Crypto Market Pulse Weekly – 💸 HK Spot Bitcoin ETFs Saw ~$250M Inflows in 3 Days

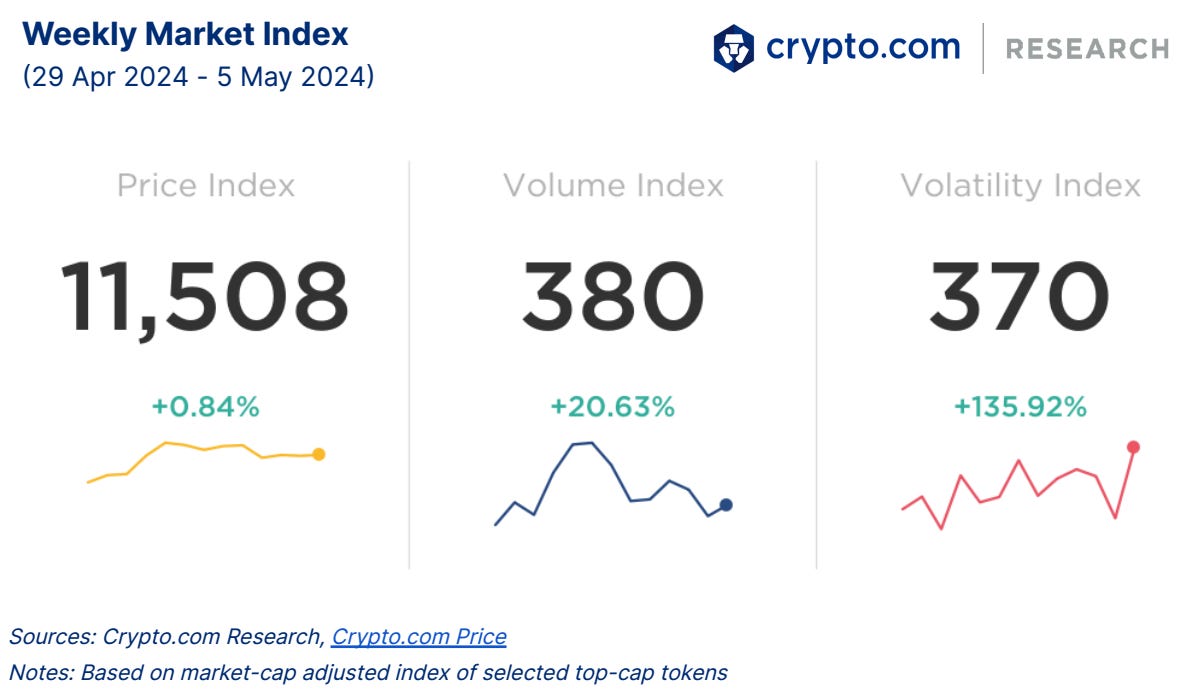

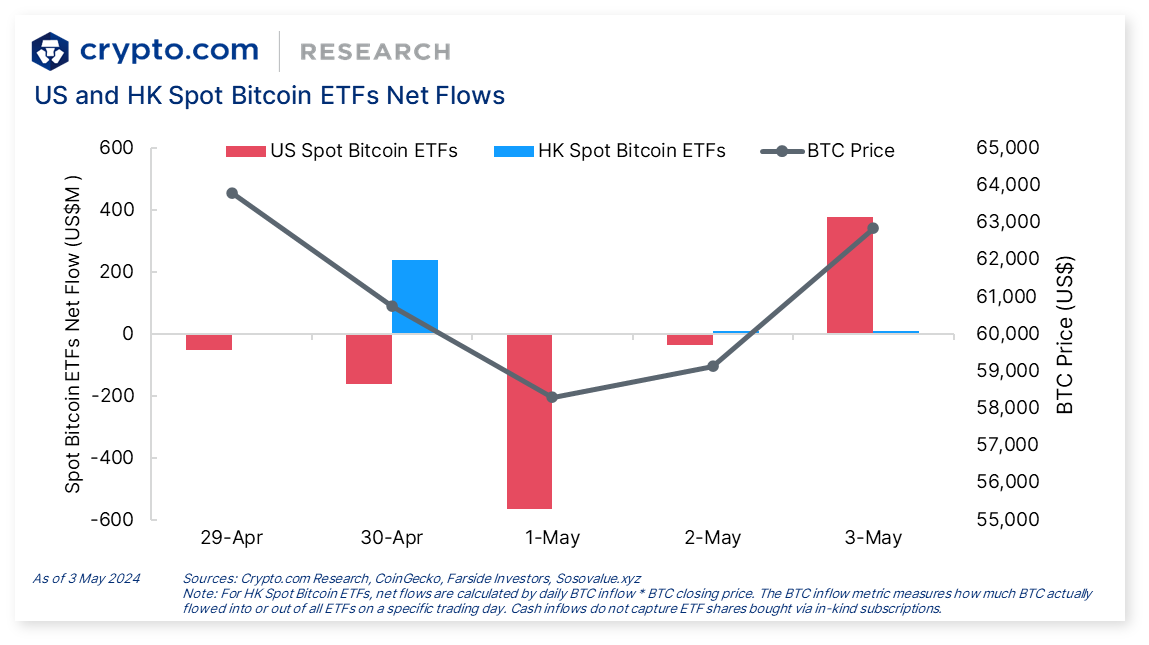

Crypto Market Pulse Weekly – 💸 HK Spot Bitcoin ETFs Saw ~$250M Inflows in 3 DaysHong Kong Spot Bitcoin ETFs saw US$250M net inflows in 3 days. Morgan Stanley filed with the US SEC to permit exposure to Bitcoin ETFs. Australia is reportedly considering the launch of Bitcoin ETFs.Weekly Market IndexAll three crypto market indices increased last week. The price index increased slightly by +0.84%. However, the volume and volatility indices increased more drastically, by +20.63% and +135.92% respectively. The volume and volatility increases were mainly led by DOGE, as news reported that Tesla accepted Dogecoin as an official payment method. Bitcoin (BTC) dropped to a near-US$57,000 level mid-week before rallying close to US$64,000 over the weekend. Ether (ETH) showed a similar trajectory and increased to the US$3,150 level over the weekend. The US Federal Reserve (Fed) kept its interest rate target range unchanged at 5.25-5.50% in its 1 May meeting, in line with market expectations. Fed Chairman Jerome Powell said it’s likely to take longer than previously expected to gain confidence in the country’s inflation trajectory before starting rate cuts. On 3 May, the US’s April nonfarm payrolls data came in below market expectations, which boosted optimism for a potential rate cut later this year due to signs of labour market weakness. Chart of the WeekAsia's first Spot Bitcoin and Ether ETFs commenced trading on 30 April in Hong Kong. The total trading volume on the first day for Bitcoin ETFs was $8.5 million, while Ether ETFs saw $2.5 million, lower than the previously expected $100 million. Meanwhile, the Bitcoin and Ether ETFs have garnered a net inflow of 4,220 BTC (~$250 million) and 16,280 ETH (~$49 million) respectively in the three trading days last week. On the other hand, US Spot Bitcoin ETFs had a week of net outflows totalling $433 million, its fourth consecutive week of net outflows. On 1 May, the ETFs saw their largest day of net outflows, at $564 million, since launch. On the same day, Blackrock’s IBIT also saw its first day of net outflows ($37 million). The Grayscale Bitcoin Trust ETF (GBTC) saw its first daily net inflow of $63 million on 3 May, although weekly net outflow still settled at $277 million last week. Weekly PerformanceBTC increased slightly by +1.8% while ETH dropped by -4.4% in the past seven days. The price action for other selected top market cap tokens were mixed. ATOM led the gains while INJ led the drop. Most selected key categories were up in terms of market capitalisation in the past seven days, with the Artificial Intelligence category leading the gain. News Highlights

Recent Research Reports

Recent University Articles

Catalyst CalendarWe’re all ears.Your feedback helps make our reporting more insightful. Tell us how we can improve this newsletter by taking the survey below. It will take less than a minute of your time. Thank you! AuthorResearch and Insights Team Disclaimer:The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.The brands and the logos appearing in this report are registered trademarks of their respective owners.Thank you for reading! We hope you find Market Pulse, our new weekly market insights newsletter enlightening! Hungry for more? Visit our Research Hub and University to access other insightful crypto research! Share with a friend if you like our email! Crypto Trends from Crypto.com: Market, DeFi, NFT, Gaming is free today. But if you enjoyed this post, you can tell Crypto Trends from Crypto.com: Market, DeFi, NFT, Gaming that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

