The Generalist - Messi, Inc.

Messi, Inc.Being the GOAT has more upside than ever. Lionel Messi’s upcoming $200MM fund and incubation studio lays the groundwork for a modern approach to capitalizing on singular talent.Friends, On February 4, Lionel Messi committed the unthinkable crime of being injured. As the result of a groin strain, the 36-year-old (!) star missed a friendly (!) match between his Inter Miami and a “Hong Kong XI.” The absence of the world’s greatest-ever footballer created immediate drama, which only increased after he played 30 minutes in another friendly a few days later. Infuriated, China’s sporting entity canceled two friendly matches against Messi’s Argentina, fans demanded refunds, conspiracy theories abounded, and Hong Kong lawmakers even joined the fray with one saying, “Hong Kong people hate Messi, Inter-Miami, and the black hand behind them.” Though it would hardly have been the welcome Messi had hoped for from his Chinese fans, it indicated his influence. When straining your adductor is enough to spark a geopolitical controversy, you know you’re in elite company as an athlete. Messi has reached the pinnacle of the world’s most popular sport thanks to his formidable influence on the pitch. At least in modern memory, no other player has boasted as reliable or powerful an impact as the pint-sized magician from Rosario, Argentina. But it’s his growing power off the pitch that is increasingly interesting. Perhaps more than any other athlete, Messi’s unique abilities and recent moves position him to build a level of wealth that far outstrips even other legends. In particular, his move to America in 2022 and the launch of the holding company Play Time have opened up new monetization opportunities that reveal much about contemporary stardom, technological shifts, and the incredible leverage of tech startups. A small ask: If you liked this piece, I’d be grateful if you’d consider tapping the ❤️ above! It helps us understand which pieces you like best and supports our growth. Thank you! Brought to you by AirwallexA powerful and accessible approach to embedding financial services. SMBs around the world are struggling to get access to basic financial services from traditional banks. Airwallex’s recent research study revealed that 82% of global SMBs feel overlooked by banks and would change their banking provider if an existing software platform or marketplace offered an alternative. This represents a major opportunity. By adding financial services to your product, you can drive acquisition, improve retention, and significantly increase the lifetime value of your customers. With Airwallex, you can leverage our APIs, 60+ global licenses, international KYC expertise, and flexible deployment options to build and launch financial products worldwide in a fraction of the time. No need to set up bank partnerships or licensing – regional compliance is already built in. There’s a reason Airwallex is trusted by fast-growing companies like Brex, Navan, and ZipHQ. Airwallex can help your platform offer natively integrated financial services globally. Get in touch with our team today. Actionable insightsIf you only have a few minutes to spare, here’s what investors, operators, and founders should know about Messi, the businessman.

