Astral Codex Ten - Mantic Monday 5/13/24

Mantic Monday 5/13/24Manifold pivot || Lab leak hindcasting || CFTC extra-double-bans prediction marketsDisclaimer: This post involves more discussion of laws than usual. I am not a lawyer. Assume there are some errors. I will try to correct them after I learn about them. CFTC Extra-Double-Bans Prediction MarketsThe Commodity Futures Trading Commission, the body that thwarts real-money prediction markets, has announced that it will be thwarting them even harder from now on. The proposed resolution is 17 CFR Part 40. It starts by explaining the current state of the law: the CFTC is allowed to regulate “events contracts”, ie predictions. The law says they should favor contracts about economic events (like “will interest rates go up”), and disfavor contracts about atrocities or gaming (like “will there be a terrorist attack?” or “will the Yankees win the World Series?”). Everything else - the bread and butter of prediction markets - is in a gray zone that the CFTC has to review on a case-by-case basis. The new resolution says that, if you think about it, elections and awards ceremonies are kind of like gaming (they’re a competition and you’re betting on the winners). And they’re more likely to be bet on by gamblers than by people with legitimate financial motives. So the CFTC is moving them out of the gray zone and prohibiting them by default. Does this change much? The CFTC already prohibited these in practice - they were in the ask-for-permission gray zone, but whenever someone asked them for permission, they said no. The only semi-exception was PredictIt, which was small enough and established enough that they got grandfathered in; the CFTC tried to go after them, but got bogged down enough in the courts that PredictIt isn’t quite dead yet. So on a first read, this slightly strengthens the CFTC’s case against PredictIt, tells everyone else to give up hope, but doesn’t really alter the landscape. I think the biggest change is that it saves the CFTC time. They’re pretty open about this as a motive:

They especially don’t want to have to be forced to investigation elections:

I think their thought process is: if you manipulate the commodity markets by (for example) saying that you have lots of nickel when you don’t, the CFTC has to investigate that and penalize the people responsible. In a hypothetical world with election contracts, if someone manipulated an election - for example, they put out a fake poll showing that the incumbent would definitely win so there’s no point in even voting - someone could ask the CFTC to investigate. I don’t know if I like the idea of federal agencies banning things because, if they were allowed, it would create more work for the federal agency. Imagine if the medical regulators banned surgery, because otherwise some surgeons might be accused of malpractice, but the malpractice lawyers want to go home early on Fridays. Otherwise, I’ll just reiterate the same points everyone made last time they tried this:

And a few extra points:

Anyway, although this is dumb, I don’t think it changes facts on the ground very much. Some possible exceptions:

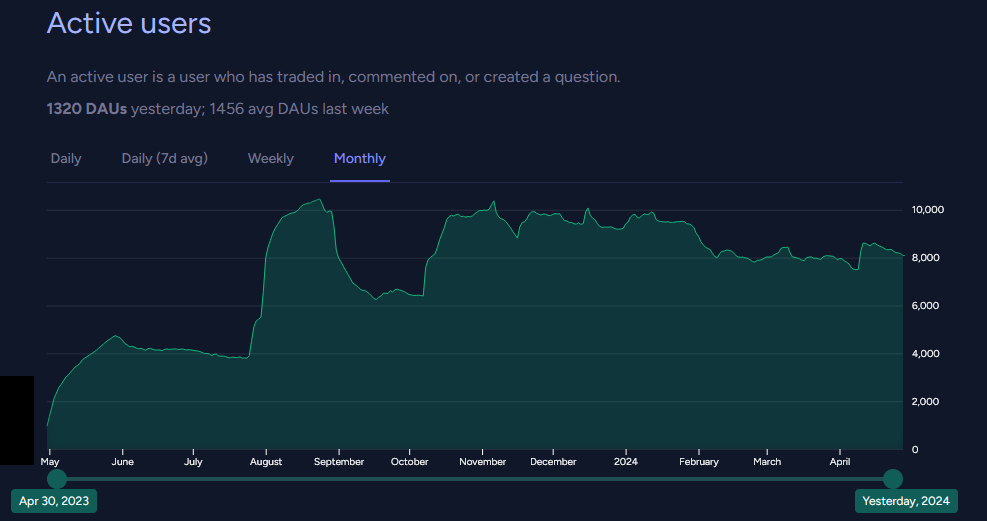

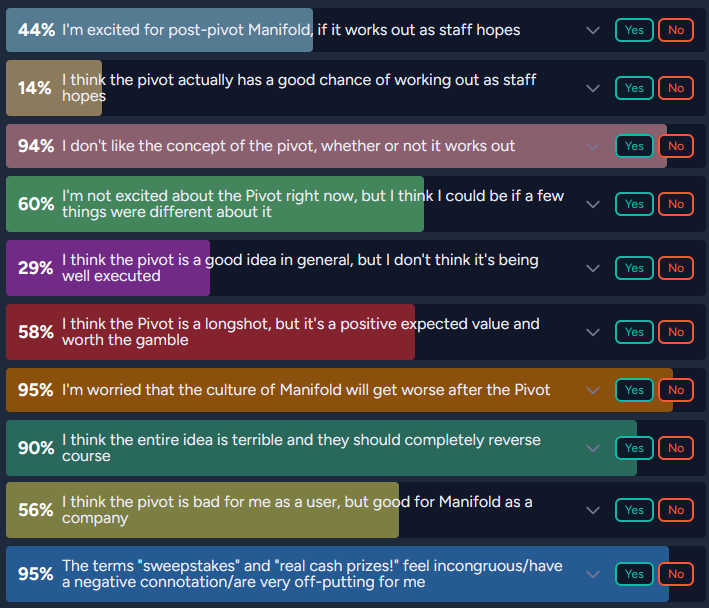

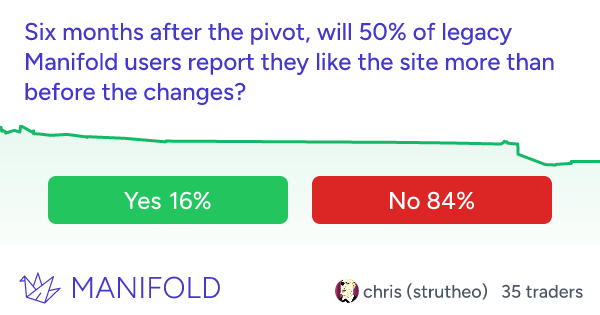

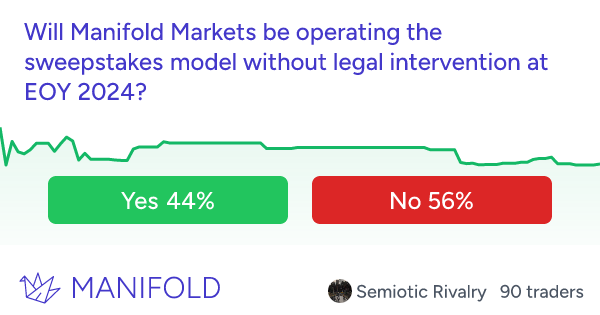

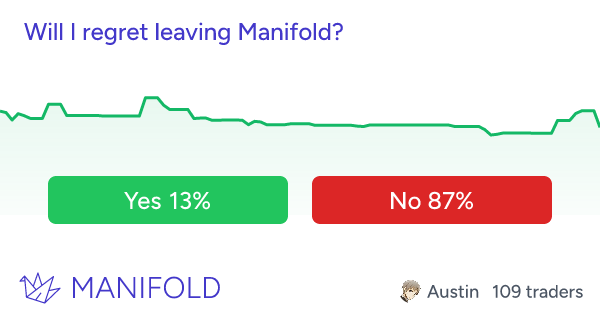

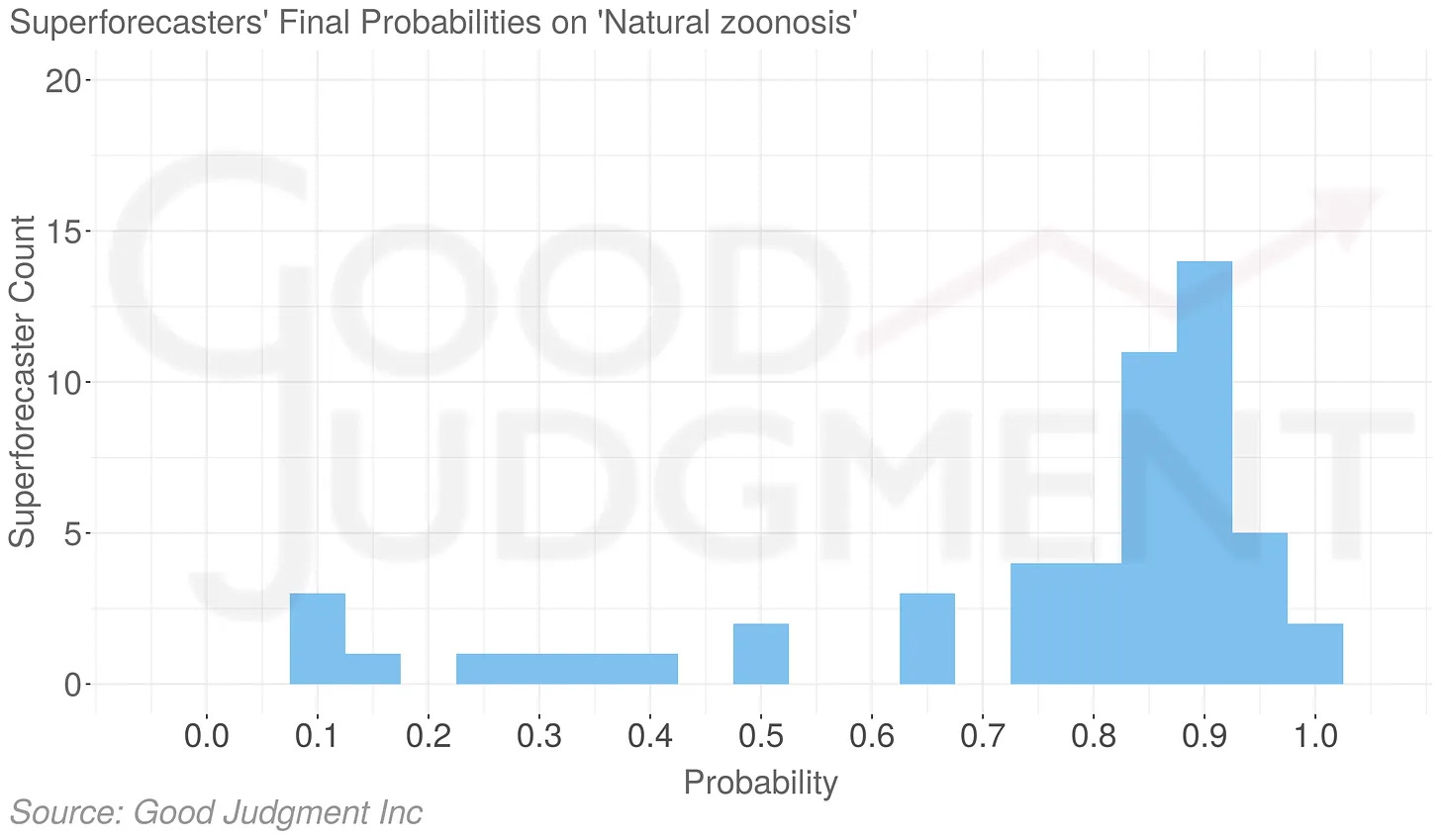

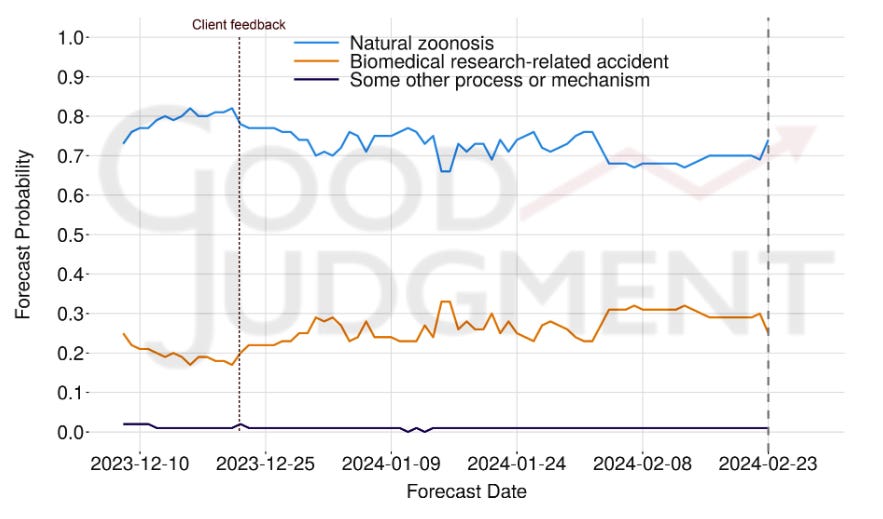

See Maxim Lott’s article on this for more information, including the chances that this gets tied up in the courts. Pivotal ActManifold Markets says they’re pivoting to a new model combining play money points and real-money gambling. Manifold may be a beloved local fixture, but their growth and revenue aren’t too impressive: In the interests of continuing to exist and push prediction markets forward, they will switch to a “sweepstakes” model. Although gambling is illegal in most US states and requires complicated licensing in others, there’s a “sweepstakes loophole”; companies are allowed to offer “prize sweepstakes”, and you can use this to sort of reconstruct the concept of gambling in a legal way. You don’t give the company money and get back money. You pay for “points”, get “sweepstakes tokens” as a bonus, gamble the “sweepstakes tokens”, and then cash in the sweepstakes tokens for money. This is a pretty surprising loophole, but it’s already used by sites like Chumba Casino and Fliff. (and apparently it creates weird incentives! In order to maintain the fiction of being a “sweepstakes”, these casinos have to give you “tokens” if you request them by mail. If you send a postcard to Chumba Casino asking for free money, they’ll give it to you, $5 per postcard. Is this an infinite free money pump? My impression is in theory yes, but the postcards have to be handwritten in a very specific way, the company sometimes rejects them for weird reasons, the cost of materials and mailing lowers your profit to more like $4, and so you’d have to hand-write 250 postcards to make $1,000. I’m still surprised more people don’t do this.) Because real money is involved, Manifold will have to tighten the rules on markets, including banning N/A resolutions. You can see a full list of changes here. Manifold users are split between acknowledging that the for-profit company they love needs some way to make money, being salty about the changes, and being worried that creating more of a casino atmosphere will be bad for users / the world / ability to function as a good prediction market. (I understand most of the NO vote here is based on