The Pomp Letter - The Conflicting Data of the US Economy

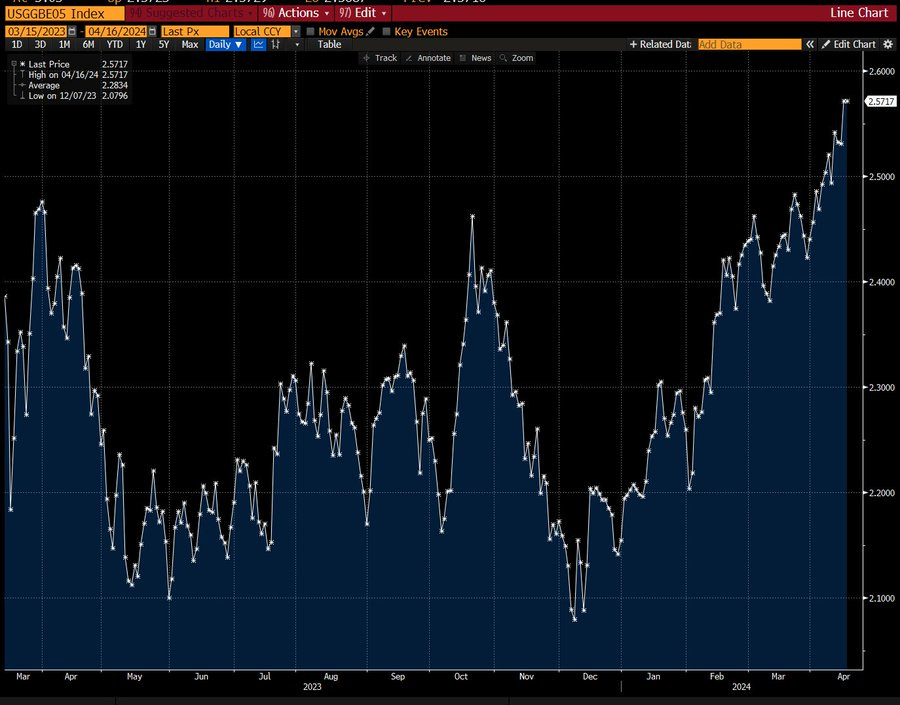

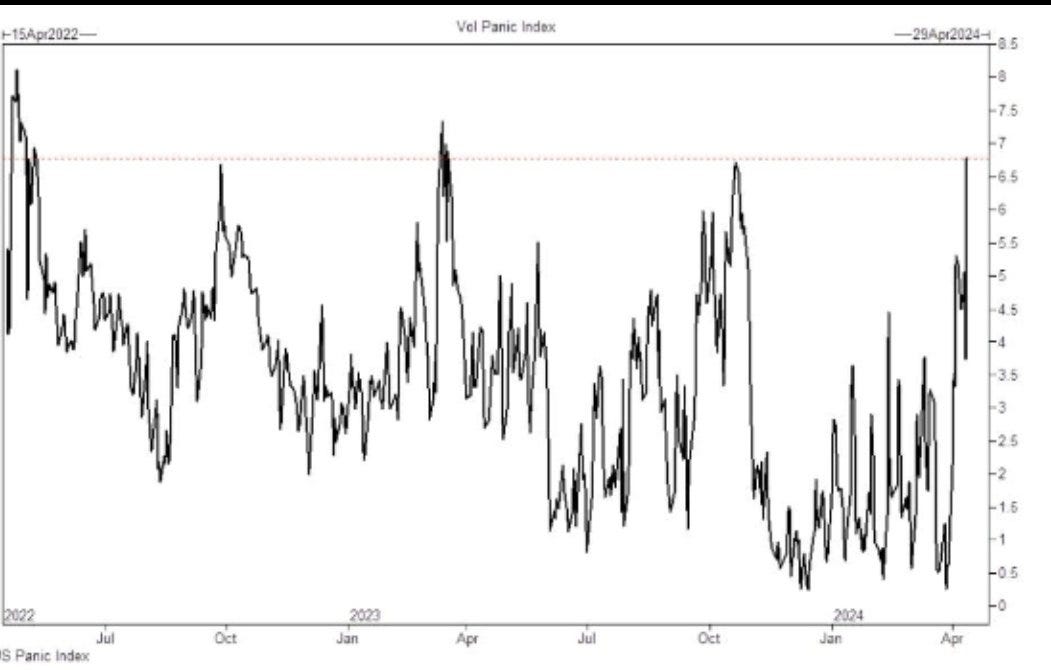

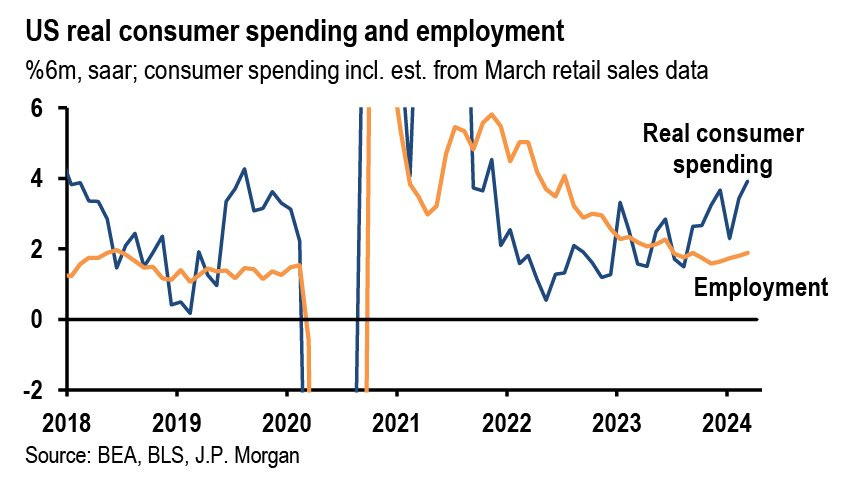

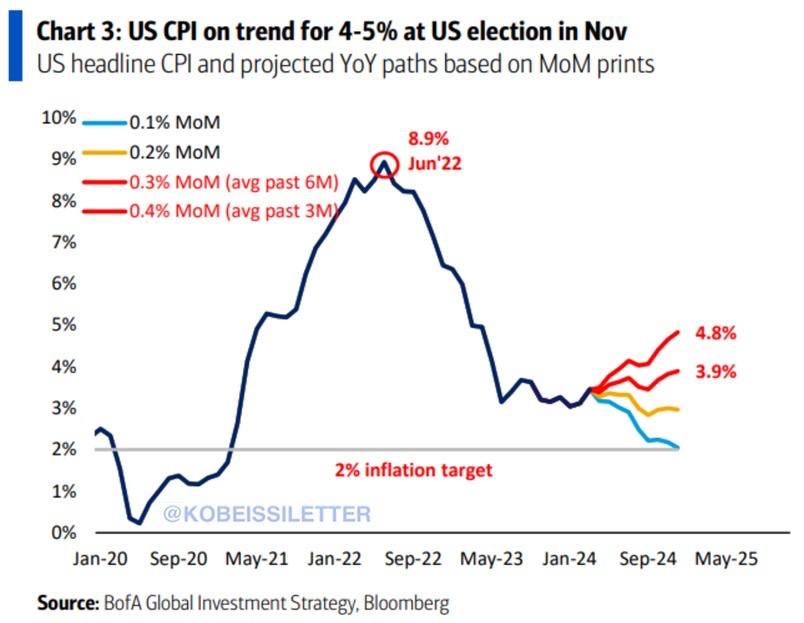

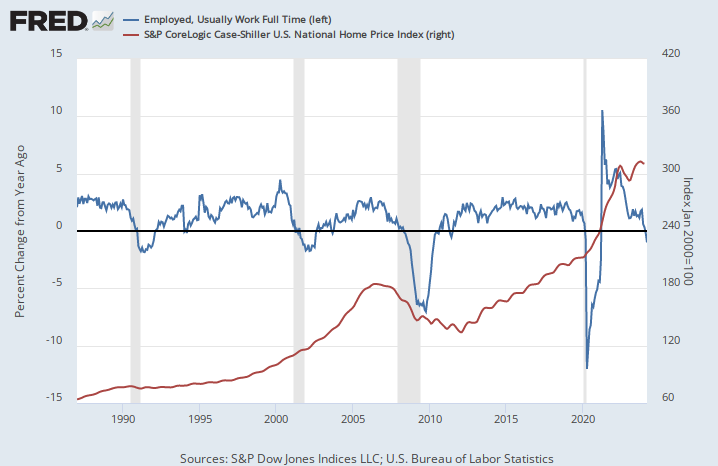

To investors, The current economic situation is confusing to most investors. Many data points are pointing to an incoming recession, while the metrics that the Fed uses to gauge economic strength continue to show a hot economy with no signs of slowing down. Below are a few charts that highlight these differences. Bloomberg’s Lisa Abramowicz shows “longer-term inflation expectations are rising again. The market's implied rate of inflation over the next five years has risen to the highest level in more than a year, at 2.6%, according to breakeven rates.” Inflation expectations rising usually leads to behavior from market participants that causes inflation to rise. Not a great sign of things to come if this becomes reality. Will this cause investors to panic? Maybe. Winfield Smart explains that the “Goldman Sachs Panic Index soars to highest level since March 2023.” CNBC’s Carl Quintanilla points out an opposing viewpoint from JP Morgan, which stated the recent retail sales beat, “alongside upward revisions to previous months, suggests a strong 3.3% rise in 1Q real consumer spending and some upside risk to our 2.25% GDP forecast, as well as building momentum going into 2Q.” The Kobeissi Letter shared a shocking statistic: “US CPI inflation is on track to hit 4.8% by the 2024 election, according to Bank of America. Over the last 3 months, CPI inflation has averaged 0.4% on a month-over-month basis. If this trend continues it puts year-over-year inflation on pace to hit 4.8% by November, its highest since April 2023. That would be more than DOUBLE the Fed’s 2% inflation target. Inflation has been above the Fed's 2% long-term target for 37 straight months. Inflation is far from over.” Lastly, the full-time employment situation in America is getting bad very quickly. This should lead to a major drag on US home prices in the future if