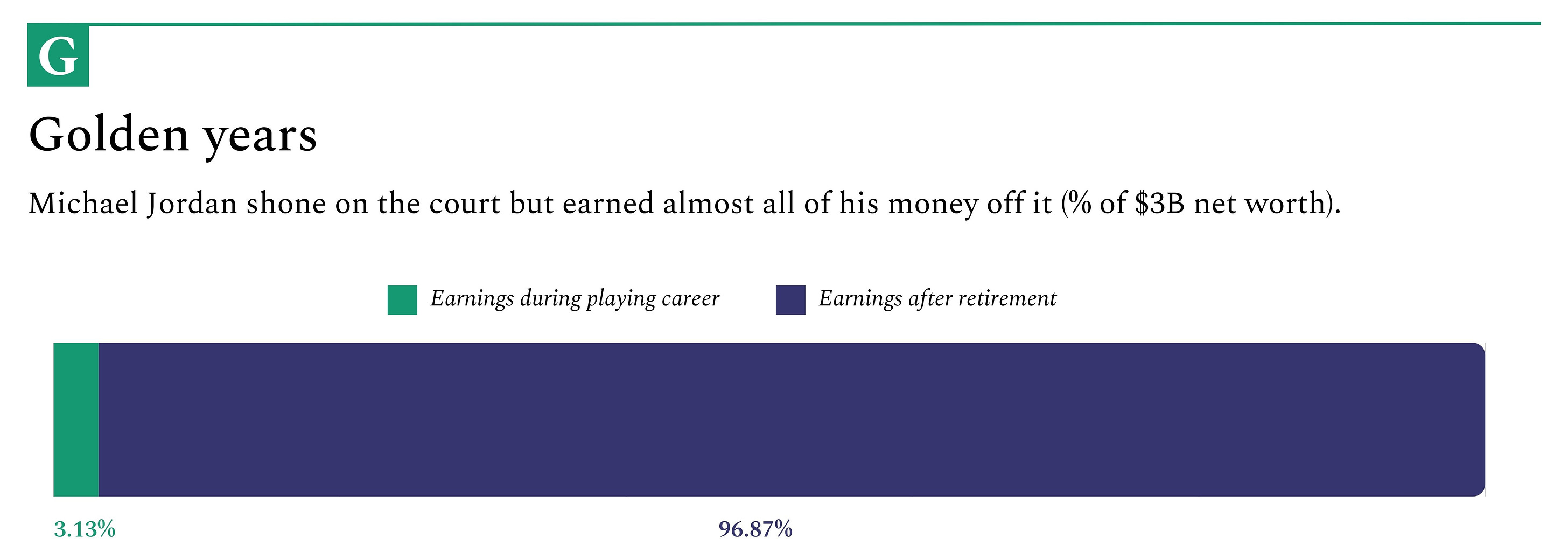

Toward the end of the movie Air, Nike marketer Sonny Vaccaro (played by Matt Damon) turns to an off-screen Michael Jordan and asks: “Who are you, Michael?” It is the crescendo in the film’s plot and Vaccaro’s rousing pitch, a segue between the ad-man’s narration of Jordan’s future and the commercial matters at hand. “I think you already know the answer, and that’s why we’re all here,” Vaccaro continues. “A shoe is just a shoe until somebody steps into it. Then it has meaning.” That a film about a brand partnership was made at all is another illustration of Hollywood’s addiction to established IP, from shoes to dolls. It is also a testament to the fundamental truth in Air’s script. If we cannot be great ourselves, we aspire to be as close to it as possible, to ally ourselves with it, to adopt its trappings. In even manufactured proximity, meaning emerges. To Nike’s credit, its executives recognized the strength of this desire and its commercial potential. In the 40 years since MJ lent his leaping likeness to the Almighty Swoosh, “Jordan Brand” has grown into a global franchise, with Nike’s 2023 annual report attributing $6.6 billion in gross revenue to the sub-division. In many respects, it is a brand that has eclipsed its inspiration, extending beyond basketball into other sports and the broader public consciousness. Around the world, millions rep the latest high-tops or hoodies but may only have a passing familiarity with the athlete that galvanized their creation. “Jumpman,” the brand’s iconic logo, will outlive Jordan. In addition to securing Michael Jordan’s legacy, the apparel brand has made him a very wealthy man. Estimates suggest Air Jordan directly added $1.5 billion to Jordan’s coffers thanks to his 5% share of royalties. That figure doesn’t include the ancillary opportunities a broad, persistent brand presence affords. According to Forbes, it has helped Jordan become one of America’s 400 wealthiest people and the richest athlete on the planet, with a net worth of $3 billion. Jordan’s sale of his majority stake in the NBA’s Charlotte Hornets has been another key driver. The franchise was valued at $3 billion in its 2023 transaction, which saw GameStop short-seller Gabe Plotkin among the buyers. In a decade or two, we may look back on Jordan’s current wealth as a rounding error compared to modern athletes’ affluence. The rise of social media and software allows players to monetize directly, cut out intermediaries, and build extraordinary wealth. Rather than relying on executives like Sonny Vaccaro and Nike founder Phil Knight, today’s Air Jordan would run on Shopify, collect payments through Stripe, and advertise over Instagram and TikTok. Its titular star wouldn’t have just 5% royalties but 100% ownership. More than any other athlete, Lionel Messi is best placed to capitalize on these changing dynamics. The greatest footballer of all time is a singular talent entering his second act in the richest country in the world. While Messi’s move to America’s Major League Soccer has attracted more attention, his holding company “Play Time” – which SEC filings suggest is raising $200 million in capital – may illustrate the true scale of his commercial aspirations. Through public statements and conversations between The Generalist and Play Time’s co-founder Razmig Hovaghimian, a clearer image emerges: Messi doesn’t want to simply sell sneakers – he wants to build and invest in the great software and media companies of the next generation. It’s an ambitious plan that, if successful, offers much higher upside. The business of being the GOAT looks more lucrative than ever before. Friends of The GeneralistWhat's next in tech: Our friends over at Semafor Tech write a twice weekly newsletter on the people, the money and the ideas at the center of the new era. They track the shifting dynamics and the new ideas that just might be crazy enough to change the industry as we know it. Subscribe for free. The GOATThe best place to begin is by tweaking Vaccaro’s question to ask: “Who are you, Lionel?” Even if you have the most severe sporting allergies, you will know the name Lionel Messi, but you may not appreciate his influence. In simple terms, Lionel Messi is the greatest player of the world’s most popular sport. He is the most singularly gifted footballer to grace a game loved by billions of fans across every continent and country. That he is the third-most-popular account on Instagram with approximately 500 