the theory that there will be legal intervention - maybe because the government is willing to tolerate sweepstakes casinos but not sweepstakes prediction markets). Manifold co-founder Austin Chen won’t be involved. He’s leaving the site - not explicitly because of the pivot, he just said it seems to be “trapped in local optima”. He plans to focus on other parts of the Manifold empire, especially Manifund, which tests impact markets, regranting, and other “experimental” charity models. Manifold will continue in the hands of the other two co-founders, James and Stephen Grugett. SuperhindcastingI mentioned this in my lab leak post, but it deserves more attention here: Good Judgment Project’s report on Superforecasting The Origins Of The COVID-19 Pandemic. Good Judgment Project employs superforecasters who will predict things for clients. Some people interested in COVID origins asked them to judge whether lab leak was plausible. Their headline result was 74% zoonosis, 25% lab leak, 1% something else. Part of GJP’s method is getting their forecasters to share sources and talk to each other. Here’s the graph for how that went: People changed their minds a little over time, but not in a very consistent way that mattered much in the end. What was the “client feedback”? The report says:

Is this bad? I’m imagining a pro-lab-leak client saying “But what about [this list of pro-lab-leak arguments]?” and then the superforecasters read them and adjust. In one sense, it’s good that they got to see more arguments; on the other, it seems like a potential route by which clients could bias the results - probabilities never quite got back to where they were before the feedback, though they got pretty close. The last-minute spike for zoonosis might be the Rootclaim debate results, which were released on 2/18. So maybe the client feedback and the Rootclaim results both slightly affected the numbers, but mostly the superforecasters started out pro-zoonosis and stuck to their guns. Dan Schwarz and the FutureSearch team say that forecasting has a “rationale-shaped hole”. Despite the report making this sound like a pretty intense process, we don’t get much information about details:

Probably it would be too much to ask for to get a transcript of all their discussions - then they’d be nervous saying things that might make them look bad to an audience. What would be a good balance between getting more information and not imposing on their time? Forecasting is an unusually legible and easy-to-judge domain. One of the theories of change for forecasting was to use it to identify smart people with good reasoning, then turn them loose on less well-behaved problems. This is one of the first big attempts to do this at scale. How did it work? We can’t tell, because it’s inherently an illegible and hard-to-judge domain. Darn. I don’t know what I expected. Notes From A Local OptimumAustin’s concern - that forecasting has reached a local optimum - is widely shared. We have some good sites: Manifold, Metaculus, Polymarket, GJO, etc - all doing good work. We have good-ish probabilities for a few important questions. Every so often a news source cites them. Sometimes a decision-maker looks at them behind the scenes, maybe. Is this all there is? The FutureSearch team says the next step is to focus on “rationale”. We need to use forecasting not just to get a raw probability, but to explain what’s going on and why we think something. Then instead of just convincing policy-makers to trust forecasts, we can tell them why something is true, or inform their discussions even if they’re not willing to blindly trust a number. Is this a betrayal of the forecasting ethos? The original dream was that instead of a bunch of people giving arguments, we could just test who was right. Now we’re going back to the arguments? People have argued forever; what does forecasting add to that? Well, they add the knowledge that the arguments are from people who have been right a lot before and are incentivized to be right again. Still, it’s not a natural fit. Probably it’s relevant here that FutureSearch’s forecasting AI does a really good job of this by default, in a way humans can’t match. Nuno’s yearly forecasting roundup doesn’t have a single thesis, but the first part is a well-supported complaint that most forecasting sites aren’t good business. They either burn VC money, burn EA donations, or converge towards casinos to support themselves. He gives an honorable exception to Cultivate Labs, which sells prediction market software rather than the results themselves. Open Philanthropy (billionaire Dustin Moskovitz’s EA-aligned charitable foundation) has at least given forecasting a vote of confidence, recently choosing to promote it to one of their main donation areas. Still, they got a lot of pushback on the decision, for example SuperDuperForecasting here:

And Marcus Abramovich here:

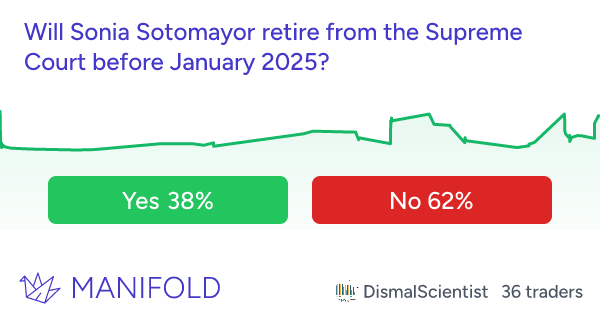

Eli Lifland has a long and hard-to-summarize comment here, response from Ozzie Gooen here, podcast between them on “Is Forecasting A Promising EA Cause Area?” here. I’m split on this. My previous hope was that the field would gradually grow, without any qualitative changes or discontinuities, until it became big enough that journalists and policy-makers were aware of it and took it seriously (compare eg the growth of the Internet as a scholarly resource). I think the strongest argument against this is Manifold’s relatively flat user numbers. Is there a new hope? I think if nothing else, forecasting might be useful as a testing ground:

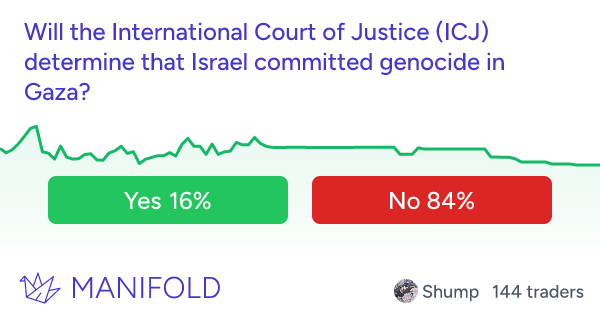

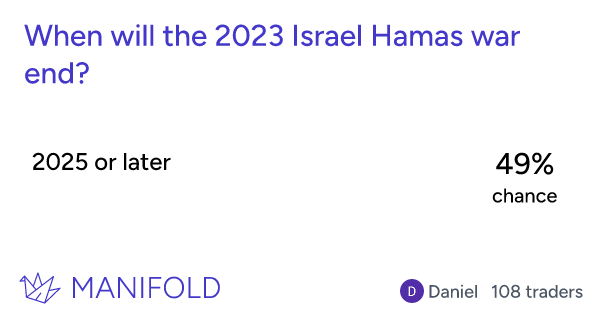

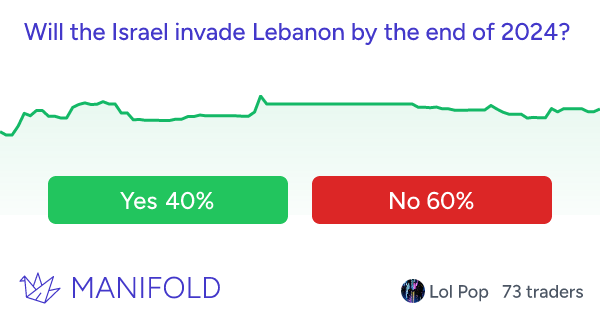

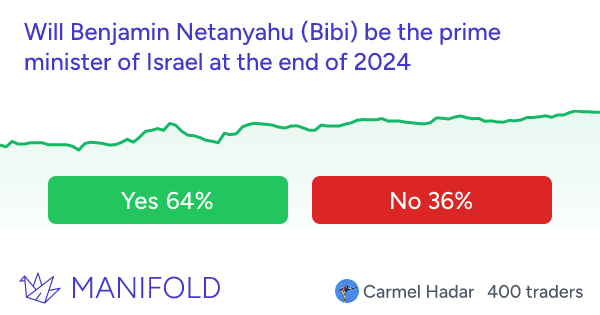

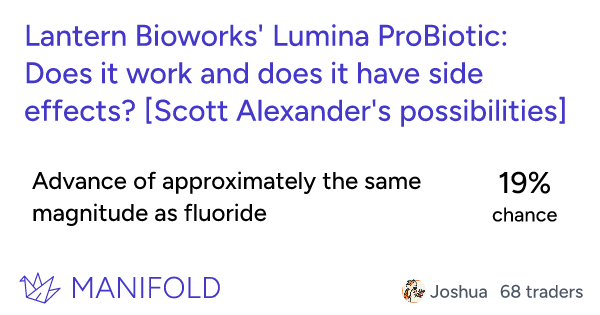

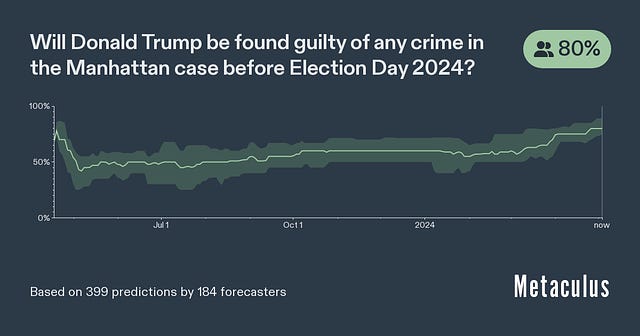

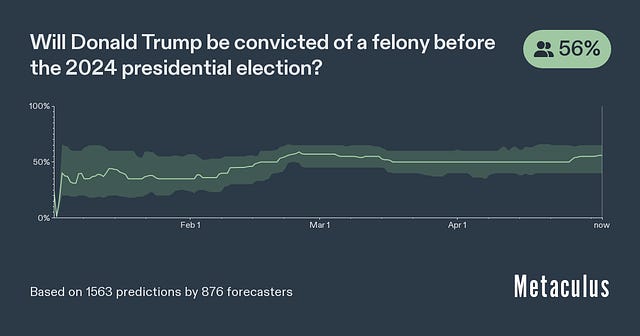

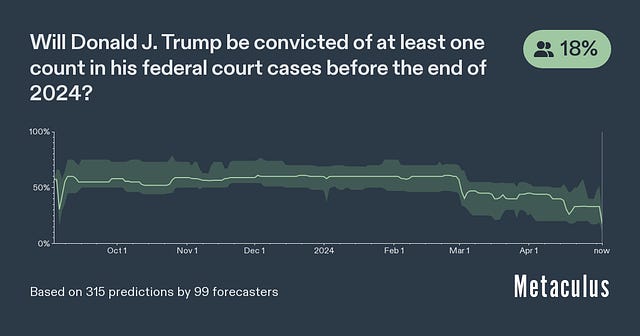

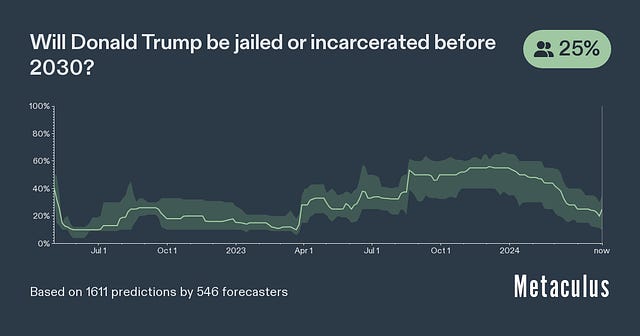

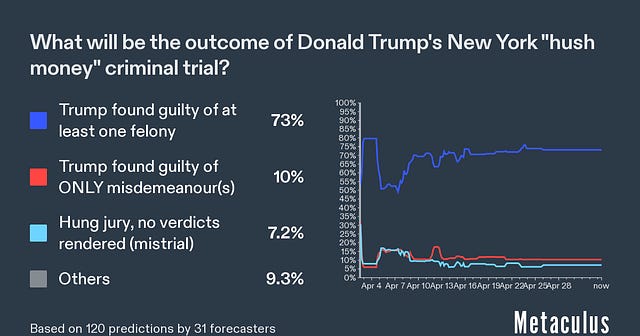

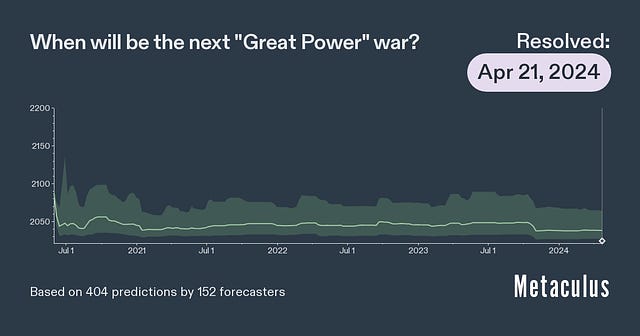

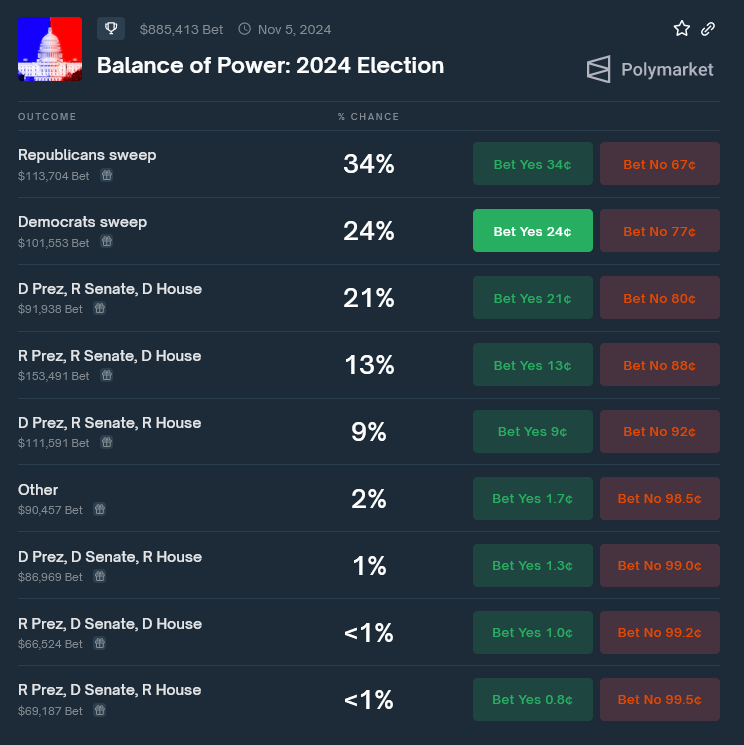

But this is a pretty limited vision, and a time-limited one (once we’ve done these things, why keep putting the millions of dollars in?) I still maintain some hope that someone will find the killer app that makes forecasting explode, but I don’t know what it would be. One bright spot: both DeepMind (see 8) and OpenAI (see 2.12) recently hired forecasters (Swift Centre for DeepMind, OpenAI still keeping details secret) to predict some features of their AI models. I think this is cool, but it probably owes more to there being a bunch of rationalists at those companies (and rationalists loving forecasting) than to