The Signal - The great Indian donor dump

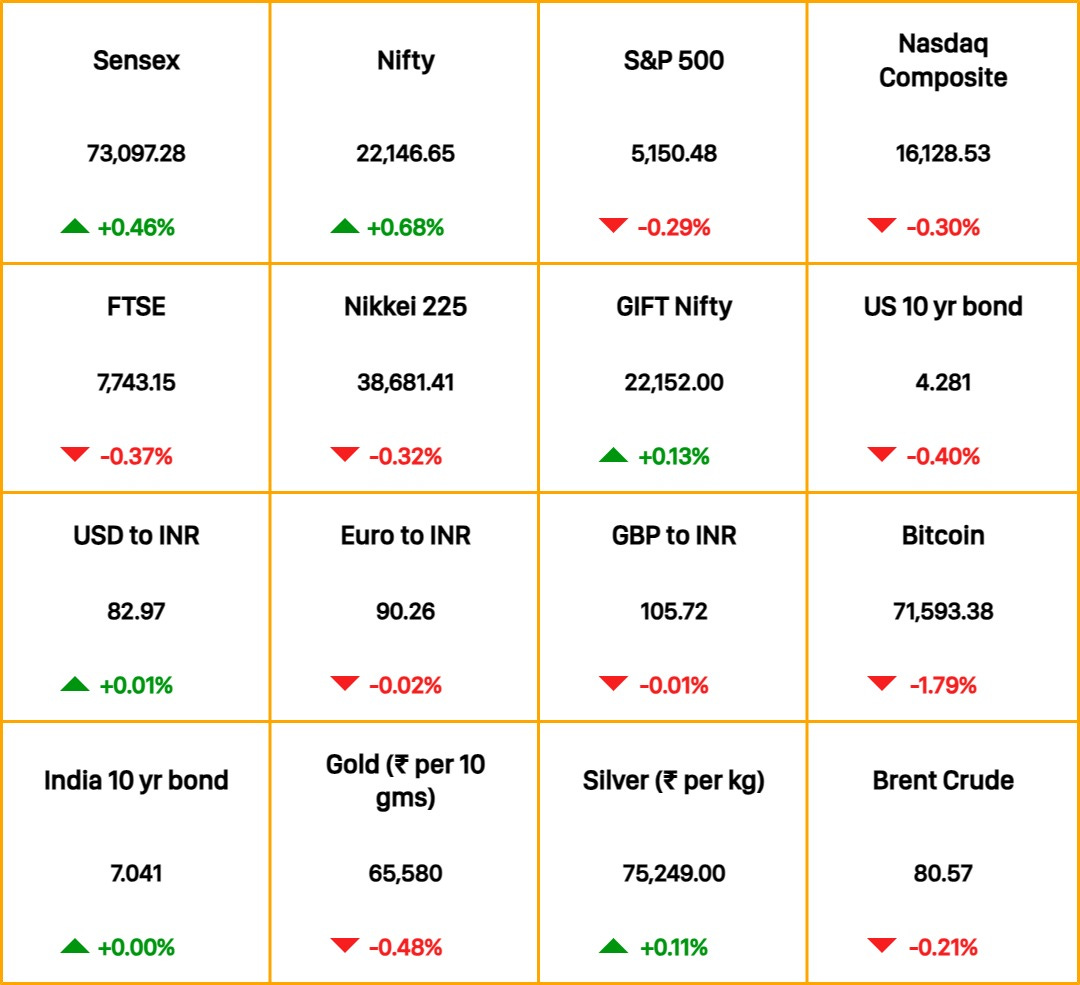

The great Indian donor dumpAlso in today’s edition: Poll poll everywhere; Ullu’s hawala links; Washington irks Tokyo; 2-minute noodle economyGood morning! This was a problem that literally required a rocket scientist. What do you do when the wind turbine blades you need are too unwieldy and big to move by land? Rocket scientist Mark Lundstrom’s answer was to build a monster plane. The Wall Street Journal reports that Lundstrom’s startup Radia is building WindRunner, a transport plane as big as a football field and designed to specifically lug the world’s largest windmills. These are typically erected offshore but are now being seen as a solution to ramp up renewable energy production onshore. More wind in Radia’s sails. 🎧 A global cocoa crisis is upon us. Also in today's episode: the Mahadev betting app case and its potential connection to the recent slump in small and midcap stocks, which hit their lowest point in two years. Tune in to The Signal Daily on Spotify, Apple Podcasts, Amazon Music, Google Podcasts, or wherever you get your podcasts. Roshni Nair and Venkat Ananth also contributed to today’s edition. The Market Signal*Stocks & Economy: Fitch Ratings has raised India's FY25 GDP growth forecast to 7% from its earlier forecast of 6.5%. Fitch expects a half a percentage point rate cut by the Reserve Bank of India in the second half of the year and foresees retail inflation falling to 4% by the end of 2024. The global ratings agency, meanwhile, trimmed China’s 2024 forecast to 4.5% from its earlier estimated 4.6%. US equities were subdued on inflation remaining outside the Fed’s comfort zone. The mood spread to Asia with markets awash in red in early trade. The Bank of Japan is now expected to end its negative rate monetary policy as early as next week. Wall Street biggies such as BlackRock and Man Group are upping their bets in anticipation. Strong inflows continued to hold up Indian shares, and the GIFT Nifty indicates the trend will continue today. POLITICSList Is Out But Key Is MissingAs expected, the window into political funding in India opened only half, throwing light on the donors behind opaque electoral bonds but not revealing who donated to who. The Election Commission of India published two lists: one of who bought the bonds and when, and another of who encashed them on which date. The key to matching the two, however, is still missing. Future Gaming and Hotel Services, owned by Santiago Martin, known as the lottery king, bought a record ₹1,368 crore (~$165 million) or more than 11% of the bonds worth ₹12,000 crore