Aziz Sunderji - The Week in Review

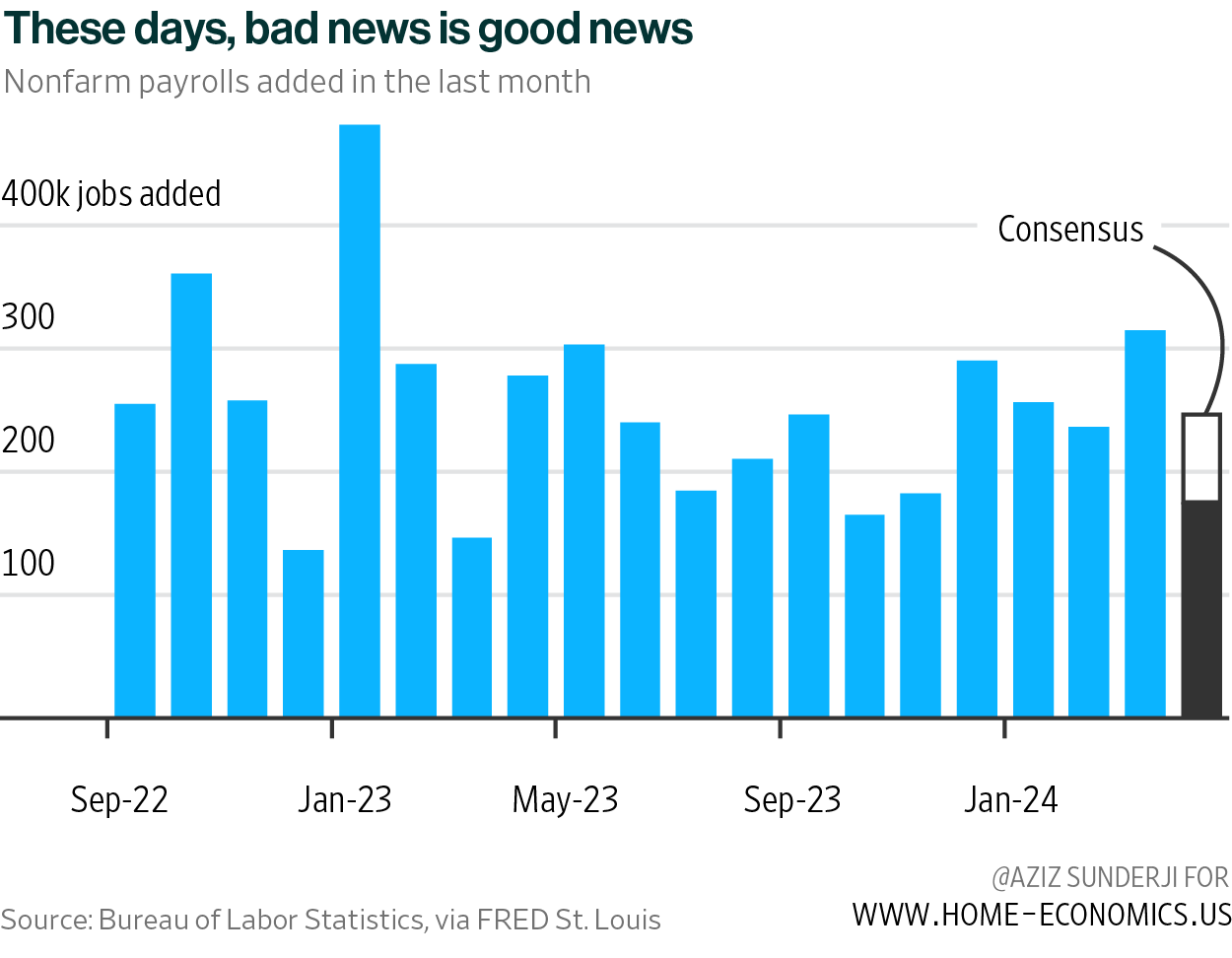

Welcome back to The Week in Review. I hope you had a good week. Articles with a ◎ are free. Those with a ◉ have free previews but are only accessible in full for paying subscribers. Upgrade your subscription here. 🚨 New: I made an economic data release calendar for you! News: A slew of jobs data all pointed in the same direction: down Goldilocks. That’s the word “the sell side” (investment banks) are using to describe this week’s data. It’s a dumb term that only bankers and people reading books to children use. But, I used to write research at a big bank and I get it—the word captures a more long winded message: the economy is neither running too hot (too much inflation), nor too cold (too little growth). The reason for the G word? Jobs! Specifically, less of them. The number of jobs companies added last month (“nonfarm payrolls”) was 175k—way lower than the consensus expectation for 240k. The unemployment rate also unexpectedly rose. Wages were a bit weaker, too (although the type of wage data released this week tends to bounce around). The weak jobs numbers come on top of other data pointing to softening growth: surveys of sentiment in the manufacturing and service industries dipped below 50, indicating contracting conditions. In their earnings calls, a bunch of companies cited softening consumer demand. The Fed wants a slowdown in wages and buying to curb rising prices. This week’s data is therefore the kind of bad news that is actually good news. At the FOMC meeting midweek (a humdrum one, since the Fed didn’t release a “summary of economic projections”), Powell played down the likelihood of Fed hikes. More data like this week’s and people might start talking about more than just one or two cuts again. And you know what that means—I can start banging on about my 6% end-of-the-year mortgage rate call again.

