The Signal - Quick commerce plays dress up

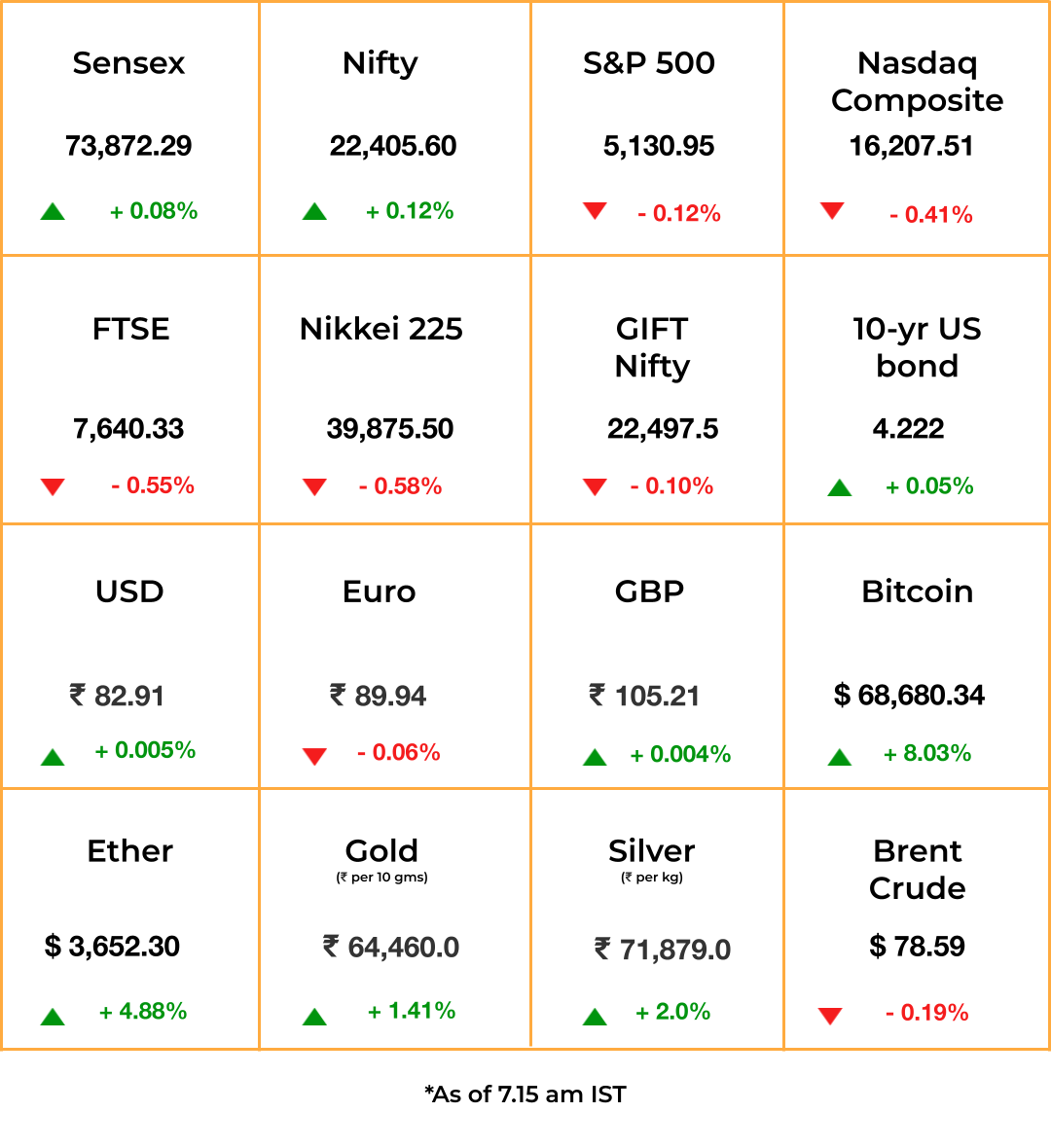

Quick commerce plays dress upAlso in today’s edition: Reliance primes the pump; A cut too deep for RBI; Dismal science; Wall Street ends its Samaritan spellGood morning! Other businesses may be tired of China, but global spirit makers such as Diageo and Pernod Ricard are just warming up to it. As per Financial Times, the two are part of the growing list of companies that are vying to establish local distilleries in the country so as to negate the influence of local spirits like baijiu. Indian malts such as Indri, Amrut, and Paul John have won top global honours. It’s one industry China has been lagging in. Going by the booze giants’ ambition, a Chinese single malt that could take the world by storm is perhaps already ageing in barrels somewhere. 🎧 What’s the uproar with India’s new AI rules? Also in today’s edition: China and India compete again… this time, over whisky. Tune in to The Signal Daily on Spotify, Apple Podcasts, Amazon Music, Google Podcasts, or wherever you get your podcasts. Roshni Nair and Adarsh Singh also contributed to today’s edition. The Market Signal Stocks & Economy: A 5% GDP growth target might seem tame by Chinese standards, but that is what it will aim for this year. Relative to the current size of its crisis-beset economy, it will still be an impressive expansion. It will also issue bonds worth $139 billion with ultra-long tenures to shore up the economy. And China is also keeping up with the global trend of raising military spending. It will spend 7.2% of the GDP, a five-year high, this year on arming up. The moves failed to enthuse Asian markets as they took cues largely from the US, where equities took a breather after the recent rally. Japanese stocks retreated from their historic highs. Indian shares do not have any immediate trigger but continue to remain buoyant. The GIFT Nifty is hinting at a flat or positive start to the day. E-COMMERCENeed: Outfit In A HurryQuick commerce naysayers were convinced people won’t pay a premium for 15-minute grocery deliveries. They were wrong. Now Blinkit and Zepto are going to offer us all more 15-minute non-necessities, including fashion. Both companies have reportedly tied up with top apparel brands including Adidas, Jockey, and even wedding wear seller Manyavar to deliver ‘fits in a flash. But… why?: Will Indians shell