Net Interest - The Points Guy

“People are willing to pay anything for a free ticket.” — Apocryphal airline executive. When it comes to frequent flyer points, I’m more of a saver. It’s daft: Points devalue over time like any currency and they don’t even pay any interest. But the thrill of refreshing a balance that currently exceeds 2 million miles makes up for it. This holiday season I added to my haul, flying to Vietnam via Qatar while also spending liberally on my British Airways co-branded credit card. The allure of oneworld Gold status for life, which I am 85% of the way to securing, keeps me motivated. A retirement of free champagne, flat bed seats and exclusive lounge access awaits. Frequent flyer programs are big business. Introduced by American Airlines in 1981, they were launched to bolster customer retention in an industry growing increasingly competitive following the US Airline Deregulation Act of 1978. “Using incentives was hardly new,” Bob Crandall, American Airlines’ CEO said later. Supermarkets were giving out S&H Green Stamps, buying customers’ loyalty with free toasters and vacuum cleaners. As long ago as 1793, a merchant in Sudbury, New Hampshire is recorded to have awarded copper tokens to his customers for them to redeem later for goods. But airlines are almost uniquely positioned to maximize the economic features of loyalty schemes:

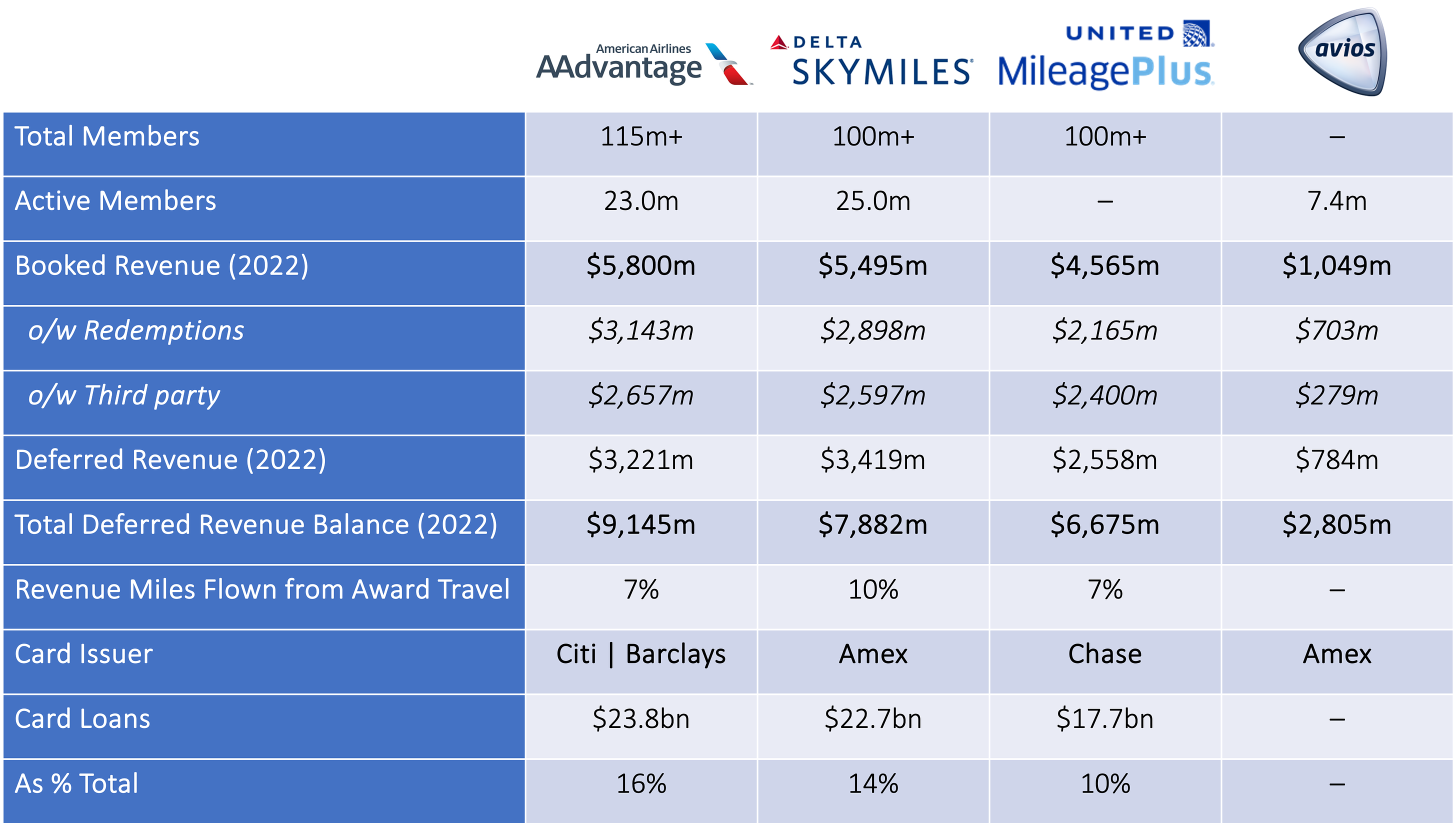

More than a million people signed up for American Airlines’ frequent flyer program in its first three months of launch, and other airlines quickly followed. Within a few years, an estimated 75% of business travelers had joined at least one program. Initially, the schemes allowed members to claim the occasional free flight (usually to Hawaii) in the course of their regular business travel. Then, in 1988, Delta introduced a Triple Mileage scheme which allowed travelers to clock up points at a turbo-charged rate. It led to a frequent-flying frenzy, as the industry’s first “points guys” emerged to play the game the programs spawned. Flying back and forth between two short-leg cities, a rewards ticket to Hawaii could be earned in just eight continuous hours of flying. “One of the most popular ones was Dallas to Austin,” an early points maven told the New York Times. “People would do that eight, nine, 10 times in a day.”¹ At around the same time, another innovation opened up airline programs to a broader market than just frequent flyers. In 1987, American partnered with Citi to launch a co-branded credit card. Now, consumers could collect points simply by spending on their card, whether that was on American Airlines flights or not. As a marketing strategy, it was genius. By offering rewards, card issuers provided card holders with an incentive to use their card. Meanwhile, the rewards themselves created loyalty towards the airline. Because the airline can adjust the redemption rate to encourage the use of rewards in ways that reduce their marginal cost, it is able to offer rewards to card issuers at a discount.² In this way, reward programs can generate profits for both issuers and airlines while generating loyalty to both, a significant positive sum outcome. With points in the mix, airlines, consumers and banks all end up as winners: Airlines make money selling rewards; consumers enjoy the indulgence of free travel; banks recruit new customers and profit from more spend on their card. Today, the largest programs have over 100 million members each. The three big ones – American’s AAdvantage, Delta’s SkyMiles and United’s MileagePlus – generated $15.6 billion of revenue in 2022, equivalent to 11% of their parent companies’ total revenue. Because it is typically a more stable income stream, loyalty revenue helps insulate airlines from