sold between April 2019 and February 2023. The Bharatiya Janata Party collected just over 50% of the total, with Trinamool Congress bagging ₹1,609 crore. Vedanta topped the roll of listed companies, donating ₹402 crore. Here is a background to how political parties colluded to create electoral bonds for political funding. PODCASTTune in every Monday to Friday as financial journalist and host Govindraj Ethiraj gives you the most important take on the latest in business and tech. In today’s episode, Sneha Poddar, AVP, Retail Research, Broking and Distribution at Motilal Oswal Financial, talks about the recent stock market crash and midcaps. Plus: Former Novartis CEO Anil Matai remembers pharma legend and once-country head of Novartis India, the late Ranjit Shahani. ELECTIONSPoll Commission Is Whole AgainA panel led by Prime Minister Narendra Modi and including leader of the opposition in the Lok Sabha, Adhir Ranjan Chowdhury, chose former bureaucrats Gyanesh Kumar and Sukhbir Singh Sandhu as election commissioners. Kumar was overseeing the cooperative sector when he retired while Sandhu helped draft the Uniform Civil Code in Uttarakhand in his last assignment as chief secretary to the state. The appointments came on the day another committee headed by former President Ram Nath Kovind recommended (flipbook) holding simultaneous national, state and local body elections. It also envisaged a common electoral roll and a single electoral identity for each voter. Among other things, business organisations told the panel that simultaneous elections will help them maintain their production cycles as workers taking off to cast their votes will reduce. Migrant workers will avoid wage losses and save on travel costs, the panel said in the report. CORPORATEObscene Money

Turns out streaming platform Ullu isn’t just the preferred destination for thrill seekers. Dubai-based hawala operator Hari Shankar Tibrewal is also invested in the IPO-bound company, The Morning Context reports. Tibrewal is under investigation for his role in the Mahadev betting scam. Ullu, best known for its adult entertainment offerings, has filed draft papers for a public issue on the SME exchanges. Small cap, big problems: Promoters of the Mahadev betting app are accused of running a network of illegal betting apps and transferring the proceeds to accounts in the UAE. Now, authorities have found evidence that Tibrewal and associates were laundering their riches in small- and mid-cap companies listed on Indian stock exchanges. Market regulator Sebi warned that valuations in Indian small-caps were overheated; individuals such as Tibrewal are part of the problem.