out tens of thousands, even lakhs of rupees, to buy a sherwani or snag a pair of kicks from a quick commerce company? Both Blinkit and Zepto said these tie-ups are early-stage. But, as we said earlier, this is all about boosting average order values or AOV. Manyavar may not sell a full bridal trousseau on Blinkit or Zepto, but may curate a collection of last-minute needs for wedding guests. Besides, fashion brands could consider running ads on quick commerce platforms—serving India’s rich, urban customers. RENEWABLE ENERGYConglomerate Pump-UpThere is a gold rush in pumped storage projects (PSPs) thanks to the government rolling out the policy red carpet last year. Mint reports that Reliance Industries’ renewables arm Reliance New Energy (RNE) is location-scouting to set up PSPs. RNE joins, among others, NHPC, Adani Green Energy, the Tata Group, and JSW Energy in setting up PSPs eyeing a 70 GW energy storage opportunity (ppt) by 2031-32. Adani has also tied up with Greenko for PSP power for its new industrial complex. Last year was a watershed year for PSPs—which use solar and wind energy to pump water up to an elevated storage that can later be used to spin turbines—as the government removed (pdf) environment clearance for off-stream projects and included the grid-scale ones for production-linked incentives. The projects can also be financed almost entirely with debt because they are allowed a debt:equity ratio of 80:20. BANKINGIs An RBI Rate Cut A Good Idea?

Of the six members of the Reserve Bank of India’s Monetary Policy Committee, only one voted for a rate cut at the last policy-setting meeting. The rest strongly felt it is not yet time. A rate cut would bring respite from tight liquidity conditions prevalent for the last six months. It, however, could not have addressed a fundamental problem in the Indian banking sector but could even contribute to its weakness. Until now, Indian banks were enjoying what Goldman Sachs recently described as the “Goldilocks period” of cheap funds and high margins. While banks have seen high credit growth, CASA—banker speak for current accounts and savings accounts—has been falling. That’s because household balance sheets have gone wonky. Their net financial assets plunged from 11.5% of GDP in FY21 to 5.1% of GDP in FY23. Their deposits with banks as a share in total household deposits fell from 97% to 93% in the last two financial years.