any sign of broader commercial adoption. This Month In The MarketsNate Silver, Josh Barro, and others have been banging this drum recently: the most important thing Democrats can do this year is get Sonia Sotomayor to retire. Sotomayor is an older liberal-leaning Supreme Court justice. She might get sick or die in the next four years, and if Republicans win the 2024 election, then they get to choose her replacement and the Court shifts even further right. If she retired today, Biden and the Democratic Senate would choose her replacement and the Court wouldn’t shift. She doesn’t want to resign, but Silver (remembering the similar case of RBG) thinks Democrats should pressure her as best they can. The markets have been shifting between 20% and 40%, but don’t seem to expect this to happen. Kind of feel like I should be hearing more about this. Bibi must have sold his soul to the Devil or something, I cannot believe he’s going to make it through this. This is a response to the predictions I made in my update on the Lumina probiotic. You can click “see three more answers” for the question on side effects (separate from this question on efficacy). My numbers were 5/35/10/50 for the first question and 30/5/<1 for the second. Huh? Okay, so there are at least three cases. There’s paying Stormy Daniels hush money, currently going on in New York. There’s a Georgia election interference case. And there’s a federal election interference / January 6th case. The Supreme Court recently said there were so many presidential immunity issues that it’s going to take forever to start trying the federal case, which is why that one is at 20%. The New York case is going on now, and it seems like there’s an 80% chance he’ll be found guilty. The part I don’t understand is the last one (73% found guilty of felony in New York) vs. the