POLICYThis Is AwkwardWould you rather anger a critical geopolitical ally, or anger blue-collar workers during election year? US President Joe Biden seems to have chosen the former. Context: Japan-based Nippon Steel’s proposed acquisition of US Steel. The ~$15 billion deal has been contentious because US Steel, headquartered in the swing state of Pennsylvania—a manufacturing hub—is a national icon. United Steelworkers, the largest industrial union in the US, is opposed to the takeover. Financial Times reports that Biden will issue a statement expressing “concern” about the acquisition ahead of Japan PM Fumio Kishida’s April state visit. Japan is miffed with the protectionist stance: it’s a strategic partner in the US-China trade war and also the largest foreign investor in the US. The UK too is embracing protectionism. PM Rishi Sunak may change the law to ban foreign ownership of national newspapers, effectively killing Abu Dhabi-backed RedBird IMI’s takeover of The Telegraph. CONSUMPTIONStorm In A Ramen CupHeard of the hemline index and market basket? The theory for the former is that women’s dresses get longer in bearish times and shorter in bullish times. The market basket, which consists of foods and services typically consumed by people, is used to track inflation. There’s also the lipstick index, men's underwear index, and other unconventional indicators about where the economy is placed, and where it may be headed. Then there’s noodlenomics. Spill: Cheap, convenient, delicious, long shelf life. That’s the appeal of instant noodles, especially in developing countries, to meet calorie deficits. But developed nations are consuming more instant noodles than ever, which is great news for Nissin Foods and Toyo Suisan but not so much for the global economy. Take Japan: it’s consuming more of the stuff despite a shrinking population. Why?: Inflation. Btw, India is the fourth-largest consumer by total servings, though Vietnam tops per-capita consumption. FYIStart the count: The Indian government is reportedly mulling a new population census after the conclusion of the general elections as part of measures to improve the quality of its economic data. It will also consider the revival of a business survey that was last released in 2014. Homecoming?: The Tata Group is considering buying back Disney’s minority stake in its subscription-based broadcasting service Tata Play, Bloomberg reported. The deal, should it go through, could value Tata Play at $1 billion+. I'll have it: Former US Treasury Secretary Steven Mnuchin is putting together a consortium to buy TikTok’s US business. Mnuchin’s formal bid comes a day after US lawmakers voted resoundingly to approve a bill that would force a sale of TikTok or face a ban. China is not happy. Poll gift: Oil marketing companies have slashed diesel and petrol prices by ₹2 per litre each effective March 15, just ahead of the Lok Sabha elections. Pink slips?: Paytm Payments Bank (PPB) is reportedly planning to let go of 20% of its staff, with most of its operations impacted by the Reserve Bank of India order. However, it got a green signal from the National Payments Corporation of India (NPCI) to become a Third Party Application Provider. Backchannel: In January, the US and Iran held “secret talks” in Oman over attacks on ships in the Red Sea by the Houthis, Financial Times reported. The US also brought up its concerns over Iran’s nuclear programme during the talks. ✅: Thailand is on track to become the first Southeast Asian country to legalise same-sex marriage after its lawmakers approved the draft amendment to its Civil and Commercial Code. The process of the bill becoming a law is likely to be completed by the end of the year. THE DAILY DIGIT₹1,601 croreThe price at which Maharashtra is buying the iconic Air India building on Mumbai’s Marine Drive. (DIPAM) FWIWApp trap: Talk about synchronicity. Yesterday, we wrote about Bengaluru’s worst water shortage in four decades, which is also when the news about India’s tech capital resorting to what else but apps to help manage the crisis dropped. The Bangalore Water Supply and Sewerage Board (BWSSB) has launched four apps, Samrakshaka, Jalamithra, Parisara Jalasnehi, and Andar Jala. The second is a volunteer service for people to report leakage detection and conduct surveys, while Parisara Jalasnehi will enable folks to book treated water for non-drinking purposes. With Andar Jala, Bangaloreans can apply for borewell permissions. Our personal fave is Samrakshaka, through which BWSSB will issue penalties for water misuse. Question: why would anyone download that app then? Bird brain: Science grads are probably familiar with Dippy The Bird, the toy water-drinking bird that sways up and down to demonstrate the laws of thermodynamics. Turns out Dippy’s influence goes beyond labs. A study by Chinese and Hong Kong scientists published in the journal Device reveals that the bird can be used to turn evaporated water into electricity, which in turn can power an engine. Dippy can apparently use just 100ml of water to generate 100 volts of power. Clean energy geeks, head here to know the what and how. Not so Honest Abe: Ok, this isn’t on Abraham Lincoln as much as it is the photographer’s cross to bear. Lincoln wasn’t just one of the most popular US Presidents of all time; he was also one of the most photographed, having sat for over 120 photos in the last 18 years of his life. One of these, an iconic engraving that made it to the American five-dollar bill, was probably doctored. The person who did so was photojournalist Anthony Berger. It’s been revealed that Berger regularly retouched images, sometimes even superimposing the faces of US Presidents onto other people’s bodies. And you thought deepfaking was unique to our era. The Signal is free today. But if you enjoyed this post, you can tell The Signal that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

FAME and (mis)fortune

Thursday, March 14, 2024

Also in today's edition: One election, higher GDP?; Time and tide against TikTok; The Assam feather in Tata's hat; Small mercies for parched Luru ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

It pays to be cheap

Wednesday, March 13, 2024

Also in today's edition: Sebi goes grey hunting; Guns and the men; Amazon's nuclear reaction; BYD's overseas woes ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

If at first you don’t succeed, Trai again

Tuesday, March 12, 2024

Also in today's edition: Dark stores, light touch; No country for AI research; Co-branded cards under the scanner; Hedgies against Sebi ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Is this the end of TikTok?

Monday, March 11, 2024

Also in today's edition: Public good, private preference; Boeing's latest setback; Better to be safe than Sora; Soot at sight ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Does the WTO have a viable future?

Saturday, March 9, 2024

Power politics is paralysing the global trade body ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Marketing Weekly #222

Sunday, March 9, 2025

Why Faceless Social Media Accounts Don't Work — Lessons From Someone Who Tried • How We Cut Lead Costs by 75% with Facebook Ads (and How You Can Too) • The True Art of Being Customer-Centric • The

Why The Per-Seat Model Isn’t Dead (Yet)

Sunday, March 9, 2025

And the top SaaStr news of the week To view this email as a web page, click here The Per-Seat Model Isn't Dead. But Also, Surprisingly, It Was Never Dominant. The Per-Seat Model Isn't Dead. But

Startups gear up for EU defense surge

Sunday, March 9, 2025

Also: Female founder face anti-DEI wave, our Global Markets Snapshot wraps up February's action & more Read online | Don't want to receive these emails? Manage your subscription. Log in The

Sunday Thinking ― 3.9.25

Sunday, March 9, 2025

"Whenever honesty is missing, walls slowly start appearing."

🚨 Weekend Wrap-Up: Chatbots Are Stealing 96% Of Your Clicks

Sunday, March 9, 2025

The Weekend Update... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 How to create a unicorn

Sunday, March 9, 2025

Vanta opens up about building a security game-changer. 🔐

Brain Food: Guts Over Brains

Sunday, March 9, 2025

Your reputation isn't just what people say about you—it's the position from which you make every move. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Recruiting Brainfood - Issue 439

Sunday, March 9, 2025

50 Thoughts on DOGE, World Energy Employment Report, a self updating spreadsheet with Real Time TA jobs, the psychological injury of being laid off and why AI Agents need to be KPI'd... ͏ ͏ ͏ ͏ ͏ ͏

+49% increase in cart adds (funny A/B test)

Sunday, March 9, 2025

Launching a product? I'm helping startups build better products and reach product-market fit. To do that, we've built ProductMix and you should use it: https://rockethub.com/deal/productmix

🦸🏻#13: Action! How AI Agents Execute Tasks with UI and API Tools

Saturday, March 8, 2025

we explore UI-driven versus API-driven interactions, demystify function calling in LLMs, and compare leading open-source frameworks powering autonomous AI actions