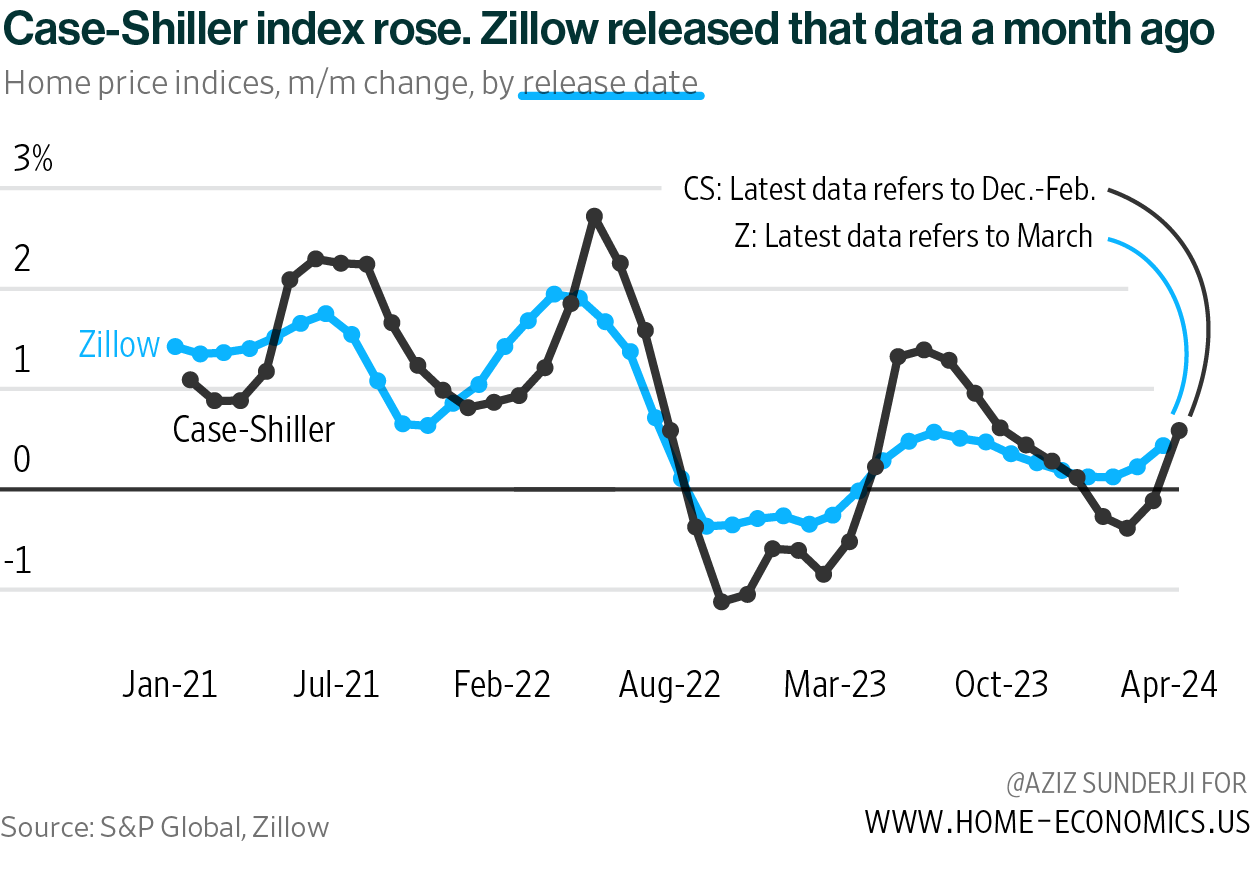

News: Case-Shiller home prices rose 6.4% year-over-year I’m not really sure why Case-Shiller remains the gold standard and the most watched home price index. Sure, it’s way better than, say, the NAR index. But Case-Shiller is incredibly delayed, and very broad (covering only major cities and nothing smaller). In probably the most niche article I’ve ever written (here ◉), I analyzed the three major home price indices (Case-Shiller, Zillow, and FHFA) and found there is really no reason to follow any index other than Zillow’s. Zillow is by far and away the best index, not least because their data comes out a month earlier than the others. Case in point: this week Case-Shiller price data came out for—wait for it—February! It included transactions that closed as far back as December 1. Here we are, in early May, enjoying the sunshine and budding flowers, looking at price data from the days when skies were gray and the trees barren. By contrast, Zillow last week came out with price data for March. Needless to say, the Case-Shiller index showed prices rising healthily (either measured month-over-month seasonally adjusted, or year-over-year, as I show below). For those who took my analysis to heart and follow the Zillow index, this is old news. Unlike most charts, the one below plots each index not by the date that each index refers to, but rather by the release date. All the big indices moves together when plotted in the conventional way, but when you line them up by release date, the advantage of the Zillow index being released 5 weeks earlier than Case-Shiller is clear: Zillow is a far more timely way of spotting turning points in the market, which is ultimately what we really care about, right?

