Net Interest - Funding Mr Bates

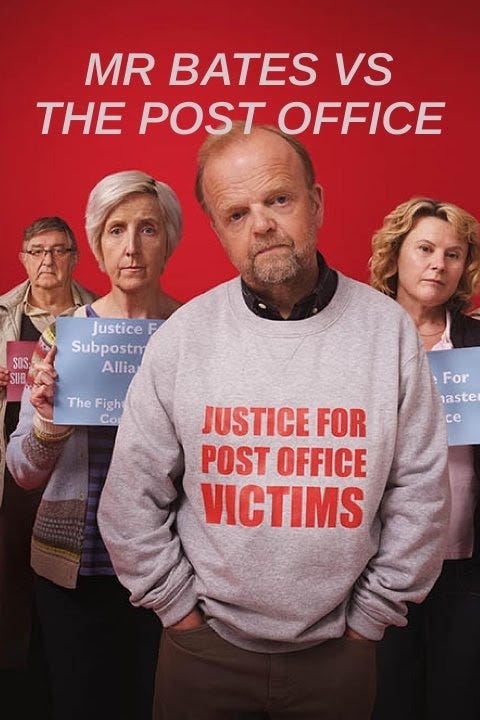

Earlier this year, a TV mini-series galvanized public attention in the UK like nothing before. Mr Bates vs The Post Office told the story of a long-running scandal that saw post office managers prosecuted for cash shortfalls conjured up by a faulty IT system. As a piece of drama its impact was immense. It lent voice to the victims, many of whom lost their liberty as well as their livelihoods as a result of wrongful convictions. It made a national hero of their spokesman, Mr Alan Bates, who fronted a two-decade campaign for justice. And it revealed the lengths the Post Office and its IT supplier Fujitsu went to thwart the subpostmasters’ search for answers and, ultimately, recompense. It also shone a light on an obscure area of financing. When Alan Bates lost his post office in Llandudno, North Wales, in 2003, he knew it would be hard to fight back. He’d refused to sign weekly accounts which he believed were riddled with computer errors because doing so would have made him personally liable for losses. The Post Office responded by taking away his contract and with it, the £60,000 that he and his partner had invested in their post office shop. “I never tried to take it to court,” he told a journalist later. “I was told that it could keep me in court and keep appealing any findings until I ran out of money.” Within a few years, Bates realized he was not alone and, in 2009, formed the Justice for Subpostmasters Alliance (JFSA). Meeting in a village hall in Fenny Compton, Warwickshire, their numbers grew but still, money was an issue. An investigation commissioned by the Post Office itself didn’t lead to a satisfactory outcome and the group were keen to escalate the matter through the courts. In the last episode of the series, Bates addresses the hall: “Finally, 555 of us now, ready to tell our stories to a court.” “That’s all fine and dandy, Alan, but how are we going to pay for it?” asks an Alliance member. The group’s solicitor, James Hartley, comes to the front of the stage. “There are a few specialist funders who are prepared to take on this kind of risk. If we win, we pay them back out of your compensation.” “If we lose, please?” asks another member. “Well, then they lose too. Their entire investment.” The group did win. After a hard-fought battle across two trials, two failed attempts to appeal and one failed application to have the judge recuse himself by the Post Office, a settlement was reached for £58 million in compensation. The specialist funder that helped them was Therium. Founded the same year Bates set up his Justice for Subpostmasters Alliance, it is one of a number of firms that finance litigation in return for a share of any award. Since launch, Therium has raised $1.1 billion of funds from third-party investors and has funded claims valued at over $40 billion. As well as the Post Office case, it funded the UK “dieselgate” action against Volkswagen, an antitrust case against European truck manufacturers, merchant interchange litigation against Visa and Mastercard, and more. Its largest peer, Burford Capital, also founded in 2009, currently manages a portfolio of $7.1 billion of cases, including a big recent win against the Argentine Republic over its nationalization of oil company YPF. It has never been made public how much Therium made on the Post Office case, but we can speculate. Spoiler: the postmasters weren’t happy. To understand more about this still-young asset class, the kinds of returns it generates and how sustainable they are, read on… Subscribe to Net Interest to read the rest.Become a paying subscriber of Net Interest to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

New York State of Mind

Friday, February 2, 2024

The State of US Regional Banks

Debt Collectors

Friday, January 26, 2024

The Subsector at the End of the Value Chain

Hard Assets

Friday, January 19, 2024

Infrastructure: The Rise of an Asset Class

The Points Guy

Friday, January 12, 2024

Inside the Business of Air Miles

The Business of News

Saturday, January 6, 2024

The Ways the Financial Press Creates Value

You Might Also Like

Longreads + Open Thread

Saturday, March 8, 2025

Personal Essays, Lies, Popes, GPT-4.5, Banks, Buy-and-Hold, Advanced Portfolio Management, Trade, Karp Longreads + Open Thread By Byrne Hobart • 8 Mar 2025 View in browser View in browser Longreads

💸 A $24 billion grocery haul

Friday, March 7, 2025

Walgreens landed in a shopping basket, crypto investors felt pranked by the president, and a burger made of skin | Finimize Hi Reader, here's what you need to know for March 8th in 3:11 minutes.

The financial toll of a divorce can be devastating

Friday, March 7, 2025

Here are some options to get back on track ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Too Big To Fail?

Friday, March 7, 2025

Revisiting Millennium and Multi-Manager Hedge Funds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The tell-tale signs the crash of a lifetime is near

Friday, March 7, 2025

Message from Harry Dent ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👀 DeepSeek 2.0

Thursday, March 6, 2025

Alibaba's AI competitor, Europe's rate cut, and loads of instant noodles | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March 7th in 3:07 minutes. Investors rewarded

Crypto Politics: Strategy or Play? - Issue #515

Thursday, March 6, 2025

FTW Crypto: Trump's crypto plan fuels market surges—is it real policy or just strategy? Decentralization may be the only way forward. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What can 40 years of data on vacancy advertising costs tell us about labour market equilibrium?

Thursday, March 6, 2025

Michal Stelmach, James Kensett and Philip Schnattinger Economists frequently use the vacancies to unemployment (V/U) ratio to measure labour market tightness. Analysis of the labour market during the

🇺🇸 Make America rich again

Wednesday, March 5, 2025

The US president stood by tariffs, China revealed ambitious plans, and the startup fighting fast fashion's ugly side | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March

Are you prepared for Social Security’s uncertain future?

Wednesday, March 5, 2025

Investing in gold with AHG could help stabilize your retirement ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