The Generalist - Ho Nam on VC’s Power Law

🌟 Hey there! This is a subscriber-only edition of our premium newsletter designed to make you a better investor and technologist. Members get access to the strategies, tactics, and wisdom of exceptional investors and founders. Friends, We’re back with our latest edition of “Letters to a Young Investor,” the series designed to give readers like you an intimate look at the strategies, insights, and wisdom of the world’s best investors. We do that via a back-and-forth correspondence that we publish in full – giving you a chance to peek into the inbox of legendary venture capitalists. Below, you’ll find my second letter with Altos co-founder and managing director Ho Nam. For those who are just joining us, Ho is, in my opinion, one of the great investors of the past couple of decades and a true student of the asset class. Because of his respect for the practice of venture capital, I was especially excited to talk to him about today’s topic: learning from the greats. Who were Ho’s mentors? Which investors does he most admire and why? What lessons from venture’s past should be better remembered by today’s managers? Join our premium newsletter, Generalist+, to read the full correspondence and unlock a library of investing wisdom. Lessons from Ho

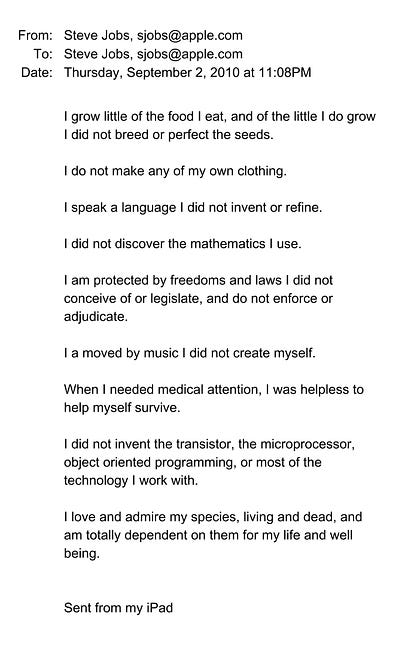

Mario’s letterSubject: Learning from the greats Ho, After moving out of New York City (at least for a little bit), I’m writing to you from a small house on Long Island. It’s been really lovely to have a bit more space and quiet away from the city’s intermittently inspiring and exhausting buzz. I have been enjoying some meandering forest walks with my dog, reading the exceptional novel Demon Copperhead, watching The Three Body Problem adaptation (I suspect you’d really enjoy the books if you haven’t gotten to them yet), and trying to learn more about the world of robotics. I’d love to hear what’s animating your springtime, both in and out of the office. I recently came across a message Steve Jobs sent to himself roughly a year before his death. I imagine you know it well, as will many readers. In it, Jobs reflects on an aspect of the human condition. Namely, that all of us rely on each other and the innovations of our ancestors. It’s his version of Isaac Newton’s phrase, “If I have seen further, it is by standing on the shoulders of giants.” The Jobs memo reminded me of our conversation for a couple of reasons. For one thing, its application to the craft of investing. Every great investor refines their abilities through mentorship, competition, and conversation. Buffett would not be Buffett without Munger, Graham, and even, perhaps, the One Thousand Ways to Make $1000 book he borrowed from the library as a seven year old. No one succeeds alone. Secondly, Jobs’ email reminds me of legendary venture capitalist, Arthur Rock. I first learned about Rock through you and eventually wrote a piece about his remarkable career. As you know well, Rock was an early backer of Apple, writing a $57,400 check in 1997. Jobs later referred to Rock as something of a father figure. I share this background because it forms the basis for an aspect of your craft I’d love to explore together. As you look back on your 34 years of investing, from starting out at Trinity Ventures to building Altos, who are the people you’ve learned the most from? What have they taught you? These might be people you worked with, of course – your old bosses and current partners, for example – but might also be figures you studied from afar. From our last exchange, I know that Buffett is one of them, of course. Above all, I’d love to understand the stories behind the pieces of advice you’ve received and how they’ve impacted the way you analyze investments and make decisions. What company might you have missed without the right guidance? What mistake could you have avoided if you’d listened to a mentor’s advice? Though I am just beginning my investing career, there are a lot of pieces of advice I’ve gathered that I find helpful when evaluating a startup. A few examples:

I’d be curious if these tidbits resonate, and whether there are pieces of advice that you keep returning to over the years. Underneath all of my questions is a final strand: what advice would you give to today’s investors? What does the current generation appreciate too little or praise too much? How can younger venture capitalists improve their chances of having the kind of remarkable career you’ve managed to build? I’d love to hear any of your thoughts, from the tactical to the theoretical. Thank you for sharing your wisdom! Best, Mario Ho’s responseSubject: Learning from the greats Mario, Those are such great lessons, and I also owe so much to generous mentors over time. I think there is also a lot to be learned from what NOT to do and there are many people who taught me such great lessons. Examples of what not to do include not facing reality and exhibiting self-serving behavior, which may benefit you in the short term but cause harm in the long term by eroding trust. It’s a subset of behavior that I refer to as people digging their own graves. One of the most important lessons I’ve learned in my career overlaps with 3-4 of the ones you shared. It’s one that Charlie Munger has shared many times over the decades and is very much related to the power law of returns in venture capital. Charlie said that no one is so smart or so lucky to have more than a handful of great investments in a lifetime. I’d add that one of our companies does not have to be one of the greatest companies in history. All we need to know is that if we are fortunate enough to make many investments over decades, only a few (likely only one or two) will make all the difference. So, we are always looking for potential outliers within our portfolio. We look to deepen our understanding and relationship with a handful of companies, which leads to multi-decade partnerships. If we, as a team, were able to do this only a few times in our lifetime, we thought we’d have a chance to become legendary VCs. We did not care about building our money management business. What we cared about was the legacy of our companies. If some of our companies can be great, then the track record would give us many degrees of freedom – to grow the firm or remain small, manage our own family office, etc. Decades ago, we did not know where we would end up, but we knew that if we did not take care of the primary goal (of building great companies), the secondary goal of building Altos would fail. There is a paradox. For fund manager “entrepreneurs” who take the risk of leaving good jobs to start and build their own VC firms, the most obvious marker of success is raising new funds and growing AUM. But in achieving such goals, they may sow the seeds of their own destruction... Subscribe to The Generalist to read the rest.Become a paying subscriber of The Generalist to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

The Founders Guide to Culture Building

Tuesday, April 30, 2024

What it takes to build a high-output team. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Early bird pricing ends tonight. Have you subscribed?

Monday, April 29, 2024

Subscribe by midnight ET to get The Generalist's premium newsletter for $19/month. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Try our premium newsletter for just $19/month

Saturday, April 27, 2024

This weekend only, early-bird pricing is back. Learn from exceptional founders and investors for just $19/month or $200/year. New series are being published now. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Editor’s Brief: The Robotics Renaissance

Thursday, April 25, 2024

Why we're entering into an automation supercycle. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Working with The Olympians: Inside Traba’s Intense Culture

Sunday, April 21, 2024

The $200 million industrial staffing platform is disrupting a big, unsexy market. It's doing so with a work ethic that has captured attention and courted controversy. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

BSSA #116 - Outsourcing to scale 🚀

Tuesday, March 4, 2025

March 04, 2025 | Read Online Hello everyone! The Wide Event is almost sold out. More than 90% of the tickets have been booked. If you're one of the people waiting until the last minute to purchase,

🔥 The secret factories big brands don’t want you to know 👗👖

Tuesday, March 4, 2025

The best fashion suppliers don't advertise—here's how to find them. Hey Friend , If you've ever struggled to find high-quality fashion manufacturers, there's a reason: The best

Making Wayves

Tuesday, March 4, 2025

+ Girls just wanna have funding; e-bike turf war View in browser Powered by ViennaUP Author-Martin by Martin Coulter Good morning there, Since 2021, VC firm Future Planet Capital (FPC) has secured more

Animal Shine And Doctor Stein 🐇

Monday, March 3, 2025

And another non-unique app͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

upcoming analyst-led events

Monday, March 3, 2025

the future of the customer journey, tech M&A predictions, and the industrial AI arms race. CB-Insights-Logo-light copy Upcoming analyst-led webinars Highlights: The future of the customer journey,

last call...

Monday, March 3, 2025

are you ready? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 Dimmable window technology

Monday, March 3, 2025

Miru is creating windows that uniformly tint—usable in cars, homes, and more.

Lopsided AI Revenues

Monday, March 3, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. Lopsided AI Revenues Which is the best business in AI at the

📂 NEW: 140 SaaS Marketing Ideas eBook 📕

Monday, March 3, 2025

Most SaaS marketing follows the same playbook. The same channels. The same tactics. The same results. But the biggest wins? They come from smart risks, creative experiments, and ideas you

17 Silicon Valley Startups Raised $633Million - Week of March 3, 2025

Monday, March 3, 2025

🌴 Upfront Summit 2025 Recap 💰 Why Is Warren Buffett Hoarding $300B in Cash 💰 US Crypto Strategic Reserve ⚡ Blackstone / QTS AI Power Strains 🇨🇳 Wan 2.1 - Sora of China ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