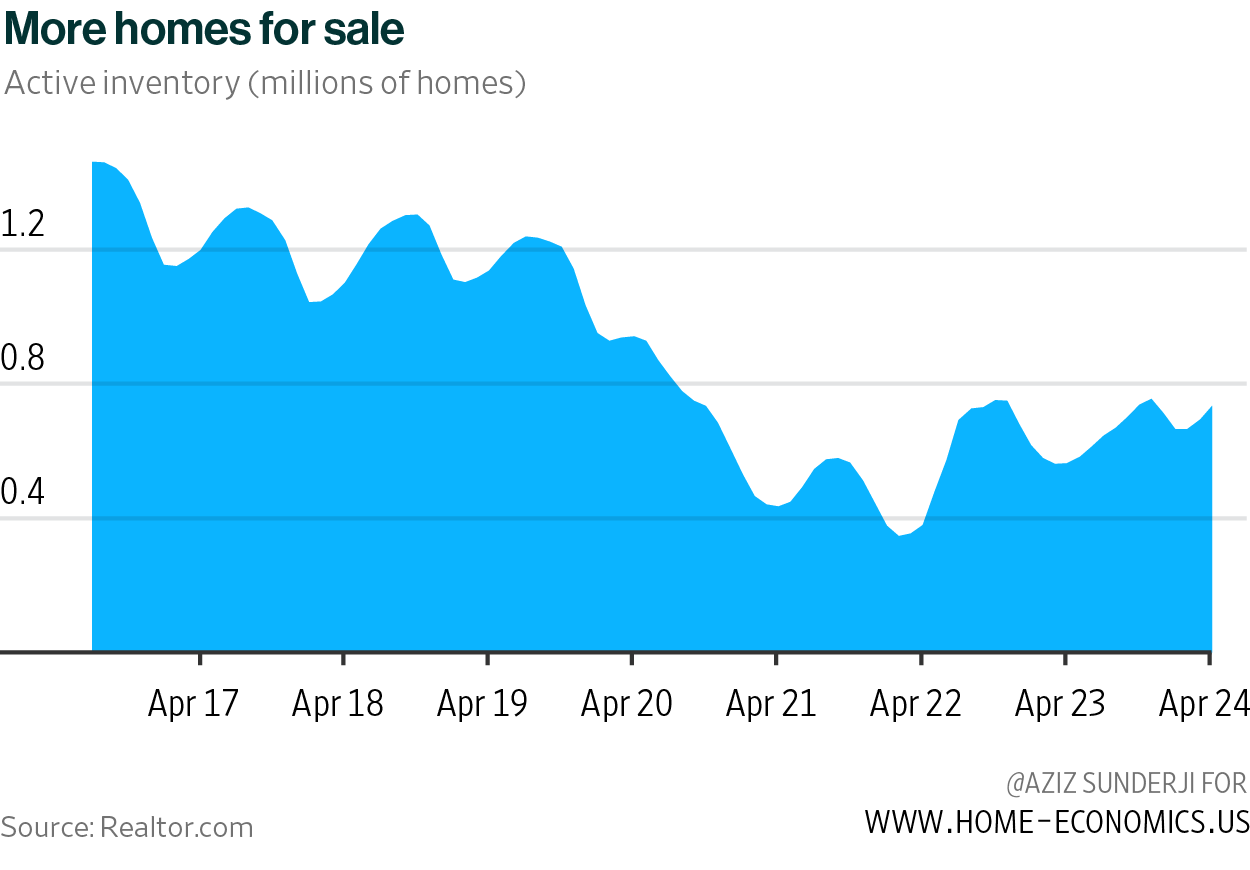

News: Realtor.com put out its monthly analytics If there is a theme in this week’s WIR, it’s that there is too much data (and not enough analysis and digesting of the data, which is probably the best raison d’etre for Home Economics). But the reason I pay attention to the Realtor.com data (and the reason it’s on the data release calendar, here ◉), is that some of the information is unique—for example, the number of days homes are sitting on the market. Realtor.com’s latest report, which covers April, reports that inventory (homes actively for sale) is 30% higher than a year ago. It’s grown 6 months in a row. The average home was on the market for 47 days—basically unchanged from last year, but 7 days less than before the COVID-19 pandemic. RSS feeds are a game changer (still¹). One solution is simply to have a handful of websites you visit whenever you want to catch up on what’s happening². But this is hugely inefficient—you have to visit all these different sites, and click through all of their pages to feel like you’re not missing anything. An RSS reader is the solution to this problem: it’s an app that gives you all the headlines from all the sources you tell it you want to follow³. Since I follow about 150 different economics and housing-focused sources, this has been a game changer for me. There are many RSS reader apps. I use Reeder. Once you get that setup, you’ll need to find feeds to follow. That’s a whole process (not hard, just time consuming). Paying subscribers can get a jump on this by loading my reading list—my curated feed of 150 news sources—into Reeder. Download it