Research: Expected Valuation and Airdrop Calculation from Blur to Blast

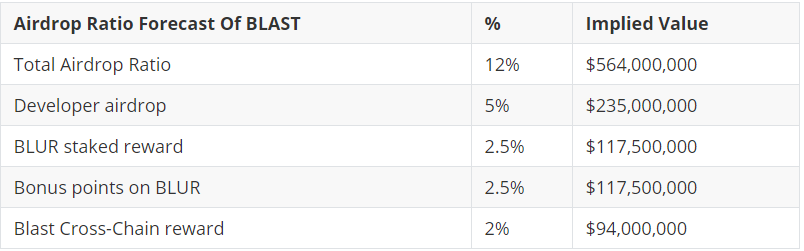

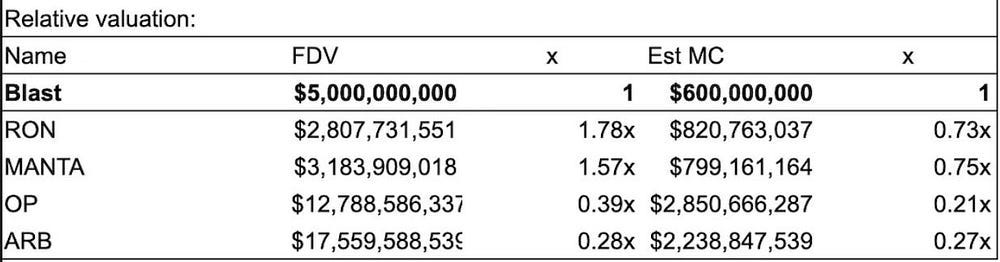

Author: 0xShangdidi, WuBlockchain Podcast Host, Former BitMEX Analyst Source: https://mirror.xyz/shangdidi.eth/7gEYtirGJ6n4BAVAS5omtJbZrxpKae2ab8H_o2D2GU8 This article attempts to examine the unique aspects of BLAST’s operational strategy and provide an analysis of the $BLUR token and airdrop predictions from the perspective of secondary participants, determining whether active participation is worthwhile. To begin with the conclusion, Blast stands out as a top-tier ecosystem, highly worthy of attention and participation: ● Strong Disruptive Genes: The extensive replication of strategies by peers, from BLUR’s scoring system to BLAST’s cross-chain lock-up and developer airdrops, is the greatest proof of its success. ● Substantial Market Size: Supported by a powerful network of Key Opinion Leaders (KOLs) and over $1 billion in capital accumulation. ● Demonstrated Capability: The BLAST team boasts successful experiences, strong execution, excellent understanding of market demand, and top-tier VC support. Meanwhile, BLUR serves as a cost-effective, two-in-one tool: ● BLUR leads the NFT platform market on Ethereum. ● With OpenSea’s primary market valuation reaching $13.3 billion during the 2022 bull market, BLUR’s fully diluted valuation (FDV) is currently only $2 billion. ● Over 30% of BLAST’s implied airdrop value is embedded within BLUR (sensitive to staking duration). ● BLUR faces no selling pressure from miners in the short term. Disruptive Elements in the Mix In the previous cycle, due to the high status of VCs and the scarcity of public chains, everyone tacitly understood the logic of harvesting retail investors. In the game between retail investors, projects, and ecosystems, retail investors often suffered heavily. User incentives were mostly limited to DeFi mining supported by ecosystems. It was common to see people going all-in just because of the arrival of blue-chip projects and the launch of “ecosystem funds”. And now? With as many as 140 EVM chains supported by RABBY, not to mention Cosmos, BTCL2, and the easier-to-launch new narrative of restaked roll-ups, here’s wishing investors and infrastructure projects good luck. Thus, this cycle has led to oversupply on the supply side, resulting in a significant increase in customer acquisition costs, and the summer of retail investors has arrived. At this point in the market, retail users who have survived from FTX and LUNA are very clear about why they entered the crypto world — not to overthrow Wall Street or promote decentralization, but to make damn money. Obviously, in a highly homogeneous infrastructure, compared to scalability and low gas fees, whoever can better design incentives and operate ecosystems to generate wealth and sustainability and enlarge the cake is more important. Among the new public chains, the best in sustainability and game theory may be Berachain, but BLAST truly has many commendable aspects in its strategy: ● The investment lineup of BLAST covers both the front and back end, with Paradigm providing technical innovation and security support, and powerful KOLs such as egirl Capital and loomdart calling the shots. ● “Luring” a large amount of TVL through cross-chain lock-up. This means users who mine BLAST will be “forced” to continue seeking new project interactions on the BLAST mainnet after it goes live. ● The team has been innovative in distributing tokens and has had a significant impact on the industry. BLUR has created a scoring system that is now a must-have for projects. Blast has ignited market dynamics and popularity with cross-chain lock-up airdrops. In addition to the often-discussed cross-chain lock-up, which provides TVL and ongoing interactions on the first day, and developer airdrops, Blast’s token distribution this time is unique in that the token will be distributed three months after the mainnet launch, rather than the traditional route of token issuance followed by mainnet launch. This move is likely also a good move. ● Focusing on building an application ecosystem. Appreciate Blast’s focus and scale, discovering and incubating early-stage projects that have not yet issued tokens through transparent developer airdrops and hackathons. With over $1 billion in liquidity, a strong network of KOLs, and support from VC firms, projects launched on Blast are likely to have one or two breakout points similar to Friend Tech. Estimated Valuation and Airdrop Calculation for BLAST Based on publicly available information, we know that there are four ways to obtain the Blast airdrop: rewards for developing projects on Blast, scoring on BLUR, staking BLUR, and cross-chain locking on Blast. Referring to BLUR’s TGE, Blast’s initial circulation and airdrop probability are likely to be around 12%; among them, the rewards for scoring on BLUR will be consistent with the rewards for staking BLUR, and developers will receive half of the rewards, and finally, cross-chain staking. Below are the airdrop ratios and allocations that I believe are most likely: I estimate BLAST’s valuation conservatively at $5 billion. If we refer to the current mainstream and BLUR’s TGE ratio, the initial