Inflation Is Accelerating And The Fed Has No Control

To investors, The inflation report this morning shows that the economic measurement is headed in the wrong direction. Year-over-year CPI came in at 3.5% and the month-over-month growth in inflation was 0.4%. This means that inflation is going up, not down, which is a major problem for the Federal Reserve. The central bank has been talking about cutting interest rates. The market has been expecting those interest rate cuts. But this economic report is going to make it nearly impossible for the Fed to follow through on it’s promise. The inflation report is actually signaling that the Fed should be RAISING interest rates, rather than cutting them. That is a big narrative violation. But maybe we shouldn’t be surprised by the hot inflation reading. In the letter I wrote on February 27th to this group, which was titled “Bitcoin Is Sounding The Alarm On Inflation,” I highlighted that bitcoin could be acting as an alarm system for incoming hot inflation:

Later in the letter I stated:

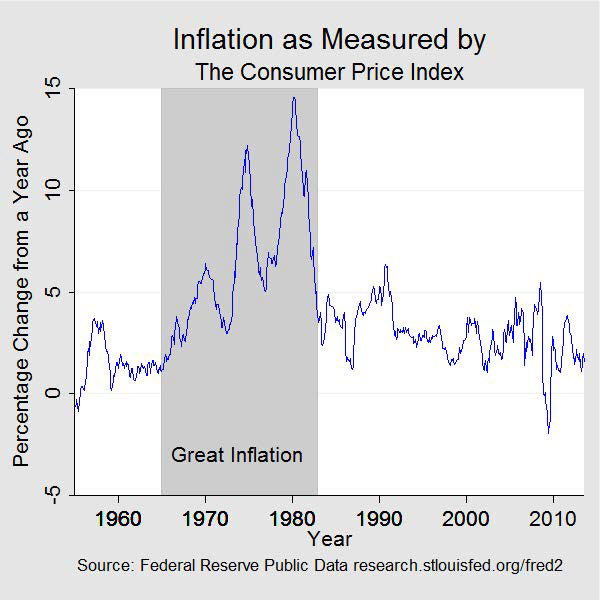

It turns out that this phenomenon of bitcoin as an alarm system was correct once again. The risk now is what I called out in our March 13th letter titled “Will We Repeat The Great Inflation?”

A true resurgence in inflation would be catastrophic to the US economy. The Federal Reserve has done so much work, including raising interest rates at the fastest pace in history, that it is unclear whether they have the commitment to continue raising interest rates from here. I don’t envy their position. It feels like there is a lose-lose scenario in front of them. If they keep raising rates to fight inflation, they will most likely push the US economy into a painful recession. If they don’t raise interest rates, then inflation is going to come back with a vengeance. Regardless of what happens in the coming months, American citizens are the ones who lose. We are living in an economy with 3.5% inflation, an accelerated pace of currency debasement, a national debt that is growing to the sky, over $1 trillion of credit card debt, a housing situation that makes it cheaper to rent than buy in the 50 major metros, and tens of millions of Americans who feel like there is no path forward for them financially. Insane. But the hot inflation reading is now reality. Bitcoin sounded the alarm bell. Hopefully more people will pay attention to this economic signal in the future. Have a great day. I’ll talk to everyone tomorrow. -Anthony Pompliano Reader Note: Today is a free email available to everyone. If you would like to receive these letters each morning, please subscribe to become a paying member of The Pomp Letter by clicking here. Darius Dale is the Founder & CEO of 42Macro. In this conversation, we talk about the probability of different economic outcomes, why "no landing" might happen, what that means, inflation, optimism index, small business survey, and outlook on asset prices. Listen on iTunes: Click here Listen on Spotify: Click here Darius Dale Breaks Down What He Expects On Inflation Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

The Bitwise Q1 2024 Crypto Market Review: Staggeringly Bullish

Saturday, April 13, 2024

To investors, Today we have a guest post from Juan Leon, a senior crypto research analyst at Bitwise Asset Management. Juan put together an overview of Bitwise's Q1 2024 Crypto Market Overview

Is Gold Warning Us About An Incoming Geopolitical Event?

Saturday, April 13, 2024

Listen now (3 mins) | To investors, Gold hit $2400 over the last 24 hours, which is a new all-time high price for the precious metal. Most of you would not expect me to cover gold given my interest in

Fake Currencies, Meme Coins, And History Lessons

Tuesday, April 9, 2024

Listen now (4 mins) | Today's letter is brought to you by Espresso Displays! I normally work on my desktop computer and am hyper productive. The second that I leave my desk, I lose my productivity

The Stock I Would Have Pitched At The Sohn Conference

Thursday, April 4, 2024

Listen now (6 mins) | Today's letter is brought to you by Shortform! Shortform has the world's best guides to 1000+ nonfiction books. Learn key points and gain insights you won't find

The Pomp Letter Takes On Wall Street

Wednesday, April 3, 2024

Listen now (4 mins) | To investors, I started writing The Pomp Letter in May 2018. Next month will mark 6 years of writing every morning about bitcoin and financial markets. Throughout this time, I

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these