here ◉, and schedule a call with me here ◉ if you need help. Artificial Intelligence I am happy to be an evangelist about the tricks and tools I’ve discovered. Schedule a call with me here ◉. This past week I had a great conversation with a mortgage lender in Wisconsin, and a climate change specialist in New York. AI things to watch / read My editor/wife points out that all my “Fun Stuff” is actually work stuff. Fair enough. I love my job? Ok fine, a dog video that gave us both a good laugh, here ◎. 1 RSS has been around for ages but neither the tech companies nor the media companies want you to use it because RSS means you don’t need to go to their social media apps or their websites. Google decommissioned their beloved RSS reader because they wanted people to use Google+. This is insane and true and you can read about it here. 2 For me, it’s the FT, Bloomberg, NYT, and WSJ—and a dozen newsletters. I happily pay for subscriptions to all of these. 3 You can follow specific topics, authors, newspaper sections, newsletter writers, or the entire source (eg, the New York Times). Since you’re not going to want to click on most headlines, you just quickly scroll through all of them. When you see one you like, you click on it, and read the full article either in the RSS app or on the source’s website. Home Economics is a reader-supported publication. Please consider upgrading to a paid subscription to support our work. Paying clients receive access to the full archive, forecasts, data sets, and exclusive in-depth analysis. This edition is free—you can forward it to colleagues who appreciate concise, data-driven housing analysis. |