fluctuations in the business cycle and can be used to secure cheaper funding. During the pandemic, all three used their programs as collateral to issue bonds at more favorable rates than the airlines themselves would have received. The schemes anchor issuers’ credit card businesses, too. American’s co-branded card accounts for around 16% of Citi’s card loans, while the partnership American Express forged with Delta in 1996 makes up 14% of Amex card loans. “We’ve had record acquisition with…Delta in recent quarters,” said the Vice Chairman of American Express last year. “And I think there is a ton more that we can do together to create value and customer experiences… It unlocks a whole bunch of distribution reach that would be difficult to do without a really powerful partner.” Points schemes are a business inside a business, sitting at the intersection of airlines and banks. To understand how they work, where points come from and where they go, read on… Subscribe to Net Interest to read the rest.Become a paying subscriber of Net Interest to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

The Business of News

Saturday, January 6, 2024

The Ways the Financial Press Creates Value

Monetising an Algorithm

Friday, December 15, 2023

The Story of FICO

Battle of the Buttons

Friday, December 8, 2023

How PayPal, Amazon and Shopify are Changing the Checkout

Lenders of Last Resort

Friday, December 1, 2023

The $1.3 trillion institution that backstops American banks

The Data Exchange

Friday, November 24, 2023

How the Market for Financial Data Changed

You Might Also Like

Longreads + Open Thread

Saturday, March 8, 2025

Personal Essays, Lies, Popes, GPT-4.5, Banks, Buy-and-Hold, Advanced Portfolio Management, Trade, Karp Longreads + Open Thread By Byrne Hobart • 8 Mar 2025 View in browser View in browser Longreads

💸 A $24 billion grocery haul

Friday, March 7, 2025

Walgreens landed in a shopping basket, crypto investors felt pranked by the president, and a burger made of skin | Finimize Hi Reader, here's what you need to know for March 8th in 3:11 minutes.

The financial toll of a divorce can be devastating

Friday, March 7, 2025

Here are some options to get back on track ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Too Big To Fail?

Friday, March 7, 2025

Revisiting Millennium and Multi-Manager Hedge Funds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The tell-tale signs the crash of a lifetime is near

Friday, March 7, 2025

Message from Harry Dent ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👀 DeepSeek 2.0

Thursday, March 6, 2025

Alibaba's AI competitor, Europe's rate cut, and loads of instant noodles | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March 7th in 3:07 minutes. Investors rewarded

Crypto Politics: Strategy or Play? - Issue #515

Thursday, March 6, 2025

FTW Crypto: Trump's crypto plan fuels market surges—is it real policy or just strategy? Decentralization may be the only way forward. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What can 40 years of data on vacancy advertising costs tell us about labour market equilibrium?

Thursday, March 6, 2025

Michal Stelmach, James Kensett and Philip Schnattinger Economists frequently use the vacancies to unemployment (V/U) ratio to measure labour market tightness. Analysis of the labour market during the

🇺🇸 Make America rich again

Wednesday, March 5, 2025

The US president stood by tariffs, China revealed ambitious plans, and the startup fighting fast fashion's ugly side | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March

Are you prepared for Social Security’s uncertain future?

Wednesday, March 5, 2025

Investing in gold with AHG could help stabilize your retirement ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