This ad regulation is from Tughlak’s textbook

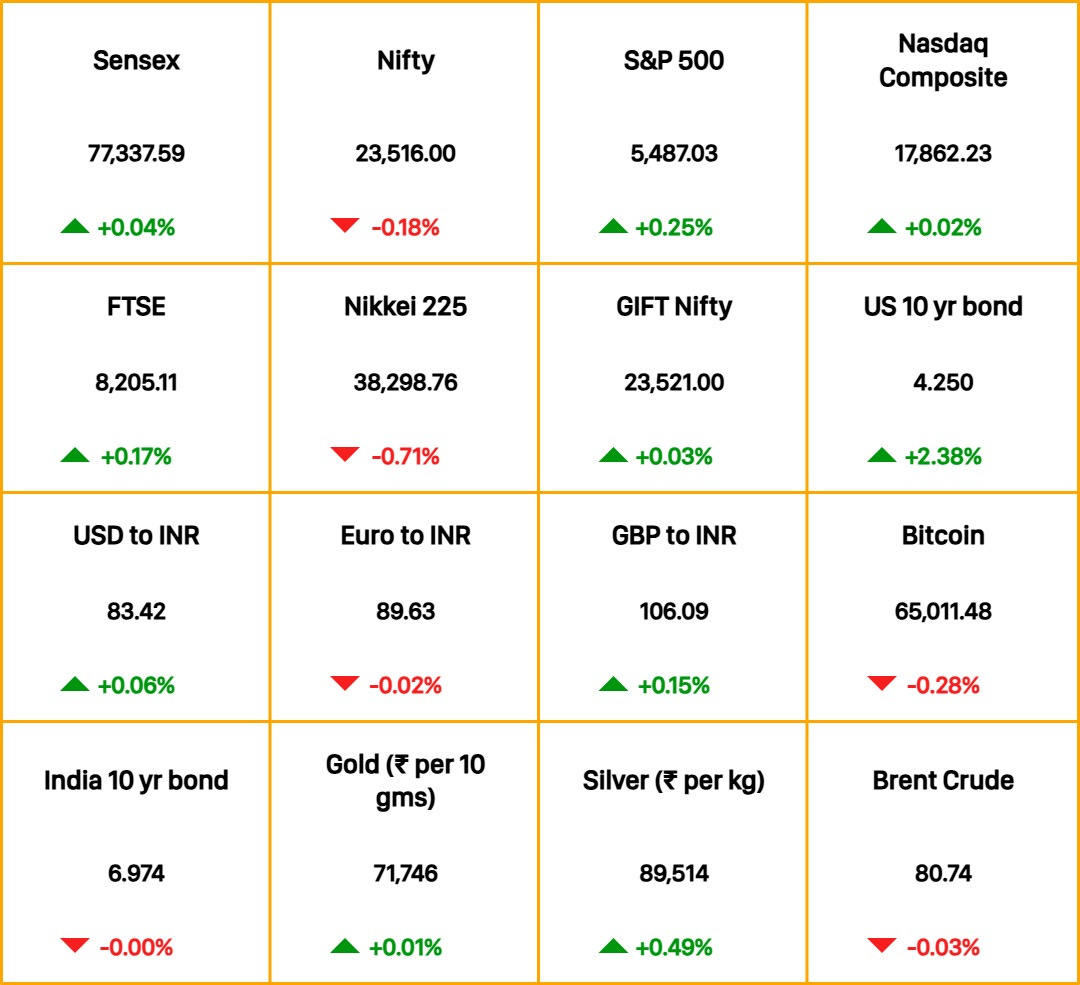

This ad regulation is from Tughlak’s textbookAlso in today’s edition: Breaking free of the family pact; Yet another ATM crisisGood morning! If you follow Sufi Motiwala, Diet Sabya, and other fashion mavens on the 'gram, you've surely had a moment or two where Nita Ambani's massive jewels left you gobsmacked. For those blissfully unaware, Ms. Ambani has been parading huge rocks at her son's neverending pre-wedding festivities. And when we say huge, we mean the kind that could proverbially sink a small ship. One of her diamond necklaces flaunted two colossal step-cut emeralds, with the larger one weighing in at 562 carats. The New York Times says such a grand display of Indian jewels harks back to the opulent days of maharajas and nawabs. Well, the Ambanis are certainly no paupers themselves. 🎧 Are Meta’s smart glasses all they're cracked up to be? Tune in to Spotify, Apple Podcasts, Amazon Music, Google Podcasts, or wherever you get your podcasts. Roshni Nair, Dinesh Narayanan, and Anup Semwal also contributed to today’s edition. The Market Signal*Stocks & Economy: Authorities overseeing the Indian economy may be beginning to worry about the disconnect between stock market exuberance and sluggishness in the real economy. “Options and futures volumes are larger than the nominal GDP of the country. We have discussed this matter with SEBI, and they will address it,” Reserve Bank of India governor Shaktikanta Das said at a media event. India now accounts for over 80% of global derivatives volumes. A couple of months ago, Sebi chair Madhabi Puri Buch had warned of froth in the small cap segment. High food prices are thwarting the RBI’s efforts to bring down inflation, hobbling its ability to bring down interest rates, which could prod private consumption and capital expenditure. Asian investors, meanwhile, did not share their US counterparts’ enthusiasm in early morning trade as most markets opened weak. The GIFT Nifty hints at a flat opening for Indian equities. WEALTHModern Family In DeedYoung global citizens hailing from traditional Indian business families are discovering an invisible leash in their inheritance. Designed to protect and manage wealth built over generations, iron-clad family settlement deeds — often decades old — deter new forays and overseas expansion. Several wealthy families are hiring armies of accountants, lawyers and succession specialists to amend and update them to