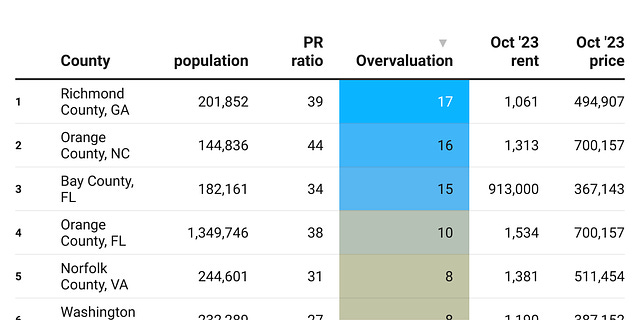

I’ve been working on an article about the ‘buy versus rent decision’ for the past week. It’s melting my brain. In the meantime, here is one facet of the question I’ve been grappling with—the relative pricing of home purchases compared to rents and incomes. TLDR: it doesn’t look great for home prices. SPEED READMy dad has a photo of himself as a 10-year-old boy scout, standing on a mountain in Tanzania with his troop. He was the scout leader. What's most notable about the photo—aside from my dad's evident pride in his hard-won title—is the disproportionately large size of his nose compared to the rest of his tiny body. It’s adorable. Luckily, he eventually grew into his nose—and if you believe him—today people often tell him he looks like the actor Richard Gere. With time, everything sorted itself out. Growing painsThe economy has grown surprisingly rapidly over the past few years. But home prices have grown even faster. Today, two valuation anchors for home prices—the price to rent ratio and the price to income ratio—are both wildly stretched. It’s tempting to think these ratios will eventually subside to their more typical levels via steep falls in home prices. That’s what happened in 2007-09. But the Great Financial Crisis was the exception that proves the rule: home prices rarely fall (at least in nominal terms). Sellers prefer to sit on the sidelines rather than cut prices. As Robert Shiller wrote in 2003, “home prices are sticky downward. That is, when excess supply occurs, prices do not immediately fall to clear the market.” So how do we get back to normal looking valuations? One path—maybe the most likely one—is modest home price gains which lag those in rents and incomes in the years to come. Home prices have risen too fast. But like a young boy growing into his nose, it may just take time for the rest of the economy to catch up. DEEP READThis wouldn’t be the first time home price growth cooled while the rest of the economy caught up. The price-to-income ratio was also stretched in 2014. Over the subsequent 5 years, real incomes grew by 21% while real home prices only rose by 3%. If homes prices buck the typical rising trend and stagnate for some time, which regions are more vulnerable? Oranges to orangesResearch has shown that, at the county level, high price to rent ratios successfully¹ forecast subsequent price moves². But it’s not as simple as betting against the counties with high price to rent ratios. New York City, for example, has always had a high ratio (over 50x). Instead, it makes more sense to look for vulnerabilities in counties with high the price to rent ratios adjusted for local prices. Adjusted for prevailing home prices, places like Orange County, Florida, look overvalued. Oddly enough, another Orange County—in California—seems sharply undervalued. The table below lists all US counties with their most recent median rents and home prices (both for 2 bedroom units, for comparability), and their price to rent ratios. Clicking on the table will take you a site where you can rank the counties by each metric. Take these numbers with a grain of salt. In my area for example (Park Slope, Brooklyn), aggregate statistics far underprice rents. Still—if a rising tide will no longer lift all boats—properly calibrated price to rent figures might usefully feed into a broader analysis of which areas are most vulnerable to years of stagnating home prices. 1 Capozza and Seguin were able to forecast home prices moves based on price-to-rent ratios. But their results were contingent on two things. First, they adjusted rent prices up to account for the inferior quality of rental units compared to for-sale units. Second, they split the price-to-rent ratio into a local component and a “disequilibrium” component. Only those counties where high ratios were not justified by local conditions did prices subsequently drop. 2 The elephant in the room I’ve left unaddressed here is the cost of financing. Historically, price to rent ratios have risen for long stretches as mortgage rates fell (the price to rent ratio rose but the all-in cost of ownership to rents remained stable). But this is of course not the case today: the stretched valuations shown above are, if anything, exacerbated further when accounting for interest rates. Home Economics is a reader-supported publication. Please consider upgrading to a paid subscription to support our work. Paying clients receive access to the full archive, forecasts, data sets, and exclusive in-depth analysis. This edition is free—you can forward it to colleagues who appreciate concise, data-driven housing analysis. |

Older messages

This bird is cooked

Thursday, November 23, 2023

Rising unemployment is bad news for the economy and for home prices

How to Make Great Charts

Friday, November 17, 2023

An entirely biased view

Another Reason Mortgage Rates will Fall

Friday, November 10, 2023

As rate vol dips and the yield curve steepens, prepayment risk will abate

A Smaller “Term Premium” means Lower Mortgage Rates

Friday, November 3, 2023

Especially after Wednesday's announcement from the Treasury

Mortgage rates are set to fall

Wednesday, October 25, 2023

Everyone's done with hiking

You Might Also Like

EmRata Flaunted Pelvic Bone Cleavage, Aka "Pelvage," In The Tiniest Skirt

Monday, March 10, 2025

Plus, your love life this week, your daily horoscope, and more. Mar. 10, 2025 Bustle Daily Chet Hanks EXCLUSIVE Chet Hanks Has The Last Laugh It's easy to make assumptions about Chet Hanks, namely

The 20 best cookbooks of spring

Monday, March 10, 2025

NYC steakhouse sues Texas over attempted “Texts Strip” rebranding.

(sorry)

Monday, March 10, 2025

now with the link this time ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

an equinox stretch

Monday, March 10, 2025

everything you need for Wednesday's workshop ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

9 Strange Tax Deductions You Might Actually Qualify For

Monday, March 10, 2025

Easiest Ways to Spot an Unpaid Tolls Scam Text. Good news: The IRS might allow you to deduct all those gambling losses. Not displaying correctly? View this newsletter online. TODAY'S FEATURED STORY

Maybe You Fund The People Who *Will Start* Families

Monday, March 10, 2025

At best, the DOT's new funding priorities get causation wrong ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

“In this Poem, We Will Not Glorify Sunrise” by Sarah Freligh

Monday, March 10, 2025

nor admire the apples that blossom / during a February heat wave ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Glen Powell to the (couture) rescue

Monday, March 10, 2025

— Check out what we Skimm'd for you today March 10, 2025 Subscribe Read in browser But first: our editors' cult-status products Update location or View forecast Good morning. While we might

Deporting Undocumented Workers Will Make Housing More Expensive

Monday, March 10, 2025

The effect will be most pronounced in Texas and California ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Viral "Jellyfish" Haircut Is 2025's Most Controversial Trend

Monday, March 10, 2025

So edgy. The Zoe Report Daily The Zoe Report 3.9.2025 The Viral "Jellyfish" Haircut Is 2025's Most Controversial Trend (Hair) The Viral "Jellyfish" Haircut Is 2025's Most