Hot in Enterprise IT/VC - What's 🔥 in Enterprise IT/VC #377

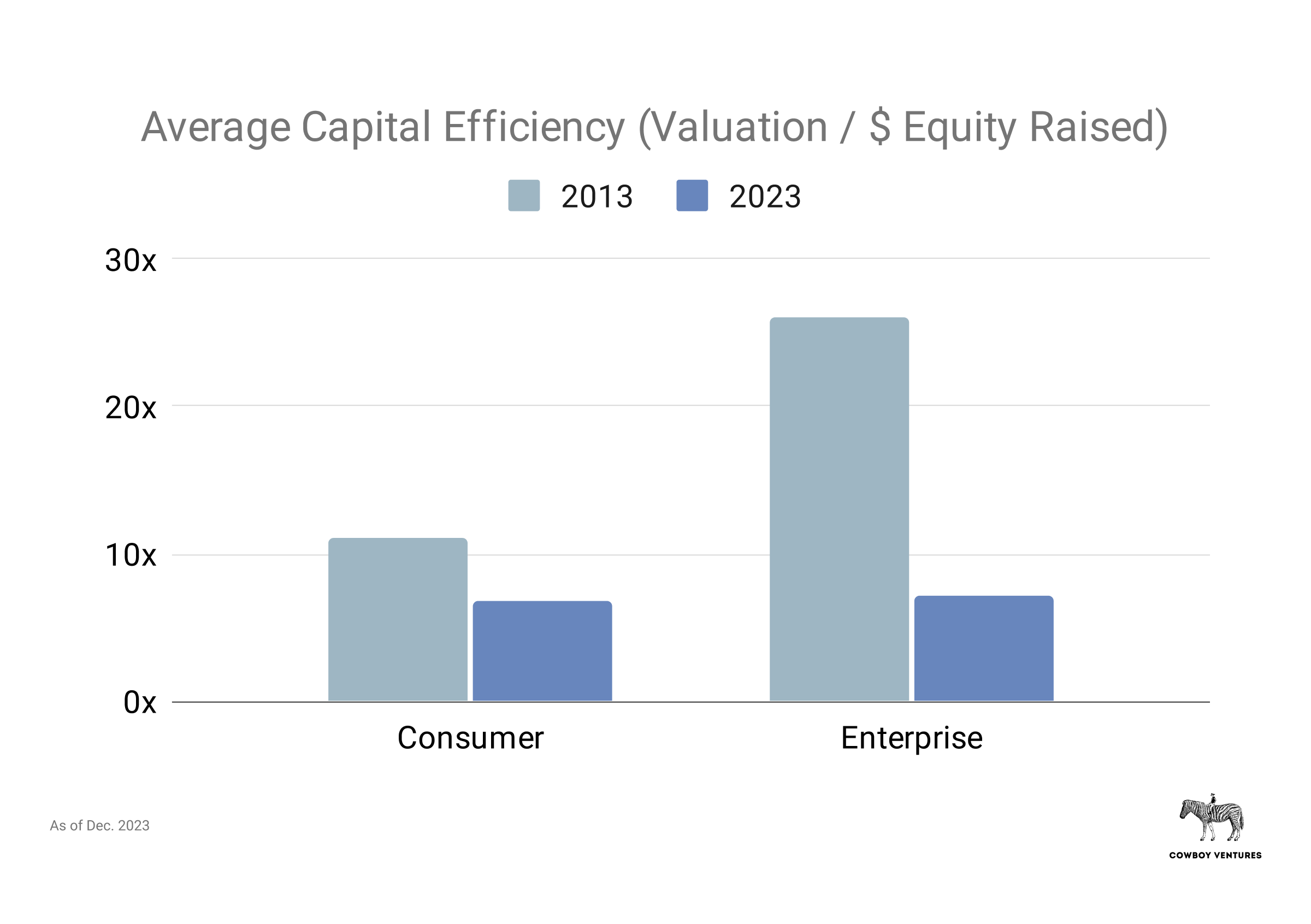

What's 🔥 in Enterprise IT/VC #377Who would have that thought that enterprise would become too sexy - from 15 to 416 🦄 in 10 years 🤯Besides just organizing my thoughts from the week, one of my other reasons for writing What’s 🔥 in Enterprise IT/VC over 7 years ago was to shed more light and excitement around enterprise software. To that end, it was quite shocking 🤯 to see Aileen Lee’s data-driven look at unicorns 🦄, a coin she termed over 10 years ago. Let me repeat, there were only 15 enterprise 🦄 representing 39% of the total number and only 20% of the overall market cap of all 🦄. 10 years later, we have an over 27x increase in the total number of enterprise 🦄 at 416 which make up almost 80% of the overall 🦄 value. So yes, we have a problem. As I mentioned in last week’s newsletter, we now have 10 of each in every category with many 1 product companies who aren’t IPOable and many 1 feature companies who just are not worth what they are worth. In addition, this slide from Aileen’s presentation should get your attention now👇🏼 - once upon a time capital efficiency was the name of the game for enterprise software companies with a 27X Valuation/Equity Raised ratio and now it’s just like consumer 🫢! To quote Aileen Lee from Cowboy Ventures:

Be careful what you wish for! Maybe it was much nicer when no one was paying as much attention to enterprise software companies? Or perhaps we will get VCs to be contrarian again and run for the hills from enterprise leaving the rest of us die-hards to do our work efficiently? Here’s Aileen’s conclusion:

We learned that the laws of gravity are still in full force and everything is not just 📈 because we say it is. Capital efficiency always matters even though we lost our minds for quite some time during the ZIRP era. Yes, there will be more pain ahead. Last week, investing legend Howard Marks wrote an essay titled “Easy Money” that perfectly captures the state of 🦄 and enterprise software companies, which were essentially on moving sidewalks.