cater to the aspirations of a new generation. The Economic Times quoted a lawyer as saying that “issues about separation of ownership and management, succession and gender neutrality, the ability for parties to exit the structure and more nuanced dispute-resolution provisions are some of the areas where thinking has evolved”. For instance, a few generations ago, women were kept away from business, which is antithetical to modern progressive mores. Similarly, in some communities, marrying outside the community could result in denial of inheritance. FINANCEGhost In The MachineATMs ran dry in India during demonetisation. Then came Covid-19, when ATM operators had to shut down machines due to social distancing and fears of contagion over handling bank notes. That left the industry in a crisis, crippling the cash economy in a country that stubbornly holds on to the stuff, the digital payment revolution notwithstanding. Another crisis is now in the making. And this time, policy is to blame. The Economic Times reports that banks have appealed to the Centre and RBI about low ATM capacity due to stringent Make in India guidelines and procurement via the government e-marketplace (GeM) portal. The issue is compounded by the fact that banks have to upgrade ATMs in line with norms issued by the RBI in 2023. What now?: Lenders want the government to accommodate independent “requests for proposals” once all guidelines are met. We’ll see how that goes. POLICYAdvertisers Rush To Declare That They… Advertise

As of yesterday, brands across India had registered nearly 9,000 ads along with a certificate solemnly swearing they carried no false or illegal claims. Why? Because the Supreme Court said so. While hearing a defamation lawsuit against Baba Ramdev and Patanjali Ayurved this May, the Court ruled (pdf) all online and offline advertisements must be registered with a self-declaration certificate starting June 18. This, in accordance with a 1994 cable TV ads law. That means every kind of ad – TV spot, Instagram post, sponsored Google search result, and local newspaper classified – must first be registered with the Ministry of Information & Broadcasting. This is a mammoth exercise. Remember, India’s ad industry is worth over Rs 1 lakh crore. Predictably, advertisers struggled as the certification portal crashed frequently while they rushed to register their ads for everything from cat litter, annual general meetings notices, obituaries, web-series trailers, and hundreds of dummy ad copies.