the historical trends hold. So what happens from here? How do we reach a conclusion based on the conflicting data points? The short answer is that I don’t know. It is an impossible situation to figure out. Rather than focus on the short-term price movements of assets, I am spending all of my time focused on what I believe to be true over the next 5-10 years. Those trend lines appear to be easier to identify than what will happen in the US economy over the next 1-2 years. Hope you all have a great day. I’ll talk to everyone tomorrow. -Anthony Pompliano Trevor Bacon is the Co-Founder & CEO of Parcl, a decentralized real estate trading platform. In this conversation, we talk about where they are getting real estate data from, how they want to help you trade on real estate prices, the impact of real time real estate data, and more. Listen on iTunes: Click here Listen on Spotify: Click here Parcl Will Let You Trade Real Estate Prices Without Owning Real Estate Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

Why Did Bitcoin's Price Drop Over The Weekend?

Monday, April 15, 2024

Listen now (6 mins) | To investors, Iran launched a barrage of missiles and drones at Israel over the weekend. This escalation of force did not come as a surprise to the United States and our allies.

Podcast app setup

Sunday, April 14, 2024

Open this on your phone and click the button below: Add to podcast app

Podcast app setup

Saturday, April 13, 2024

Open this on your phone and click the button below: Add to podcast app

Inflation Is Accelerating And The Fed Has No Control

Saturday, April 13, 2024

Listen now (4 mins) | To investors, The inflation report this morning shows that the economic measurement is headed in the wrong direction. Year-over-year CPI came in at 3.5% and the month-over-month

The Bitwise Q1 2024 Crypto Market Review: Staggeringly Bullish

Saturday, April 13, 2024

To investors, Today we have a guest post from Juan Leon, a senior crypto research analyst at Bitwise Asset Management. Juan put together an overview of Bitwise's Q1 2024 Crypto Market Overview

You Might Also Like