circulation of BLAST will be around 15%, with an implied market cap of $600 million, ranking Blast’s market cap between 50th and 100th in the entire market. As an irresponsible guess, Blast’s valuation should be most similar to RON, which is also an application-to-public chain ecosystem with some similarities in background, and its upper limit should perhaps be half of Arb’s, after all, Blast does not have the premium of technology and L3. Currently, the estimated valuation of Blast on the Pre-market trading platform Aevo ranges from $3 billion to $10 billion. Blast’s current price support points are based on the following: ● Blast’s TVL ranks 6th worldwide and 2nd among L2s. ● Blast has attracted 120,000 users and is likely to become the L2 platform with the most daily active users. ● There is a high probability of innovation and application fire on Blast. TVL Blast’s TVL is currently $1.3 billion, second only to Solana, and 50% more than Polygon and Avalanche. It ranks sixth among smart contract platforms in terms of TVL. Although defining market value based on TVL may not be significant, TVL of this magnitude will to some extent support the market value. Blast User Count Blast’s user count also ranks among the top in the market. It is conservatively estimated that the number of daily active users on Blast after its launch will exceed 120,000. Because there are 120,000 wallets for cross-chain lock-ups, and these wallets will continue to lock up for two months after Blast goes live, users will actively interact to earn additional income. Each wallet needs Twitter verification, and there are no special rewards for multiple wallet scoring. We can estimate the number of wallets as a relatively safe number of daily active users after Blast goes live. If the above assumptions hold true and are applied to the current market environment, Blast’s daily active users will exceed Optimism, Avalanche, and Base, slightly fewer than Arbitrum. This further demonstrates that Blast’s valuation will not be too low. User Stickiness of Projects on BLAST Along with the pre-heating of Blast’s cross-chain points, the appearance of the testnet on Blast and the expectations for related ecosystem projects and airdrop incentives are also underway. Here are some interesting and hot new projects and triggers currently observed: NFT projects launching tokens on Blast As a significant portion of the beneficiaries on Blast are veterans of the NFT community, support for and relevance to NFTs on Blast should be high. I maintain high expectations for the interaction between NFT projects/communities and Blast. ByWassies is an OG NFT project on Ethereum, with a floor price of 0.9 ETH and strong awareness in the Ethereum community’s degens. It has confirmed that it will launch tokens on Blast and airdrop to Blast/Friendtech users. Ideal venues for Gamblefi Blast’s emphasis on gamified aspects, its massive KOL matrix, and the design of native yields make Blast the best breeding ground for gambling projects. Among them, Fantasy.top is a project that has received extensive discussion and praise during the testnet phase. It cleverly combines Sorare and Friend.tech, allowing players to profit by buying KOL cards to increase their influence, similar to the gameplay of fantasy sports. This project hits the pain points of many players and adds another innovative speculative method. In addition, Blur’s native returns support lossless gambling/speculative trading. In the previous cycle, Luna also attempted to launch a launchpad with a 20% return on UST, and the effect was not bad. Opportunities for High Volatility Speculation Due to Blast’s high participation and strong KOL lineup, and with sufficient TVL, there will certainly be many hot new opportunities on Blast, such as Thurster, which emphasizes fair launches and has announced several collaborating projects, with a strong lineup of backers including Loomdart, CBB, DCFgod, and Not3Lau. Risks of Blast: (Not to be Ignored) ● The risk of multisignature wallets in Blast’s cross-chain bridge. ● The risk of rugs occurring on Blast may be higher, as projects receiving airdrops may be more short-sighted and exit after receiving airdrops. ● If Blast cannot enlarge the cake through innovative applications, the token price will inevitably decline due to excessive selling pressure, with no new players entering. Implied Airdrop Value in BLUR It is difficult to accurately calculate BLUR’s staking rewards, as the rewards for staking BLUR to receive airdrops depend to a large extent on the duration of staking, with the multiplier increasing with time. It is necessary to consider the duration of staking by other stakers. Therefore, the following is a simple estimate without considering the multiplier, only used to determine BLUR’s price support given the expected airdrop to BLAST. $0.3 would be a strong support for BLUR’s token price, as the hidden value within Blast can basically cover Blur’s cost. At the same time, we see that the current price of $0.6 is relatively reasonable, and if NFT activity continues to decline, $0.6–0.7 would also be a significant hedging resistance for BLUR. Follow us Twitter: https://twitter.com/WuBlockchain Telegram: https://t.me/wublockchainenglish Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