million followers, behind rival Cristiano Ronaldo and Instagram’s own handle, indicates his celebrity. One of the frustrating aspects of debating whether an athlete is the “greatest of all time” (GOAT) in their respective discipline is the inherent haziness of the rubric. At this very moment, people are engaged in one of these frazzling contests. In a pub or bar, on a long road trip, or in heavy traffic, someone is saying, “OK, but greatest, how exactly? Are we comparing peaks or averages? How important is longevity? Are we basing this on the numbers, or do aesthetics matter?” This debate makes sense for many sports: Tennis has its “Big Three,” basketball has Jordan and LeBron, and boxing imagines matchups between Ali and Tyson. Football’s GOAT is beyond debate. Though that statement sounds like a provocation to fans of Pele, Maradona, Cruyff, and both Ronaldos, it shouldn’t be. The remarkable aspect of Messi’s career is that he is the greatest to play the game by any meaningful measure. He has won everything individually and as part of a team, recorded goals and assists at a ludicrous rate, maintained exceptional standards for twenty years, and produced hundreds of moments of jaw-dropping genius. If you are a stats wonk, his quantitative output will astonish. If you’re an aesthete, simply watch him glide over tackles, caress a pass through the eye of a needle, or loft a chip just beyond a keeper’s reach. Rather than asking whether Messi is the greatest footballer of all time, the better question may be whether he is the greatest male athlete of all time, as suggested by ESPN’s Ryan O’Hanlon. Far from being parochial score-settling, the question of Messi’s greatness matters when considering his commercial ceiling. Football’s history is full of many great players, a few legends, and precisely one GOAT. Holding an unparalleled position in the sporting landscape gives Messi leverage that even other absurdly talented athletes may be unable to match. Messi’s move to Inter Miami is a manifestation of what such influence looks like in practice. In the summer of 2022, Apple paid $2.5 billion for the ten-year rights to broadcast the MLS and the associated Leagues Cup. While you can still catch games on terrestrial networks like ESPN and Univision, Apple is now the definitive destination for the domestic league. That deal put Tim Cook’s company in an intriguing position when Messi’s Inter Miami deal was being negotiated. Knowing that Messi’s presence in the MLS would immediately increase viewership – and potentially help it grow its smartphone share in Latin America, a geography in which it lags players like Samsung, Motorola, and Xiaomi – Apple offered an inducement. Messi receives a cut for every new MLS Season Pass purchased via Apple TV. Though the exact terms have not been disclosed, the fact that the world’s largest company (depending on the day) ceded to an individual athlete indicates Messi’s power. There’s a reason an industry expert referred to the partnership as “unprecedented.” Messi reportedly struck a similar revenue-sharing agreement with Adidas and was granted partial equity rights to Inter Miami. Athletes and wealthBefore focusing on Messi’s particular opportunity, let’s examine how other athletes have accumulated multi-generational wealth. Across his 15 seasons as an NBA player, Michael Jordan’s salary totaled $94 million. Given he is worth $3 billion today, he accumulated roughly 97% of his net worth after he left the basketball court. While many athletes struggle to make their salaries last into retirement, outliers like Jordan have succeeded in growing their earnings by leveraging their fame to strike partnerships and make lucrative investments. Often, the investments these athletes make are ones in which their star power can deliver outsized impact, lending credibility and improving customer acquisition. Beyond Jordan and Messi, five athletes are worth paying attention to. It should be said that these are not necessarily the highest-paid or richest athletes. Saudi Arabia’s entry into football, golf, and other arenas has allowed many sports people to earn astonishingly high base salaries. Cristiano Ronaldo, for example, makes $213 million per year playing for Al Nassr. Meanwhile, golfer Dustin Johnson secured $125 million for joining the Kingdom’s breakaway LIV tour. Rather than providing a high-to-low wealth ranking, we’ve focused on athletes who have been particularly creative in building wealth beyond their playing careers.