Older messages

The Week in Review

Saturday, April 27, 2024

Week of Apr 22 — Economy eases, Fertility falls, New home purchases pop ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Impending Demographic Collapse

Wednesday, April 24, 2024

Organic population growth turns negative in 24 years ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Week in Review

Saturday, April 20, 2024

Week of Apr 16 — Home starts stutter, Sales stagnate, Rates rip ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Home Starts? More like Home Stops

Tuesday, April 16, 2024

A sharp downturn in new and planned construction ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

One Home Price Index to Rule them All?

Thursday, April 4, 2024

Case-Shiller, FHFA, Zillow, the list goes on. But one is better than the rest. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

The Viral "Jellyfish" Haircut Is 2025's Most Controversial Trend

Monday, March 10, 2025

So edgy. The Zoe Report Daily The Zoe Report 3.9.2025 The Viral "Jellyfish" Haircut Is 2025's Most Controversial Trend (Hair) The Viral "Jellyfish" Haircut Is 2025's Most

Reacher. Is. Back. And Alan Ritchson's Star is STILL Rising

Sunday, March 9, 2025

View in Browser Men's Health SHOP MVP EXCLUSIVES SUBSCRIBE THIS WEEK'S MUST-READ Reacher. Is. Back. and Alan Ritchson's Star is STILL Rising. Reacher. Is. Back. and Alan Ritchson's Star

12 Charming Movies to Watch This Spring

Sunday, March 9, 2025

The sun is shining, the tank is clean – it's time to watch some movies ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

10 Ways to Quiet Annoying Household Noises

Sunday, March 9, 2025

Digg Is Coming Back (Sort Of). Sometimes the that's noise bothering you is coming from inside the house. Not displaying correctly? View this newsletter online. TODAY'S FEATURED STORY 10 Ways to

The Weekly Wrap # 203

Sunday, March 9, 2025

03.09.2025 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekend: Introducing the Butt Mullet Dress 👀

Sunday, March 9, 2025

— Check out what we Skimm'd for you today March 9, 2025 Subscribe Read in browser Header Image But first: Join the waitlist for a new premium Skimm experience Update location or View forecast

Starting Thursday: Rediscover Inspiration Through Wordsworth

Sunday, March 9, 2025

Last chance to register for our next literary seminar starting March 13. March Literary Seminar: Timothy Donnelly on William Wordsworth Rediscover one of the most influential poets of all time with

5 little treats for these strange and uncertain times

Sunday, March 9, 2025

Little treat culture? In this economy?

RI#266 - Down the rabbit hole/ What is "feels-like" temp/ Realtime voice tutor

Sunday, March 9, 2025

Hello again! My name is Alex and every week I share with you the 5 most useful links for self-improvement and productivity that I have found on the web. ---------------------------------------- You are

Chaos Theory: How Trump is Destroying the Economy

Sunday, March 9, 2025

Trump's erratic, chaotic governing style is dragging down the economy ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