Net Interest - Lenders of Last Resort

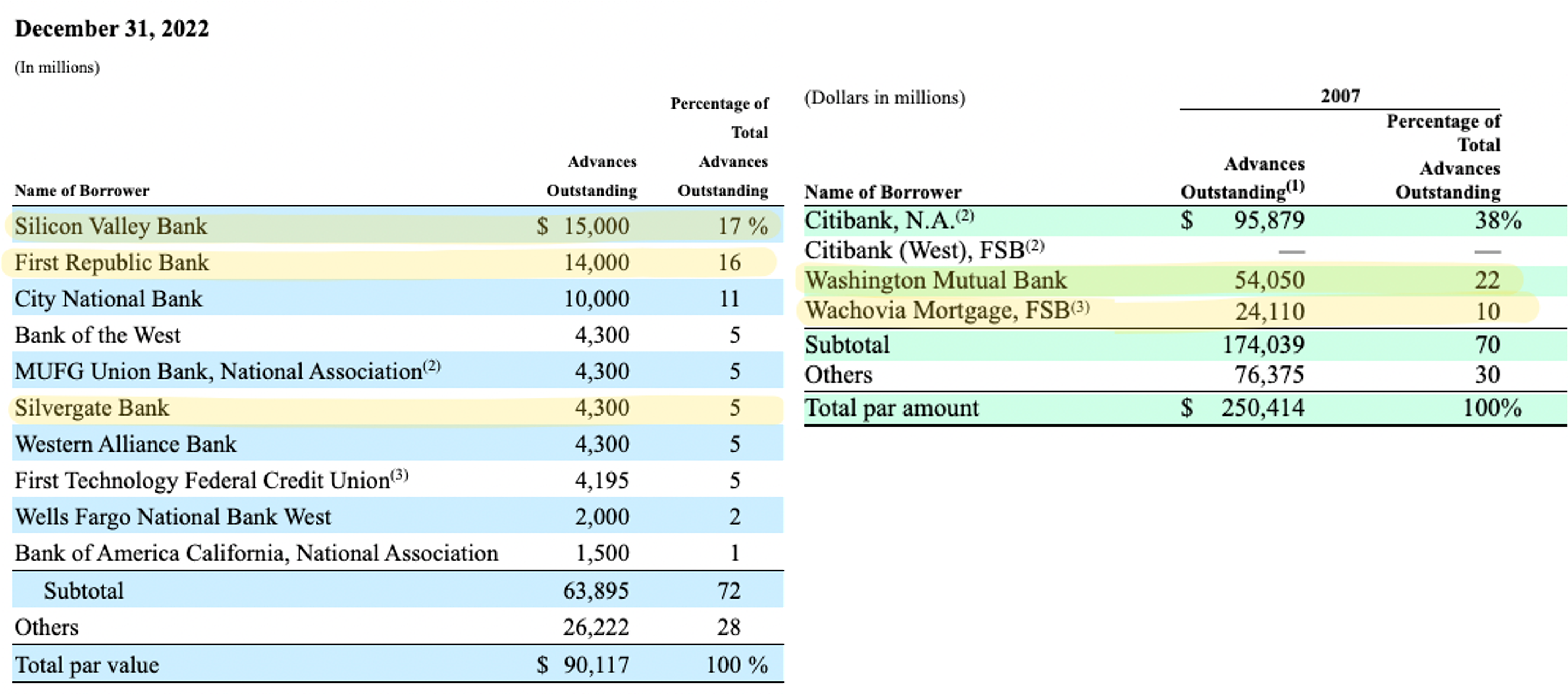

Silvergate Capital is in the final throes of winding itself up. Last week, the bank – the first domino to fall in a cascade that brought down Silicon Valley Bank, First Republic and Credit Suisse – announced that it has repaid all remaining depositors, eight and a half months after beginning a process of voluntary liquidation. At peak, Silvergate housed $14.3 billion of customer deposits. But ties to the crypto community, which accounted for 90% of deposits, led to a huge exodus in the weeks following the FTX collapse, and in the fourth quarter of last year customers pulled $8.1 billion. In a preview of what would unfold at Silicon Valley Bank, Silvergate couldn’t access cash quickly enough to meet demand. Its balance sheet comprised $11.0 billion of securities at fair value whose cost was $12.0 billion; selling them would have crystallized a $1 billion loss it could ill afford. So La Jolla, California-based Silvergate paid a visit to its local Federal Home Loan Bank in San Francisco. As a “member”, it was entitled to draw on special loans. By the end of the year, it had tapped the Home Loan Bank for $4.3 billion, up from $0.7 billion at the end of September. Although it paid them all back by the beginning of March, the loans provided Silvergate with a lifeline that kept it afloat longer than its fundamentals warranted. Silvergate wasn’t the only struggling bank to make the trip to San Francisco. Three of the Federal Home Loan Bank’s six largest customers at year end 2022 would cease to exist a few months later; some 38% of its outstanding advances were to borrowers who wouldn’t make it. And it’s not the first time the Federal Home Loan Bank of San Francisco (FHLBSF) has found itself in that position. Two of its biggest four borrowers at the end of 2007, accounting for 32% of advances, failed over the course of the following year. The optics haven’t been lost on FHLBSF’s regulator, the Federal Housing Finance Agency (FHFA). In a report released earlier this month, authorities made a number of proposals to reform FHLBSF and its peers. The regional bank failures, they said, “highlighted the need for a clearer distinction between the appropriate role of the FHLBanks, which provide funding to support their members’ liquidity needs across the economic cycle, and that of the Federal Reserve, which maintains the primary financing facility for troubled institutions with immediate, emergency liquidity needs.” So who are these Federal Home Loan Banks? Few outside the US financial services industry are familiar with them. Yet, with $1.3 trillion of assets, they wield a power that dwarfs their low profile. To learn more, read on... Subscribe to Net Interest to read the rest.Become a paying subscriber of Net Interest to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