HEALTHCAREToo Many Walls, Not Enough CollaborationThat’s the concern voiced by the president of one of the world’s foremost health research institutes. Yasmine Belkaid, who heads Institut Pasteur (Pasteur Institute) in France, reckons geopolitical tensions are compounding funding and skilling issues in healthcare—when international cooperation is needed more than ever to capitalise on AI breakthroughs. This extends to collaboration in pandemic surveillance, where there’s growing distrust in China after the Covid-19 outbreak. The technological cold war between the US and China and subsequent barriers in information-sharing have intensified another years-old problem: the global STEM [science, technology, engineering, mathematics] paradox (pdf). Though there are more STEM graduates than ever, STEM roles, especially in emerging economies like India, are going unfilled. Throw AI into the mix, and you have a widening gulf between the Global North—from where AI technologies are largely deployed—and the Global South, which offers a goldmine of health data (pdf). FINANCEOne Step Forward, Two Steps BackWall Street has been treating ESG (environment, sustainability and governance) like a cuss word, avoiding it to the point where the investment arms of financial giants such as JPMorgan even left Climate Action 100+ or CA100+. Considering that BlackRock also retreated from CA100+, it doesn’t come as a surprise that the world’s largest asset manager has dropped “ESG” from its communique altogether. Instead, chief Larry Fink is going big on a new term: “transition investing”, which reflects BlackRock’s double-down on green infrastructure projects. The change in terminology comes after blowback against ESG from conservative investors and lawmakers in the US. To that end, Big Capital is also retreating from diversity, equality, and inclusion (DEI) commitments. Bloomberg reports that Bank of America, Goldman Sachs, JPMorgan, and others have either opened up DEI programmes and recruitment opportunities to white people, or binned affirmative action for leadership roles. FYIExtension: The State Bank of India has asked the Supreme Court for time until June 30 to submit details of electoral bonds purchased and redeemed since 2019. Back on the ballot: Donald Trump can run for President unhindered. The US Supreme Court has said that state courts do not have the power to disqualify individuals vis-a-vis federal offices, especially the presidency. A separation: Tata Motors is separating its commercial and passenger vehicle companies into separate listed entities; the latter will house Tata’s electric vehicles and Jaguar Land Rover businesses. Pay up: The EU has fined Apple €1.84 billion (~$2 billion) for App Store restrictions on music streaming apps, marking one of the largest antitrust actions in the bloc. Easy peasy pay: India will launch an interoperable payments system for internet banking this year, RBI governor Shaktikanta Das said. Macro raise: Ananya Birla-led Svatantra Microfin has raised ₹1,930 crore (~$233 million), the largest fundraise by an Indian microfinance firm. THE DAILY DIGIT205The number of patents filed by Ola Electric in 2022-23, making it the most prolific patent publisher in the EV space in India. (The Times of India) FWIWLost knowledge: A contemporary version of the burning of the library in Alexandria is playing out. A new study published in the Journal of Librarianship and Scholarly Communication found that a quarter of all scholarly articles ever published online are at risk of being lost forever. The reason? Improper preservation. Most of the scholarly work today is catalogued through a system called digital object identifiers (DOIs) and the research found that 28% of them didn’t appear in a digital archive. Time’s ripe for a change it seems. Font-runner: Long-time users of Microsoft Word might’ve noticed something. The word processing software changed its default font from Calibri to Aptos. The change was introduced 17 years after Calibri was first made the default. Aptos is said to be slightly ‘whimsical’, which will help distinguish letters more clearly like a capital ‘I’ and small ‘l’. Of course, you can revert to Calibri if you want to, but why not wait and see if Aptos grows on you? Coder’s secret: Morse Code, the thing we’ve mostly seen in spy films but never really used IRL, is not a thing of the past yet. While it was officially phased out in 1999 as the standard for maritime communication, the code is still being kept alive by a group of enthusiasts called ‘radio squirrels’. They run the last operational Morse-code station in North America and scan the corners of the internet to keep the machines from the World War II era running. Now that’s dedication. The Signal is free today. But if you enjoyed this post, you can tell The Signal that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Sweater weather is scorching food security

Monday, March 4, 2024

Also in today's edition: Indian apps won't Play ball with Google; The spring in Mercuria's step; Downtime? Blame Red Sea chaos; China to the rescue ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

In search of employment

Saturday, March 2, 2024

India urgently needs to ramp up labour-intensive economic activity to provide jobs for its young workforce ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Prudence takes precedence for IPL 2024

Friday, March 1, 2024

As funding crunch rolls in, brands are rethinking their strategies for this year's IPL ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Fat chance

Friday, March 1, 2024

Also in today's edition: Thrasio topples over; The beeline for India's EV market; No rest for pilots; Ram Mandir, gamified ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Ambani gets keys to the Magic Kingdom

Thursday, February 29, 2024

Also in today's edition: Apple puts its Titan to rest; Levi's goes bottoms up; CBAM isn't all that; Scavenger hunts paused for the taxman ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

10x more leads (powerful)

Monday, March 10, 2025

Launching a product? I'm helping startups build better products and reach product-market fit. To do that, we've built ProductMix and you should use it: https://rockethub.com/deal/productmix

🥒 Now you’re in a pickle

Monday, March 10, 2025

This upstart grew sales by 29% YoY in a stalling industry View in browser mim-email-logo-2025-2 As liquor sales stagnated last year for nearly the first time in two decades, one segment of the market

I launched the ULTIMATE seo chrome extension (free)

Sunday, March 9, 2025

You are so very welcome ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s Bitcoin Reserve, Tokyo Beast’s $1M Championship & King of Destiny’s 2M $GOD Showdown – Your Ultimate Crypto & Gaming Update!

Sunday, March 9, 2025

PlayToEarn Newsletter #263 - Your weekly web3 gaming news

The Profile: The man who wants to know everything & the med spas offering balding treatments

Sunday, March 9, 2025

This edition of The Profile features Tyler Cowen, Lalisa Manobal, Zhang Shengwei, and others. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Marketing Weekly #222

Sunday, March 9, 2025

Why Faceless Social Media Accounts Don't Work — Lessons From Someone Who Tried • How We Cut Lead Costs by 75% with Facebook Ads (and How You Can Too) • The True Art of Being Customer-Centric • The

Why The Per-Seat Model Isn’t Dead (Yet)

Sunday, March 9, 2025

And the top SaaStr news of the week To view this email as a web page, click here The Per-Seat Model Isn't Dead. But Also, Surprisingly, It Was Never Dominant. The Per-Seat Model Isn't Dead. But

Startups gear up for EU defense surge

Sunday, March 9, 2025

Also: Female founder face anti-DEI wave, our Global Markets Snapshot wraps up February's action & more Read online | Don't want to receive these emails? Manage your subscription. Log in The

Sunday Thinking ― 3.9.25

Sunday, March 9, 2025

"Whenever honesty is missing, walls slowly start appearing."

🚨 Weekend Wrap-Up: Chatbots Are Stealing 96% Of Your Clicks

Sunday, March 9, 2025

The Weekend Update... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