The Uniswap protocol fee distribution proposal ignites the market, analysis of future trends

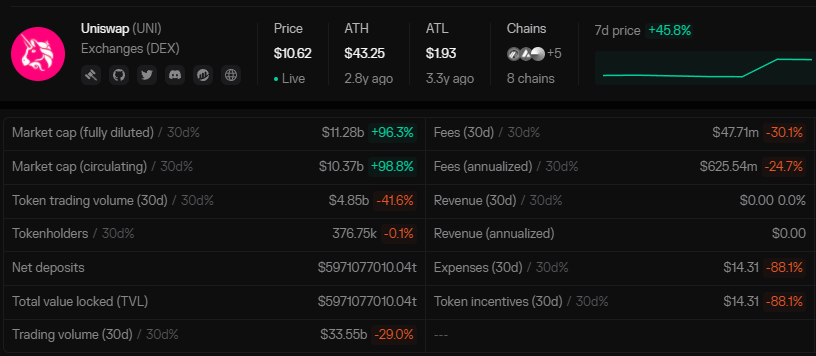

Author: defioasis On the evening of February 23, Uniswap Foundation’s Gov Lead, Erin Koen, proposed to the Uniswap governance forum, suggesting the use of a fee mechanism to reward UNI token holders who have delegated and staked their tokens. Since Uniswap announced the token airdrop in late September 2020, there has been ongoing discussion about whether UNI should capture protocol fees to increase token utility, but almost all have fizzled out. This proposal by the head of the Uniswap Foundation formally brings the discussion of UNI token utility to the governance level, thereby causing a frenzy among holders and driving up the price of UNI and other DeFi protocol tokens. Firstly, it’s important to clarify that this proposal was put forward by representatives of the Uniswap Foundation, which is not the same as Uniswap Labs. Uniswap Labs is responsible for the development, maintenance, and updates/upgrades of the Uniswap protocol, playing a central role in technical development and innovation. Essentially, Uniswap Labs is a commercial company. The Uniswap Foundation, on the other hand, primarily focuses on the governance and community development of the Uniswap protocol and is a non-profit organization. Uniswap Labs tends to consider issues from the protocol/company perspective, while the Uniswap Foundation represents community interests to a certain extent. It’s noticeable that the official Uniswap Labs social media has not mentioned or shared this matter, and even Uniswap protocol founder Hayden has not participated much in the discussion. Secondly, it’s necessary to understand what protocol fees entail. Currently, there are two types of fees: front-end fees and LP (Liquidity Provider) fees. Front-end fees refer to the 0.15% fee charged since mid-October 2023 for transactions executed through the Uniswap Labs front-end, i.e., fees collected from the official Uniswap front-end and paid to Uniswap Labs; Hayden stated that the purpose of collecting this fee is to fund the sustainable operation of Uniswap Labs. LP fees are the fees charged by the Uniswap pools, paid by traders to LPs, such as the 0.3% fee collected by the WBTC/ETH pool with the highest TVL in Uniswap V3. The proposal specifies that protocol fees are expressed as a fraction of LP fees, which can be 0, 1/4, 1/5, 1/6, 1/7, 1/8, 1/9, or 1/10 (currently set to 0), and the specific fraction can be adjusted through governance. (Data Source: https://tokenterminal.com/terminal/projects/uniswap) According to data from Token Terminal on February 25, the annualized LP fees for Uniswap are approximately $626 million. Assuming the proposal is passed and 1/10 to 1/4 of the LP fees are distributed as protocol fees to UNI holders, then UNI holders could receive approximately $62.62 million to $156.5 million in annual dividends. The current market cap of UNI is about $8 billion, with the market cap to annual dividend ratio ranging between 51.1 and 127.8. Of course, this is just a simple calculation for reference and not a basis for investment. Finally, this proposal is still in the proposal and community discussion stage, and whether it will pass depends on the final vote by the community and UNI delegates representing various forces. The Uniswap Foundation believes that if there are no major obstacles, it is expected to post a Snapshot vote on March 1 and an on-chain vote on March 8. As an early investor in Uniswap, a16z could play a key role in the future vote on this proposal. According to Arkham data, addresses marked as a16z (and those suspected to be a16z) may control about 60 million UNI tokens. Of course, nothing is set in stone yet, and the passage of the proposal remains uncertain, but it ultimately represents an attempt to transition to utility tokens. Even if this proposal ultimately fails, it is believed that other institutions or community leaders will continue to strive to convert UNI into a utility token. Additionally, if the proposal is passed, the impact of siphoning off a portion of LP earnings as dividends for token holders on LPs, and how to better balance the interests of UNI holders and LPs as the protocol evolves, will become new governance issues. Over the years, Uniswap has arguably become the Beta that can represent the entire Crypto industry after BTC and ETH. Now that the foundation has formally proposed to empower UNI, this might be benefiting from favorable outcomes like the Grayscale and Ripple court victories, the smooth approval of spot BTC ETFs, increased trading activity, and relatively more lenient US regulatory policies. At the same time, this could also set an example for other protocol developers or teams, especially those in the United States. For instance, Blur and Blast founder Pacman has expressed approval of the proposal put forward by the Uniswap Foundation and hopes Blur can learn from it. (Note: The NFT trading market Blur’s token BLUR, similar to UNI, is also an unempowered governance token.) Whether it’s UNI or BLUR, the protocols they represent are leaders in their respective fields. Uniswap occupies about 60% of the DEX market share, not only possessing outstanding technological innovation and market influence but also making an indelible contribution to the advancement of the Crypto industry, which are the core focuses of our continued attention. For Uniswap, empowering UNI might just be the icing on the cake, whereas the upcoming v4 hook might be even more exciting. Follow us Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Asia's weekly TOP10 crypto news (Feb 19 to Feb 25)