WuBlockchain Weekly: MicroStrategy's Bitcoin Profits Exceed $4 Billion, Criminal Judgment Against CZ Postponed and…

Monday, February 19, 2024

1. US January Unadjusted CPI Annual Rate at 3.1%, Expectation at 2.90% link In January, the seasonally adjusted CPI (Consumer Price Index) in the United States showed an annual rate of 3.1%, slightly

Weekly Project Updates: Uniswap v4 to Be Released in Q3, Aptos Launches JamboPhone, Yuga Acquires Moonbirds Group,…

Monday, February 19, 2024

1. Uniswap v4's Launch Scheduled for the Third Quarter of 2024 link The Uniswap Foundation has announced that the launch of Uniswap v4 is tentatively scheduled for the third quarter of 2024.

Asia's weekly TOP10 crypto news (Feb 12 to Feb 18)

Monday, February 19, 2024

1. Japan's Weekly Summary 1.1 Japan's Financial Services Agency Urges Financial Institutions to Strengthen Monitoring of “Illegal” Cryptocurrency Transfers link The Japanese Financial Services

Cex Data in Jan: there's not much change in trading volume, with a 13% decrease in website traffic

Monday, February 12, 2024

The data analysis conducted by the Wu team indicates: In January, the spot trading volume of major exchanges increased by 2.6% month-on-month. The top three in terms of change rate were Bitfinex at 20%

Asia's weekly TOP10 crypto news (Feb 5 to Feb 11)

Sunday, February 11, 2024

1. The United Nations Investigates $3 Billion Worth of 58 Cryptographic Network Attacks Originating from North Korea link The United Nations sanctions monitors are investigating 58 suspected

You Might Also Like

Monthly Update on Blockchain Technology: Pectra testnet activation, zero-knowledge gossip, BNBChain roadmap

Thursday, March 6, 2025

Written by: GaryMa, WuBlockchain ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Reminder: White House Schedules First Ever Crypto Summit

Thursday, March 6, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

Donald Trump to reportedly unveil Bitcoin reserve strategy at White House crypto summit

Wednesday, March 5, 2025

Key industry figures, including Michael Saylor and Brian Armstrong, to join Trump at White House crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Global Crypto Mining News in February:U.S. Customs Increases Scrutiny of Chinese Bitcoin Mining Machines, Bitdeer …

Wednesday, March 5, 2025

1. Bitfarms said it is exploring ways to enter the artificial intelligence and high-performance computing space, as bitcoin miners continue to explore alternatives following last April's bitcoin

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