Room at the top: price holds key to Tier 2 competitors

Room at the top: price holds key to Tier 2 competitorsHoldCrunch price data analysis, Games Global IPO prospectus, Vegas visitation +More

Price point matters for Tier 2sThe price of success: The narrative around the top two in the US OSB market sharing an unassailable lead over the rest of the market is challenged by new data that suggests Tier 2 operators might yet find a way to succeed with market shares of between 10% and 15%.

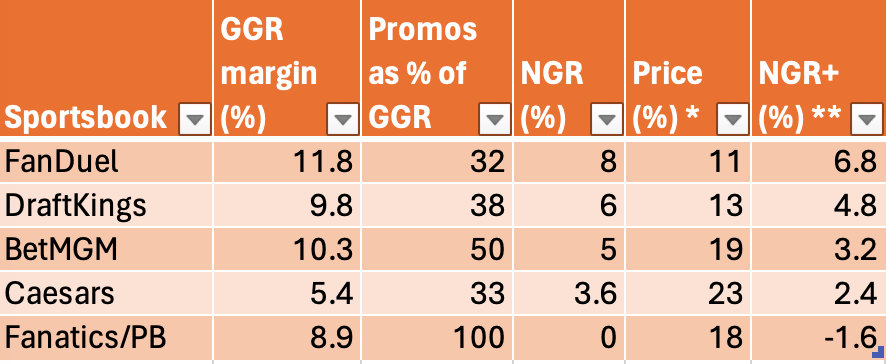

How did we get here? Looking at the data from the states that report at an NGR level, the HoldCrunch analysis shows which sportsbooks are offering the best prices to customers while at the same time returning the highest margins. The table below shows how in 2023 FanDuel and DraftKings led the major challengers by some distance on both of these price and margin metrics. States reporting NGR at an operator level, Feb23-Jan24 Source: HoldCrunch. The NGR states in this analysis are AZ, CT, KS, KY (October only), MD, MI, OH, PA. Each operator's margins are calculated using only data from states where that operator is present *The lower the percentage, the better the prices offered to customers. Data is from NBA, NCAAB, MLB, NFL, NCAAF **NGR+ is NGR after taking account of the cost of equaling the leader on price (GGR minus 'the promo % plus the price %') Some explaining to do: The first three columns of data are numbers everyone is familiar with: GGR, promos as a percentage of GGR and NGR. The fourth column, price, comes from the HoldCrunch platform and it shows who was offering customers the best prices (odds/lines). The lower the price % number, the better the prices offered to customers.

Why the market leaders lead: A 10% difference MoM is likely to move handle share. “FanDuel and DraftKings didn’t just lead on price; they made a point of staying very close to each other,” Johnson says.

EveryMatrix delivers iGaming software, solutions, content and services for casino, sports betting, payments, and affiliate/agent management to 300+ global Tier-1 operators and newer brands. The platform is modular, scalable, and compliant, allowing operators to choose the optimal solution depending on their needs. EveryMatrix empowers clients to unleash bold ideas and deliver outstanding player experiences in regulated markets. Explaining the plussesSnapshot: Johnson explains that two books reporting 10% GGR and 6% NGR might look the same, but if one is offering -111 on average and the other -109 their true margin performance is not the same at all. “NGR is a snapshot in time of profitability,” he says.

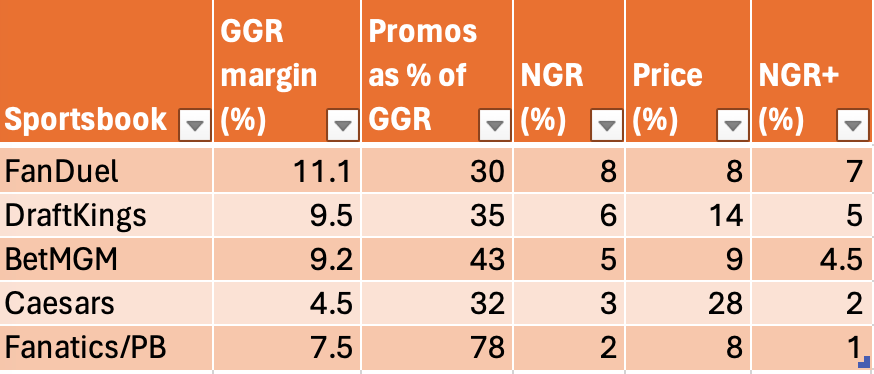

A change is gonna come: The table below is a more recent quarter, November 2023 to January 2024, and there are some significant differences: States reporting NGR at an operator level, Nov23-Jan24 Holding the line: Johnson points out that the most notable price+margin profile change is BetMGM where the price % as calculated by HoldCrunch is almost 9%, which is in line with the best, in this instance FanDuel, which is on 8%.