What is it to have a free plan for your SaaS?

Saturday, December 28, 2024

These deals are ending: Inro, Qolaba, MySEOAuditor, ContentRadar, and SEO Pilot - get them now to start off your 2025 right!! Get these lifetime deals now! (https://www.rockethub.com/) Today's hack

The Biggest News of 2024!

Friday, December 27, 2024

Over the past year, there has been some pretty big SEO and digital marketing news that has impacted bloggers and content creators. Since its the end of the year, Jared and I decided to sit down and

Online Sales Grew This Much During the Holidays [Crew Review]

Friday, December 27, 2024

You're an Amazon whiz... but maybe not an email whiz. Omnisend makes setting up email for your brand as easy as click, drag, and drop. Make email marketing easy. Hey Reader, Merry belated Christmas

A strategy for more prospects in 2025

Friday, December 27, 2024

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's Make Cut Out Snowflakes Day, Reader... Let your inner child out to play!

Influence Weekly #369 - TikTok At A Crossroads: 23 Experts Weigh In On The Ban, ByteDance, And What’s Next

Friday, December 27, 2024

Social Media as a Recruitment Tool: School Bus Driver Influencers

Issue #48: When Hardware Hits Reality

Friday, December 27, 2024

Issue #48: When Hardware Hits Reality

The UGLIEST website ever? (He paid $55k for it)...

Friday, December 27, 2024

You have to hear this story, it's crazy. View in browser ClickBank Day 3 of Steven Clayton and Aidan Booth's '12 Day Giveaway' celebration has just been published. Click here to find

"Notes" of An Elder ― 12.27.24

Friday, December 27, 2024

Life is too precious to be lived on autopilot.

10 busiest VCs in supply chain tech

Friday, December 27, 2024

9 VCs that ruled 2024 fundraising; aircraft parts market becomes a hotbed for PE; EMEA's 10 biggest buyout funds Read online | Don't want to receive these emails? Manage your subscription. Log

🔔Opening Bell Daily: Housing Outlook 2025

Friday, December 27, 2024

Mortgage rates have climbed as the Fed has cut borrowing costs, and unaffordability will likely persist in the new year.