The Pomp Letter - Corporations Want A Lot More Bitcoin

Today’s letter is brought to you by Consensus 2024!Consensus 2024 is happening May 29-31 in Austin, Texas. This year marks the tenth annual Consensus, making it the largest and longest-running event dedicated to all sides of crypto, blockchain and Web3. Don’t miss Bitcoin: We Are So Back, where Anthony Pompliano will discuss what the next bull market will look like, how it will differ from previous run-ups and the broad macro investment thesis for bitcoin and crypto more broadly. Consensus has tailored programming for Bitcoin maxis and multi-chain mavericks alike, covering everything from post-halving strategies to mining and more. Plus, you absolutely won’t want to miss the epic BTC (Nic Carter) vs ETH (David Hoffman) battle at Karate Combat. That’s just a taste of what's to come at crypto’s only big-tent event. Join Consensus in Austin alongside 15,000+ investors, founders, brands and more to take in all that blockchain has to offer. Get your pass today and use code POMP to save 20%. Can’t make it to Austin for Consensus 2024? Livestream from wherever you are with the Virtual Pass for $79. Available here. To investors, Another public company announced this morning that they are adopting bitcoin as their treasury reserve asset. Here is the opening of their press release:

Why would they do this? According to the Chairman of the company:

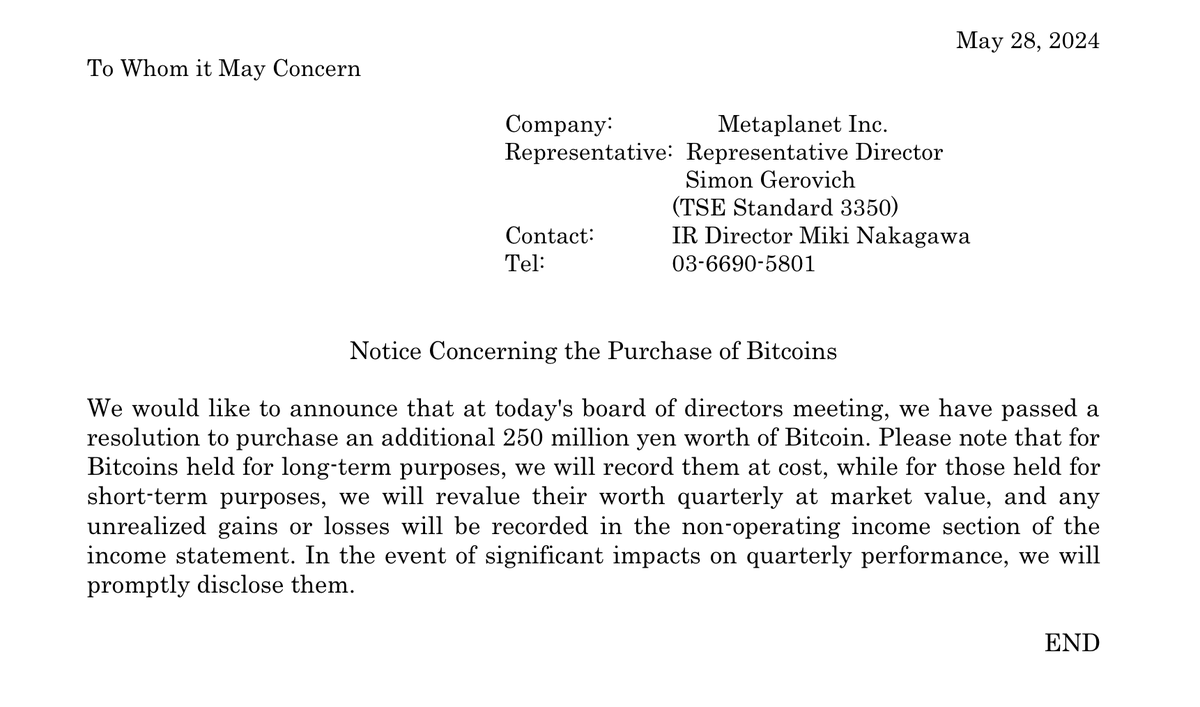

The Semler Scientific announcement comes on the same day that Metaplanet, a Japan-based company pursuing the Microstrategy bitcoin playbook, announced they received board approval to purchase more bitcoin for their balance sheet. When one company does something, it is a dot. When two do something, it is a line. When three companies do something, it is a trend. There are at least five publicly-traded non-crypto companies that I know of that are using bitcoin as a treasury asset. This is on top of the many crypto-related companies that are also holding bitcoin on their balance sheet. I don’t anticipate that every company is going to put bitcoin on their balance sheet. But I do think we will see many more companies pursue the strategy in the coming months. Bitcoin has shown itself to be a superior asset to store value long-term. The institutional adoption, coupled with the recent regulatory approval, is only going to green light even more executives to consider this option. Bitcoin is the only asset in the world where retail investors were able to front-run the institutions and corporations. But the corporations are not going to watch this pass them by. Capitalism is an incredible system of incentives, so we know the outcome of actions by simply looking at the incentives that bitcoin provides — protect your hard-earned economic value over the long-term regardless of what the fiat currency debasement rate is. There may be no greater pitch to corporate America. While everyone thought bitcoin was going to be a high-risk asset, it turned out to be the risk-mitigation tool for the suits. What a beautiful thing to see. Hope you all have a great start to your week. I’ll talk to everyone tomorrow. -Anthony Pompliano Reader Note: Today is a free email available to everyone. If you would like to receive these letters each morning, please subscribe to become a paying member of The Pomp Letter by clicking here. Jack Mallers is the Founder & CEO of Strike. In this conversation, we talk about the macro environment, the edge case, use case, investment case for bitcoin, bitcoin vs shitcoins, politics, regulation, and why he believes Wall Street will capitulate and all become bitcoiners. Listen on iTunes: Click here Listen on Spotify: Click here Strike CEO Jack Mallers on Bitcoin, Macro Environment, and Altcoins Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. Invite your friends and earn rewardsIf you enjoy The Pomp Letter, share it with your friends and earn rewards when they subscribe. |