Recall, both JV parents at BetMGM have spoken about the improvements that will be brought to bear on BetMGM’s offering by Entain’s acquisition last year of Angstrom. Just last week, Entain’s interim CEO Stella David said during the company’s Q1 trading update call with analysts that the “tangible benefits” of Angstrom were “just starting to reach players now.”

Taking a view: Johnson says that it is important to look at both the price percentage and NGR+ together. “You want to see an ability to deliver competitive prices for customers but also high margins at the same time,” he suggests.

He adds that only now is the market seeing a challenger with those characteristics and that is why he believes the possibility of a profitable middle group shouldn’t be discounted.

Further reading: Investors believe the race in US OSB is down to two competitors, says the team at Morgan Stanley. Maximize your trading success in 2024 with OpticOdds’ real-time Odds Screen. Built for operators with an emphasis on speed and coverage, OpticOdds offers:

Get in touch at opticodds.com/contact. +More takesHindsight is a wonderful thing: The team at JMP reported that FanDuel CFO David Jennings felt it would have spent even more money on player acquisition in 2021 and 2022 now that it knows the level of rewards it is reaping from those customer cohorts. Las Vegas Sands: Reacting to the company’s Q1 earnings last week, the team at Seaport Research Partners, said Sands continues to face an element of market share loss partly due to disruption caused by redevelopment work at The Londoner and the closure of the Macau Arena.

Delivery hero: Following 888’s brief Q1 trading update, the team at Jefferies said that “delivery is now the focus.” After a tough comparison period in Q124 and guidance implying double-digit growth through the rest of FY24E, “execution” is now the big question. The team noted, though, that leverage remains high in the short term at 5.6x FY23 numbers. Games Global’s iCasino hopesA stretch: A somewhat unlikely forecast for the number of legalized iCasino states rising to 15 by 2028 and for revenues to top $20bn compared to the $5bn achieved in 2022 lies at the heart of the Games Global IPO prospectus released last week. As noted last week, the IPO is likely to be the largest in the sector this year. Super six: Recall, the stuttering progress of iCasino legalization to date has seen only six states go down the regulated path – New Jersey, Pennsylvania, Michigan, Connecticut, Delaware and, most recently, Rhode Island.

Are you sure we’re on the right track? Commenting on X, Chris Krafcik from EKG said the estimate for 2028 “feels really, really tough – impossible even. I just don't see a path.” Still, Games Global insists in its prospectus that “there is potential for longer-term growth” if additional states legalize iCasino alongside SB.

Hit the north: Games Global’s confidence in its opportunities in the US is in part driven by the success it has enjoyed in recent years in Canada. It said revenues from Canada grew by 32% YoY in the nine months to Dec23.