The Data Exchange

Friday, November 24, 2023

How the Market for Financial Data Changed

Slicing and Dicing

Friday, November 17, 2023

How Apollo is Creating a Deconstructed Bank

The Capital Cycle Hits Payments

Friday, November 10, 2023

Adyen's American Adventure

Private Lending

Friday, November 3, 2023

The Growth of an Asset Class

A Reckoning in Payments

Friday, October 27, 2023

First Adyen and now Worldline: Is this the end of Fintech?

You Might Also Like

Longreads + Open Thread

Saturday, March 8, 2025

Personal Essays, Lies, Popes, GPT-4.5, Banks, Buy-and-Hold, Advanced Portfolio Management, Trade, Karp Longreads + Open Thread By Byrne Hobart • 8 Mar 2025 View in browser View in browser Longreads

💸 A $24 billion grocery haul

Friday, March 7, 2025

Walgreens landed in a shopping basket, crypto investors felt pranked by the president, and a burger made of skin | Finimize Hi Reader, here's what you need to know for March 8th in 3:11 minutes.

The financial toll of a divorce can be devastating

Friday, March 7, 2025

Here are some options to get back on track ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Too Big To Fail?

Friday, March 7, 2025

Revisiting Millennium and Multi-Manager Hedge Funds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The tell-tale signs the crash of a lifetime is near

Friday, March 7, 2025

Message from Harry Dent ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👀 DeepSeek 2.0

Thursday, March 6, 2025

Alibaba's AI competitor, Europe's rate cut, and loads of instant noodles | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March 7th in 3:07 minutes. Investors rewarded

Crypto Politics: Strategy or Play? - Issue #515

Thursday, March 6, 2025

FTW Crypto: Trump's crypto plan fuels market surges—is it real policy or just strategy? Decentralization may be the only way forward. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What can 40 years of data on vacancy advertising costs tell us about labour market equilibrium?

Thursday, March 6, 2025

Michal Stelmach, James Kensett and Philip Schnattinger Economists frequently use the vacancies to unemployment (V/U) ratio to measure labour market tightness. Analysis of the labour market during the

🇺🇸 Make America rich again

Wednesday, March 5, 2025

The US president stood by tariffs, China revealed ambitious plans, and the startup fighting fast fashion's ugly side | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March

Are you prepared for Social Security’s uncertain future?

Wednesday, March 5, 2025

Investing in gold with AHG could help stabilize your retirement ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