Older messages

The Legacy Exchanges Want To Get In The Crypto Game

Monday, June 3, 2024

To investors, Politicians on both sides of the aisle are coming together to support crypto. The industry has become too large and many of the participants are single-issuer voters going into

Podcast app setup

Monday, June 3, 2024

Open this on your phone and click the button below: Add to podcast app

Podcast app setup

Monday, June 3, 2024

Open this on your phone and click the button below: Add to podcast app

Thank you for supporting The Pomp Letter

Thursday, May 23, 2024

Hey - Thank you for reading The Pomp Letter. Based on the data, you are one of our most engaged free email subscribers out of more than 235000 people. Impressive! As a token of my appreciation, I'm

Podcast app setup

Thursday, May 23, 2024

Open this on your phone and click the button below: Add to podcast app

You Might Also Like

🎯 Stop Planning Your Goals Like An Amateur

Monday, December 23, 2024

Here's how to actually crush 2025 while everyone else is nursing their hangover... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🌁#81: Key AI Concepts to Follow in 2025

Monday, December 23, 2024

Plus – we become Hugging Face's residents 🤗

The best countries to manufacture your product [Roundup]

Monday, December 23, 2024

Here's your chance to win our best-selling "How to Find a Product to Sell on Amazon" course for FREE by answering our Amazon Software Poll. Hey Reader, Want to start sourcing from places

This "Boring" Website Makes $35k/month + A Special Deal

Monday, December 23, 2024

I'm always fascinated by different types of websites and how they make money. I recently ran across a website on such a boring subject, it got me thinking...maybe boring is a great way to make

How brands leverage commerce media for seasonal success in 2025

Monday, December 23, 2024

How diversifying ad placements reveals untapped revenue opportunities

Holiday Special: Lifetime Access for Less Than $1/Day

Monday, December 23, 2024

Make 2024 Your Year – Special Holiday Deal ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Create a LinkedIn funnel from personal posts

Monday, December 23, 2024

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Pfeffernuesse Day, Reader! Who wants a delicious and spicy

New SEO strategies for 2025

Monday, December 23, 2024

60% of Google searches result in no clicks. Zero. With AI integration, that number could become even higher. I'll show you how to adjust your strategy so you can capitalize on these shifts in our

Can We Mine Bitcoin In Space With Solar Panels?

Monday, December 23, 2024

To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI keeps its grip on early-stage deals

Monday, December 23, 2024

Playground Ventures pares flagship fund size again; ecommerce startups ring up a funding surge; is 2025 the year of the industrials revival? Read online | Don't want to receive these emails? Manage