second one (56% of any felony at all). This might just be a failure of arbitrage. It looks like nobody expects jail time in any case. Here’s an embarrassing screwup from Metaculus. This question was about when there would be a “Great Power war”, with Great Powers defined as any country in the top ten of military spending. But surprise surprise, Ukraine getting invaded made them spend a lot of money on their military that year, so they rose to #8 in the world in military spending in 2023. Since Russia is also in the top ten, this qualifies as a “Great Power war” by the technical definition, and the question resolves positive. Moral of the story: resolution criteria are hard! Polymarket on 2024 election results. In the past they’ve had a Republican bias, but now their Presidential markets are in tune with everyone else in the polls, so maybe this is accurate. Forecasting Links1: Swift Centre forecasts that global coal consumption will stay high, despite the standard line that it will decline as cleaner energy comes on line. This is a rare case where superforecasters take a clear position opposed to a mainstream consensus, so I look forward to grading it later. 2: TimeGPT is supposedly a revolution in “time series forecasting”. I don’t know enough about this field to have an opinion. 3: Kiko Llaneras of Spanish media EL PAIS is hosting an elections forecasting tournament on Metaculus. 4: Limitless is the latest attempt at a crypto prediction market. I don’t know why they expect to succeed when the last n has failed, but people are betting 51% odds of $10 million volume in their first year. 5: Manifest, the prediction market conference, is still in Berkeley this June, see here for more information. You're currently a free subscriber to Astral Codex Ten. For the full experience, upgrade your subscription. |