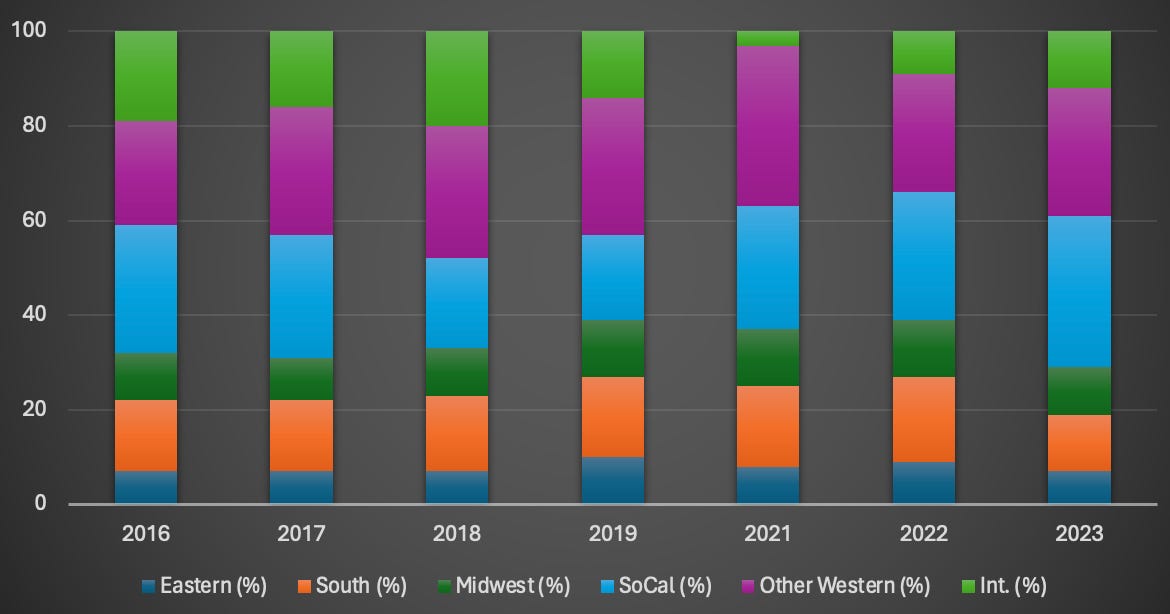

Golden roadsCan’t you hear the whistle blowing? The news that construction of the $12bn high-speed rail line between Las Vegas and Southern California has finally begun comes as the number of visitors to the city from the region is at a multi-year high.

🚆 ✈️ & 🚘 Where do the visitors to Las Vegas come from? On the up: The team at MS pointed out that the recent strength in the GGR numbers in Nevada has been driven by the increase in spend per head rather than any absolute increase in visitation, which is actually down 5% on 2019 levels.

Calendar

Kambi Group is the leading provider of premium sports betting technology and services, empowering operators with all the tools required to deliver world-class sports betting and entertainment experiences. The Group’s services not only include its award-winning turnkey sportsbook but also an increasingly open platform and a range of standalone sports betting services from frontend specialists Shape Games, esports data and odds provider Abios, and AI-powered trading division Tzeract. Together, we are limitless. For more info, go to www.kambi.com An +More Media publication. For sponsorship inquiries email scott@andmore.media. |

Older messages

NJ iCasino will ‘soon be bigger than Atlantic City’

Monday, April 22, 2024

New Jersey analysis, analyst takes – Bally's, Penn, 888, shares watch – Melco Resorts, startup focus – the Tenth Man +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Sands sheds $3bn on investor Macau fears

Friday, April 19, 2024

LVS earnings reaction, 888 progress, sector watch – retail financial trading +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Capital Markets Forum, New York

Thursday, April 18, 2024

Our debut event on May 6 at the New York Stock Exchange ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Games Global files for IPO in New York

Wednesday, April 17, 2024

Games Global float, Entain's first quarter, Inspired earnings review +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Turn, turn, turn: betting and gaming overrun by strategic reviews

Tuesday, April 16, 2024

Strategic reviews abound, the quarterly roundup of deals from the first quarter +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

🎙️ New Episode of The Dime Uniform Genetics, F1 Hybrids, Better Yields: New Age Cannabis Cultivation ft. Ralph Risch

Thursday, December 26, 2024

Listen here 🎙️ Uniform Genetics, F1 Hybrids, Better Yields: New Age Cannabis Cultivation ft. Ralph Risch F1 hybrid seeds are the cornerstone of modern agriculture, offering the least expensive and

Would you like to WIN a MacBook Pro?

Thursday, December 26, 2024

You're invited to join in on all the fun! View in browser ClickBank Steven Clayton and Aidan Booth officially kicked off their monster '12 Day Giveaway' celebration yesterday, and you'

The Daily Coach's 10 Most-Read Pieces of 2024

Thursday, December 26, 2024

Thank you for being part of our journey and allowing us to be part of yours.

New top offers (and CB Summit is coming!)

Thursday, December 26, 2024

Just in time for 2025, we have a plethora of top offers goodness for you – plus a new ClickBank Summit live event you won't want to miss... CB Logo High Res 200x23 ClickBank Newsletter Check out

What the rise of the niche and nano-creator means for influencer marketing

Thursday, December 26, 2024

As the creator economy swells, niche creators stand out capturing user attention and advertiser dollars. December 26, 2024 What the rise of the niche and nano-creator means for influencer marketing As

Numbers mean nothing without benchmarking

Thursday, December 26, 2024

The funds-of-funds conundrum; a comeback year for PE mega-funds; see where European VC went in 2024; ultrafast delivery drives foodtech VC Read online | Don't want to receive these emails? Manage

🔔Opening Bell Daily: Santa makes history

Thursday, December 26, 2024

Historically, the S&P 500's final week of the year is the strongest.

Fixing conversions and killing the business

Thursday, December 26, 2024

Inro, Qolaba, MySEOAuditor, ContentRadar, and SEO Pilot are still available til end of this week. Then, they're gone!! Get these lifetime deals now! (https://www.rockethub.com/) Today's hack

How to Write a Job Description

Wednesday, December 25, 2024

A deep dive into a job description that speaks to the deepest longings of the human spirit.

🎄 Recap: 21 Episodes of AI 101 Guide

Wednesday, December 25, 2024

Take some time to learn or refresh the key concepts, techniques, and models that matter most