FYICan’t beat the heat: The RBI has warned that the disinflationary process will be affected by an “exceptionally” hot season stunting summer crop harvests. Delhi’s ongoing water crisis may also get worse, with Central Ground Water Board data revealing that the national capital has already extracted 99.1% of available groundwater. Support, on condition: The Centre has approved the Minimum Support Price (MSP) for 14 Kharif crops, including various millets, ahead of Assembly polls in states such as Maharashtra and Haryana. About that data void: India is set to change the frequency of its urban labour force survey from quarterly to monthly, and that of rural data from annual to quarterly, by the end of 2024. Making bank: OpenAI has more than doubled its annualised revenue from $1.6 billion to $3.4 billion in the last six months, The Information reports. Rogue support: North Korea’s supreme leader Kim Jong Un has pledged “unconditional support” to Russian President Vladimir Putin over the war on Ukraine. THE DAILY DIGIT4,300The number of millionaires expected to quit India this year, according to Henley Private Wealth Migration Report 2024. (The Economic Times) FWIWA palace of illusions: Beach view ✅. Italian marbles and tiles ✅. A spa in the bathroom ✅. Sounds like a dream hotel, right? Yeah, keep dreaming, ‘cos it's actually a government building in Visakhapatnam built with public funds. The sarkari hilltop palace was unveiled last Sunday, and has since sparked outrage over its ₹450 crore price tag. Ruling party TDP alleges the previous CM YS Jagan Mohan Reddy constructed this opulent palace for his use. Reddy's party shot back, claiming it was built to host visiting dignitaries such as the president and governors. Either way, it’s one outrageously expensive guest house. The Signal is free today. But if you enjoyed this post, you can tell The Signal that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Coming up: fridge delivery in 10 minutes

Wednesday, June 19, 2024

Also in today's edition: Air India's solution for the pilot crisis; India's third-largest landlord is on a property selling spree ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Paytm disposes, Zomato proposes

Monday, June 17, 2024

Also in today's edition: Modi, Li Qiang offer olive branches; OpenAI may shed its old skin ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How to build a circular economy

Saturday, June 15, 2024

Microfactories, an innovative approach to extracting value from waste materials, point the way to sustainable production and consumption. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Football has a referee abuse crisis

Friday, June 14, 2024

Breaking down a study on why referees are being driven out of the game ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Agnipath is not soldiering on

Friday, June 14, 2024

Also in today's edition: Adani's cement spree; McKinsey's all tell, little show ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Building complete rank and rent sites in just minutes

Monday, March 3, 2025

This tool is incredible

🌁#90: Why AI’s Reasoning Tests Keep Failing Us

Monday, March 3, 2025

we discuss benchmark problems, such as benchmark saturation, and explore potential solutions. And as always, we offer a curated list of relevant news and important papers to keep you informed

I interviewed THE largest Amazon Seller [Roundup]

Monday, March 3, 2025

Need funding for your Canadian Amazon business? Not sure if you should use a Canadian corporation or US LLC to form your company? We'll cover these questions and more in our Start and Grow Your FBA

The state of data-driven decision-making for CPG brands

Monday, March 3, 2025

How marketers use purchase insights to maximize campaign performance

Facebook updates, TikTok ROI, Instagram format matches, and more

Monday, March 3, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... presented by social-media-marketing-world-logo New week, fresh insights, Reader! Stay sharp with the latest updates on AI, social

Are you losing revenue to rivals?

Monday, March 3, 2025

This is a challenge that costs businesses millions every year: Their customers are switching to competitors for various reasons... even though most of them could easily be fixed. On Tuesday, March 4,

DeepSeek’s 545% Profit Claim

Monday, March 3, 2025

PLUS: Siri 2027?!

Insurtech VC resets, readies for growth

Monday, March 3, 2025

Europe's share of regional IPOs sinks; the agtech revolution is now; hope flares for natural gas deals Read online | Don't want to receive these emails? Manage your subscription. Log in The

What I Think About The Crypto Strategic Reserve

Monday, March 3, 2025

Listen now (8 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

$92K BTC After Trump’s Crypto Call, MARBLEX Invests $20M—WOOF Ups the Game!

Monday, March 3, 2025

PlayToEarn Newsletter #262 - Your weekly web3 gaming news