NFT & Blockchain Gaming Weekly - 📈 NFT Lending Volume Exceeds US$2.1B in Q1

Friday, May 3, 2024

NFT Lending Volume Exceeds $2.1B in Q1, Led by Blend. Moonbirds changes copyright policy under Yuga Labs. "Gacha Grab" catapults Azuki NFT sales to $1.1M in a day. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly - 📈 EigenLayer Withdrawal Queue Rises Amid EIGEN Airdrop Controversy

Thursday, May 2, 2024

EigenLayer withdrawal queue count rises amid EIGEN airdrop controversy. Runes make up over two-thirds of Bitcoin transactions since its launch. BlackRock's BUIDL leads the tokenised fund race. ͏ ͏

Crypto Market Pulse Weekly – ₿ Bitcoin Hits Record Daily Number of Transactions

Monday, April 29, 2024

$BTC hits record daily number of transactions. Spot $BTC and $ETH ETFs to start trading in Hong Kong on 30 April. Franklin Templeton listed its Spot Ether ETF on US DTCC. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

NFT & Blockchain Gaming Weekly - 📈 Runes Dominated BTC Transactions Post-Halving

Friday, April 26, 2024

Runes Dominated BTC Transactions Post-Halving. Telegram to tokenise stickers & emojis as NFTs. ApeCoin price drops 66% amid BAYC decline. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly - 💧Ethereum Liquid Restaking Drives DeFi TVL to 2-Year Highs

Wednesday, April 24, 2024

Ethereum liquid restaking drives DeFi TVL to 2-year highs. Cronos unveils Spring Odyssey campaign powered by Galxe. Runes launch fueled Bitcoin miners' earnings to surge. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Texas doubles down on crypto with new $250 million Bitcoin reserve bill

Tuesday, March 11, 2025

Texas' second crypto bill seeks to enhance state and local government participation in digital asset investments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How-ey Can Get Out of Here

Tuesday, March 11, 2025

How On-Chain Data Can Clarify the Regulation of Cryptoassets ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

February CEX Data Report: Significant Decline in Trading Volume Across Major CEXs - Spot Down 21%, Derivatives Dow…

Tuesday, March 11, 2025

In February 2025, the spot trading volume of major CEXs decreased by 21% compared to January. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

El Salvador defies IMF, continues Bitcoin purchases amid market downtrend

Monday, March 10, 2025

El Salvador's Bitcoin holdings grow to $504 million, challenging IMF directives amid sharp price declines. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🖊️ Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO …

Monday, March 10, 2025

Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO for a Cronos Strategic Reserve; Texas's Senate passed bitcoin reserve bill SB-21 ͏ ͏ ͏

Vitalik TAKO AMA: ETH Positioning, Sequencer Centralization, L1 vs L2, Governance, and Success Metrics

Monday, March 10, 2025

On the evening of February 19th at 12 PM UTC and lasting until 12 PM UTC on February 20th, Vitalik Buterin, the founder of Ethereum, was invited to participate in a flash text interview on Tako (a

Donald Trump Creates U.S. Bitcoin Reserve

Monday, March 10, 2025

March 10th, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Donald Trump Creates US Bitcoin Reserve Diddy Shows 'Kindness' To Sam Bankman-Fried Robinhood Conducts $1M Crypto Trivia

Bitcoin’s realized volatility surges in as traders face extreme price swings

Sunday, March 9, 2025

Volatility clustering in Bitcoin reveals the impact of turbulent rallies and sharp pullbacks. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Mar 3 to Mar 9)

Sunday, March 9, 2025

Ms. Sun Xueling, Minister of State, Ministry of Home Affairs of Singapore, said that cryptocurrency fraud cases accounted for a quarter of the total loss amount involved in fraud last year. ͏ ͏ ͏ ͏ ͏ ͏

Trump declares end to ‘war on crypto,’ vows to propel America to Bitcoin supremacy

Saturday, March 8, 2025

Trump brands the Biden era as a crypto setback, .President Trump vows to make America the Bitcoin leader, ending Operation Chokepoint 2.0 and bolstering crypto strategies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