By investing savvily, especially in sports franchises or mass-market consumer brands, athletes can earn far more in retirement than they ever did as athletes. The Generalist’s Most Detailed Case Study EverEarlier this month, we published our deep dive into Airwallex, the $5.6 billion fintech challenging Stripe. It is probably our most detailed and deeply researched case study ever, spanning multiple months of research, a review of never-before-seen collateral, and more than a dozen interviews. The result is a chronicle of one of the fastest-growing companies of recent years, a portrait of an intense, outlier founder, and a discussion of the issues hyper-growth can bring. If you haven’t had a chance to check it out yet, I think you’d like it: A different gameDespite the transformative effect of the Nike partnership, it’s hard not to believe that Jordan was underpaid. Nike’s market cap sits at approximately 3.4x of annual revenue – applying that same multiple would value Jordan Brand at $22.4 billion. If, instead of 5% royalties, Jordan had been afforded 50% equity, his holdings would be worth $11.2 billion with room to run. Although Michael Jordan may not have spent late nights grinding at Nike HQ, it seems clear he delivered much more than the 5% in value he has been able to capture. Jordan Brand could not exist without him and would never have reached its current scale without his on-court brilliance and cultural cache. Though its success undoubtedly rested on the work of Nike’s employees, the one irreplaceable ingredient is the man whose name is printed on the leather. If Jordan created the brand today, he could drive a much harder bargain. Over the last forty years, the sports, media, and technology industries have all radically changed. The result is that more power than ever rests in the hands of superstar athletes. Three shifts are particularly profound:

Taken together, these shifts have made superstar athletes the owners of their particular intellectual property. Each great player like LeBron James, Serena Williams, or Lionel Messi is the author and proprietor of their story and has greater financial and technological flexibility to monetize it. As a result, it is increasingly possible for an athlete to think of surpassing $10 billion in net worth. Messi’s moneyMessi’s first salary at Barcelona paid him €120,000 a year, enough to support the young player and his family. He has come a long way since then. Though Messi’s precise net worth is unknown, a 2022 article estimated it at $400 million. Given this predated his game-changing move to Inter Miami, it’s likely considerably higher. By 2025, Messi’s career earnings (not net worth) are projected to hit $1.6 billion, taking into account on-and-off-field revenue. So, how has football’s GOAT earned his money? And how can he multiply it in the years to come? PuzzlerRespond to this email for a hint.

Well done to Bruce G, Kelly O, Shashwat N, Michael O, and F Dak for answering our last riddle correctly:

The answer? Add 7 hours to 11 o’clock and you get 6 o’clock. Until next time, Mario You're currently a free subscriber to The Generalist. For the full experience, upgrade your subscription. |

Older messages

A Contrarian’s Guide to Hiring

Tuesday, February 13, 2024

What signals do elite founders look for when hiring? This edition of The Braintrust digs in. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Unrelenting Ambition of Airwallex

Thursday, February 8, 2024

The $5.6 billion fintech has established itself in APAC. It will not rest until it wins the rest of the world.

How to Stop Worrying and Start a Company

Tuesday, February 6, 2024

In this edition of “Ask Mario,” we talk about entrepreneurial leaps of faith, the newsletter business, and pragmatic optimism about crypto.

Generalist Capital: New Epics

Thursday, February 1, 2024

We've backed ten startups building at the frontier in the two years since founding Generalist Capital. Here's who we've invested in and why we're excited.

CEOs on Their Least Popular But Most Impactful Decisions

Tuesday, January 23, 2024

Great leadership requires making tough choices.

You Might Also Like

🚀 Ready to scale? Apply now for the TinySeed SaaS Accelerator

Friday, February 14, 2025

What could $120K+ in funding do for your business?

📂 How to find a technical cofounder

Friday, February 14, 2025

If you're a marketer looking to become a founder, this newsletter is for you. Starting a startup alone is hard. Very hard. Even as someone who learned to code, I still believe that the

AI Impact Curves

Friday, February 14, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. AI Impact Curves What is the impact of AI across different

15 Silicon Valley Startups Raised $302 Million - Week of February 10, 2025

Friday, February 14, 2025

💕 AI's Power Couple 💰 How Stablecoins Could Drive the Dollar 🚚 USPS Halts China Inbound Packages for 12 Hours 💲 No One Knows How to Price AI Tools 💰 Blackrock & G42 on Financing AI

The Rewrite and Hybrid Favoritism 🤫

Friday, February 14, 2025

Dogs, Yay. Humans, Nay͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 AI product creation marketplace

Friday, February 14, 2025

Arcade is an AI-powered platform and marketplace that lets you design and create custom products, like jewelry.

Crazy week

Friday, February 14, 2025

Crazy week. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

join me: 6 trends shaping the AI landscape in 2025

Friday, February 14, 2025

this is tomorrow Hi there, Isabelle here, Senior Editor & Analyst at CB Insights. Tomorrow, I'll be breaking down the biggest shifts in AI – from the M&A surge to the deals fueling the

Six Startups to Watch

Friday, February 14, 2025

AI wrappers, DNA sequencing, fintech super-apps, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How Will AI-Native Games Work? Well, Now We Know.

Friday, February 14, 2025

A Deep Dive Into Simcluster ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