Older messages

Open Thread 329

Monday, May 13, 2024

... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Highlights From The Comments On Hanson And Health Care

Friday, May 10, 2024

... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Emotional Support Animal Racket

Thursday, May 9, 2024

... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asterisk/Zvi on California's AI Bill

Wednesday, May 8, 2024

... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Highlights From The Comments On "The Origin Of Woke"

Tuesday, May 7, 2024

... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

GeekWire Awards finalists revealed | How to supercharge Seattle’s startup scene

Tuesday, March 4, 2025

Rec Room layoffs | Anthropic's Seattle office | Tech Moves ADVERTISEMENT GeekWire SPONSOR MESSAGE: Revisit defining moments, explore new challenges, and get a glimpse into what lies ahead for one

SCOTUS to America: Eat 💩

Tuesday, March 4, 2025

Plus, new tariffs realize the dream of the original billionaire candidate, whose populism began reshaping working-class politics. Forward this email to others so they can sign up ⏪ ICYMI in The Lever:

☕ Do it live

Tuesday, March 4, 2025

How Whatnot aims to become a home for uncertain TikTok livestreamers. March 04, 2025 View Online | Sign Up Marketing Brew Presented by StartEngine It's Tuesday. Ready to score big in sports

☕ Black History math

Tuesday, March 4, 2025

Target's Black History Month posts by year. March 04, 2025 View Online | Sign Up Retail Brew Presented By Bloomreach It's Tuesday. Tomorrow, we're making online shopping fun again—no more

Trump's federal cryptocurrency reserve.

Tuesday, March 4, 2025

Plus, why do people always talk past each other on abortion? Trump's federal cryptocurrency reserve. Plus, why do people always talk past each other on abortion? By Isaac Saul • 4 Mar 2025 View in

Mom Magnet

Tuesday, March 4, 2025

Writing of lasting value Mom Magnet By Uri Bram & Peter Hirsch • 4 Mar 2025 View in browser View in browser Always Look Up Everybody's Mom Ada Palmer | Ex Urbe | 12th February 2025 Two

Hey, Elon. Say hello to the Freedom of Information Act.

Tuesday, March 4, 2025

The Intercept is preparing a blizzard of FOIA requests to uncover the documents we need to find out exactly what's happening at DOGE, who's in charge, and what laws they may be breaking. Elon

What America's most senior military leader does

Tuesday, March 4, 2025

+ tariffs 101

🍔 Rethinking Ultraprocessed Foods

Tuesday, March 4, 2025

Plus: Leaked Avengers concept art may reveal Marvel's weirdest villain twist yet. Inverse Daily Americans get about 58 percent of our calories from foods that are considered "ultraprocessed

Are they annoying or is the system annoying?

Tuesday, March 4, 2025

My first thought when we hit friction. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