Like Howard says we all looked pretty smart the last 10 years with the number of Unicorns hitting 80% of value of overall index. The next few years will separate the good from the great as the moving sidewalks come to a full stop. For many years, I felt like we were all pushing a rock up a hill with the idea that enterprise startups delivers repeatable value and growth, but I am still shocked at how quickly and how far the pendulum swung from consumer to enterprise. The question we need to all ask ourselves is if dominant entrenched players in enterprise will prevent ginormous liquid outcomes similar to consumer cos who were gateways and controlled access to users. IMO, the answer is no, but the cost of selling due to competition and vendor consolidation has skyrocketed as seen in Aileen’s report resulting in similar capital efficiency as consumer cos. And what that means once again is if larger platform cos have the installed customer base, if customers are consolidating vendors, then yes, we will see many smaller one feature or one product companies get acquired. Combine this with multiple compression, slower overall growth for all companies at scale, and one needs to ask what this looks like for the venture capital industry overall. I’m biased, but IMO Inception investing is the best place to be and one must think about a world where a $3B outcome is as big as one can get instead of $6B one which means ownership and fund size truly matters. I continue to believe that this will be one of the best classes of startups as only the die-hard founders who are slightly crazy 😜 will start a company today, there will be less me-toos in every single category, access to higher quality talent is better than ever before, AI-infused in all software and operations will help create ground-breaking new companies which are more efficient, and finally, founders and investors have the religion again - nail it before you scale it, stay lean and mean and capital efficiency ALWAYS Matters! As always, 🙏🏼 for reading and please share with your friends and colleagues. Scaling Startups

Enterprise Tech

Markets

What's Hot in Enterprise IT/VC is free today. But if you enjoyed this post, you can tell What's Hot in Enterprise IT/VC that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

What's 🔥 in Enterprise IT/VC #376

Saturday, January 13, 2024

Know when to hold 'em, know when to fold 'em - founder reflections

What's 🔥 in Enterprise IT/VC #375

Saturday, January 6, 2024

The come to Jesus moment for founders, investors, and boards - either you're early and lean, growing efficiently + lean with cash in bank or access to cash, or you need to find a home or die...

What's 🔥 in Enterprise IT/VC #374

Saturday, December 30, 2023

Predictions for 2024 and scoring 2023

What's 🔥 in Enterprise IT/VC #373

Saturday, December 23, 2023

Thoughts on M&A in light of Adobe Figma, what's the right number of founders to start a company, + Top 5 What's 🔥 Posts in 2023

What's 🔥 in Enterprise IT/VC #372

Saturday, December 16, 2023

On pattern recognition in venture and startups

You Might Also Like

🚀 Ready to scale? Apply now for the TinySeed SaaS Accelerator

Friday, February 14, 2025

What could $120K+ in funding do for your business?

📂 How to find a technical cofounder

Friday, February 14, 2025

If you're a marketer looking to become a founder, this newsletter is for you. Starting a startup alone is hard. Very hard. Even as someone who learned to code, I still believe that the

AI Impact Curves

Friday, February 14, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. AI Impact Curves What is the impact of AI across different

15 Silicon Valley Startups Raised $302 Million - Week of February 10, 2025

Friday, February 14, 2025

💕 AI's Power Couple 💰 How Stablecoins Could Drive the Dollar 🚚 USPS Halts China Inbound Packages for 12 Hours 💲 No One Knows How to Price AI Tools 💰 Blackrock & G42 on Financing AI

The Rewrite and Hybrid Favoritism 🤫

Friday, February 14, 2025

Dogs, Yay. Humans, Nay͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 AI product creation marketplace

Friday, February 14, 2025

Arcade is an AI-powered platform and marketplace that lets you design and create custom products, like jewelry.

Crazy week

Friday, February 14, 2025

Crazy week. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

join me: 6 trends shaping the AI landscape in 2025

Friday, February 14, 2025

this is tomorrow Hi there, Isabelle here, Senior Editor & Analyst at CB Insights. Tomorrow, I'll be breaking down the biggest shifts in AI – from the M&A surge to the deals fueling the

Six Startups to Watch

Friday, February 14, 2025

AI wrappers, DNA sequencing, fintech super-apps, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How Will AI-Native Games Work? Well, Now We Know.

Friday, February 14, 2025

A Deep Dive Into Simcluster ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