Sunday, February 25, 2024

1. The Japanese Cabinet Approves New Proposal: Allowing Venture Capital Firms to Directly Invest in Cryptocurrency and Web3 Startups link On February 16th, the Ministry of Economy, Trade, and Industry

Weekly Project Updates: Uniswap Token Dividend Proposal, STRK Token Unlock Schedule Adjustment, Merlin's TVL Soars…

Saturday, February 24, 2024

1. Ethereum Foundation: First Round of ZK Grants Now Open link The Ethereum Foundation has announced the opening of the first round of ZK Grants. Collaborating with Aztec, Polygon, Scroll, Taiko, and

WuBlockchain Weekly: Bitcoin Spot ETF Experiences Net Outflows, Surge in User Count for World APP, Nigeria's Crypt…

Friday, February 23, 2024

1. Bitcoin Spot ETF Witnesses Net Outflows Following Net Inflows on the 17th link On February 21st, the grayscale ETF GBTC experienced a net outflow of $199 million, while the bitcoin spot ETF with the

ABCDE: Summarizes the AI+Crypto Track over the past year

Thursday, February 22, 2024

Author: ABCDE Investment Partner Lao Bai More than a year after the release of ChatGPT, the discussion about AI+Crypto has heated up again in the market recently. AI is considered one of the most

The Role, Responsibilities, and Challenges of CFOs in Cryptocurrency Companies

Wednesday, February 21, 2024

Author | Elven 1. Challenges Faced by Today's Web3 CFOs The FTX incident has exposed serious financial issues within the Web3 industry, including the misuse of a significant amount of user funds.

You Might Also Like

Donald Trump to reportedly unveil Bitcoin reserve strategy at White House crypto summit

Wednesday, March 5, 2025

Key industry figures, including Michael Saylor and Brian Armstrong, to join Trump at White House crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Global Crypto Mining News in February:U.S. Customs Increases Scrutiny of Chinese Bitcoin Mining Machines, Bitdeer …

Wednesday, March 5, 2025

1. Bitfarms said it is exploring ways to enter the artificial intelligence and high-performance computing space, as bitcoin miners continue to explore alternatives following last April's bitcoin

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask