The First Chinese Translator of the Ethereum Whitepaper Discusses Why Modular Blockchain Will Prevail

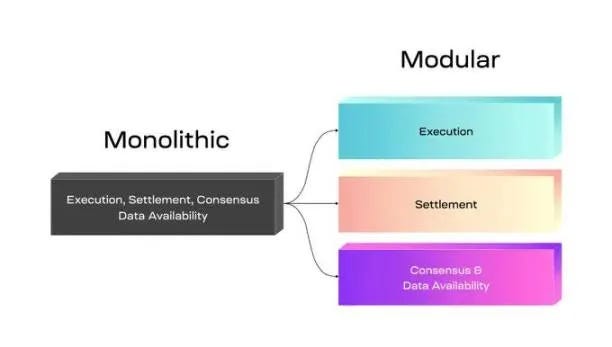

Author: chainfeeds Source: https://substack..xyz/p/7a9 The DenCun upgrade marks a significant milestone in Ethereum’s development path. The introduction of EIP-4844 in this upgrade will notably enhance the efficiency of Ethereum’s L2 network by introducing a new Blob space data structure, aiding Ethereum in achieving higher throughput and lower costs on Rollup. In this context, ChainFeeds invited Ethereum OG Gulu to discuss key topics in the Ethereum ecosystem, including understanding chains, the importance of decentralization in blockchain development, and the potential development in areas such as DeFi, stablecoins, and value storage. Gulu, the Chinese translator of the Ethereum whitepaper who participated in the Ethereum crowdfunding. Additionally, he created the blockchain education platform BiHu and the multi-chain smart wallet MYKEY, and is also an advocate for DeGate. Key Points: 1. The ultimate form of the blockchain industry is Modular Blockchain, consisting of Layer1 + Layer2, with the possibility of Layer3 in the future. 2. Blockchain provides a “non-national independent space,” promoting the development of global financial infrastructure, enabling any user to transact freely using private keys, and leading to unforeseen applications. 3. When the underlying infrastructure’s throughput is not a concern, the blockchain transaction paradigm will change, and the order book trading model may become the ultimate form. Blockchain Endgame: Which is Superior, Modular Blockchain or Monolithic Blockchain? The debate between modular and monolithic solutions in the blockchain field has never ceased, with each camp believing their approach is superior. Twitter is filled with controversies about these two approaches, involving issues such as cost, speed, decentralization, and scalability. In this Spaces session, Gulu also shared his views. He believes that the ultimate form of the entire blockchain industry is Modular Blockchain, the combination of Layer1 and Layer2, and explains his viewpoint from the perspectives of gas cost and decentralization. Gas Cost In a monolithic blockchain, each consensus node must verify every transaction in every block. This means that when dealing with a large number of transactions, each node bears a significant computational burden. For example, if the transaction demand of the blockchain grows to 100,000 transactions per second, each consensus node must process 100,000 transactions per second, which would be a huge challenge. In contrast, Gulu believes that the gas cost of Modular Blockchain is lower. Taking the Ethereum Rollup scaling route as an example, Layer1 provides computing and data storage services, while Layer2 handles actual transactions. Eventually, all transactions will occur at Layer2. Gulu gives an example: suppose there are 50 Layer2s in the future, each processing 2,000 transactions per second, the entire modular ecosystem can process 100,000 transactions per second, and transaction verification will ultimately be completed by Layer1 nodes. This model is more economical for the entire ecosystem because not every node needs to verify and compute every transaction, but only needs to pay for the hardware cost of 2,000 transactions per second. Additionally, after the Cancun upgrade, Layer2 using BlockData will become very cheap, and the gas price for data is expected to drop by at least one order of magnitude, and possibly two. Considering both cost and gas cost, for different Layer2s, the gas cost can be reduced by at least 80%. Decentralization From the perspective of decentralization, a monolithic blockchain may eventually be reduced to a dozen or even fewer nodes, which are likely to be operated by data centers. In this case, governments or other entities can intervene in the operation of the blockchain by controlling these nodes, thereby affecting its decentralization. For example, in the case of Bitcoin, governments may restrict its issuance or control transaction rules. Gulu believes that in this scenario, the blockchain will lose its core value, independence. Therefore, a monolithic blockchain may not achieve true decentralization, and its ecosystem will become fragile and vulnerable to attacks. In contrast, in a modular blockchain, Layer2 actually has weak independence because the overall design goal is to make Layer2 lose some independence and transfer its management to Layer1. In other words, although Layer2 still retains some degree of autonomy, the ultimate control lies in Layer1. Gulu believes that this design pattern can maintain the decentralization characteristics of the entire Layer1 network. For example, Arbitrum has already achieved features such as Trustless and Permissionless. On the Concept of Blockchain “Non-national Space”: Trust, Scalability, and Financial Revolution The term “non-national space” in historiography refers to the early formation of states, where most areas were not ruled by states, creating large areas of “non-national space” between state distributions. These spaces contain various primitive human organizational forms, such as tribes. In this concept, being outside the national borders means gaining independence and freedom. Early on, the scope of states was typically limited to a radius of about 48 kilometers, which was the range that states could effectively control. Mapping this concept to the blockchain, it becomes the so-called independent space, meaning independent of the national system. This independent space provides a decentralized, sovereign, and free environment, enabling individuals to better control their data and assets. Similar to the early “non-national space,” the “non-national space” on the blockchain is a network composed of decentralized nodes without centralized governing institutions. Gulu pointed out that Bitcoin is the earliest application in the blockchain “non-national space,” demonstrating decentralized characteristics and a perfect fit with the currency market. Subsequently, more flexible applications based on blockchain technology architecture have emerged, such as DeFi, NFTs, and lending. These applications and the essence of the blockchain in Web2 exploit the “non-national space” of the blockchain. So why choose to build applications on the blockchain, and what advantages does the blockchain “non-national space” bring? Gulu also provided insights: ● Trust: Blockchain applications increase users’ trust in applications because their data is publicly visible and cannot be tampered with. For example, the contract for issuing tokens can be publicly verified on the chain, and anyone can verify its validity. ● Scalability: As mentioned in “Endgame Analysis (Part 1): Ethereum is Winning,” the blockchain “non-national space” will gradually evolve into an Internet financial center, covering various DeFi applications, decentralized transactions, collateral, stablecoins, etc., providing users with more financial choices and services. ● Product-Market Fit: Gulu particularly mentioned the product-market fit of stablecoins in the blockchain “non-national space,” especially in cross-border payments. Unlike traditional international remittances that incur high costs, blockchain-based solutions offer low transfer fees and efficient transaction speeds, facilitating global economic activities. ● Dollarization Process: Although the consensus on the dollar is stronger, there are national border issues, resulting in a slow dollarization process. However, with the popularity of blockchain technology, a second wave of dollarization trends may emerge, making products like the dollar more widely used in the blockchain “non-national space.” ● Asset Blockchainization: Gulu believes that the demand for asset blockchainization is fundamentally attractive. Blockchain technology makes it possible to put assets on the chain, further expanding application scenarios. For example, real estate certificates are tokenized as NFT tokens, which can be used as collateral, providing users with convenient lending services. From a long-term perspective, asset blockchainization is an anticipated track that will spawn many innovations and applications. Follow us Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Talk with BOME investor Flynngao: How to make investment decisions in half an hour

Monday, March 18, 2024

Interview by Flynngao, Trillion fi Scientist Team Disclaimer: The content of this article only represents the personal views of the interviewee, does not represent the position of Wu Blockchain, does

Asia's weekly TOP10 crypto news (Mar 11 to Mar 17)

Sunday, March 17, 2024

1. South Korea's Weekly Summary 1.1 Cryptocurrency Exchange Trading Volume in South Korea Surpasses Stock Market link On March 10th, the trading volume on South Korean cryptocurrency exchanges

Weekly Project Updates: Starknet Establishes Gaming Committee, MakerDAO to Launch Endgame in Summer, EigenLayer to…

Saturday, March 16, 2024

1. Arbitrum Foundation Proposes Establishment of $400 Million Crypto Gaming Fund to its DAO link The Arbitrum Foundation has announced plans to invest 200 million ARB tokens (approximately $400 million

WuBlockchain Weekly: Ethereum Completes Dencun Upgrade, Biden Proposes Heavy Taxes on Mining Again, US CPI Exceeds…

Friday, March 15, 2024

1. Bitcoin's Market Capitalization Surpasses Silver, Becoming the 8th Largest Asset Globally link On March 11th, following Bitcoin's surge above $71000, its market capitalization has reached

2024 Web3 Sector Analysis, a perspective from Asia’s largest Crypto VC Hashkey

Friday, March 15, 2024

As one of the most active crypto VCs, HashKey Capital regularly analyzes every Web3 sector internally. In the New Year of 2024, we “open source” our internal sector analysis and insights as our

You Might Also Like

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